By Variant Perception Research

An old asset base + large infrastructure spending gap + negative real financing costs (financial repression) = an incoming capex supercycle. This is the final part of our 3-part series based on the insights from our “Age of Scarcity” thematic report sent to VP clients in November 2022. See here for Part 1 and Part 2.

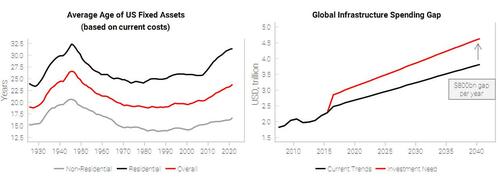

The US’s fixed asset base is extremely old. The last time it was this old was just after WWII, which preceded a huge capex reconstruction boom. The American Society of Civil Engineers has graded the US infrastructure as C-. The Global Infrastructure Hub estimates that the infrastructure spending gap is now at 800bn USD per year (right-hand chart). The surge in net-zero commitments will also necessitate plenty of investment and capex.

Is it finally “infrastructure week”? Minsky called it “managerial welfare-state capitalism”: big government + big business + big labor. Financial repression is usually needed to keep debt servicing costs low. There are lots of successful examples:

- France’s Les Trente Glorieuses: 1945-75. Ministry of Finance promoted growth by steering domestic savings towards investment in PPE. Charles de Gaulle launched a second phase of industrial policy from mid-1960, rapid modernization in high tech sectors like electronics and telecoms.

- East Asian Model: inspired by Japan, east Asian economies saw rapid development after WWII. Government intervention was critical: targeted and subsidized credit to selected industries, low deposit rates and ceilings on borrowing rates, subsidies to declining industries, the establishment and financial support of government banks.

- US New Deal era: FDR entered office with enormous political capital. Creation of a middle class as well as the baby boom kept consumer demand high and fueled rapid spending on infrastructure.

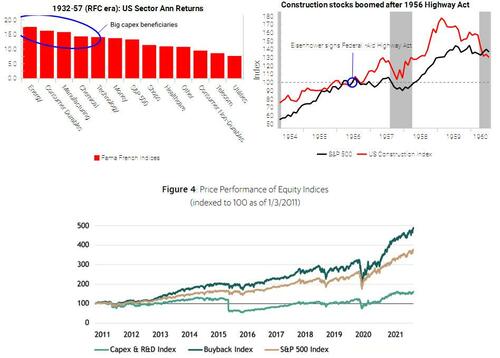

During the New Deal era, capex-heavy stocks outperformed. (top left chart, we use the lifetime of the Reconstruction Finance Corp to define this period). Construction stocks boomed after the Federal-Aid Highway Act and were quite resilient through the 1957-58 recession.

Capex-heavy stocks have significantly underperformed over the last 10+ years (bottom chart from Goldman Sachs). Investors have much preferred asset-light businesses, financial engineering and buybacks.

Infrastructure is in the sweet spot of being a politically-favored industry and capital scarce, and is set to benefit greatly out of the next recession.

The Kalecki-Levy profits identity shows that private sector profits are boosted when governments run fiscal deficits. Changes in savings (usually driven by counter-cyclical government policies) lead future profits growth:

- Government Budget Balance + Household Sector Balance + Current Account Balance = Financial Profits

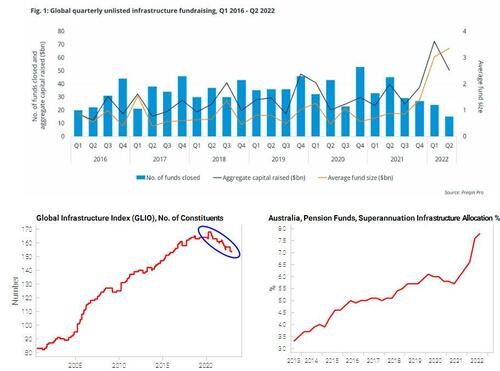

Infrastructure fund raising has been extremely strong in 2022 despite the bear market ($90bn raised in 1H22 in US. This is 21% of all private market fundraising vs 8% long-term average, source: Preqin).

Unlisted infrastructure funds are taking a lot of public infrastructure companies off the market (bottom-left chart).

The surge in infrastructure dry powder will intensify the demand-supply mismatch: expect higher take-private deal multiples as the listed universe shrinks. This has already happened in the Australian listed market. There are just a small handful of pure listed infrastructure companies left after a surge in take-private deals over the last 2 years.

