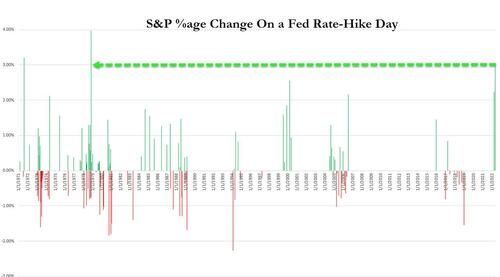

Tl:dr: This was the biggest gain on a Fed day since Dec 2008 (a rate-cut day), but this was the greatest upside-day for the S&P 500 on a Fed Rate-Hike day since Nov 1978!!

And here's what happened last time the S&P rallied this much on a Fed rate-hike day... (we made new lows)

* * *

"Inflation is much too high," warned Fed Chair Powell in his opening words, in an effort to assure the American people - and the markets - that they are really really serious this time, pinky-swear, about hiking even if the market pukes its guts out... (or not).

Powell: "It is important that they know that we know how painful it is."

— zerohedge (@zerohedge) May 4, 2022

You mean the pain you caused when you said it was transitory for 9 months straight!?

The market did not like that news (stocks fell, yields rose, rate-hike-odds rose)

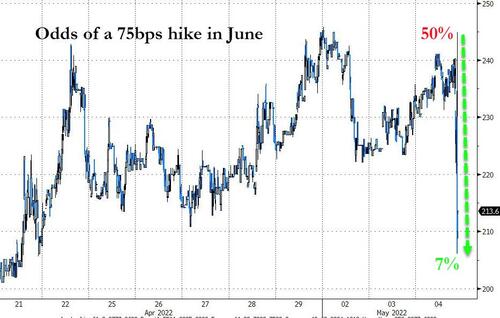

But then Powell tried to assuage fears of a 75bps hike:

"A 75 basis point increases is not something the committee is actively considering," but noted that the "next couple of meetings" will be 50bps hikes.

The market loved that news (stocks surged, USD dumped, yield curve steepened with short-end yields plunging)... monkeyhammering all the risk away (VIX crashed to a 24 handle)...

STIRs immediately priced-out the odds of a 75bps hike in June...

Source: Bloomberg

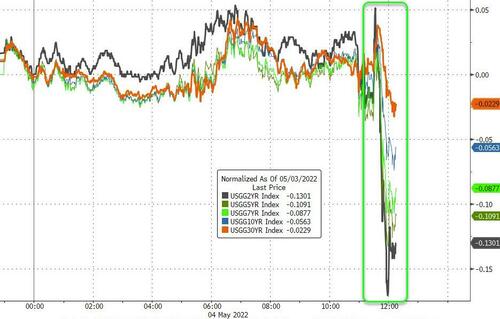

And the rate-hike-trajectory also dropped on Powell's more dovish tilt...

Source: Bloomberg

The short-end of the yield curve collapsed (2Y -13bps, 30Y -2bps)...

Source: Bloomberg

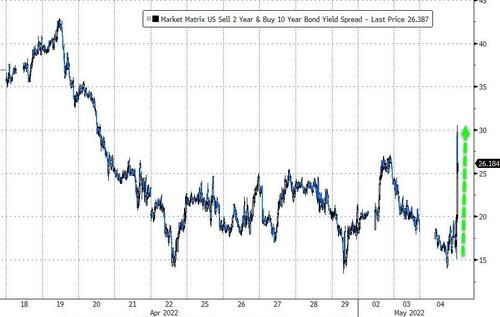

...and the yield curve steepened drastically...

Source: Bloomberg

Notably Bloomberg's Ira Jersey warned that "The market may be interpreting the lack of a 75-bp move incorrectly as ‘dovish’ given the strong rally in the front end of the yield curve. A string of 50-bp hikes, without a 75-bp move, could actually mean a higher terminal rate and over time may not mean much for the short end of the yield curve. There could be an opportunity building in the curve.”

Additionally, Powell warned The Fed could act "expeditiously" - which could easily mean more than three 50bps-hikes are in order if inflation remains high.

