Today saw the quiet (short squeeze higher) before the storm of risk catalysts ahead this week (including 41% of SPX earnings and a handful of key macro data - JOLTS, GDP, PCE, NFP). But October Dallas Fed manufacturing activity was better than expected today, adding to momentum in the Citi US Macro Surprise Index...

Source: Bloomberg

The 'good' data sent rate-cut expectations (hawkishly) lower with 2024 now a coin toss between 1 and 2 25bp cuts and 2025 down to pricing in just 3 cuts...

Source: Bloomberg

Goldman's trading desk noted that market volumes are down -5% and top of book depth is only $8.4mm with a "squeezy price action" evident in stocks: Bitcoin Equities (GSCBBTC1, +7.5%); China ADRs (GSXUCADR, +4.6%); Non-Profitable Tech (GSXUNPTC, +3%) & Most Short Rolling (GSCBMSAL, +2.8%) - third major squeeze day in a row...

Source: Bloomberg

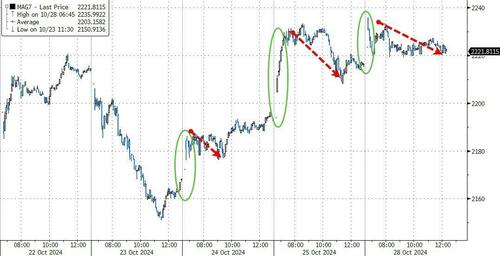

Mag7 stocks ended very marginally higher on the day after a short-squeeze open.

Source: Bloomberg

Bear in mind that today marks the first day of the estimated open window period for corporate buybacks with ~50% in open window today. We have already seen a number of companies start entering into new 10b5-1 plans over the past week.

Taking all that into consideration, Small Caps were the days best performer (squeeze) while Nasdaq was the laggard (barely holding on to unchanged). The S&P lagged The Dow...

VIX was lower today but the vol term structure for the S&P 500 is very much anticipating some malarkey over the next couple of weeks...

Source: Bloomberg

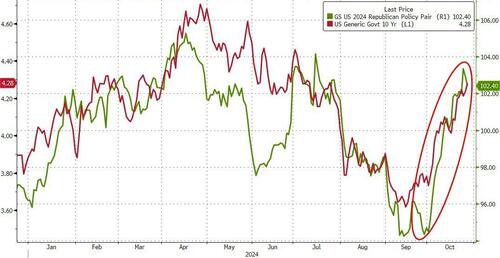

Bond yields pushed higher with the 'Trump Trade'...

Source: Bloomberg

With yields up 3-4bps across the curve - but it was a wild day in bond-land with TSYs bid across Europe and then offered during most of the US session...

Source: Bloomberg

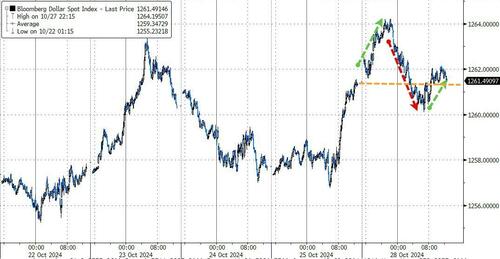

The dollar ended the day unchanged after extending Friday's gains, falling back then inching back up to unch...

Source: Bloomberg

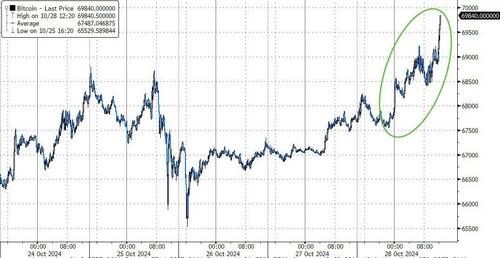

Bitcoin surged back up within a few ticks of $70,000...

Source: Bloomberg

Crude prices were clubbed like a baby seal today as the Iran-Israel theatrics seemed to calm traders minds and erase geopolitical risk premium....

Source: Bloomberg

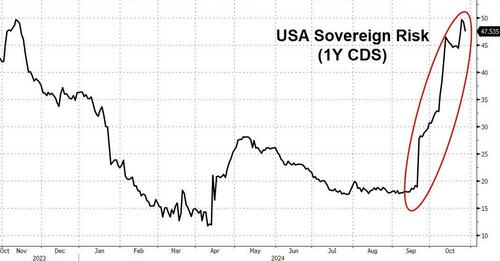

Finally, USA Sovereign risk continues to rise quietly behind the scenes...

Source: Bloomberg

...as the world bids on the ultimate 'insurance' bet into an election surprise (red or blue sweep)...

Today saw the quiet (short squeeze higher) before the storm of risk catalysts ahead this week (including 41% of SPX earnings and a handful of key macro data – JOLTS, GDP, PCE, NFP). But October Dallas Fed manufacturing activity was better than expected today, adding to momentum in the Citi US Macro Surprise Index…

Source: Bloomberg

The ‘good’ data sent rate-cut expectations (hawkishly) lower with 2024 now a coin toss between 1 and 2 25bp cuts and 2025 down to pricing in just 3 cuts…

Source: Bloomberg

Goldman’s trading desk noted that market volumes are down -5% and top of book depth is only $8.4mm with a “squeezy price action” evident in stocks: Bitcoin Equities (GSCBBTC1, +7.5%); China ADRs (GSXUCADR, +4.6%); Non-Profitable Tech (GSXUNPTC, +3%) & Most Short Rolling (GSCBMSAL, +2.8%) – third major squeeze day in a row…

Source: Bloomberg

Mag7 stocks ended very marginally higher on the day after a short-squeeze open.

Source: Bloomberg

Bear in mind that today marks the first day of the estimated open window period for corporate buybacks with ~50% in open window today. We have already seen a number of companies start entering into new 10b5-1 plans over the past week.

Taking all that into consideration, Small Caps were the days best performer (squeeze) while Nasdaq was the laggard (barely holding on to unchanged). The S&P lagged The Dow…

VIX was lower today but the vol term structure for the S&P 500 is very much anticipating some malarkey over the next couple of weeks…

Source: Bloomberg

Bond yields pushed higher with the ‘Trump Trade’…

Source: Bloomberg

With yields up 3-4bps across the curve – but it was a wild day in bond-land with TSYs bid across Europe and then offered during most of the US session…

Source: Bloomberg

The dollar ended the day unchanged after extending Friday’s gains, falling back then inching back up to unch…

Source: Bloomberg

Bitcoin surged back up within a few ticks of $70,000…

Source: Bloomberg

Crude prices were clubbed like a baby seal today as the Iran-Israel theatrics seemed to calm traders minds and erase geopolitical risk premium….

Source: Bloomberg

Finally, USA Sovereign risk continues to rise quietly behind the scenes…

Source: Bloomberg

…as the world bids on the ultimate ‘insurance’ bet into an election surprise (red or blue sweep)…

Loading…