Echoing Jim Cramer's infamous 2007 "they know nothing" rant, a far more calm and eloquent Barry Sternlicht, Chairman and CEO of Starwood Capital, warned the co-anchors on CNBC this morning that if the Fed doesn’t pump the brakes on its rate hikes, the US economy is facing a serious downturn.

“The economy is braking hard,” Sternlicht told the outlet.

“If the Fed keeps this up, they are going to have a serious recession and people will lose their jobs.”

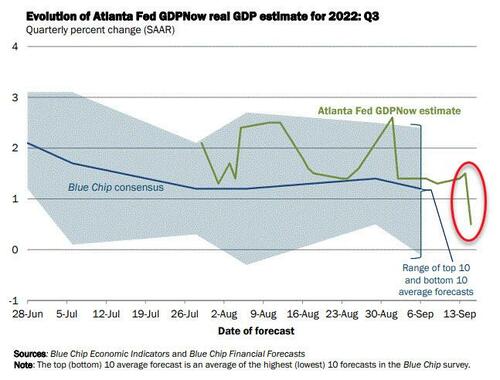

He was proved right very quickly as The Atlanta Fed cut its GDP forecast for Q3 to just +0.5%...

The billionaire investors clammed The Fed for being late to the inflation-fighting game (exclaiming how ridiculous and obvious so many aspects of the market have been in recent years under The Fed's heavy hand) and is now overdoing it:

“This is the steepest increase in rates in history - especially since Volcker - but the background of the country today is so different than when Paul Volker was chairman,” he said.

Consumer confidence is "terrible" and CEO confidence is “miserable,” Sternlicht said, and highlighte dthe fact The Fed is relying old 'old' data to make its decision:

“The CPI, the data they are looking at is old data. All they have to do is call Doug McMillon at Walmart, call any of the real estate fellas and ask what is happening to our apartment rents,” he said, pointing out that the rate of rent growth is now slowing.

The Starwood Capital founder echoed Jeff Gundlach's recent comments that the biggest threat going forward is deflation with a continuation of rate hikes will also cause a “major crash” in the housing market

“Look at the housing market, [the Fed has] caused a crash of unprecedented proportions,” Sternlicht told CNBC.

“500,000 single family home sells, new sells, is the lowest since 1952. We are going to have a major crash in the housing market and housing prices are going down. You are seeing housing prices correct.”

Sternlicht concluded, The Fed is "attacking the economy with a sledgehammer and they don’t need to.”

As for when the “serious recession” will hit, Sternlicht believes it is imminent.

“I think [in the] fourth quarter. I think right now,” he said.

“You are going to see cracks everywhere.”

Watch the full interview below:

Echoing Jim Cramer’s infamous 2007 “they know nothing” rant, a far more calm and eloquent Barry Sternlicht, Chairman and CEO of Starwood Capital, warned the co-anchors on CNBC this morning that if the Fed doesn’t pump the brakes on its rate hikes, the US economy is facing a serious downturn.

“The economy is braking hard,” Sternlicht told the outlet.

“If the Fed keeps this up, they are going to have a serious recession and people will lose their jobs.”

He was proved right very quickly as The Atlanta Fed cut its GDP forecast for Q3 to just +0.5%…

The billionaire investors clammed The Fed for being late to the inflation-fighting game (exclaiming how ridiculous and obvious so many aspects of the market have been in recent years under The Fed’s heavy hand) and is now overdoing it:

“This is the steepest increase in rates in history – especially since Volcker – but the background of the country today is so different than when Paul Volker was chairman,” he said.

Consumer confidence is “terrible” and CEO confidence is “miserable,” Sternlicht said, and highlighte dthe fact The Fed is relying old ‘old’ data to make its decision:

“The CPI, the data they are looking at is old data. All they have to do is call Doug McMillon at Walmart, call any of the real estate fellas and ask what is happening to our apartment rents,” he said, pointing out that the rate of rent growth is now slowing.

The Starwood Capital founder echoed Jeff Gundlach’s recent comments that the biggest threat going forward is deflation with a continuation of rate hikes will also cause a “major crash” in the housing market

“Look at the housing market, [the Fed has] caused a crash of unprecedented proportions,” Sternlicht told CNBC.

“500,000 single family home sells, new sells, is the lowest since 1952. We are going to have a major crash in the housing market and housing prices are going down. You are seeing housing prices correct.”

Sternlicht concluded, The Fed is “attacking the economy with a sledgehammer and they don’t need to.”

As for when the “serious recession” will hit, Sternlicht believes it is imminent.

“I think [in the] fourth quarter. I think right now,” he said.

“You are going to see cracks everywhere.”

Watch the full interview below:

[embedded content]