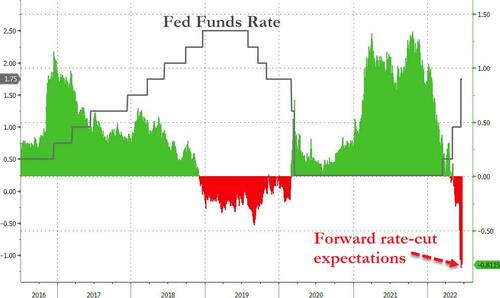

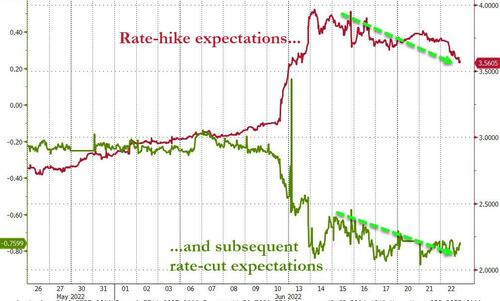

Fed Chair Powell actually sounded 'hawkish-er' during today's Humphrey-Hawkins testimony, but the bid in bonds that started overnight drove rate-hike expectations lower and subsequent rate-cut expectations higher...

Source: Bloomberg

Digging into the details, July and September are still pricing a high likelihood of a 75bps rate-hike (though September is fading). December and February rate-hike odds are evaporating fast...

Source: Bloomberg

And the subsequent rate-cut expectations are soaring (and ED markets actually inverted from Dec 22 to March 23 - implying rate-cuts start there)...

Source: Bloomberg

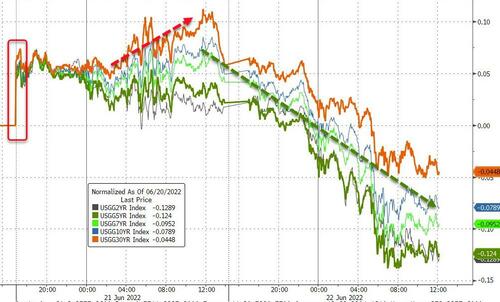

Treasury yields ripped lower - erasing all of yesterday's selling - with the short-end outperforming (3Y -17bps, 30Y -10bps)...

Source: Bloomberg

10Y Yields have erased 35bps of the 50bps spike post-CPI...

Source: Bloomberg

US futures were weak overnight but as soon as the cash market opened, the buying frenzy began ripping the US majors from decent losses to big gains on no real fundamental news. Nasdaq ran from -2.25% overnight top +1.5% ahead of the European close. Trouble started for stocks around 1430ET (Margin call time)...

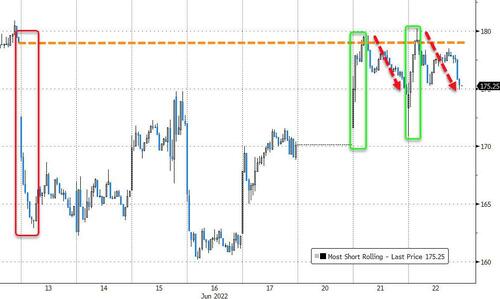

For the second day in a row, a short-squeeze lifted the market to fill the post-CPI gap-down and failed...

Source: Bloomberg

The dollar ended lower on the day after a big pump and dump (reversing lower as Europe opened)...

Source: Bloomberg

Bitcoin extended losses from yesterday morning, breaking back below $20,000

Source: Bloomberg

Gold managed to end the day unchanged having ramped up to $1850 but unable to hold it...

Oil prices extended their recent downtrend with WTI briefly trading with a $101 handle ahead of tonight's API data...

President Biden unveiled his cunning plan to lower taxes on gasoline... and wholesale gasoline prices went up...

But we do note that national average regular gas prices are down 6c over the past week... Mission Accomplished?

