For the 10th month in a row, The Dallas Fed Manufacturing Outlook survey printed negative (signaling contraction) with the February print dropping to -13.5 from -8.4 (-9.3 exp).

Source: Bloomberg

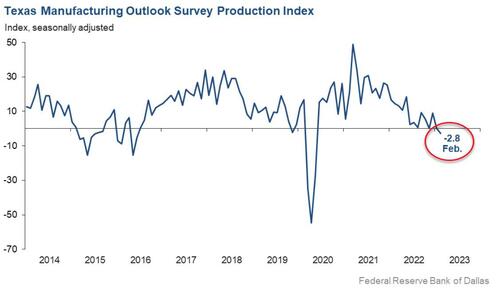

The production index, a key measure of state manufacturing conditions, edged down from 0.2 to -2.8, a reading suggestive of a modest contraction in output.

Under the hood, the new orders index was negative for a ninth month in a row and moved down nine points to -13.2. The growth rate of orders index fell from -12.3 to -16.9. The capacity utilization index returned to negative territory after two positive readings, falling 10 points to -4.1, while the shipments index was largely unchanged at -5.0.

Perceptions of broader business conditions worsened in February as pessimism increased, as evidenced by comments from survey respondents:

-

Primary metal manufacturing: "We expect recession in the second half of this year. We already had a first round of layoffs. We are looking at each employee very carefully to learn who may have to be in a second wave of layoffs, if and when business slows down again."

-

Printing and related support activities: "It seems like someone turned off the spigot, as we have gotten stupid slow, as have others in our industry. We are not sure if it’s the Federal Reserve jacking with interest rates, or else some sort of cyclical slowdown, but it feels like business has ground to a halt. We have some nice work planned for later on this year, but right now we are just stupid slow."

-

Printing and related support activities: "Our residential building and construction business has decreased drastically over the past few months due to mortgage rate increases, inflation and other factors. One major factor affecting our industry is foreign competitors dumping product into the U.S. at lower prices than their domestic prices—and lower than U.S. producers’ prices. Mexico, India, Colombia, Ecuador, Vietnam, Malaysia, Turkey and Poland are among countries exporting aluminum extrusions to the U.S. at record levels."

-

Computer and electronic product manufacturing: "I am currently worried about the time I am seeing it take for my customers to pay me."

-

Plastics and rubber products manufacturing: "Revenue dollars per sale are going down. People are watching their money."

-

Textile product mills: "February has been a slow month; it is hard to know why, but our outlook has worsened for both our business and retail activity in general."

-

Miscellaneous manufacturing: "All markets served have slowed down and are ordering lower quantities as compared with last year. Automotive OEM [original equipment manufacturers] customers’ volumes are most affected by lower quantities."

-

Transportation equipment manufacturing: "There is nothing positive with respect to the economy."

Is this what Powell wants to hear?

For the 10th month in a row, The Dallas Fed Manufacturing Outlook survey printed negative (signaling contraction) with the February print dropping to -13.5 from -8.4 (-9.3 exp).

Source: Bloomberg

The production index, a key measure of state manufacturing conditions, edged down from 0.2 to -2.8, a reading suggestive of a modest contraction in output.

Under the hood, the new orders index was negative for a ninth month in a row and moved down nine points to -13.2. The growth rate of orders index fell from -12.3 to -16.9. The capacity utilization index returned to negative territory after two positive readings, falling 10 points to -4.1, while the shipments index was largely unchanged at -5.0.

Perceptions of broader business conditions worsened in February as pessimism increased, as evidenced by comments from survey respondents:

-

Primary metal manufacturing: “We expect recession in the second half of this year. We already had a first round of layoffs. We are looking at each employee very carefully to learn who may have to be in a second wave of layoffs, if and when business slows down again.”

-

Printing and related support activities: “It seems like someone turned off the spigot, as we have gotten stupid slow, as have others in our industry. We are not sure if it’s the Federal Reserve jacking with interest rates, or else some sort of cyclical slowdown, but it feels like business has ground to a halt. We have some nice work planned for later on this year, but right now we are just stupid slow.”

-

Printing and related support activities: “Our residential building and construction business has decreased drastically over the past few months due to mortgage rate increases, inflation and other factors. One major factor affecting our industry is foreign competitors dumping product into the U.S. at lower prices than their domestic prices—and lower than U.S. producers’ prices. Mexico, India, Colombia, Ecuador, Vietnam, Malaysia, Turkey and Poland are among countries exporting aluminum extrusions to the U.S. at record levels.”

-

Computer and electronic product manufacturing: “I am currently worried about the time I am seeing it take for my customers to pay me.“

-

Plastics and rubber products manufacturing: “Revenue dollars per sale are going down. People are watching their money.“

-

Textile product mills: “February has been a slow month; it is hard to know why, but our outlook has worsened for both our business and retail activity in general.”

-

Miscellaneous manufacturing: “All markets served have slowed down and are ordering lower quantities as compared with last year. Automotive OEM [original equipment manufacturers] customers’ volumes are most affected by lower quantities.”

-

Transportation equipment manufacturing: “There is nothing positive with respect to the economy.“

Is this what Powell wants to hear?

Loading…