The stock market is set to plummet by a large degree should debt ceiling negotiations drag into the coming days with no deal on the table.

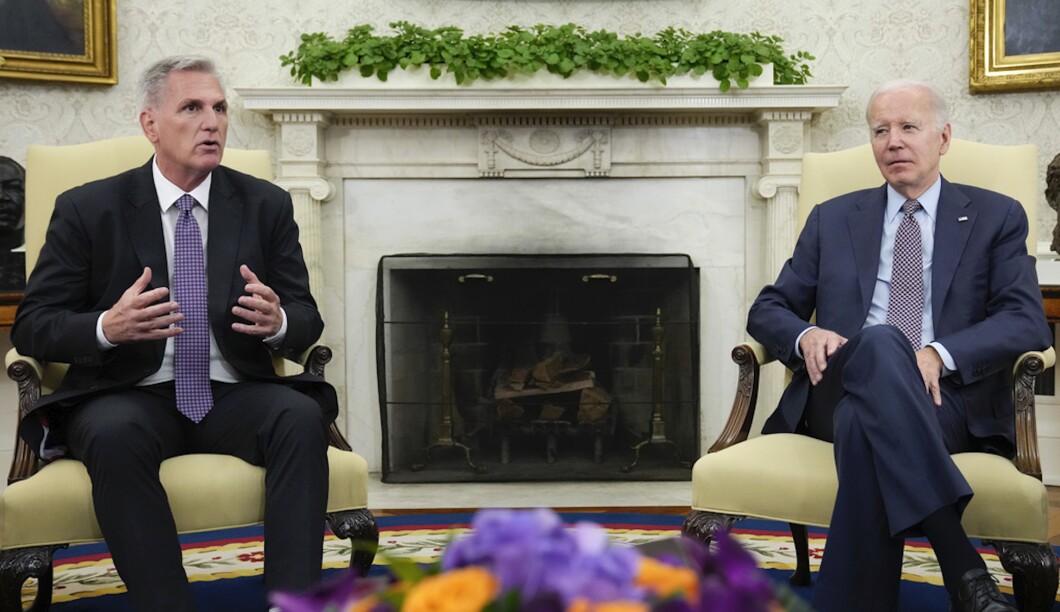

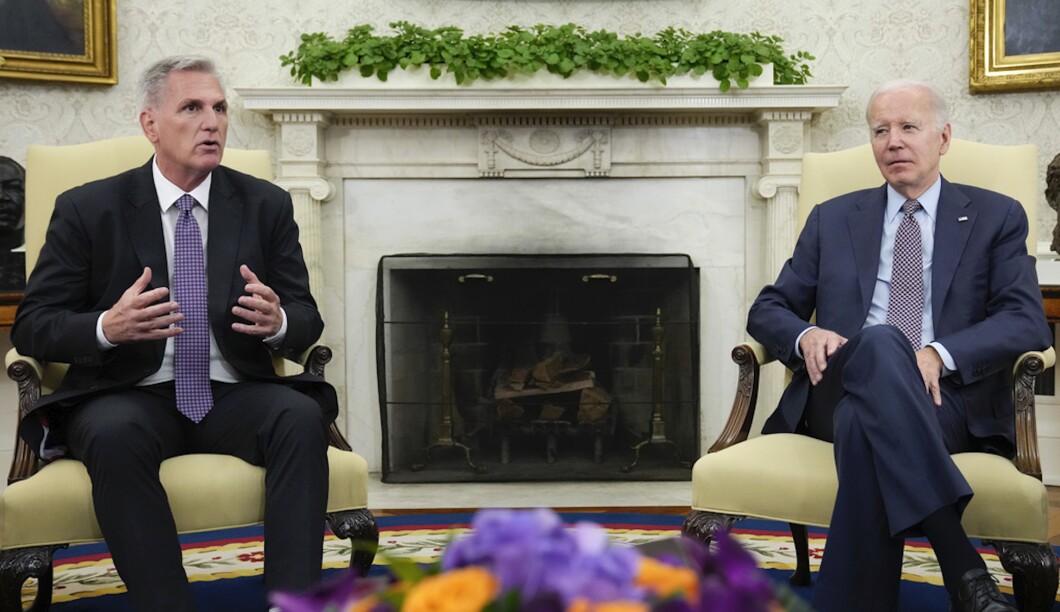

The White House and congressional Republicans, led by House Speaker Kevin McCarthy (R-CA), are currently embroiled in the worst debt ceiling standoff since 2011, when House Republicans and then-President Barack Obama failed to reach an agreement until just days before the date that the Treasury Department said it would exhaust its borrowing authority.

