Tesla is slated to report earnings after the bell today, and the street is expecting

-

revenue of $24.5B

-

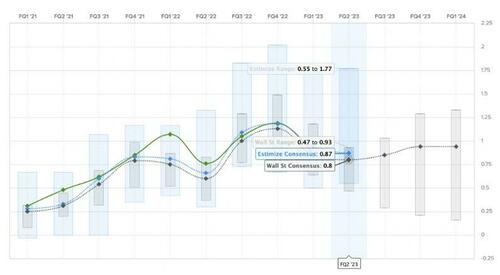

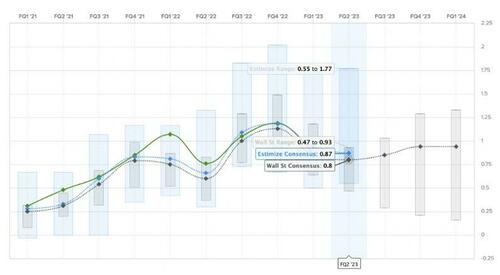

EPS of $0.81

-

gross margin at 18.7%, down from 19.3% in Q1

-

EBITDA at $4.14 billion, down from $4.27 billion YOY

-

free cash flow of $2.2 billion

Guidance will be the bigger issue, with Investing.com astutely noting that "a negative EPS surprise can be easily offset by the message that, despite the still challenging 2023, a bright 2024 is on the horizon."

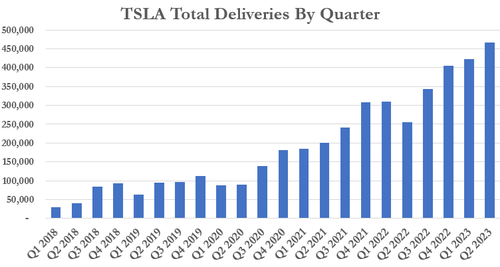

The company has already posted its deliveries for the quarter, beating estimates. At the end of Q2, Tesla once again proved that price cuts can help move metal, posting 466,140 deliveries for the quarter, ahead of Bloomberg's consensus estimate of 448,351. The auto manufacturer produced 479,700 vehicles in the quarter, exceeding estimates of 456,617.

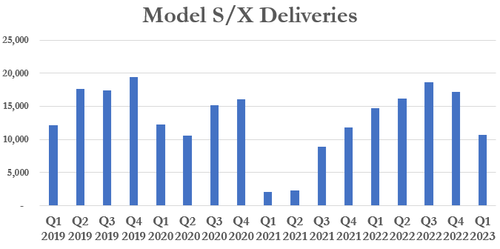

Tesla delivered 19,225 Model S/X vehicles in the quarter, beating expectations of 14,606.

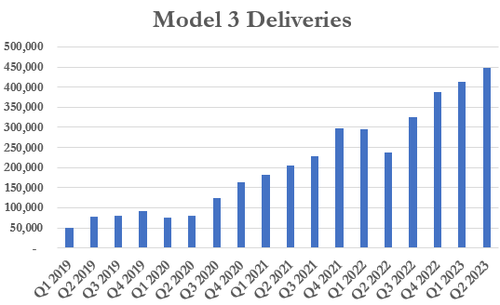

The EV manufacturer also delivered 446,915 Model 3/Y vehicles in the quarter, exceeding estimates of 437,386.

One of the key focuses going forward will again be margins, at the street looks to analyze whether price cuts to drive demand will show more of an impact this quarter than they did last year.

Wedbush analyst Dan Ives wrote this week: “We believe the line in the sand is Auto GM (ex credits) of ~17.5% with [Q2] being the trough quarter for Tesla GM that should ramp back over the coming quarters and back towards the 20% level heading into 2024.”

Jefferies added last week: “We join a consensus view that Q2 will be a trough in auto gross margin.”

Goldman had downgraded the name heading into the end of the quarter. Led by analyst Mark Delaney they cited a tougher pricing environment for autos several weeks ago:

We’re downgrading Tesla shares to Neutral from Buy, as we believe the stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning post the substantial move higher YTD (up 108% vs. the S&P 500 up 13%) and in the last month (up 38% vs. the S&P 500 up 5%). While the primary reason for the change in our view is that we think the market is now giving the stock more credit for its longer-term opportunities, we are also cognizant of the difficult pricing environment for new vehicles that we think will continue to weigh on Tesla’s automotive non-GAAP gross margin this year.