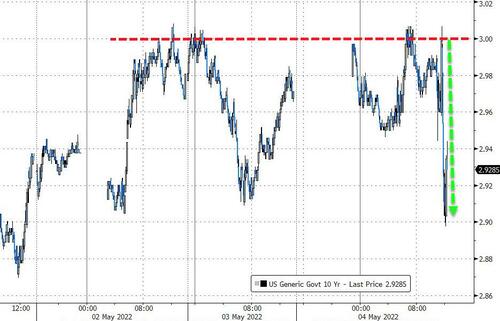

10Y Yields reversed once again at 3.00% (exactly where they did in Dec 2018 before Powell folded)...

Source: Bloomberg

Stocks went utterly vertical on the 'lack of 75bps move' (as the dramatically oversold/over-hedged positioning unwound again)...Yes, the Nasdaq exploded 3.5% higher on the day (from down 1.5% this morning)....

'That escalated quickly..."

All the sectors shot higher, led by tech and discretionary (but energy was best on the day)...

Source: Bloomberg

...apparently ignoring the fact that they are not at all priced for a series of 50bps hikes...

Source: Bloomberg

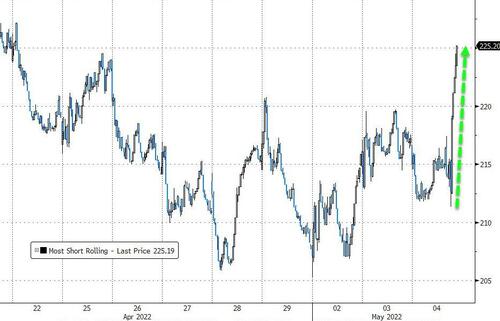

The chart above shows what happened after the last FOMC meeting - will we see another melt-up squeeze? This afternoon saw a serious short-squeeze begin...

Source: Bloomberg

So that's it then... The Fed has the problem in hand and a soft landing is now priced in (and a hard landing, in case we dip again).

At this rate, stocks will be at ATH by Friday and Fed speakers will be throwing around emergency 100bps rate hikes

— zerohedge (@zerohedge) May 4, 2022

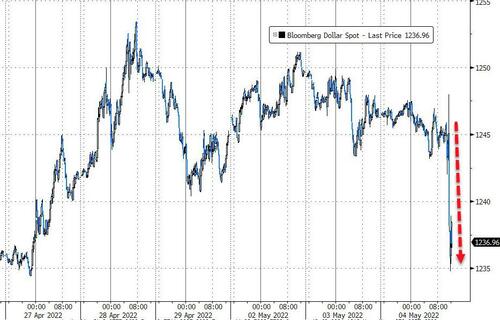

The dollar tumbled during the press conference...

Source: Bloomberg

The Ruble soared to its strongest relative to the USD since Feb 2020...

Source: Bloomberg

Oil prices soared on the day on the heels of EU embargo headlines - erasing all of Biden's 'improvements' in price...

Finally, Powell admitted that The Fed is useless:

"Our tools don’t really work on supply shocks, our tools work on demand."

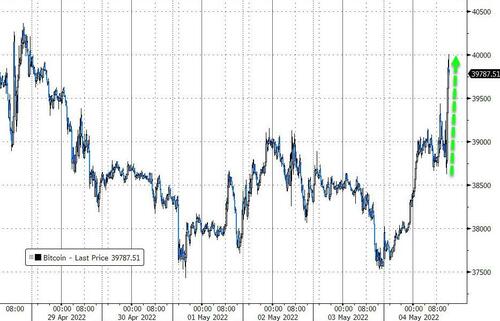

Which could be why Bitcoin quickly ripped up to $40k...

Source: Bloomberg

Gold was also bid on his comments...

As hard as Powell tried to rescue his credibility, crypto and gold exposed the lie.

*POWELL SAYS `NO, I DON'T' THINK FED HAS CREDIBILITY PROBLEM

— zerohedge (@zerohedge) May 4, 2022

Narrator: what credibility

As one veteran trader noted: "it seemed like Powell reverted back to his 'inflation is transitory' perspective... good fucking luck with that!"