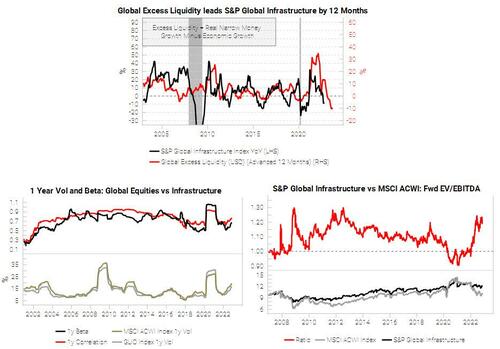

Do not forget about the importance of the business cycle. Liquidity leading indicators lead global listed infrastructure returns (top chart).

All of VP’s cyclical indicators point risk-off on a 6-month horizon, so global listed infrastructure will likely offer little diversification benefit from equities (bottom-left chart).

Listed infrastructure typically trades at a premium relative to equities because of their more predictable cash flows (bottom right chart). Today EV/EBITDA multiples are at the top of their historical range.

The solution: find capital-scarce and government-aligned infrastructure companies. These companies are most likely to outperform after the business cycle downturn.

Upstream industries offer a more levered way to play the capex supercycle. Infrastructure assets offer investors inflation-linked exposure with an upside takeover / valuation catalyst.

More at Variant Perception

By Variant Perception Research

An old asset base + large infrastructure spending gap + negative real financing costs (financial repression) = an incoming capex supercycle. This is the final part of our 3-part series based on the insights from our “Age of Scarcity” thematic report sent to VP clients in November 2022. See here for Part 1 and Part 2.

The US’s fixed asset base is extremely old. The last time it was this old was just after WWII, which preceded a huge capex reconstruction boom. The American Society of Civil Engineers has graded the US infrastructure as C-. The Global Infrastructure Hub estimates that the infrastructure spending gap is now at 800bn USD per year (right-hand chart). The surge in net-zero commitments will also necessitate plenty of investment and capex.

Is it finally “infrastructure week”? Minsky called it “managerial welfare-state capitalism”: big government + big business + big labor. Financial repression is usually needed to keep debt servicing costs low. There are lots of successful examples:

- France’s Les Trente Glorieuses: 1945-75. Ministry of Finance promoted growth by steering domestic savings towards investment in PPE. Charles de Gaulle launched a second phase of industrial policy from mid-1960, rapid modernization in high tech sectors like electronics and telecoms.

- East Asian Model: inspired by Japan, east Asian economies saw rapid development after WWII. Government intervention was critical: targeted and subsidized credit to selected industries, low deposit rates and ceilings on borrowing rates, subsidies to declining industries, the establishment and financial support of government banks.

- US New Deal era: FDR entered office with enormous political capital. Creation of a middle class as well as the baby boom kept consumer demand high and fueled rapid spending on infrastructure.

During the New Deal era, capex-heavy stocks outperformed. (top left chart, we use the lifetime of the Reconstruction Finance Corp to define this period). Construction stocks boomed after the Federal-Aid Highway Act and were quite resilient through the 1957-58 recession.

Capex-heavy stocks have significantly underperformed over the last 10+ years (bottom chart from Goldman Sachs). Investors have much preferred asset-light businesses, financial engineering and buybacks.

Infrastructure is in the sweet spot of being a politically-favored industry and capital scarce, and is set to benefit greatly out of the next recession.

The Kalecki-Levy profits identity shows that private sector profits are boosted when governments run fiscal deficits. Changes in savings (usually driven by counter-cyclical government policies) lead future profits growth:

- Government Budget Balance + Household Sector Balance + Current Account Balance = Financial Profits

Infrastructure fund raising has been extremely strong in 2022 despite the bear market ($90bn raised in 1H22 in US. This is 21% of all private market fundraising vs 8% long-term average, source: Preqin).

Unlisted infrastructure funds are taking a lot of public infrastructure companies off the market (bottom-left chart).

The surge in infrastructure dry powder will intensify the demand-supply mismatch: expect higher take-private deal multiples as the listed universe shrinks. This has already happened in the Australian listed market. There are just a small handful of pure listed infrastructure companies left after a surge in take-private deals over the last 2 years.

Do not forget about the importance of the business cycle. Liquidity leading indicators lead global listed infrastructure returns (top chart).

All of VP’s cyclical indicators point risk-off on a 6-month horizon, so global listed infrastructure will likely offer little diversification benefit from equities (bottom-left chart).

Listed infrastructure typically trades at a premium relative to equities because of their more predictable cash flows (bottom right chart). Today EV/EBITDA multiples are at the top of their historical range.

The solution: find capital-scarce and government-aligned infrastructure companies. These companies are most likely to outperform after the business cycle downturn.

Upstream industries offer a more levered way to play the capex supercycle. Infrastructure assets offer investors inflation-linked exposure with an upside takeover / valuation catalyst.

More at Variant Perception

Loading…