While it is possible that the market had priced in a hot print (as we previewed) and which explains the rise in futures after the hotter than expected CPI print, it is certain that - as Bloomberg's Chris Anstey writes - this isn’t good news for the Fed: the second straight 0.4% reading for core CPI suggests that January wasn’t a one-off anomaly, contrary to what Goldman claimed with its bet on the "January effect."

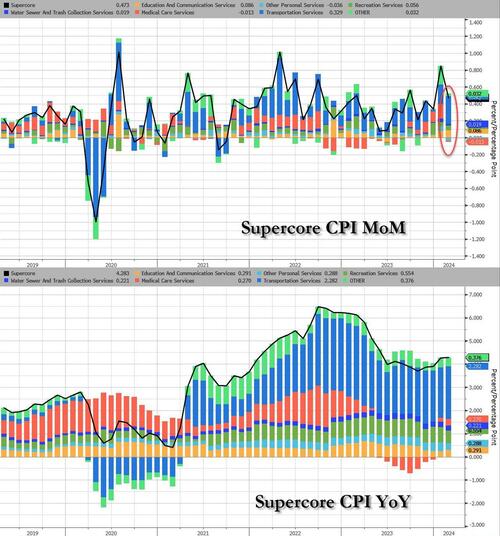

And while this certainly isn’t good news for the Fed, it’s hardly good news for the Biden administration either. This year was meant to be one of dis-inflation but today’s data really lean into the idea that the last mile is the hardest. Still, Biden may take some solace from the fact that the food index was unchanged given his administration has been going hard on the theme of “shrinkflation” and that supercore inflation didn't come in superhot, unlike last month.

Still, overall inflation is looking stubborn.

With that in mind, here is a snapshot of the kneejerk reactions by a selection of Wall Street analysts, economists and strategists.

Brian Coulton, chief economist at Fitch Ratings:

“That is not the direction the Fed wants to see.”

Derek Tang, economist with LH Meyer/Monetary Policy Analytics:

“CPI came in a touch higher than expected but not so high to stop them from cutting in June as we expect. Powell and others have warned inflation will come down in a bumpy way. There’s still a few more prints before they meet in June, and what matters if the whole path down. As Powell said, they’re ‘not far’ from gaining the confidence they need to start cutting, and this report alone doesn’t detract from that.”

Augusta Saraiva, Bloomberg:

"After a brisk January reading, the report adds to evidence that inflation is proving stubborn, which is keeping central bankers wary of easing policy too soon."

Kathy Jones, Charles Schwab’s chief fixed-income strategist:

“This will probably be seen as a reason to keep policy on hold a while longer. Through the volatility, the downtrend in inflation seems to be leveling off and the Fed would like to see it continue to move lower before easing rates.”

Bloomberg Intelligence Rates Strategist Ira Jersey (who confirms what we said yesterday: a hot print was mostly priced in).

“The rates market looks to have been set up for an even worse inflation print. “But we don’t think this print warrants a sustained rally from these levels.”

to David Russell, Head of Market Strategy at TradeStation:

“Inflation came in a little hot but the bulls aren’t ready to throw in the towel yet. Investors remain optimistic that shelter costs will come down. We still have three more reports before that key Fed meeting in June to confirm or reverse that hope. Wall Street is keeping the faith for now but that could change if future prints don’t improve. Stocks are still climbing the wall of worry.”

Alan Detmeister, UBS Research:

"Overall, this report, while strong, was a good sign the elevated January pace is unlikely to persist into the spring, but, as we have noted before, today's report is unlikely to have any effect on the upcoming FOMC meeting."

Torsten Slok, Apollo:

“Fresh upward momentum is building in inflation. Inflation has started to move sideways and remains well above the Fed’s 2% inflation target. This means the Fed will keep rates higher for longer.”

Leo He, UBS Macro Sales:

"Markets are finding relief from the US inflation data as core CPI rose less than the CPI fixing market had expected (36bp versus 41bp priced). The US 2y yield rose more than 8bp in a knee-jerk reaction but is now falling back. The USD is slightly lower and equities are higher after the data release."

Marvin Loh, State Street

“I think the real concerns were that we were going to get accelerating supercore and housing, and since that didn’t happen, we are off to the races again. The market wants to read into the positivity that the Fed will be able to start the rate-cutting process over the summer. It does not want to fret the details of what comes after that until after it starts.”

Ali Jaffery, CIBC Capital Markets:

“Labor market rebalancing and decelerating wage growth suggest softer service price gains down the road. The Fed will remain highly data-dependent, and we expect they will be more comfortable easing policy in the second half of the year.”

Rubeela Farooqi, chief US economist at High Frequency Econ:

“The latest data further reinforce the case for a patient and vigilant approach from Fed officials as they consider future policy decisions.”

Jay Hatfield, founder of Infrastructure Capital Management:

“The core print was only 3.6% without rounding and the components that drove the beat are likely to reverse in the future, particularly airline fares, up 3.6% for the month. PCE core should be below 0.3% which means core PCE will slowly decline over the next three months setting the stage for a June or July rate cut, with the ECB moving in June.”

