US equity markets are extending Friday's rip higher this morning, having bounced off the 200DMA, broken through the 100DMA, and now testing 4,000 level and the 50DMA around 4,012...

Friday's action was helped (juiced) by one of the heaviest volume 0DTE options days on record.

SpotGamma recorded >50% of total volume, and 1.5mm contracts (which are “top 5” marks). Note here how in the previous few weeks 0DTE reduced which correlates to the bank crisis, FOMC, etc.

This 0DTE flow remains to be long buyers in the morning, as 0DTE call buyers seem particularly heavy into weak market openings. This can bee seen here in the composite S&P500 HIRO signal, as 0DTE bought the dip, and unwound those positions as the S&P pulled up into 4000 territory.

SpotGamma suggests that much of this 0DTE call buying on lows is traders delta hedging core long put positions.

And we are seeing a similar trend this morning...

The reason we bring this up is that, as Bloomberg's Ven Ram notes this morning, expressions of volatility in equities remain subdued despite raging concern about the broader macroeconomic backdrop and elevated pricing in rates and currency-option gauges.

The VIX Index is hovering nonchalantly around 20. A Rip Van Winkle coming out of hibernation and missing the latest context would perhaps have concluded that all is hunky-dory in the markets. Juxtapose that with the sharp moves in the Move Index and comparable currency-market gauges, and the contrast couldn’t be more stark.

Ram goes on to note that a considerable part of that insouciance in stock volatility stems from the growing presence of zero-day-to-expiry options. Unlike the newer cousin, VIX is based on options that have an average expiry of about 30 days, and that’s obviously a lot of theta decay to pay for. That is especially so in the context of positioning for a calendar-led event risk that may suggest a very short burst of volatility rather than a prolonged one.

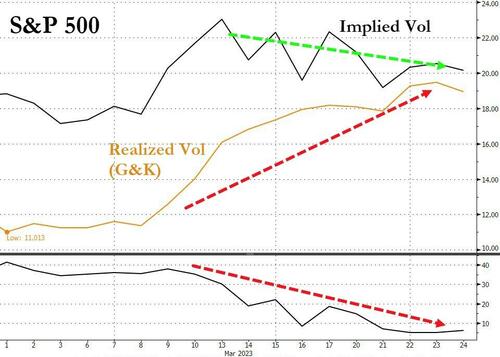

[ZH: while not a direct apples to apples comparison, the following chart shows the leak lower in implied vol (amid all the chaos) while a realized volatility measure that accounts for intraday movements (i.e. the potential impact of 0DTE trading on amplifying intraday swings) has been rising significantly.]

This is a market that seems to be undergoing a complete regime change, so if the current risk-averse macroeconomic backdrop doesn’t send volatility spiraling in equities, it’s hard to think what else might.

However, tactically-speaking, our strongest view remains that of resistance around 4000 for today into tomorrow, and 4065 into Friday. Dealers are likely long gamma in this area, which suggests that volatility should contract sharply if the 4000 level is breached.

US equity markets are extending Friday’s rip higher this morning, having bounced off the 200DMA, broken through the 100DMA, and now testing 4,000 level and the 50DMA around 4,012…

Friday’s action was helped (juiced) by one of the heaviest volume 0DTE options days on record.

SpotGamma recorded >50% of total volume, and 1.5mm contracts (which are “top 5” marks). Note here how in the previous few weeks 0DTE reduced which correlates to the bank crisis, FOMC, etc.

This 0DTE flow remains to be long buyers in the morning, as 0DTE call buyers seem particularly heavy into weak market openings. This can bee seen here in the composite S&P500 HIRO signal, as 0DTE bought the dip, and unwound those positions as the S&P pulled up into 4000 territory.

SpotGamma suggests that much of this 0DTE call buying on lows is traders delta hedging core long put positions.

And we are seeing a similar trend this morning…

The reason we bring this up is that, as Bloomberg’s Ven Ram notes this morning, expressions of volatility in equities remain subdued despite raging concern about the broader macroeconomic backdrop and elevated pricing in rates and currency-option gauges.

The VIX Index is hovering nonchalantly around 20. A Rip Van Winkle coming out of hibernation and missing the latest context would perhaps have concluded that all is hunky-dory in the markets. Juxtapose that with the sharp moves in the Move Index and comparable currency-market gauges, and the contrast couldn’t be more stark.

Ram goes on to note that a considerable part of that insouciance in stock volatility stems from the growing presence of zero-day-to-expiry options. Unlike the newer cousin, VIX is based on options that have an average expiry of about 30 days, and that’s obviously a lot of theta decay to pay for. That is especially so in the context of positioning for a calendar-led event risk that may suggest a very short burst of volatility rather than a prolonged one.

[ZH: while not a direct apples to apples comparison, the following chart shows the leak lower in implied vol (amid all the chaos) while a realized volatility measure that accounts for intraday movements (i.e. the potential impact of 0DTE trading on amplifying intraday swings) has been rising significantly.]

This is a market that seems to be undergoing a complete regime change, so if the current risk-averse macroeconomic backdrop doesn’t send volatility spiraling in equities, it’s hard to think what else might.

However, tactically-speaking, our strongest view remains that of resistance around 4000 for today into tomorrow, and 4065 into Friday. Dealers are likely long gamma in this area, which suggests that volatility should contract sharply if the 4000 level is breached.

Loading…