Authored by Simon White, Bloomberg macro strategist,

Financial conditions are loosening significantly, further fueling a global upswing that began last year.

Longer-term yields and yield curves in the US and around the world are set to remain in an upward trend.

We’re said to now live in a post-truth world. Markets, however, have always existed in a pre-truth one. None of the major developed-market central banks has cut rates yet, but conditions around the world have already de facto eased considerably. That has been charging a global and US cyclical upswing – discussed here last October – which is gaining momentum. Yields and yield curves need to re-rate higher to reflect stronger nominal growth and a resurgence in global inflation.

Pictures are worth a thousand words, which is why I’ll use plenty of charts in today’s commentary (even more than usual!) to quickly and succinctly show the extent of the loosening in conditions and the rise in global growth it is catalyzing.

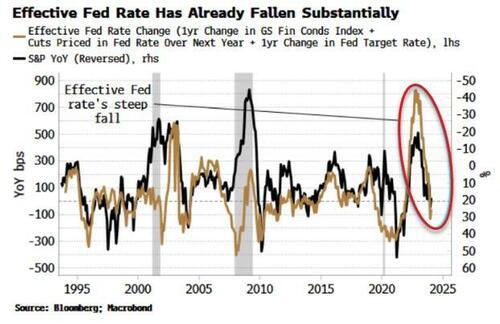

To see the full breadth of loosening, we can combine the Fed’s policy rate with rate cuts priced and the easing in financial conditions. This measure has collapsed, representing a significant loosening, well before the Fed’s rate has itself been cut.

In fact, the central-bank policy rate is typically the last to move when the direction of interest rates is changing. Further, on its own it doesn’t capture how restrictive actual lending conditions are.

Including forward rates – lower now due to the market expecting multiple rate cuts – and financial conditions, which have eased significantly, provides the totality of the policy rate’s impact. (Goldman’s Financial Conditions Index, part of the Effective Fed Rate in the above chart, is designed so that the change in US financial conditions is made equivalent to a change in the Fed’s rate.)

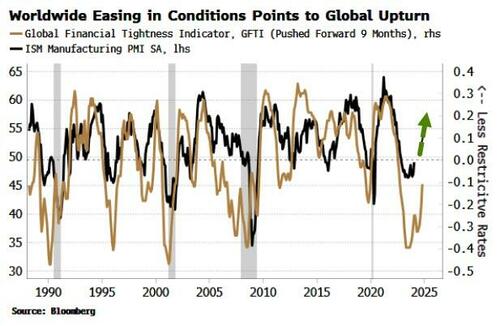

It’s not just a US phenomenon. Global central banks reached their peak rate restrictiveness last summer. First, banks in the aggregate stopped hiking, then some started cutting. The Global Financial Tightness Indicator (GFTI) shown below — essentially a diffusion of central-bank rate hikes — captures this and is now clearly easing. That points to a continued rise in the US manufacturing ISM, itself a highly reliable indicator of a cyclical upswing in the global economy.

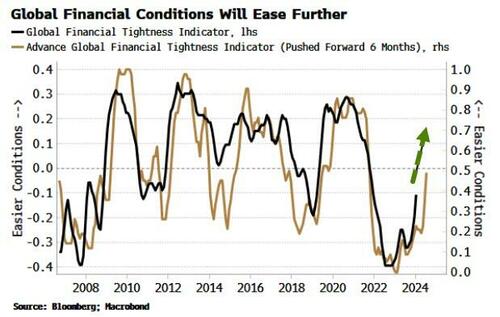

There’s more to come. The easing captured by the GFTI should continue for the time being, given that the Advanced GFTI — based on rate cuts anticipated by futures prices — leads the GFTI by about four months and is also heading higher. These are all highly reliable ex ante indicators of the nascent rise in global growth we see today.

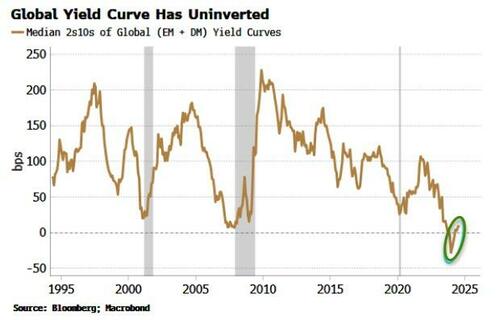

Looser conditions can also be seen in the recent disinversion of the global yield curve. Globally, shorter-term yields are no longer higher than long-term yields. Yield curves are likely to maintain their steepening trend.

