Tesla shares are lower by almost 2% early in the session on Thursday after the company - which has drawn the ire of the Biden administration for not folding to unionization - told all of its U.S. workers they were getting a pay raise.

"All U.S. production associates, material handlers and quality inspectors are getting a market adjusted pay increase," according to StreetInsider.

Tesla has been the beneficiary of not being unionized like automakers Ford and GM, who recently had to re-engineer labor contracts that were so costly that both companies slashed their research and development into electric vehicles.

Recall in late November we wrote that Ford was cutting $12 billion in EV investments as a result of the newly-engineered UAW labor contracts. Ford disclosed at the time that its new labor agreement with the UAW was anticipated to have a financial impact of $8.8 billion throughout the contract's duration, which concludes in April 2028.

For comparison, General Motors, a rival in the industry, recently reported a $9.3 billion impact resulting from their own labor agreement.

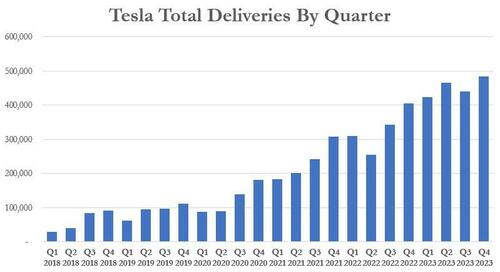

Tesla sold over 1.8 million cars in 2023, helped along by aggressive price cuts that kept metal moving even as the EV industry became saturated. While competitors like BYD have been neck-and-neck with Tesla for the most fully electric vehicles sold worldwide, we also noted in late December that a good number of Tesla "wannabes" have dropped out - or are about to drop out - of the EV race due to lack of capital.

BYD, as we noted earlier this month, beat Tesla's Q4 number with its battery only electric, reporting sales of 526,000 for Q4.

Tesla noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for 2023. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period.

Tesla likely feels as though it has the wind at its back heading into the new year to raise pay for employees. However, those pushing down the company's stock this morning are likely worried about the impact to (already pressured) margins of rising labor costs.

Tesla shares are lower by almost 2% early in the session on Thursday after the company – which has drawn the ire of the Biden administration for not folding to unionization – told all of its U.S. workers they were getting a pay raise.

“All U.S. production associates, material handlers and quality inspectors are getting a market adjusted pay increase,” according to StreetInsider.

Tesla has been the beneficiary of not being unionized like automakers Ford and GM, who recently had to re-engineer labor contracts that were so costly that both companies slashed their research and development into electric vehicles.

Recall in late November we wrote that Ford was cutting $12 billion in EV investments as a result of the newly-engineered UAW labor contracts. Ford disclosed at the time that its new labor agreement with the UAW was anticipated to have a financial impact of $8.8 billion throughout the contract’s duration, which concludes in April 2028.

For comparison, General Motors, a rival in the industry, recently reported a $9.3 billion impact resulting from their own labor agreement.

Tesla sold over 1.8 million cars in 2023, helped along by aggressive price cuts that kept metal moving even as the EV industry became saturated. While competitors like BYD have been neck-and-neck with Tesla for the most fully electric vehicles sold worldwide, we also noted in late December that a good number of Tesla “wannabes” have dropped out – or are about to drop out – of the EV race due to lack of capital.

BYD, as we noted earlier this month, beat Tesla’s Q4 number with its battery only electric, reporting sales of 526,000 for Q4.

Tesla noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for 2023. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period.

Tesla likely feels as though it has the wind at its back heading into the new year to raise pay for employees. However, those pushing down the company’s stock this morning are likely worried about the impact to (already pressured) margins of rising labor costs.

Loading…