One day after a "sinkhole" slide for US stocks driven by news of an Apple hiring freeze and facilitated by zero market liquidity, the risk now - as Goldman described over the weekend - is of a meltup in the opposite direction as buyback blackout period ends on July 22, at which point some $5.5BN in daily buybacks will return and relentlessly lift offers with little concerns for price...

Today's slide showed just how illiquid the market is and impact of even modest sell orders. However, on Friday buyback blackout period ends and over $5.5BN in buybacks hit every day (on average), enough volume for material impacthttps://t.co/hMh30d3A0q

— zerohedge (@zerohedge) July 18, 2022

... and amid the catastrophic liquidity where top-of-book liquidity is a tiny $2 million (meaning a $2MM order can move ES by one tick)...

Liquidity pic.twitter.com/DXt8InKI7M

— zerohedge (@zerohedge) July 15, 2022

... we could see a sharp move higher, an observation which today was also validated by the latest notes from Nomura's Charlie McElligott, who writes (full note available to pro subscribers in the usual place) that despite a still-bearish macro/fundamental case - especially with i) aggressive negative earnings revisions still to come and ii) Russia cutting off all European nat gas flows on Thursday - it is the systematic (trend followers, CTAs, vol control funds) world that is "absolutely lifting Global Equities futures in size" because, as McElligott calculates, CTAs have now bought +$33.4BN of futures over the past 1w, both covering legacy “Shorts” and even flipping outright “Long,” with more indices near the next proximate “buy” triggers today.

Even more importantly, looking forward,McElligott concludes that the Vol Target / Risk Control space "is looking set to take the rein of flows from the systematic side, as projecting out over the coming weeks, it is likely that trailing 3m realized Vol begins to catch-down to the move recent collapse in 1m rVol."

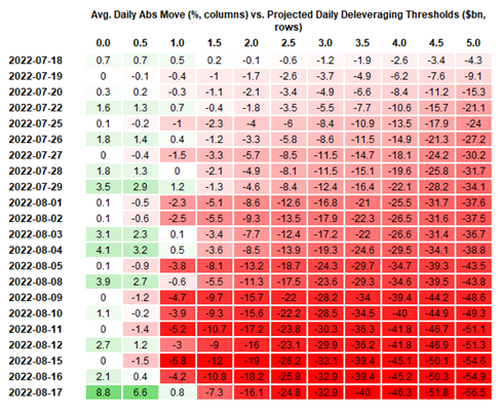

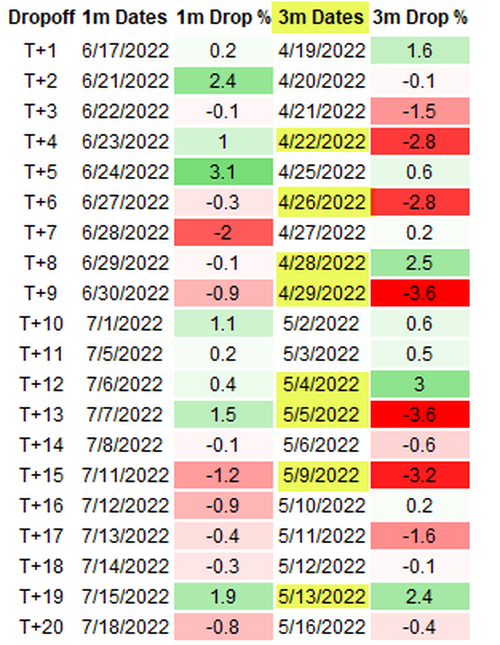

In other words, all that matters for risk right now, is the 3-month volatility lookback period, as over the next two weeks, a number of outlier Vol spasms (in both directions, but particular large “down days” in that late Apr / early May window) will be dropping out of sample, and, in-turn, will allow for substantial mechanical reallocation flow looking out past 2 weeks and ahead into 1m forwards.

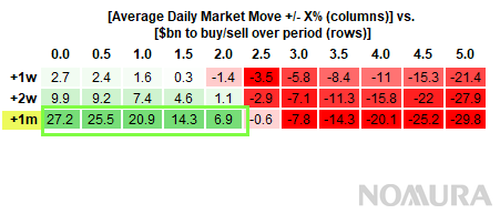

Putting it all together, McElligott estimates upwards of $21BN to buy over the next month on daily SPX changes of ~1% (as a self-reinforcing loop), which reconciles with what 10-day SPX rVol of 17 roughly implies on a projection, to wit:

In a “Summer doldrums” environment (and coming out of an already “well-socialized” 75bps Fed hike, as per new Fed Chair WSJ Timiraos), the recent SPX 10d rVol environment of 17.3 implies a ~1.1% daily SPX change—and if we were to then theoretically project that magnitude of daily change out for the next 1m, we would expect nearly +$21B of US Equities buying from Vol Control over that 1m window (jumps to +$25.5B for 0.5% daily chg out over 1m, or drops down to +$14.3B on daily 1.5% chg)

Add to this $5.5BN in the previously discussed day-to-day stock buyback flows, and suddenly the bearish case looks very precarious, at least on a short-term tactical basis...

