By George Lei, Bloomberg markets live commentator and reporter

Tensions surrounding Taiwan eased a bit this week as China on Tuesday concluded its military exercises held around the island. Taiwan’s benchmark equity index closed above its 50-day moving average on Thursday for the first time since May 31.

For policy makers in both Beijing and Washington, however, the push to reduce economic dependence on each other appears far from over. US House Speaker Nancy Pelosi’s Taiwan trip and China’s military responses added tension and put decoupling on a fast track.

Since the war in Ukraine broke out in February, US and China have worked to lessen the impact on their respective supply chains and financial markets, with a potential Taiwan conflict on the mind. In early April, Treasury Secretary Janet Yellen said Washington is ready to use all its sanctions tools if China attacks the island. Last month, she stressed the need for “trusted” US allies to shore up global supply chains.

China responded by making preparations to sanction-proof its overseas assets and banking systems -- including Hong Kong’s. In May, the head of the Hong Kong Monetary Authority said the de facto central bank had plans for extreme situations, such as the financial hub being kicked out of the SWIFT system. The same month, China’s holdings of US Treasuries fell below the $1 trillion mark for the first time since 2010.

The latest gambit came from Washington, with President Biden signing the CHIPS Act into law on Tuesday. The legislation bans companies receiving US money from “material expansion” of chip-making in China. It is particularly relevant for Taiwan Semiconductor Manufacturing Co., the world’s premier chip supplier that’s currently building a factory in Arizona.

CHIPS Act helped “cement TSMC’s position with Team USA,” Bloomberg columnist Tim Culpan wrote, noting that the company’s supposed neutrality may already be questioned by Beijing after senior executives met with Pelosi last week in Taiwan. Latest events probably increased China’s urgency to get ready for future escalation, according to Julian Evans-Pritchard, senior economist at Capital Economics.

Beijing’s war games, on the other hand, have also hardened hawkish views in the West, increasing the likelihood of continued efforts to curtail technology access, Evans-Pritchard added. On Wednesday, Pelosi said at a news briefing that the US couldn’t let China establish a “new normal” around Taiwan.

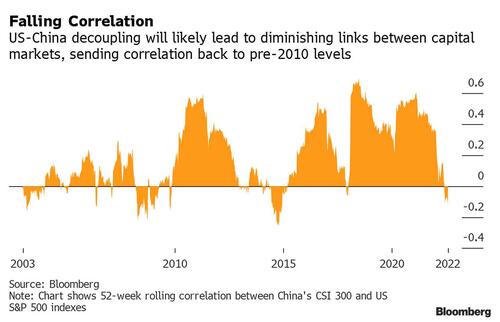

Pelosi’s Taiwan trip was only brief episode amid the broader trend of US-China decoupling, Hao Hong, former Chief Strategist at Bocom International Holdings, told Bloomberg. To Hong, the future is quite clear with Washington and Beijing standing for two kinds of systems, markets and ideologies. As a result, “the correlation will fall further between Chinese and international capital markets.”

A future where US -- and the West -- parts ways with China may not necessarily be disastrous for domestic financial markets. Chinese companies will probably act as great hedges and remain a key part of global equity portfolios, according to Bocom’s Hong. Hedging demand, however, will likely be much smaller compared with current foreign purchases, resulting in a reduction of portfolio inflows.

Impact on China’s real economy and job markets may be much more severe as the nation still relies heavily on foreign trade for growth. External demand drives 15% of the Chinese GDP, Capital Economics’ Evans-Pritchard estimates. On a global scale, 2/3 of Chinese exports are destined for countries aligned with the US, according to Capital Economics calculations.

By George Lei, Bloomberg markets live commentator and reporter

Tensions surrounding Taiwan eased a bit this week as China on Tuesday concluded its military exercises held around the island. Taiwan’s benchmark equity index closed above its 50-day moving average on Thursday for the first time since May 31.

For policy makers in both Beijing and Washington, however, the push to reduce economic dependence on each other appears far from over. US House Speaker Nancy Pelosi’s Taiwan trip and China’s military responses added tension and put decoupling on a fast track.

Since the war in Ukraine broke out in February, US and China have worked to lessen the impact on their respective supply chains and financial markets, with a potential Taiwan conflict on the mind. In early April, Treasury Secretary Janet Yellen said Washington is ready to use all its sanctions tools if China attacks the island. Last month, she stressed the need for “trusted” US allies to shore up global supply chains.

China responded by making preparations to sanction-proof its overseas assets and banking systems — including Hong Kong’s. In May, the head of the Hong Kong Monetary Authority said the de facto central bank had plans for extreme situations, such as the financial hub being kicked out of the SWIFT system. The same month, China’s holdings of US Treasuries fell below the $1 trillion mark for the first time since 2010.

The latest gambit came from Washington, with President Biden signing the CHIPS Act into law on Tuesday. The legislation bans companies receiving US money from “material expansion” of chip-making in China. It is particularly relevant for Taiwan Semiconductor Manufacturing Co., the world’s premier chip supplier that’s currently building a factory in Arizona.

CHIPS Act helped “cement TSMC’s position with Team USA,” Bloomberg columnist Tim Culpan wrote, noting that the company’s supposed neutrality may already be questioned by Beijing after senior executives met with Pelosi last week in Taiwan. Latest events probably increased China’s urgency to get ready for future escalation, according to Julian Evans-Pritchard, senior economist at Capital Economics.

Beijing’s war games, on the other hand, have also hardened hawkish views in the West, increasing the likelihood of continued efforts to curtail technology access, Evans-Pritchard added. On Wednesday, Pelosi said at a news briefing that the US couldn’t let China establish a “new normal” around Taiwan.

Pelosi’s Taiwan trip was only brief episode amid the broader trend of US-China decoupling, Hao Hong, former Chief Strategist at Bocom International Holdings, told Bloomberg. To Hong, the future is quite clear with Washington and Beijing standing for two kinds of systems, markets and ideologies. As a result, “the correlation will fall further between Chinese and international capital markets.”

A future where US — and the West — parts ways with China may not necessarily be disastrous for domestic financial markets. Chinese companies will probably act as great hedges and remain a key part of global equity portfolios, according to Bocom’s Hong. Hedging demand, however, will likely be much smaller compared with current foreign purchases, resulting in a reduction of portfolio inflows.

Impact on China’s real economy and job markets may be much more severe as the nation still relies heavily on foreign trade for growth. External demand drives 15% of the Chinese GDP, Capital Economics’ Evans-Pritchard estimates. On a global scale, 2/3 of Chinese exports are destined for countries aligned with the US, according to Capital Economics calculations.