MAKE OR BREAK: THIS WEEK INTO NEXT IS CRITICAL WINDOW FOR DEBT CEILING NEGOTIATIONS

That 2011 deadlock, the closest the United States has ever come to defaulting, shows the toll that the current impasse might have on the markets as negotiations continue to inch closer to the Treasury’s current June 1 deadline, the earliest the government could run out of cash. During that standoff in 2011, the S&P 500 lost about 17% of its total value.

This week, the market began to react to the lack of a deal, although it has not yet posted declines comparable to 2011. The S&P 500 has only fallen by about 2.2% since Friday, but absent a deal, those declines are expected to quickly accelerate.

Phil Toews, CEO of Toews Asset Management, said Wednesday that he thinks investors and advisers have “completely missed” the risk signals around the current negotiations but that, as the days tick closer to June 1, fear could begin to show quickly in the markets. He said the country is in “unprecedented territory.”

“Markets hate uncertainty, and there is probably no financial event that we’ve experienced in recent history that is more uncertain in terms of the outcome with Treasurys and stocks than what we’re potentially going to experience right now,” Toews, whose firm has more than $2 billion in assets under management, told the Washington Examiner.

Toews said that he thinks the downward slide in the stock market is just starting to show this week, but the situation could become very painful very fast. Part of that is the psychology of the markets — if stocks start posting bigger declines, investors who see that could begin to panic and start selling. That could create a domino effect for other investors and trigger huge losses.

“I think it looks a little bit like a cliff, where it’s risk-on and risk-off. So at this point, we’re close enough to the date where negative momentum could just suddenly accelerate, and sometimes negative momentum begets more negative momentum,” Toews warned.

The dynamics of 2011 are remarkably similar to the political landscape of this latest debt fight. In 2011, Democrats controlled both the White House and the Senate while Republicans held the House (though Republicans held a much larger majority in 2011 after the Tea Party movement helped sweep a large number of fiscally conservative budget hawks into office).

But the fundamentals are the same.

The White House wanted to raise the debt ceiling without strings attached, while House Republicans wanted to exact big spending cuts in an effort to tame the country’s large budget deficit. The standoff began in May of that year, when the U.S. hit the debt ceiling and the Treasury began resorting to extraordinary measures — moving around government funds to pay incoming bills without issuing new debt. The Treasury began deploying the same measures this year when the U.S. hit the limit in January.

The Treasury-declared deadline for a deal in 2011 was Aug. 2, and much like in this current situation, lawmakers, in a game of chicken, waited until the last minute to come to an agreement. During the former standoff, a deal was announced on July 31 that included $917 billion in cuts over a 10-year period.

Something that happened in 2011 that could also happen today, and which would roil the stock market, is a downgrade of the country’s credit rating. Amid the fracas, S&P announced it was downgrading the country’s credit rating below AAA (outstanding) for the first time in history.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said there is the potential for another credit downgrade this time around as the U.S. inches closer to the X date, which is when the Treasury runs out of cash. The odds of a downgrade only increase each day that ticks by.

“We are now reaching the absolute last minute. And not only is the X date quickly approaching, but the closer we get, the more likely it is that there starts to be real concerns in the markets — or even a potential downgrade — any of which could start some of the negative effects from defaulting even without getting to that point,” she told the Washington Examiner.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

McCarthy announced that talks between his negotiators and Biden’s team would move from the Capitol to the White House on Wednesday and expressed hope they can “finish up negotiations” there. Although, he said the two sides are still “far apart” on several issues, including spending caps.

“You have to spend less than you spent last year. That’s not that difficult to do,” McCarthy said. “But in Washington, somehow, that is a problem. They have increased spending with the Democrats in the majority. … We can find waste; we can eliminate that.”