* * *

Here is the detailed summary from the Nomura x-asset strategist on why - as Goldman said over the weekend - the pain trade is higher leading to tremendous investor frustration:

Very European centric overnight macro session, where the ECB does their best Powell >> Timiraos “handoff” via a Bloomberg “sources” story overnight, which trial-balloons a potential 50bps hike in what I believe is really just an attempt at a short-term currency squeeze impact, despite the market still pricing “just” 35bps (so remaining slightly tilted to 25bps)

In my eyes, 50bps would be the “right” call for Europe, as they are so far behind on policy that they cannot even see straight—let alone the view that only doing a 25bps hike is a de facto “cut” relative to a world where the BoC is doing 100bps, the Fed is doing 75bps and the Riksbank and SNB are doing 50bps

Either way, it again reiterates that against the inflation backdrop, if you’re a net importer, the new currency wars are about jawboning your currency HIGHER, not lower

Similarly, the European Commission is now on the record as stating that their operating assumption is that the Nordstream pipeline will NOT see gas supply restarted after maintenance ends this week, further driving the EU Energy / Electricity bid, as well as a counterbalancing support for Duration and a Euro headwind, despite today’s short-squeeze in the currency and sell-off in the front-end / STIRs

What is remarkably clear (and now possibly a risk to the consensus “bear” case) is that the Macro / Rates world is even focusing upon this widely-discussed US Equities “negative earnings revision” impulse as the “next shoe to drop” for risk-asset sentiment

Few outside of Equities can reconcile the “bottoms up” Earnings forecasts going higher over the course of 2022, versus the one-way downgrading of “top down” Economic Growth forecasts in the same period

To be fair, the catalyst behind “bottoms up” Earnings forecasts having gone higher over the course of the year is largely due to inflation impact, particularly in the “Commod” centric industries / sectors (from Crude Oil and Materials to Semiconductor Chips)—hence, “Energy” almost single-handedly holding things up like a trophy

So while the “fundamental” bear-case sits and waits for this “negative revisions” impulse, the “systematic” world is absolutely lifting Global Equities futs in size: we estimate that CTA Trend has now bot +$33.4B of futures over the past 1w, both covering legacy “Shorts” and even outright flips “Long,” with more indices near the next proximate “buy” triggers today

But going-forward, the Vol Target / Risk Control space is looking set to take the rein of flows from the systematic side, as projecting out over the coming weeks, it is likely that trailing 3m realized Vol begins to catch-down to the move recent collapse in 1m rVol

It is the 3m rVol input that currently “matters,” and over the next two weeks, a number of outlier Vol spasms (in both directions, but particular large “down days” in that late Apr / early May window) will be dropping out of sample, and, in-turn, will allow for substantial mechanical reallocation flow looking out past 2 weeks and ahead into 1m forwards—where we estimate upwards of ~$21B to buy over the next 1m period on daily SPX changes of ~1%, which reconciles with what 10d SPX rVol of 17 roughly implies on a projection

One day after a “sinkhole” slide for US stocks driven by news of an Apple hiring freeze and facilitated by zero market liquidity, the risk now – as Goldman described over the weekend – is of a meltup in the opposite direction as buyback blackout period ends on July 22, at which point some $5.5BN in daily buybacks will return and relentlessly lift offers with little concerns for price…

Today’s slide showed just how illiquid the market is and impact of even modest sell orders. However, on Friday buyback blackout period ends and over $5.5BN in buybacks hit every day (on average), enough volume for material impacthttps://t.co/hMh30d3A0q

— zerohedge (@zerohedge) July 18, 2022

… and amid the catastrophic liquidity where top-of-book liquidity is a tiny $2 million (meaning a $2MM order can move ES by one tick)…

Liquidity pic.twitter.com/DXt8InKI7M

— zerohedge (@zerohedge) July 15, 2022

… we could see a sharp move higher, an observation which today was also validated by the latest notes from Nomura’s Charlie McElligott, who writes (full note available to pro subscribers in the usual place) that despite a still-bearish macro/fundamental case – especially with i) aggressive negative earnings revisions still to come and ii) Russia cutting off all European nat gas flows on Thursday – it is the systematic (trend followers, CTAs, vol control funds) world that is “absolutely lifting Global Equities futures in size” because, as McElligott calculates, CTAs have now bought +$33.4BN of futures over the past 1w, both covering legacy “Shorts” and even flipping outright “Long,” with more indices near the next proximate “buy” triggers today.

