Authored by Lance Roberts via RealInvestmentAdvice.com,

The latest rate hike announcement by the Fed sent stocks tumbling to the year’s lows. While last week’s market action was brutal, the good news is the markets are set up for a rather significant short squeeze higher.

It is quite likely the Fed has already tightened more than the economy can withstand. However, given the lag time of policy changes to show up in the data, we won’t know for sure for several more months. However, with the Fed removing liquidity from the markets at a most aggressive pace, the risk of a policy mistake is higher than most appreciate. I added some annotations to a recent graphic from Chartr.

With the Fed now hiking rates, seemingly intent on doing so at every meeting in 2022, has the correction priced in the “bad news?”

The issue, of course, is that we never know where we are within the current cycle until it is often too late. An excellent example is 2008, as I discussed recently in “Recession Risk.”

“The problem with making an assessment about the state of the economy today, based on current data points, is that these numbers are only ‘best guesses.’ Economic data is subject to substantive negative revisions as data gets collected and adjusted over the forthcoming 12- and 36-months.

Consider for a minute that in January 2008 Chairman Bernanke stated:

‘The Federal Reserve is not currently forecasting a recession.’

In hindsight, the NBER, in December 2008, dated the start of the official recession was December 2007.”

A Historical Analog

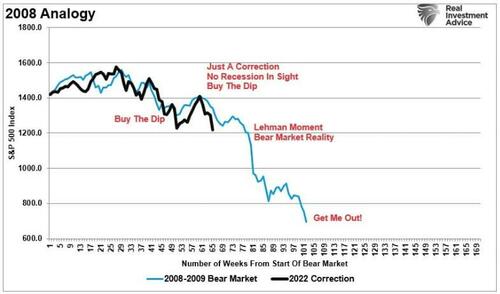

I am NOT a fan of market analogs because it is simplistic to “cherry-pick” starting and ending dates to get periods to align. However, I am going to do it anyway to illustrate a point. The chart below aligns the current market to that of 2008.

Notably, I am NOT suggesting we are about to enter a significant bear market.

I want to point out that in the first half of 2008, despite the collapse of Bear Stearns, the mainstream media did not foresee a recession or bear market coming. The mainstream advice was to “buy the dip” based on views that there was “no recession in sight” and that “subprime debt was contained.”

Unfortunately, there was a recession and a bear market, and there was NO containment of subprime mortgages.

However, even if a deeper bear market is coming, a “short squeeze” can allow investors to reduce the risk more gracefully.

Investor Sentiment Is So Bearish – It’s Bullish

Once again, investor sentiment has become so bearish that it’s bullish.

As we have often discussed, one of the investors’ most significant challenges is going “against” the prevailing market “herd bias.” However, historically speaking, contrarian investing often proves to provide an advantage. One of the most famous contrarian investors is Howard Marks, who once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

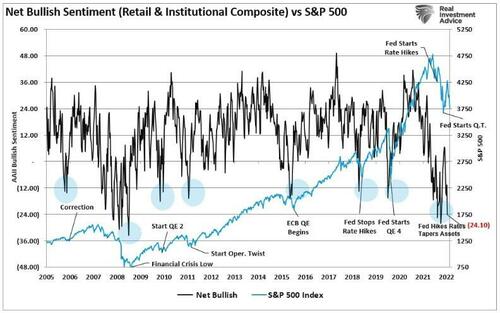

Currently, everyone is once again bearish. CNBC is again streaming “Markets In Turmoil” banners, and individuals are running for cover. Our composite investor sentiment index is back to near “Financial Crisis” lows.

We agree investors should be more cautious in their portfolio allocations. However, such is a point where investors make the most mistakes. Emotions make them want to sell. However, from a contrarian view, such is the time you need to avoid that impulse.

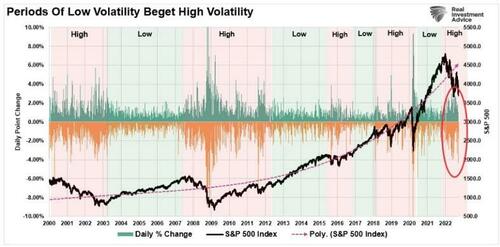

While many investors have never witnessed a “bear market,” the current market volatility is not surprising. As we discussed previously, Hyman Minsky argued that financial markets have inherent instability. As we saw in 2020-2021, asymmetric risks rise in market speculation during an abnormally long bullish cycle. That speculation eventually results in market instability and collapse.

