Via The Variant Perception blog

The downside growth risks from the bullwhip effect reversal and extreme lows in liquidity indicators favor risk-off positioning.

We advised clients to sell equities and high yield credit into the rally that started in mid-June and put on hedges. The below is an excerpt from our Aug 9th report to clients.

US HY spreads look too complacent relative to other market pricing and sharply deteriorating business and credit cycle indicators.

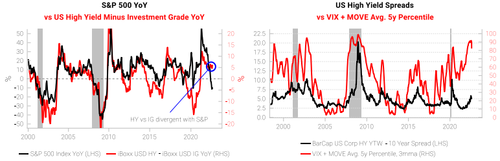

US HY vs IG relative performance is very divergent with the S&P drawdown (left-hand chart) and spreads are still very low relative to equity and bond market implied volatility.

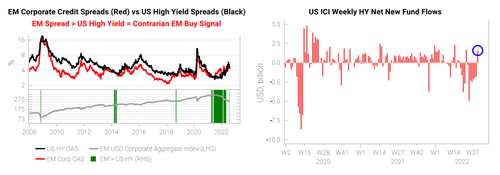

US HY spreads are below EM IG corporate spreads again and inflows have surged back to US HY funds.

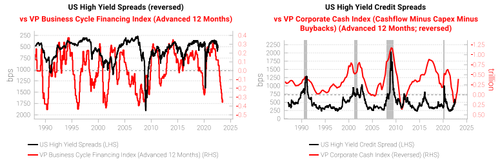

The cyclical picture for HY credit is weak. Extreme lows in liquidity LEIs (left-hand chart) and falling corporate cashflows vs capex and buybacks point to sharply rising odds of a spread blowout.

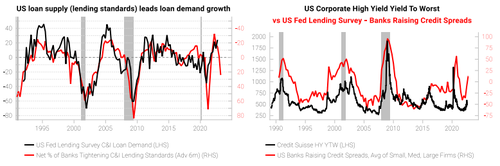

The latest Fed senior loan officer survey shows banks are tightening loan supply quickly, which generally happens in the run-up to recessions. Banks are also raising credit spreads, which is currently divergent with current HY credit spreads (right-hand chart).

* * *

Get the full picture at variantperception.com

Via The Variant Perception blog

The downside growth risks from the bullwhip effect reversal and extreme lows in liquidity indicators favor risk-off positioning.

We advised clients to sell equities and high yield credit into the rally that started in mid-June and put on hedges. The below is an excerpt from our Aug 9th report to clients.

US HY spreads look too complacent relative to other market pricing and sharply deteriorating business and credit cycle indicators.

US HY vs IG relative performance is very divergent with the S&P drawdown (left-hand chart) and spreads are still very low relative to equity and bond market implied volatility.

US HY spreads are below EM IG corporate spreads again and inflows have surged back to US HY funds.

The cyclical picture for HY credit is weak. Extreme lows in liquidity LEIs (left-hand chart) and falling corporate cashflows vs capex and buybacks point to sharply rising odds of a spread blowout.

The latest Fed senior loan officer survey shows banks are tightening loan supply quickly, which generally happens in the run-up to recessions. Banks are also raising credit spreads, which is currently divergent with current HY credit spreads (right-hand chart).

* * *

Get the full picture at variantperception.com