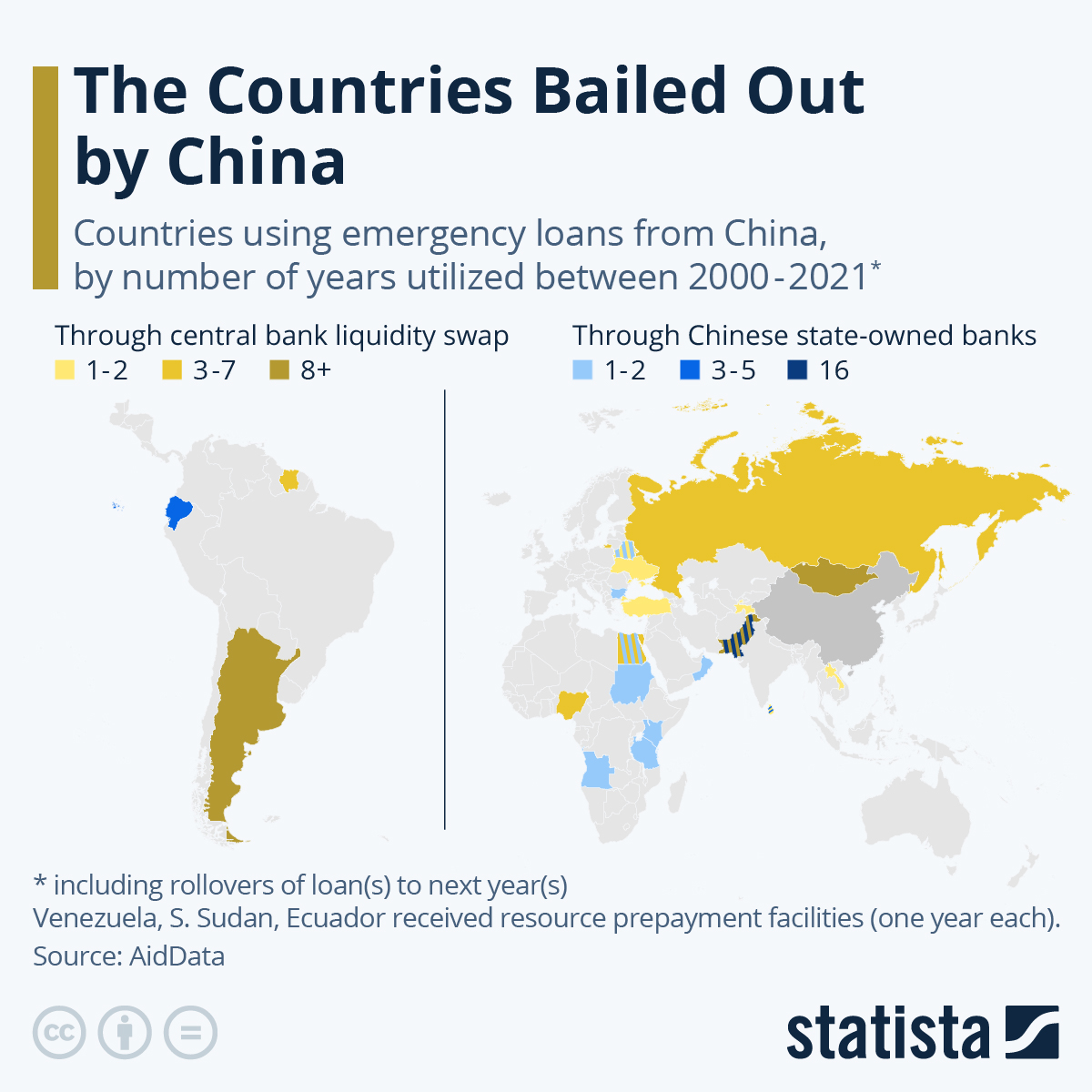

A new report published by the AidData research lab at Virginia’s College of William & Mary sheds some light on the usually nontransparent practice of Chinese bilateral emergency loans.