We can visualize these periods of “instability” by examining the daily price swings of the S&P 500 index. Note that long periods of “stability” with regularity lead to “instability.”

The markets could and possibly will fall further in the coming months as the Fed most likely makes a “policy mistake,” such doesn’t preclude a rather sharp “short squeeze” that investors can use to rebalance risks. Such is just part of the increased market volatility we will likely deal with for the rest of this year.

A Short Squeeze Setup

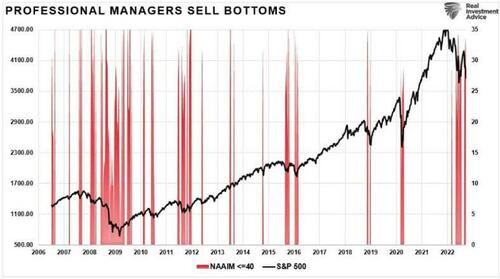

Currently, everybody is bearish. Not just in terms of “investor sentiment” but also in “positioning.” As shown, professional investors (as represented by the NAAIM index) are currently back to more bearish levels of exposure. Notably, when the level of exposure by professionals falls below 40, such typically denotes short-term market bottoms.

Another historically good indicator of extreme bearishness is the CBOE put-call ratio. Spikes in the put-call ratio historically note a surge in bearish positioning. Previous spikes in the put-call ratio have aligned with at least short-term market lows, if not bear market bottoms. The current surge in the bearish positioning suggests the markets could be setting a short-term low, particularly when a short squeeze occurs.

Lastly, the number of stocks with “bullish buy signals” is also plumbing extremely low levels. Like positioning and the put-call ratio, the bullish percent index suggests stocks have seen rather extreme liquidations. Such low levels of stocks on bullish buy signals remains a historically reliable contrarian buy signal.

As shown, when levels of negativity have reached or exceeded current levels, such has historically been associated with short- to intermediate-term market bottoms.

However, there are two critical points to note:

-

During bull markets, negative sentiment was a clear buying opportunity for the ongoing bullish trend.

-

During bear markets (2008), negative sentiment provided very small opportunities to reduce risk before further declines.

Such raises the question of what to do next, assuming a bear market is in full swing.

Navigating A Reflexive Rally

As Bob Farrell’s rule number-9 states:

“When all the experts and forecasts agree – something else is going to happen.

As a contrarian investor, excesses get built when everyone is on the same side of the trade.

Everyone is so bearish that the reflexive trade will be rapid when sentiment shifts.

There are plenty of reasons to be very concerned about the market over the next few months. We will use rallies to reduce equity exposure and hedge risks accordingly.

-

Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

-

If you are overweight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Again, after significant declines, individuals feel like they “must” do something. Think logically above where you want to be and use the rally to adjust to that level.

-

Begin by selling laggards and losers. These positions were dragging on performance as the market rose, and they led on the way down.

-

Add to sectors, or positions, that are performing with or outperforming the broader market if you need risk exposure.

-

Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

-

Be prepared to sell into the rally and reduce overall portfolio risk. There are many positions you will sell at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake.

-

If none of this makes sense to you, please consider hiring someone to manage your portfolio. It will be worth the additional expense over the long term.

Follow your process.

A “short squeeze” is coming, but we aren’t out of the woods yet.

Authored by Lance Roberts via RealInvestmentAdvice.com,

The latest rate hike announcement by the Fed sent stocks tumbling to the year’s lows. While last week’s market action was brutal, the good news is the markets are set up for a rather significant short squeeze higher.

It is quite likely the Fed has already tightened more than the economy can withstand. However, given the lag time of policy changes to show up in the data, we won’t know for sure for several more months. However, with the Fed removing liquidity from the markets at a most aggressive pace, the risk of a policy mistake is higher than most appreciate. I added some annotations to a recent graphic from Chartr.

With the Fed now hiking rates, seemingly intent on doing so at every meeting in 2022, has the correction priced in the “bad news?”

The issue, of course, is that we never know where we are within the current cycle until it is often too late. An excellent example is 2008, as I discussed recently in “Recession Risk.”

“The problem with making an assessment about the state of the economy today, based on current data points, is that these numbers are only ‘best guesses.’ Economic data is subject to substantive negative revisions as data gets collected and adjusted over the forthcoming 12- and 36-months.

Consider for a minute that in January 2008 Chairman Bernanke stated:

‘The Federal Reserve is not currently forecasting a recession.’

In hindsight, the NBER, in December 2008, dated the start of the official recession was December 2007.”

