Just when you thought the headlines couldn’t seem more absurd, Swiss banking giant UBS has issued a warning that in the global battle against inflation, the worst enemy of central banks could be none other than pop star Taylor Swift.

The report could be seen as one part genuine economic analysis, one part marketing schtick for the UBS Arena.

This is the chosen venue for many huge events including Taylor Swift concerts and the MTV Music Video Awards.

However, the underlying point is that sudden spikes in demand make it harder for central bankers to use monetary policy tools to cool inflation.

UBS economist Paul Donovan describes in his report how huge events that draw attendees from all over the world — such as Taylor Swift shows, which draw masses of screaming Swifties who flood cities around the world to see their favorite star — create demand shocks.

These are especially noticeable in industries like travel and hospitality when a sudden influx drives up prices at hotels, restaurants, airlines, taxis, and similar services. Donovan says:

“Hotel prices will often rise for accommodation near a mega event venue. Transport costs (in particular air fares) may also increase. The measurement method for these prices is more likely to capture the unusual and transitory pattern of demand, and it is here that the increase in consumer price inflation takes place.”

It isn’t so much that UBS is wrong. Sudden increases in demand drive up prices.

But the large point is how the notion itself lays bare the total absurdity of the global economy, and the nonsensical notion that a handful of central planners is able to micromanage global inflationary pressures.

Are Taylor Swift concerts really enough to move the needle on global inflation and derail monetary policy efforts?

Eurozone inflation and PMI got a boost this month, but it was entirely artificial — caused by the fact that France hosted this year’s Olympic Games. The surge in economic activity created a massive but entirely transitory increase in demand, dragging up Eurozone economic data points. Meanwhile, fundamentals remain weaker, and major Eurozone economies outside of France continue to contract, fueling motivation for the ECB to return to cutting interest rates again next month.

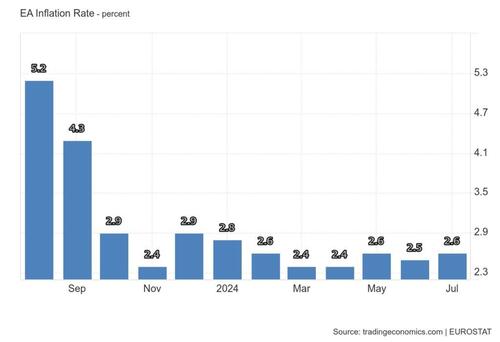

Euro Area Inflation Rate

However, with interest rates already too low to properly get inflation under control (with or without Taylor Swift and the Olympics), a rate cut will only push high prices even higher for Europeans.

And in countries like France, with high debt and unsustainable spending, there’s an increasing chance of a real debt crisis that ripples through the rest of Europe.

Even in countries like Germany where debt-to-GDP ratios are lower this year, contracting economies keep signaling trouble.

For better or worse, none of this is Taylor Swift’s fault, so Swifites are off the hook — but the same can’t be said for central banks.

All the ECB, the Fed, and other central banks know how to do is print money, locking countries into boom and bust cycles as they tinker with the money supply and set interest rates that the free market would never have settled on naturally. Central banks don’t create real or sustainable growth.

The bankers would love to be able to blame Taylor Swift or the Olympics for economic crises. But these busts arise from, and are made even worse, by their own monetary tinkering and government intervention.

Just when you thought the headlines couldn’t seem more absurd, Swiss banking giant UBS has issued a warning that in the global battle against inflation, the worst enemy of central banks could be none other than pop star Taylor Swift.

The report could be seen as one part genuine economic analysis, one part marketing schtick for the UBS Arena.

This is the chosen venue for many huge events including Taylor Swift concerts and the MTV Music Video Awards.

However, the underlying point is that sudden spikes in demand make it harder for central bankers to use monetary policy tools to cool inflation.

UBS economist Paul Donovan describes in his report how huge events that draw attendees from all over the world — such as Taylor Swift shows, which draw masses of screaming Swifties who flood cities around the world to see their favorite star — create demand shocks.

These are especially noticeable in industries like travel and hospitality when a sudden influx drives up prices at hotels, restaurants, airlines, taxis, and similar services. Donovan says:

“Hotel prices will often rise for accommodation near a mega event venue. Transport costs (in particular air fares) may also increase. The measurement method for these prices is more likely to capture the unusual and transitory pattern of demand, and it is here that the increase in consumer price inflation takes place.”

It isn’t so much that UBS is wrong. Sudden increases in demand drive up prices.

But the large point is how the notion itself lays bare the total absurdity of the global economy, and the nonsensical notion that a handful of central planners is able to micromanage global inflationary pressures.

Are Taylor Swift concerts really enough to move the needle on global inflation and derail monetary policy efforts?

Eurozone inflation and PMI got a boost this month, but it was entirely artificial — caused by the fact that France hosted this year’s Olympic Games. The surge in economic activity created a massive but entirely transitory increase in demand, dragging up Eurozone economic data points. Meanwhile, fundamentals remain weaker, and major Eurozone economies outside of France continue to contract, fueling motivation for the ECB to return to cutting interest rates again next month.

Euro Area Inflation Rate

However, with interest rates already too low to properly get inflation under control (with or without Taylor Swift and the Olympics), a rate cut will only push high prices even higher for Europeans.

And in countries like France, with high debt and unsustainable spending, there’s an increasing chance of a real debt crisis that ripples through the rest of Europe.

Even in countries like Germany where debt-to-GDP ratios are lower this year, contracting economies keep signaling trouble.

For better or worse, none of this is Taylor Swift’s fault, so Swifites are off the hook — but the same can’t be said for central banks.

All the ECB, the Fed, and other central banks know how to do is print money, locking countries into boom and bust cycles as they tinker with the money supply and set interest rates that the free market would never have settled on naturally. Central banks don’t create real or sustainable growth.

The bankers would love to be able to blame Taylor Swift or the Olympics for economic crises. But these busts arise from, and are made even worse, by their own monetary tinkering and government intervention.

Loading…