Even more importantly, looking forward,McElligott concludes that the Vol Target / Risk Control space “is looking set to take the rein of flows from the systematic side, as projecting out over the coming weeks, it is likely that trailing 3m realized Vol begins to catch-down to the move recent collapse in 1m rVol.“

In other words, all that matters for risk right now, is the 3-month volatility lookback period, as over the next two weeks, a number of outlier Vol spasms (in both directions, but particular large “down days” in that late Apr / early May window) will be dropping out of sample, and, in-turn, will allow for substantial mechanical reallocation flow looking out past 2 weeks and ahead into 1m forwards.

Putting it all together, McElligott estimates upwards of $21BN to buy over the next month on daily SPX changes of ~1% (as a self-reinforcing loop), which reconciles with what 10-day SPX rVol of 17 roughly implies on a projection, to wit:

In a “Summer doldrums” environment (and coming out of an already “well-socialized” 75bps Fed hike, as per new Fed Chair WSJ Timiraos), the recent SPX 10d rVol environment of 17.3 implies a ~1.1% daily SPX change—and if we were to then theoretically project that magnitude of daily change out for the next 1m, we would expect nearly +$21B of US Equities buying from Vol Control over that 1m window (jumps to +$25.5B for 0.5% daily chg out over 1m, or drops down to +$14.3B on daily 1.5% chg)

Add to this $5.5BN in the previously discussed day-to-day stock buyback flows, and suddenly the bearish case looks very precarious, at least on a short-term tactical basis…

* * *

Here is the detailed summary from the Nomura x-asset strategist on why – as Goldman said over the weekend – the pain trade is higher leading to tremendous investor frustration:

Very European centric overnight macro session, where the ECB does their best Powell >> Timiraos “handoff” via a Bloomberg “sources” story overnight, which trial-balloons a potential 50bps hike in what I believe is really just an attempt at a short-term currency squeeze impact, despite the market still pricing “just” 35bps (so remaining slightly tilted to 25bps)

In my eyes, 50bps would be the “right” call for Europe, as they are so far behind on policy that they cannot even see straight—let alone the view that only doing a 25bps hike is a de facto “cut” relative to a world where the BoC is doing 100bps, the Fed is doing 75bps and the Riksbank and SNB are doing 50bps

Either way, it again reiterates that against the inflation backdrop, if you’re a net importer, the new currency wars are about jawboning your currency HIGHER, not lower

Similarly, the European Commission is now on the record as stating that their operating assumption is that the Nordstream pipeline will NOT see gas supply restarted after maintenance ends this week, further driving the EU Energy / Electricity bid, as well as a counterbalancing support for Duration and a Euro headwind, despite today’s short-squeeze in the currency and sell-off in the front-end / STIRs

What is remarkably clear (and now possibly a risk to the consensus “bear” case) is that the Macro / Rates world is even focusing upon this widely-discussed US Equities “negative earnings revision” impulse as the “next shoe to drop” for risk-asset sentiment

Few outside of Equities can reconcile the “bottoms up” Earnings forecasts going higher over the course of 2022, versus the one-way downgrading of “top down” Economic Growth forecasts in the same period

To be fair, the catalyst behind “bottoms up” Earnings forecasts having gone higher over the course of the year is largely due to inflation impact, particularly in the “Commod” centric industries / sectors (from Crude Oil and Materials to Semiconductor Chips)—hence, “Energy” almost single-handedly holding things up like a trophy

So while the “fundamental” bear-case sits and waits for this “negative revisions” impulse, the “systematic” world is absolutely lifting Global Equities futs in size: we estimate that CTA Trend has now bot +$33.4B of futures over the past 1w, both covering legacy “Shorts” and even outright flips “Long,” with more indices near the next proximate “buy” triggers today

But going-forward, the Vol Target / Risk Control space is looking set to take the rein of flows from the systematic side, as projecting out over the coming weeks, it is likely that trailing 3m realized Vol begins to catch-down to the move recent collapse in 1m rVol

It is the 3m rVol input that currently “matters,” and over the next two weeks, a number of outlier Vol spasms (in both directions, but particular large “down days” in that late Apr / early May window) will be dropping out of sample, and, in-turn, will allow for substantial mechanical reallocation flow looking out past 2 weeks and ahead into 1m forwards—where we estimate upwards of ~$21B to buy over the next 1m period on daily SPX changes of ~1%, which reconciles with what 10d SPX rVol of 17 roughly implies on a projection