Anna Wong, Bloomberg Economics:

“The hot core CPI reading won’t build Fed confidence to cut rates imminently — but it also doesn’t rule out the chance of a mid-year rate cut. More importantly, the reversal of the unusual spike in owners’ equivalent rent showed January’s reading was likely just an aberration, not a signal of stickier housing inflation. We still expect the Fed to gain enough confidence to cut rates as soon as May — our base case — as both inflation and the labor market cool further.”

Andrew Hollenhorst, Citi:

“We expect 0.20%MoM core PCE inflation for February based on details of CPI. We will further refine our projection following the release of PPI Thursday - with medical services prices particularly important.”

While it is possible that the market had priced in a hot print (as we previewed) and which explains the rise in futures after the hotter than expected CPI print, it is certain that – as Bloomberg’s Chris Anstey writes – this isn’t good news for the Fed: the second straight 0.4% reading for core CPI suggests that January wasn’t a one-off anomaly, contrary to what Goldman claimed with its bet on the “January effect.”

And while this certainly isn’t good news for the Fed, it’s hardly good news for the Biden administration either. This year was meant to be one of dis-inflation but today’s data really lean into the idea that the last mile is the hardest. Still, Biden may take some solace from the fact that the food index was unchanged given his administration has been going hard on the theme of “shrinkflation” and that supercore inflation didn’t come in superhot, unlike last month.

Still, overall inflation is looking stubborn.

With that in mind, here is a snapshot of the kneejerk reactions by a selection of Wall Street analysts, economists and strategists.

Brian Coulton, chief economist at Fitch Ratings:

“That is not the direction the Fed wants to see.”

Derek Tang, economist with LH Meyer/Monetary Policy Analytics:

“CPI came in a touch higher than expected but not so high to stop them from cutting in June as we expect. Powell and others have warned inflation will come down in a bumpy way. There’s still a few more prints before they meet in June, and what matters if the whole path down. As Powell said, they’re ‘not far’ from gaining the confidence they need to start cutting, and this report alone doesn’t detract from that.”

Augusta Saraiva, Bloomberg:

“After a brisk January reading, the report adds to evidence that inflation is proving stubborn, which is keeping central bankers wary of easing policy too soon.”

Kathy Jones, Charles Schwab’s chief fixed-income strategist:

“This will probably be seen as a reason to keep policy on hold a while longer. Through the volatility, the downtrend in inflation seems to be leveling off and the Fed would like to see it continue to move lower before easing rates.”

Bloomberg Intelligence Rates Strategist Ira Jersey (who confirms what we said yesterday: a hot print was mostly priced in).

“The rates market looks to have been set up for an even worse inflation print. “But we don’t think this print warrants a sustained rally from these levels.”

to David Russell, Head of Market Strategy at TradeStation:

“Inflation came in a little hot but the bulls aren’t ready to throw in the towel yet. Investors remain optimistic that shelter costs will come down. We still have three more reports before that key Fed meeting in June to confirm or reverse that hope. Wall Street is keeping the faith for now but that could change if future prints don’t improve. Stocks are still climbing the wall of worry.”

Alan Detmeister, UBS Research:

“Overall, this report, while strong, was a good sign the elevated January pace is unlikely to persist into the spring, but, as we have noted before, today’s report is unlikely to have any effect on the upcoming FOMC meeting.”

Torsten Slok, Apollo:

“Fresh upward momentum is building in inflation. Inflation has started to move sideways and remains well above the Fed’s 2% inflation target. This means the Fed will keep rates higher for longer.”

Leo He, UBS Macro Sales:

“Markets are finding relief from the US inflation data as core CPI rose less than the CPI fixing market had expected (36bp versus 41bp priced). The US 2y yield rose more than 8bp in a knee-jerk reaction but is now falling back. The USD is slightly lower and equities are higher after the data release.”

Marvin Loh, State Street

“I think the real concerns were that we were going to get accelerating supercore and housing, and since that didn’t happen, we are off to the races again. The market wants to read into the positivity that the Fed will be able to start the rate-cutting process over the summer. It does not want to fret the details of what comes after that until after it starts.”

Ali Jaffery, CIBC Capital Markets:

“Labor market rebalancing and decelerating wage growth suggest softer service price gains down the road. The Fed will remain highly data-dependent, and we expect they will be more comfortable easing policy in the second half of the year.”

Rubeela Farooqi, chief US economist at High Frequency Econ:

“The latest data further reinforce the case for a patient and vigilant approach from Fed officials as they consider future policy decisions.”

Jay Hatfield, founder of Infrastructure Capital Management:

“The core print was only 3.6% without rounding and the components that drove the beat are likely to reverse in the future, particularly airline fares, up 3.6% for the month. PCE core should be below 0.3% which means core PCE will slowly decline over the next three months setting the stage for a June or July rate cut, with the ECB moving in June.”

Anna Wong, Bloomberg Economics:

“The hot core CPI reading won’t build Fed confidence to cut rates imminently — but it also doesn’t rule out the chance of a mid-year rate cut. More importantly, the reversal of the unusual spike in owners’ equivalent rent showed January’s reading was likely just an aberration, not a signal of stickier housing inflation. We still expect the Fed to gain enough confidence to cut rates as soon as May — our base case — as both inflation and the labor market cool further.”

Andrew Hollenhorst, Citi:

“We expect 0.20%MoM core PCE inflation for February based on details of CPI. We will further refine our projection following the release of PPI Thursday – with medical services prices particularly important.”

Loading…