Similar to Morgan Stanley, Delaney couldn't avoid the fact that he still thinks Tesla is positioned for the long term but believes the stock may be overextended heading into the report, stating: "Overall we believe our view that Tesla is well positioned for long-term growth, given its leading position in the EV and clean energy markets (which we attribute in part to its ability to offer full solutions including charging, storage, software/FSD and services with a direct sales model), is now better reflected in the stock."

The market will also want to gauge the impact of Ford, GM and Rivian, among others, adopting Tesla's NACS charging platform. Here are the charging station companies that have announced support for NACS, according to a newly released report from Electrek:

-

ABB

-

Blink Charging

-

Chargepoint

-

EVgo

-

FLO

-

Tritium

-

Wallbox

Tesla has 45,000 charging stations worldwide, 12,000 of which are in the US. Tesla owners also receive a J1772 adapter with their car to access more than 53,000 other Level 2 stations in North America.

The market is also going to be looking for clarity on the Cybertruck and the company's upcoming gen-3 platform. Just yesterday, the first Cybertruck supposedly rolled off the production line at Tesla, but as The Drive - and many others - pointed out, it looked like it had a misaligned door. The Drive noted that it has now been 1,334 days since Tesla first revealed the Cybertruck and that there is "an abundance of hype still surrounding the stainless steel pickup".

During the November 2019 unveiling of the wedge-shaped truck, Musk estimated production would begin in late 2021, with more configurations entering production in 2022. However, production was postponed because of "adjustments."

In recent weeks, Twitter users reported seeing an increasing number of Cybertrucks on the road, we noted days ago.

The company's plans to expand globally will also be in focus. Recall, just days ago we noted how Elon Musk had his sights set on Italy, India and France. Car and Driver reported last month that Musk "has been spending time in Europe this month as the electric automaker is searching for a place to build another Gigafactory in the EU".

Musk met not only with French president Emmanuel Macron for the second time in a month, he also spent time with Italian prime minister Giorgia Meloni.

France's digital minister, Jean-Noël Barrot, told CNBC last month: "It will be great to have a Tesla factory in France, there has been a lot of effort and energy to make sure this is possible, and this can happen. We have also invested in an . . . entire sector of electric batteries, so we will try to convince him that France is the best possible place in Europe to establish the next Tesla factory."

Musk also traveled to Rome to meet with Meloni. CNBC reported that Musk and the Prime Minister talked about “innovation, opportunities and risks of artificial intelligence, European market regulations, and birth rates.”

Electrek noted that Tesla is bound to answer these five questions on the ensuing conference call:

-

Has any automaker approached Tesla to license FSD?

-

When will you get more information about our Cybertruck orders? Estimated delivery schedules, pricing, and specifications?

-

Have you considered allowing FSD transferability as a lever to allow existing customers to upgrade to a new Tesla instead of being locked in to existing cars due to price of FSD?

-

What is the status of the 4680 Cell? How far are you from the specs you laid out on battery day? When do you expect to achieve what you laid out on Battery Day?

-

As you open the supercharger network in North America to other EVs, do you plan to accelerate anticipatory investments in supercharger expansion to avoid congestion, and how will you deal with long lead times to upgrade electric T&D services to these areas for multi-megawatt loads?

Tesla is slated to report earnings after the bell today, and the street is expecting

-

revenue of $24.5B

-

EPS of $0.81

-

gross margin at 18.7%, down from 19.3% in Q1

-

EBITDA at $4.14 billion, down from $4.27 billion YOY

-

free cash flow of $2.2 billion

Guidance will be the bigger issue, with Investing.com astutely noting that “a negative EPS surprise can be easily offset by the message that, despite the still challenging 2023, a bright 2024 is on the horizon.”

The company has already posted its deliveries for the quarter, beating estimates. At the end of Q2, Tesla once again proved that price cuts can help move metal, posting 466,140 deliveries for the quarter, ahead of Bloomberg’s consensus estimate of 448,351. The auto manufacturer produced 479,700 vehicles in the quarter, exceeding estimates of 456,617.

Tesla delivered 19,225 Model S/X vehicles in the quarter, beating expectations of 14,606.

The EV manufacturer also delivered 446,915 Model 3/Y vehicles in the quarter, exceeding estimates of 437,386.

