Shares of Tesla are down about 7% in the pre-market session after the company cut the price of some of its cars in China, drumming up concerns about demand just days after Musk said the company would continue robust production regardless of whether or not the global economy slipped into recession.

TSLA just broke below $200 for the first time since June 2021...

EV names like Lucid, Rivian, Fisker, and Workhorse will all be on watch heading into the cash session.

Tesla slashed the price of its Model 3 and Model Y to 265,900 Chinese yuan ($36,615) from 279,900 yuan and to 288,900 yuan versus the previous price of 316,900 yuan, CNBC reported Monday morning.

“China is experiencing a recession of sorts," CEO Musk had said last week. The cuts offset price hikes that took place earlier in the year, which came as a result of higher input costs.

Recall, CEO Elon Musk said on his company's conference call last week that the company is pushing forward with production despite the current macroeconomic climate.

Musk said: “To be frank, we’re very pedal to the metal come rain or shine. We are not reducing our production in any meaningful way, recession or not recession.”

He continued: “The public at large realizes that world’s moving towards electric vehicles, and it’s foolish to buy a new gasoline car at this point because the residual value of that gasoline car is going to be very low. So, we’re in a very good spot.”

“I wouldn’t say it’s recession-proof but it’s recession-resilient, because basically the people of Earth have made the decision in large part to move away from gasoline cars,” he added.

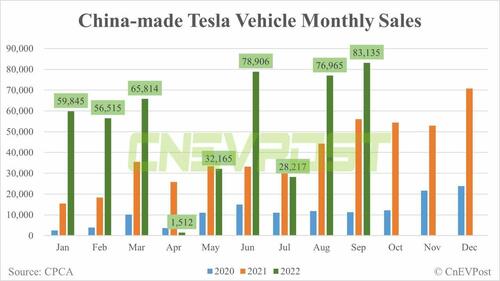

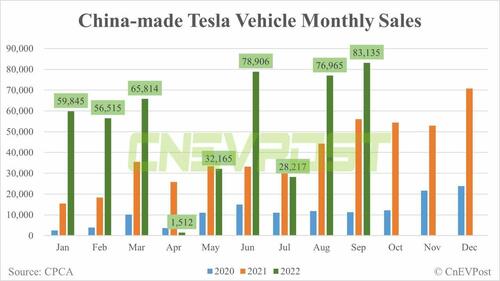

Tesla had sold 83,135 China-made vehicles in September, setting a record. The prior sales record was set in June when the company sold 78,906 China-made vehicles. The new record comes after Tesla shut down Shanghai for a portion of the summer in order to upgrade the facilities.

There were several "alternate takes" on the Tesla news on social media this morning, but here's one that actually struck us as worth noting...

We all know that there is no $TSLA demand issue in China or anywhere for that matter. My belief is that it's a smoke screen for shares going to be dumped and a cover up for the pressure that was going to be on the stock today. Could be wrong but Elon is master illusionist.

— squawksquare (@squawksquare) October 24, 2022

Shares of Tesla are down about 7% in the pre-market session after the company cut the price of some of its cars in China, drumming up concerns about demand just days after Musk said the company would continue robust production regardless of whether or not the global economy slipped into recession.

TSLA just broke below $200 for the first time since June 2021…

EV names like Lucid, Rivian, Fisker, and Workhorse will all be on watch heading into the cash session.

Tesla slashed the price of its Model 3 and Model Y to 265,900 Chinese yuan ($36,615) from 279,900 yuan and to 288,900 yuan versus the previous price of 316,900 yuan, CNBC reported Monday morning.

“China is experiencing a recession of sorts,” CEO Musk had said last week. The cuts offset price hikes that took place earlier in the year, which came as a result of higher input costs.

Recall, CEO Elon Musk said on his company’s conference call last week that the company is pushing forward with production despite the current macroeconomic climate.

Musk said: “To be frank, we’re very pedal to the metal come rain or shine. We are not reducing our production in any meaningful way, recession or not recession.”

He continued: “The public at large realizes that world’s moving towards electric vehicles, and it’s foolish to buy a new gasoline car at this point because the residual value of that gasoline car is going to be very low. So, we’re in a very good spot.”

“I wouldn’t say it’s recession-proof but it’s recession-resilient, because basically the people of Earth have made the decision in large part to move away from gasoline cars,” he added.

Tesla had sold 83,135 China-made vehicles in September, setting a record. The prior sales record was set in June when the company sold 78,906 China-made vehicles. The new record comes after Tesla shut down Shanghai for a portion of the summer in order to upgrade the facilities.

There were several “alternate takes” on the Tesla news on social media this morning, but here’s one that actually struck us as worth noting…

We all know that there is no $TSLA demand issue in China or anywhere for that matter. My belief is that it’s a smoke screen for shares going to be dumped and a cover up for the pressure that was going to be on the stock today. Could be wrong but Elon is master illusionist.

— squawksquare (@squawksquare) October 24, 2022