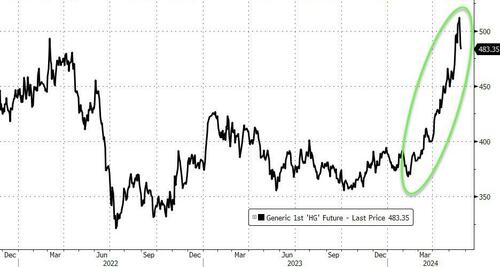

Copper has gone mad: Liquidated shorts from a flood of speculators, an AI bubble, a supply crisis, and a renewable energy craze have all combined with high global inflation to recently send it to historic all-time highs. While I believe there will be major corrections as some of these factors come back down to earth, the most important one — out-of-control inflation — will ultimately send copper even higher in the longer-term.

Yes, the market has taken on more froth than a Starbucks drink. Copper went high enough to wreck a batch of short sellers who betted that the party was over. The resulting short squeeze forced them to pony up, buying more paper copper to cover their positions and pushing prices even higher. Expect more volatility in the near-term, as the crowd of speculators looking to snatch short-term profits from copper are still here and will keep riding the wave.

Copper Futures (USD/lb) 6-Month

Source: Bloomberg

That’s because the bullish action has been too juicy to resist, and it has enough fundamentals to support more upward action in the medium and longer-term.

High inflation and a supply shortage are conspiring with increased demand for electric vehicles, a boom in renewable energy tech, and an AI bubble to keep the price going up even without the flood of speculative money.

I suspect a cooldown in a few factors driving the copper frenzy: first, I expect the AI market coming come back down to earth. In the longer-term, I also expect practical revisions of renewable energy targets like the impossible “Net Zero,” which are more about making politicians look good in the short-term than being pragmatic and achievable long-term goals. But the demand will still be there, and the current supply squeeze and inflationary pressures are here to stay.

If you’re a buyer, waves of speculation along the way can provide buying opportunities for physical copper in the form of epic volatility and dramatic dips.

While the current narrative is that inflation is easing, any apparent relief from higher prices will be temporary. To avoid a banking and commercial real estate crisis, the Fed will have no choice but to cut interest rates at some point. This will invite a new torrent of inflationary expansion as the Fed ignores the pressure cooker that its policies helped create.

You can’t undo the effects of trillions’ worth of COVID money printing in just a few years or by briefly hiking interest rates to 4% or 5%. Taming that beast would require interest rates to be much higher than the Fed would ever raise them, as it knows that loan-dependent industries like real estate can’t survive with rates upwards of 8, 9, even 10%. The problem is worsened by sustained out-of-control budget deficits that are causing a confidence collapse in US Treasury bonds — in the “full faith and credit” of the US government.

When the Fed finally cuts rates, Americans spending devalued dollars will get slammed with higher prices for gas and food, along with surging commodities like copper and precious metals. Lower rates will also incentivize borrowing over saving for an already over-indebted population. It will encourage Americans to get in even more over their heads with loans they shouldn’t get to finance expenses they can’t afford, adding more upward price pressure for the goods they already don’t have enough money to buy.

It’s enough to make your head spin, and it can only possibly result in higher prices in the coming years — including for copper — even if the AI and renewables projections end up being only half what is currently predicted. That said, the broader renewable energy and AI trends are here to stay, and LLMs like ChatGPT require a lot more power than the internet’s current run-of-the-mill web searches:

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

Copper supply woes will also continue throughout this year — and if you zoom out even more, interest rate cuts will all but guarantee higher prices even as shorter-term, speculation-fueled spikes and drawdowns cause the market to overheat.

Copper has gone mad: Liquidated shorts from a flood of speculators, an AI bubble, a supply crisis, and a renewable energy craze have all combined with high global inflation to recently send it to historic all-time highs. While I believe there will be major corrections as some of these factors come back down to earth, the most important one — out-of-control inflation — will ultimately send copper even higher in the longer-term.

Yes, the market has taken on more froth than a Starbucks drink. Copper went high enough to wreck a batch of short sellers who betted that the party was over. The resulting short squeeze forced them to pony up, buying more paper copper to cover their positions and pushing prices even higher. Expect more volatility in the near-term, as the crowd of speculators looking to snatch short-term profits from copper are still here and will keep riding the wave.

Copper Futures (USD/lb) 6-Month

Source: Bloomberg

That’s because the bullish action has been too juicy to resist, and it has enough fundamentals to support more upward action in the medium and longer-term.

High inflation and a supply shortage are conspiring with increased demand for electric vehicles, a boom in renewable energy tech, and an AI bubble to keep the price going up even without the flood of speculative money.

I suspect a cooldown in a few factors driving the copper frenzy: first, I expect the AI market coming come back down to earth. In the longer-term, I also expect practical revisions of renewable energy targets like the impossible “Net Zero,” which are more about making politicians look good in the short-term than being pragmatic and achievable long-term goals. But the demand will still be there, and the current supply squeeze and inflationary pressures are here to stay.

If you’re a buyer, waves of speculation along the way can provide buying opportunities for physical copper in the form of epic volatility and dramatic dips.

While the current narrative is that inflation is easing, any apparent relief from higher prices will be temporary. To avoid a banking and commercial real estate crisis, the Fed will have no choice but to cut interest rates at some point. This will invite a new torrent of inflationary expansion as the Fed ignores the pressure cooker that its policies helped create.

You can’t undo the effects of trillions’ worth of COVID money printing in just a few years or by briefly hiking interest rates to 4% or 5%. Taming that beast would require interest rates to be much higher than the Fed would ever raise them, as it knows that loan-dependent industries like real estate can’t survive with rates upwards of 8, 9, even 10%. The problem is worsened by sustained out-of-control budget deficits that are causing a confidence collapse in US Treasury bonds — in the “full faith and credit” of the US government.

When the Fed finally cuts rates, Americans spending devalued dollars will get slammed with higher prices for gas and food, along with surging commodities like copper and precious metals. Lower rates will also incentivize borrowing over saving for an already over-indebted population. It will encourage Americans to get in even more over their heads with loans they shouldn’t get to finance expenses they can’t afford, adding more upward price pressure for the goods they already don’t have enough money to buy.

It’s enough to make your head spin, and it can only possibly result in higher prices in the coming years — including for copper — even if the AI and renewables projections end up being only half what is currently predicted. That said, the broader renewable energy and AI trends are here to stay, and LLMs like ChatGPT require a lot more power than the internet’s current run-of-the-mill web searches:

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

Copper supply woes will also continue throughout this year — and if you zoom out even more, interest rate cuts will all but guarantee higher prices even as shorter-term, speculation-fueled spikes and drawdowns cause the market to overheat.

Loading…