Update (1100ET): The Wall Street Journal reports that JPMorgan and Morgan Stanley are among a group in talks to bolster First Republic Bank.

According to people familiar with the matter, several large banks are discussing a potential deal with First Republic Bank that could include a sizable capital infusion to shore up the beleaguered lender.

Any deal would need the blessing of regulators and will be driven at least in part by the bank’s highly volatile stock.

FRC shares are bouncing hard off the earlier lows (halted numerous times)...

That headline sent the US Majors soaring...

* * *

As we detailed earlier, First Republic Bank shares have plunged this morning, extending a week-long rout, as executives consider courting a buyer to prop up the bank in the wake of the collapse of several regional peers.

Bloomberg reports that, according to people familiar with the matter, the San Francisco-based bank is said to be exploring strategic options that include a sale. The firm is also weighing options for shoring up liquidity, some of the people said.

“Normally, a headline of a potential sale would support the stock,” Christopher McGratty, an analyst at Keefe, Bruyette and Woods, wrote in a report.

“However, the potentially significant deposit outflows post-SIVB failure likely leave FRC in a tough spot.”

“Any potential sale would likely be a tough outcome for existing shareholders, given mark-to-market accounting on loans,” McGratty wrote.

FRC shares are down over 30% this morning, back at post-SVB lows...

First Republic saw its credit rating was cut to junk by S&P Global Ratings and Fitch Ratings.

“First Republic’s options have narrowed following deposit outflow, a sharp share-price decline and recent downgrades from ratings agencies, while a potential sale of the bank could center on the attractive wealth-management business,” Herman Chan, an analyst at Bloomberg Intelligence, wrote in a note.

But, but, but President Biden said:

"Americans can rest assured that our banking system is safe. Your deposits are safe."

It's not over.

Update (1300ET): CNBC’s David Faber is reporting that the large banks are planning – as a group – to deposit around $20 billion of their own cash as deposits with First Republic.

This makes some sense as the ‘big banks’ have lots of reserves relative to assets…

So Big Banks are now parking their excess reserves/cash at Small Banks in a costless bailout funded by the Fed. Remember: Big Banks still have lots of reserves left; Small Banks are reserve constrainedhttps://t.co/wa2jVsCRFJ pic.twitter.com/3B6Wr3ROPj

— zerohedge (@zerohedge) March 16, 2023

As a reminder, JPM and the “Big 4” got even bigger recently thanks to small bank deposit run from past week, which they are now returning as deposits back into those troubled banks.

FRC shares are jumping (and halted) on the headlines…

* * *

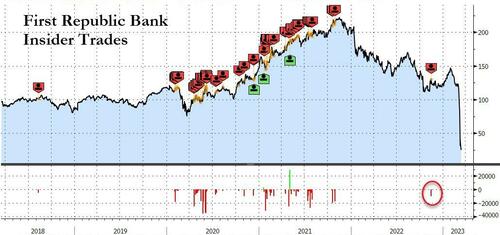

Update (1230ET): What did they know and when?

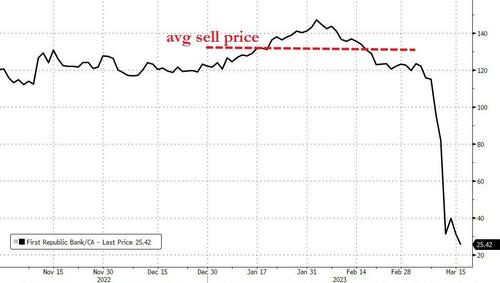

As chatter continues to build of some bailout for First Republic Bank this week, after the company’s share price has collapsed, The Wall Street Journal reports that top execs at the bank sold millions of dollars of company stock in the last two months… but did not report the sales to SEC.

A gander at the SEC filings show only one small ‘insider sale’ recently (in November)…

However, executive have been selling for months, as unlike insider sales at most companies, those at First Republic aren’t required to be reported to the Securities and Exchange Commission.

Instead, the trades were reported to the Federal Deposit Insurance Corporation.

A handful of banks currently file these forms to the FDIC, which posts them on a website where the documents can be accessed one at a time.

As of Wednesday, First Republic is the only company listed on the S&P 500 index that doesn’t file its insider trades with the SEC, a Wall Street Journal analysis shows.

In all, insiders have sold $11.8 million worth of stock so far this year at prices averaging just below $130 a share.

Finally, we would expect a knock at the door if we were them as the DoJ is already looking at insider sales made by Silicon Valley Bank executives a week before that bank’s failure,

* * *

Update (1100ET): The Wall Street Journal reports that JPMorgan and Morgan Stanley are among a group in talks to bolster First Republic Bank.

According to people familiar with the matter, several large banks are discussing a potential deal with First Republic Bank that could include a sizable capital infusion to shore up the beleaguered lender.

Any deal would need the blessing of regulators and will be driven at least in part by the bank’s highly volatile stock.

FRC shares are bouncing hard off the earlier lows (halted numerous times)…

That headline sent the US Majors soaring…

* * *

As we detailed earlier, First Republic Bank shares have plunged this morning, extending a week-long rout, as executives consider courting a buyer to prop up the bank in the wake of the collapse of several regional peers.

Bloomberg reports that, according to people familiar with the matter, the San Francisco-based bank is said to be exploring strategic options that include a sale. The firm is also weighing options for shoring up liquidity, some of the people said.

“Normally, a headline of a potential sale would support the stock,” Christopher McGratty, an analyst at Keefe, Bruyette and Woods, wrote in a report.

“However, the potentially significant deposit outflows post-SIVB failure likely leave FRC in a tough spot.”

“Any potential sale would likely be a tough outcome for existing shareholders, given mark-to-market accounting on loans,” McGratty wrote.

FRC shares are down over 30% this morning, back at post-SVB lows…

First Republic saw its credit rating was cut to junk by S&P Global Ratings and Fitch Ratings.

“First Republic’s options have narrowed following deposit outflow, a sharp share-price decline and recent downgrades from ratings agencies, while a potential sale of the bank could center on the attractive wealth-management business,” Herman Chan, an analyst at Bloomberg Intelligence, wrote in a note.

But, but, but President Biden said:

“Americans can rest assured that our banking system is safe. Your deposits are safe.”

It’s not over.

Loading…