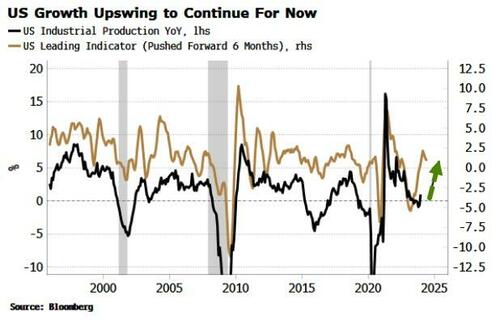

The widespread easing in financial conditions is fueling a growth upturn in the US and around the world. The US leading indicator highlighted in October pointed to a fledgling upswing in growth. The indicator has started to turn lower, but from a relatively high level, signifying the growth upturn should persist for another few months.

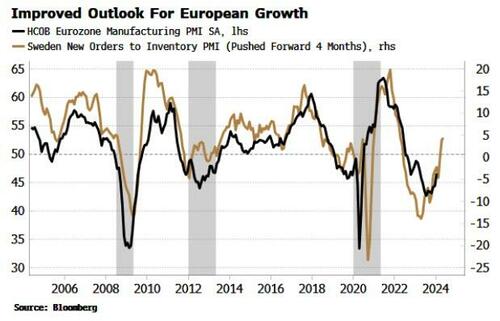

In Europe, Sweden, as a small and open economy, is a good leading indicator for the region. Swedish PMIs are turning higher, indicating sluggish growth in the euro-zone should also soon pick up.

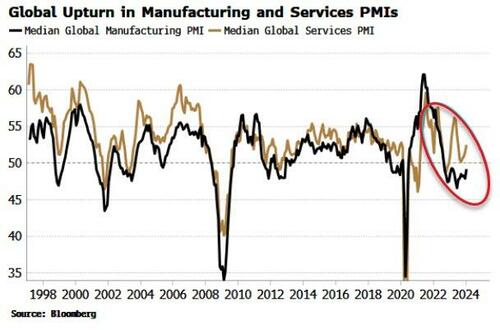

And it’s not just the US and Europe. Globally, we can see evidence of an upswing in play, with both services and manufacturing PMIs rising.

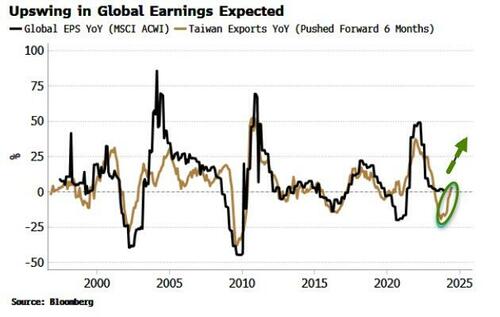

Indicators of growth momentum can also be seen in the rising exports of small and open Asian economies, such as South Korea and Taiwan, with the latter pointing to accelerating expansion in global EPS.

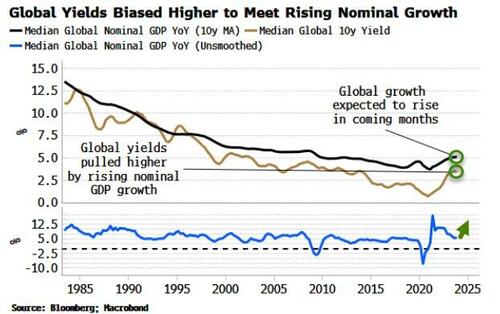

Rising global growth and a likely re-acceleration in inflation means nominal GDP should rise, acting as a ineluctable pull higher on global bond yields, especially while the risk of an imminent US recession remains low.

An inflation revival later in the year is also likely to catch central banks – who have turned prematurely dovish – off-guard, leaving yield curves more prone to bear steepening.

The Fed, ECB et al are at risk of cutting rates right around the time inflation rears its head again. Fear of flip-flopping will make them less likely to reverse direction and hike rates aggressively, increasing the chance policy rates lag inflation-sensing longer-term yields.

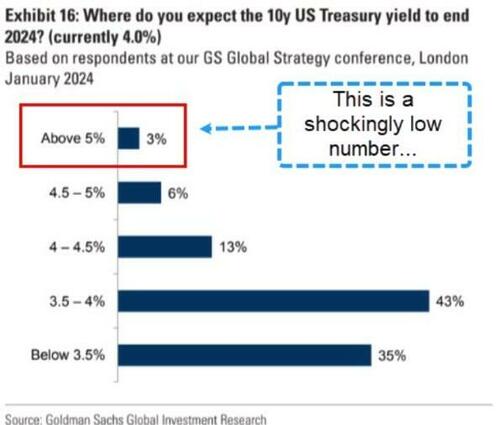

Higher yields, as exemplified by the outlook for the US, are anticipated by only a small proportion of professional investors.

