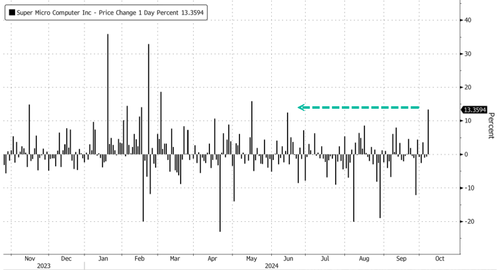

Shares of Super Micro Computer jumped on Monday, marking their largest intra-day gain in months after the company released shipment data highlighting strong customer demand for AI servers.

*SUPER MICRO SHARES EXTEND RALLY TO 17%, MOST IN SEVEN MONTHS

— zerohedge (@zerohedge) October 7, 2024

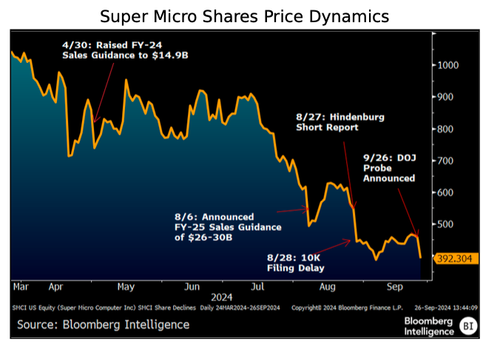

Despite internal challenges, including a 10K filing delay, a Department of Justice probe, and a short report from Hindenburg Research, AI server demand for Super Micro remained robust at 100,000 GPUs per quarter.

Here's more from Super Micro's PR:

Supermicro recently deployed more than 100,000 GPUs with liquid cooling solution (DLC) for some of the largest AI factories ever built, as well as other CSPs. With each server approaching 12kW of power needed for AI and HPC workloads, liquid cooling is a more efficient choice to maintain the desired operating temperature for each GPU and CPU. A single AI rack now generates over 100kW of heat, which needs to be efficiently removed from the data center. Datacenter-scale liquid cooling significantly reduces the power demand for a given cluster size. Up to 40% power reduction allows you to deploy more AI servers in a fixed power envelope to increase computing power and decrease LLM time to train, which are critical for these large CSPs and AI factories.

Commenting on the shipment data, Bloomberg Intellegence's Woo Jin Ho pointed out, "Assuming it shipped 1,500 of the 2,000 liquid cooled racks at roughly $3 million a rack in September implies roughly $4.5 billion for the month, which would be a good foundation for reaching its 1Q sales-guidance midpoint of $6.5 billion."

Ho said Super Micro's 10K filing delay and DoJ probe will likely overshadow any "favorable AI server demand fundamentals."

"The lack of financial transparency could sow doubt in its fiscal 2025 sales momentum, which calls for 87% revenue growth, the midpoint of its $26-$30 billion guidance. The company's strength in rack-scale design engineering and short delivery lead times has helped secure key AI deals, but customer and supplier concerns may rise amid the red flags raised on its financials," the analyst noted.

He said many of these lingering risks for Super Micro have been "highlighted in Hindenburg's short-thesis report are known and outlined in its 10-K filings or historical in nature, such as its delisting," adding, "Though we can't invalidate Hindenburg's investigation on accounting practices, it's tough to make a direct connection to financial malfeasance with the evidence provided. However, the Hindenburg report does draw attention to the need for greater transparency and for strengthening financial controls following a couple of years of exponential growth."

In markets, at one point this morning, Super Micro shares jumped to a seven-month high. Shares have given up some gains into the early afternoon trade, up 13.5%, the largest intra-day gain since mid-May.

Shares have plunged 66% since peaking around $120 in mid-March.

Ho showed the series of events that sparked the selloff.

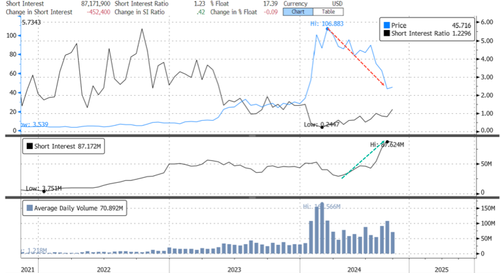

The float stands around 17.39% short, or about 87 million shares.

NVDA continues propping up the AI bubble. The negative divergence between SMCI and NVDA is purely based on the company's troubles.

This morning's PR by Super Micro executives raises questions about how much they might be trying to orchestrate a squeeze. Is this a smart idea with DoJ investigating the company?

Shares of Super Micro Computer jumped on Monday, marking their largest intra-day gain in months after the company released shipment data highlighting strong customer demand for AI servers.

*SUPER MICRO SHARES EXTEND RALLY TO 17%, MOST IN SEVEN MONTHS

— zerohedge (@zerohedge) October 7, 2024

Despite internal challenges, including a 10K filing delay, a Department of Justice probe, and a short report from Hindenburg Research, AI server demand for Super Micro remained robust at 100,000 GPUs per quarter.

Here’s more from Super Micro’s PR:

Supermicro recently deployed more than 100,000 GPUs with liquid cooling solution (DLC) for some of the largest AI factories ever built, as well as other CSPs. With each server approaching 12kW of power needed for AI and HPC workloads, liquid cooling is a more efficient choice to maintain the desired operating temperature for each GPU and CPU. A single AI rack now generates over 100kW of heat, which needs to be efficiently removed from the data center. Datacenter-scale liquid cooling significantly reduces the power demand for a given cluster size. Up to 40% power reduction allows you to deploy more AI servers in a fixed power envelope to increase computing power and decrease LLM time to train, which are critical for these large CSPs and AI factories.

Commenting on the shipment data, Bloomberg Intellegence’s Woo Jin Ho pointed out, “Assuming it shipped 1,500 of the 2,000 liquid cooled racks at roughly $3 million a rack in September implies roughly $4.5 billion for the month, which would be a good foundation for reaching its 1Q sales-guidance midpoint of $6.5 billion.”

Ho said Super Micro’s 10K filing delay and DoJ probe will likely overshadow any “favorable AI server demand fundamentals.”

“The lack of financial transparency could sow doubt in its fiscal 2025 sales momentum, which calls for 87% revenue growth, the midpoint of its $26-$30 billion guidance. The company’s strength in rack-scale design engineering and short delivery lead times has helped secure key AI deals, but customer and supplier concerns may rise amid the red flags raised on its financials,” the analyst noted.

He said many of these lingering risks for Super Micro have been “highlighted in Hindenburg’s short-thesis report are known and outlined in its 10-K filings or historical in nature, such as its delisting,” adding, “Though we can’t invalidate Hindenburg’s investigation on accounting practices, it’s tough to make a direct connection to financial malfeasance with the evidence provided. However, the Hindenburg report does draw attention to the need for greater transparency and for strengthening financial controls following a couple of years of exponential growth.”

In markets, at one point this morning, Super Micro shares jumped to a seven-month high. Shares have given up some gains into the early afternoon trade, up 13.5%, the largest intra-day gain since mid-May.

Shares have plunged 66% since peaking around $120 in mid-March.

Ho showed the series of events that sparked the selloff.

The float stands around 17.39% short, or about 87 million shares.

NVDA continues propping up the AI bubble. The negative divergence between SMCI and NVDA is purely based on the company’s troubles.

This morning’s PR by Super Micro executives raises questions about how much they might be trying to orchestrate a squeeze. Is this a smart idea with DoJ investigating the company?

Loading…