As Statista's Katharina Buchholz reports, the researchers that also hail from the World Bank, Harvard University and the Kiel Institute for the World Economy identified 22 countries that were bailed out by Chinese loans when they ran into liquidity problems between 2000 and 2021.

You will find more infographics at Statista

Countries that utilized these loans in an especially high number of years, i.e. rolled over their loans into subsequent years include Pakistan, Mongolia, Argentina and Sri Lanka.

The latter country tapped China’s central bank for the first time in 2021 before defaulting on its debt anyways in 2022. Argentina and Mongolia were also identified by the report as countries that have been in dire financial distress since the early 2010s and were using China as a lender of last resort despite the country’s loan terms being less favorable than lower-interest bailouts offered by the IMF or the U.S. Fed. The list of Chinese bailouts also includes countries experiencing major inflation events, like aforementioned Pakistan, Turkey and Egypt.

The report finds that repeated rollovers of the Chinese loans provided by central bank liquidity swaps place them in a dubious gray area that set them apart from similar lending practices, for example liquidity swaps by the U.S. Fed. These are also often used in crises situations but must be paid back within 12 months or declared as actual debt. The Fed loans are most often used by developed nations, while developing and middle-income countries – many of them also having accumulated regular debt to China - have been increasingly turning to the Asian superpower for emergency aid. These countries have therefore been able to hold on to swap lines for expended periods of time without having to declare more external debt, but at a higher cost and at a loss of transparency in international debt.

Bailout amounts provided by China remained quite low in the 2000s and early 2010s, before shooting up from 2015 onwards, climbing to a total of $100 billion for the two decades. The two most common ways in which these loans work is through a liquidity swap with the Chinese Central Bank – where most of the outstanding balances of around $40 billion were located as of 2021 – or through credit lines from Chinese state-owned banks. Three countries, Venezuela, South Sudan and Ecuador, received prepayments on goods they were to deliver to China.

A new report published by the AidData research lab at Virginia’s College of William & Mary sheds some light on the usually nontransparent practice of Chinese bilateral emergency loans.

As Statista’s Katharina Buchholz reports, the researchers that also hail from the World Bank, Harvard University and the Kiel Institute for the World Economy identified 22 countries that were bailed out by Chinese loans when they ran into liquidity problems between 2000 and 2021.

You will find more infographics at Statista

Countries that utilized these loans in an especially high number of years, i.e. rolled over their loans into subsequent years include Pakistan, Mongolia, Argentina and Sri Lanka.

The latter country tapped China’s central bank for the first time in 2021 before defaulting on its debt anyways in 2022. Argentina and Mongolia were also identified by the report as countries that have been in dire financial distress since the early 2010s and were using China as a lender of last resort despite the country’s loan terms being less favorable than lower-interest bailouts offered by the IMF or the U.S. Fed. The list of Chinese bailouts also includes countries experiencing major inflation events, like aforementioned Pakistan, Turkey and Egypt.

The report finds that repeated rollovers of the Chinese loans provided by central bank liquidity swaps place them in a dubious gray area that set them apart from similar lending practices, for example liquidity swaps by the U.S. Fed. These are also often used in crises situations but must be paid back within 12 months or declared as actual debt. The Fed loans are most often used by developed nations, while developing and middle-income countries – many of them also having accumulated regular debt to China – have been increasingly turning to the Asian superpower for emergency aid. These countries have therefore been able to hold on to swap lines for expended periods of time without having to declare more external debt, but at a higher cost and at a loss of transparency in international debt.

Bailout amounts provided by China remained quite low in the 2000s and early 2010s, before shooting up from 2015 onwards, climbing to a total of $100 billion for the two decades. The two most common ways in which these loans work is through a liquidity swap with the Chinese Central Bank – where most of the outstanding balances of around $40 billion were located as of 2021 – or through credit lines from Chinese state-owned banks. Three countries, Venezuela, South Sudan and Ecuador, received prepayments on goods they were to deliver to China.

Loading…