A Historical Analog

I am NOT a fan of market analogs because it is simplistic to “cherry-pick” starting and ending dates to get periods to align. However, I am going to do it anyway to illustrate a point. The chart below aligns the current market to that of 2008.

Notably, I am NOT suggesting we are about to enter a significant bear market.

I want to point out that in the first half of 2008, despite the collapse of Bear Stearns, the mainstream media did not foresee a recession or bear market coming. The mainstream advice was to “buy the dip” based on views that there was “no recession in sight” and that “subprime debt was contained.”

Unfortunately, there was a recession and a bear market, and there was NO containment of subprime mortgages.

However, even if a deeper bear market is coming, a “short squeeze” can allow investors to reduce the risk more gracefully.

Investor Sentiment Is So Bearish – It’s Bullish

Once again, investor sentiment has become so bearish that it’s bullish.

As we have often discussed, one of the investors’ most significant challenges is going “against” the prevailing market “herd bias.” However, historically speaking, contrarian investing often proves to provide an advantage. One of the most famous contrarian investors is Howard Marks, who once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Currently, everyone is once again bearish. CNBC is again streaming “Markets In Turmoil” banners, and individuals are running for cover. Our composite investor sentiment index is back to near “Financial Crisis” lows.

We agree investors should be more cautious in their portfolio allocations. However, such is a point where investors make the most mistakes. Emotions make them want to sell. However, from a contrarian view, such is the time you need to avoid that impulse.

While many investors have never witnessed a “bear market,” the current market volatility is not surprising. As we discussed previously, Hyman Minsky argued that financial markets have inherent instability. As we saw in 2020-2021, asymmetric risks rise in market speculation during an abnormally long bullish cycle. That speculation eventually results in market instability and collapse.

We can visualize these periods of “instability” by examining the daily price swings of the S&P 500 index. Note that long periods of “stability” with regularity lead to “instability.”

The markets could and possibly will fall further in the coming months as the Fed most likely makes a “policy mistake,” such doesn’t preclude a rather sharp “short squeeze” that investors can use to rebalance risks. Such is just part of the increased market volatility we will likely deal with for the rest of this year.

A Short Squeeze Setup

Currently, everybody is bearish. Not just in terms of “investor sentiment” but also in “positioning.” As shown, professional investors (as represented by the NAAIM index) are currently back to more bearish levels of exposure. Notably, when the level of exposure by professionals falls below 40, such typically denotes short-term market bottoms.

Another historically good indicator of extreme bearishness is the CBOE put-call ratio. Spikes in the put-call ratio historically note a surge in bearish positioning. Previous spikes in the put-call ratio have aligned with at least short-term market lows, if not bear market bottoms. The current surge in the bearish positioning suggests the markets could be setting a short-term low, particularly when a short squeeze occurs.

Lastly, the number of stocks with “bullish buy signals” is also plumbing extremely low levels. Like positioning and the put-call ratio, the bullish percent index suggests stocks have seen rather extreme liquidations. Such low levels of stocks on bullish buy signals remains a historically reliable contrarian buy signal.

As shown, when levels of negativity have reached or exceeded current levels, such has historically been associated with short- to intermediate-term market bottoms.

However, there are two critical points to note:

-

During bull markets, negative sentiment was a clear buying opportunity for the ongoing bullish trend.

-

During bear markets (2008), negative sentiment provided very small opportunities to reduce risk before further declines.

Such raises the question of what to do next, assuming a bear market is in full swing.

Navigating A Reflexive Rally

As Bob Farrell’s rule number-9 states:

“When all the experts and forecasts agree – something else is going to happen.

As a contrarian investor, excesses get built when everyone is on the same side of the trade.

Everyone is so bearish that the reflexive trade will be rapid when sentiment shifts.

There are plenty of reasons to be very concerned about the market over the next few months. We will use rallies to reduce equity exposure and hedge risks accordingly.

-

Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

-

If you are overweight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Again, after significant declines, individuals feel like they “must” do something. Think logically above where you want to be and use the rally to adjust to that level.

-

Begin by selling laggards and losers. These positions were dragging on performance as the market rose, and they led on the way down.

-

Add to sectors, or positions, that are performing with or outperforming the broader market if you need risk exposure.

-

Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

-

Be prepared to sell into the rally and reduce overall portfolio risk. There are many positions you will sell at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake.

-

If none of this makes sense to you, please consider hiring someone to manage your portfolio. It will be worth the additional expense over the long term.

Follow your process.

A “short squeeze” is coming, but we aren’t out of the woods yet.