Source: Bloomberg

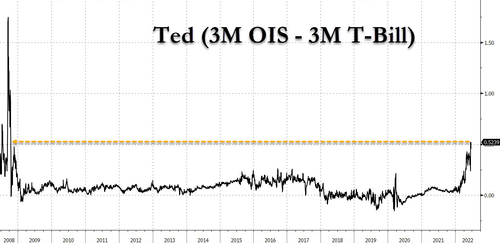

Finally, there is something serious happening behind the scenes:

The TED spread is blowing out...

Source: Bloomberg

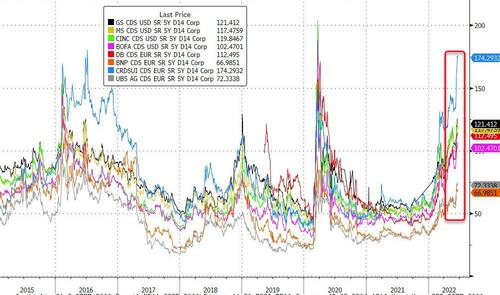

Global broker credit risk is spiking...

Source: Bloomberg

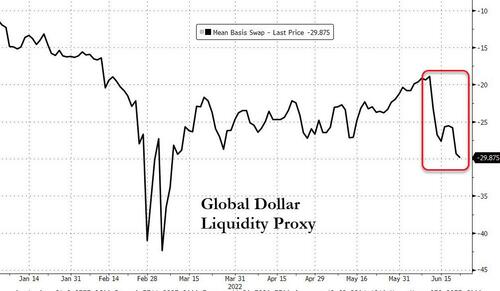

And the demand for dollars is suddenly soaring...the cross-ccy basis swaps signal dollar liquidity is drying up...

Source: Bloomberg

So, whether or not we get a bear market rally short-squeeze here, the global financial system is 'stressed'.

Fed Chair Powell actually sounded ‘hawkish-er’ during today’s Humphrey-Hawkins testimony, but the bid in bonds that started overnight drove rate-hike expectations lower and subsequent rate-cut expectations higher…

Source: Bloomberg

Digging into the details, July and September are still pricing a high likelihood of a 75bps rate-hike (though September is fading). December and February rate-hike odds are evaporating fast…

Source: Bloomberg

And the subsequent rate-cut expectations are soaring (and ED markets actually inverted from Dec 22 to March 23 – implying rate-cuts start there)…

Source: Bloomberg

Treasury yields ripped lower – erasing all of yesterday’s selling – with the short-end outperforming (3Y -17bps, 30Y -10bps)…

Source: Bloomberg

10Y Yields have erased 35bps of the 50bps spike post-CPI…

Source: Bloomberg

US futures were weak overnight but as soon as the cash market opened, the buying frenzy began ripping the US majors from decent losses to big gains on no real fundamental news. Nasdaq ran from -2.25% overnight top +1.5% ahead of the European close. Trouble started for stocks around 1430ET (Margin call time)…

For the second day in a row, a short-squeeze lifted the market to fill the post-CPI gap-down and failed…

Source: Bloomberg

The dollar ended lower on the day after a big pump and dump (reversing lower as Europe opened)…

Source: Bloomberg

Bitcoin extended losses from yesterday morning, breaking back below $20,000

Source: Bloomberg

Gold managed to end the day unchanged having ramped up to $1850 but unable to hold it…

Oil prices extended their recent downtrend with WTI briefly trading with a $101 handle ahead of tonight’s API data…

President Biden unveiled his cunning plan to lower taxes on gasoline… and wholesale gasoline prices went up…

But we do note that national average regular gas prices are down 6c over the past week… Mission Accomplished?

Source: Bloomberg

Finally, there is something serious happening behind the scenes:

The TED spread is blowing out…

Source: Bloomberg

Global broker credit risk is spiking…

Source: Bloomberg

And the demand for dollars is suddenly soaring…the cross-ccy basis swaps signal dollar liquidity is drying up…

Source: Bloomberg

So, whether or not we get a bear market rally short-squeeze here, the global financial system is ‘stressed’.