Tl:dr: This was the biggest gain on a Fed day since Dec 2008 (a rate-cut day), but this was the greatest upside-day for the S&P 500 on a Fed Rate-Hike day since Nov 1978!!

And here’s what happened last time the S&P rallied this much on a Fed rate-hike day… (we made new lows)

* * *

“Inflation is much too high,” warned Fed Chair Powell in his opening words, in an effort to assure the American people – and the markets – that they are really really serious this time, pinky-swear, about hiking even if the market pukes its guts out… (or not).

Powell: “It is important that they know that we know how painful it is.”

You mean the pain you caused when you said it was transitory for 9 months straight!?

— zerohedge (@zerohedge) May 4, 2022

The market did not like that news (stocks fell, yields rose, rate-hike-odds rose)

But then Powell tried to assuage fears of a 75bps hike:

“A 75 basis point increases is not something the committee is actively considering,” but noted that the “next couple of meetings” will be 50bps hikes.

The market loved that news (stocks surged, USD dumped, yield curve steepened with short-end yields plunging)… monkeyhammering all the risk away (VIX crashed to a 24 handle)…

STIRs immediately priced-out the odds of a 75bps hike in June…

Source: Bloomberg

And the rate-hike-trajectory also dropped on Powell’s more dovish tilt…

Source: Bloomberg

The short-end of the yield curve collapsed (2Y -13bps, 30Y -2bps)…

Source: Bloomberg

…and the yield curve steepened drastically…

Source: Bloomberg

Notably Bloomberg’s Ira Jersey warned that “The market may be interpreting the lack of a 75-bp move incorrectly as ‘dovish’ given the strong rally in the front end of the yield curve. A string of 50-bp hikes, without a 75-bp move, could actually mean a higher terminal rate and over time may not mean much for the short end of the yield curve. There could be an opportunity building in the curve.”

Additionally, Powell warned The Fed could act “expeditiously” – which could easily mean more than three 50bps-hikes are in order if inflation remains high.

10Y Yields reversed once again at 3.00% (exactly where they did in Dec 2018 before Powell folded)…

Source: Bloomberg

Stocks went utterly vertical on the ‘lack of 75bps move’ (as the dramatically oversold/over-hedged positioning unwound again)…Yes, the Nasdaq exploded 3.5% higher on the day (from down 1.5% this morning)….

‘That escalated quickly…”

All the sectors shot higher, led by tech and discretionary (but energy was best on the day)…

Source: Bloomberg

…apparently ignoring the fact that they are not at all priced for a series of 50bps hikes…

Source: Bloomberg

The chart above shows what happened after the last FOMC meeting – will we see another melt-up squeeze? This afternoon saw a serious short-squeeze begin…

Source: Bloomberg

So that’s it then… The Fed has the problem in hand and a soft landing is now priced in (and a hard landing, in case we dip again).

At this rate, stocks will be at ATH by Friday and Fed speakers will be throwing around emergency 100bps rate hikes

— zerohedge (@zerohedge) May 4, 2022

The dollar tumbled during the press conference…

Source: Bloomberg

The Ruble soared to its strongest relative to the USD since Feb 2020…

Source: Bloomberg

Oil prices soared on the day on the heels of EU embargo headlines – erasing all of Biden’s ‘improvements’ in price…

Finally, Powell admitted that The Fed is useless:

“Our tools don’t really work on supply shocks, our tools work on demand.”

Which could be why Bitcoin quickly ripped up to $40k…

Source: Bloomberg

Gold was also bid on his comments…

As hard as Powell tried to rescue his credibility, crypto and gold exposed the lie.

*POWELL SAYS `NO, I DON’T’ THINK FED HAS CREDIBILITY PROBLEM

Narrator: what credibility

— zerohedge (@zerohedge) May 4, 2022

As one veteran trader noted: “it seemed like Powell reverted back to his ‘inflation is transitory’ perspective… good fucking luck with that!”