Source: Goldman Sachs

There remain exogenous (e.g. geo-political) and endogenous (e.g. banking and CRE, credit) risks that could quickly uproot this broad-based cyclical bounce in growth.

Nonetheless, the global economy has clear momentum and, as per Newton’s First Law, it should continue moving in a straight line unless acted upon by an external force.

Authored by Simon White, Bloomberg macro strategist,

Financial conditions are loosening significantly, further fueling a global upswing that began last year.

Longer-term yields and yield curves in the US and around the world are set to remain in an upward trend.

We’re said to now live in a post-truth world. Markets, however, have always existed in a pre-truth one. None of the major developed-market central banks has cut rates yet, but conditions around the world have already de facto eased considerably. That has been charging a global and US cyclical upswing – discussed here last October – which is gaining momentum. Yields and yield curves need to re-rate higher to reflect stronger nominal growth and a resurgence in global inflation.

Pictures are worth a thousand words, which is why I’ll use plenty of charts in today’s commentary (even more than usual!) to quickly and succinctly show the extent of the loosening in conditions and the rise in global growth it is catalyzing.

To see the full breadth of loosening, we can combine the Fed’s policy rate with rate cuts priced and the easing in financial conditions. This measure has collapsed, representing a significant loosening, well before the Fed’s rate has itself been cut.

In fact, the central-bank policy rate is typically the last to move when the direction of interest rates is changing. Further, on its own it doesn’t capture how restrictive actual lending conditions are.

Including forward rates – lower now due to the market expecting multiple rate cuts – and financial conditions, which have eased significantly, provides the totality of the policy rate’s impact. (Goldman’s Financial Conditions Index, part of the Effective Fed Rate in the above chart, is designed so that the change in US financial conditions is made equivalent to a change in the Fed’s rate.)

It’s not just a US phenomenon. Global central banks reached their peak rate restrictiveness last summer. First, banks in the aggregate stopped hiking, then some started cutting. The Global Financial Tightness Indicator (GFTI) shown below — essentially a diffusion of central-bank rate hikes — captures this and is now clearly easing. That points to a continued rise in the US manufacturing ISM, itself a highly reliable indicator of a cyclical upswing in the global economy.

There’s more to come. The easing captured by the GFTI should continue for the time being, given that the Advanced GFTI — based on rate cuts anticipated by futures prices — leads the GFTI by about four months and is also heading higher. These are all highly reliable ex ante indicators of the nascent rise in global growth we see today.

Looser conditions can also be seen in the recent disinversion of the global yield curve. Globally, shorter-term yields are no longer higher than long-term yields. Yield curves are likely to maintain their steepening trend.

The widespread easing in financial conditions is fueling a growth upturn in the US and around the world. The US leading indicator highlighted in October pointed to a fledgling upswing in growth. The indicator has started to turn lower, but from a relatively high level, signifying the growth upturn should persist for another few months.

In Europe, Sweden, as a small and open economy, is a good leading indicator for the region. Swedish PMIs are turning higher, indicating sluggish growth in the euro-zone should also soon pick up.

And it’s not just the US and Europe. Globally, we can see evidence of an upswing in play, with both services and manufacturing PMIs rising.

Indicators of growth momentum can also be seen in the rising exports of small and open Asian economies, such as South Korea and Taiwan, with the latter pointing to accelerating expansion in global EPS.

Rising global growth and a likely re-acceleration in inflation means nominal GDP should rise, acting as a ineluctable pull higher on global bond yields, especially while the risk of an imminent US recession remains low.

An inflation revival later in the year is also likely to catch central banks – who have turned prematurely dovish – off-guard, leaving yield curves more prone to bear steepening.

The Fed, ECB et al are at risk of cutting rates right around the time inflation rears its head again. Fear of flip-flopping will make them less likely to reverse direction and hike rates aggressively, increasing the chance policy rates lag inflation-sensing longer-term yields.

Higher yields, as exemplified by the outlook for the US, are anticipated by only a small proportion of professional investors.

Source: Goldman Sachs

There remain exogenous (e.g. geo-political) and endogenous (e.g. banking and CRE, credit) risks that could quickly uproot this broad-based cyclical bounce in growth.

Nonetheless, the global economy has clear momentum and, as per Newton’s First Law, it should continue moving in a straight line unless acted upon by an external force.

Loading…