One of the key focuses going forward will again be margins, at the street looks to analyze whether price cuts to drive demand will show more of an impact this quarter than they did last year.

Wedbush analyst Dan Ives wrote this week: “We believe the line in the sand is Auto GM (ex credits) of ~17.5% with [Q2] being the trough quarter for Tesla GM that should ramp back over the coming quarters and back towards the 20% level heading into 2024.”

Jefferies added last week: “We join a consensus view that Q2 will be a trough in auto gross margin.”

Goldman had downgraded the name heading into the end of the quarter. Led by analyst Mark Delaney they cited a tougher pricing environment for autos several weeks ago:

We’re downgrading Tesla shares to Neutral from Buy, as we believe the stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning post the substantial move higher YTD (up 108% vs. the S&P 500 up 13%) and in the last month (up 38% vs. the S&P 500 up 5%). While the primary reason for the change in our view is that we think the market is now giving the stock more credit for its longer-term opportunities, we are also cognizant of the difficult pricing environment for new vehicles that we think will continue to weigh on Tesla’s automotive non-GAAP gross margin this year.

Similar to Morgan Stanley, Delaney couldn’t avoid the fact that he still thinks Tesla is positioned for the long term but believes the stock may be overextended heading into the report, stating: “Overall we believe our view that Tesla is well positioned for long-term growth, given its leading position in the EV and clean energy markets (which we attribute in part to its ability to offer full solutions including charging, storage, software/FSD and services with a direct sales model), is now better reflected in the stock.”

The market will also want to gauge the impact of Ford, GM and Rivian, among others, adopting Tesla’s NACS charging platform. Here are the charging station companies that have announced support for NACS, according to a newly released report from Electrek:

-

ABB

-

Blink Charging

-

Chargepoint

-

EVgo

-

FLO

-

Tritium

-

Wallbox

Tesla has 45,000 charging stations worldwide, 12,000 of which are in the US. Tesla owners also receive a J1772 adapter with their car to access more than 53,000 other Level 2 stations in North America.

The market is also going to be looking for clarity on the Cybertruck and the company’s upcoming gen-3 platform. Just yesterday, the first Cybertruck supposedly rolled off the production line at Tesla, but as The Drive – and many others – pointed out, it looked like it had a misaligned door. The Drive noted that it has now been 1,334 days since Tesla first revealed the Cybertruck and that there is “an abundance of hype still surrounding the stainless steel pickup”.

During the November 2019 unveiling of the wedge-shaped truck, Musk estimated production would begin in late 2021, with more configurations entering production in 2022. However, production was postponed because of “adjustments.”

In recent weeks, Twitter users reported seeing an increasing number of Cybertrucks on the road, we noted days ago.

The company’s plans to expand globally will also be in focus. Recall, just days ago we noted how Elon Musk had his sights set on Italy, India and France. Car and Driver reported last month that Musk “has been spending time in Europe this month as the electric automaker is searching for a place to build another Gigafactory in the EU”.

Musk met not only with French president Emmanuel Macron for the second time in a month, he also spent time with Italian prime minister Giorgia Meloni.

France’s digital minister, Jean-Noël Barrot, told CNBC last month: “It will be great to have a Tesla factory in France, there has been a lot of effort and energy to make sure this is possible, and this can happen. We have also invested in an . . . entire sector of electric batteries, so we will try to convince him that France is the best possible place in Europe to establish the next Tesla factory.”

Musk also traveled to Rome to meet with Meloni. CNBC reported that Musk and the Prime Minister talked about “innovation, opportunities and risks of artificial intelligence, European market regulations, and birth rates.”

Electrek noted that Tesla is bound to answer these five questions on the ensuing conference call:

-

Has any automaker approached Tesla to license FSD?

-

When will you get more information about our Cybertruck orders? Estimated delivery schedules, pricing, and specifications?

-

Have you considered allowing FSD transferability as a lever to allow existing customers to upgrade to a new Tesla instead of being locked in to existing cars due to price of FSD?

-

What is the status of the 4680 Cell? How far are you from the specs you laid out on battery day? When do you expect to achieve what you laid out on Battery Day?

-

As you open the supercharger network in North America to other EVs, do you plan to accelerate anticipatory investments in supercharger expansion to avoid congestion, and how will you deal with long lead times to upgrade electric T&D services to these areas for multi-megawatt loads?

Loading…