Overnight trading in Japan saw a landmark event pass quietly into the history books.

For the first time since 2014, there are no negative-yielding bonds in the world...

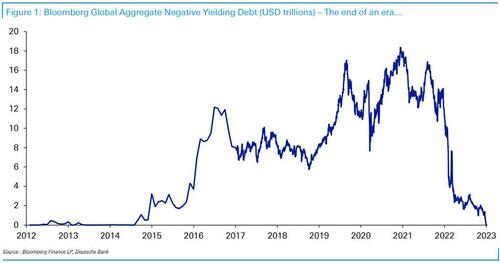

From a peak of $18.4 trillion in December 2020 (and over 4000 bonds with a negative yield), the experiment in financial repression is over... for now...

Will we ever see the 2014-2022 era again?

As Deutsche's Jim Reid notes, before this point most people would have thought negative-yielding debt was an inconceivable concept.

While there is no value in buying negative yielding debt, especially in a fiat world where inflation will always likely be positive, you can’t rule out central banks having to buy large amounts of debt again in the future.

However, for now this looks set to be the welcome end of an era as some value returns to global fixed income.

Overnight trading in Japan saw a landmark event pass quietly into the history books.

For the first time since 2014, there are no negative-yielding bonds in the world…

From a peak of $18.4 trillion in December 2020 (and over 4000 bonds with a negative yield), the experiment in financial repression is over… for now…

Will we ever see the 2014-2022 era again?

As Deutsche’s Jim Reid notes, before this point most people would have thought negative-yielding debt was an inconceivable concept.

While there is no value in buying negative yielding debt, especially in a fiat world where inflation will always likely be positive, you can’t rule out central banks having to buy large amounts of debt again in the future.

However, for now this looks set to be the welcome end of an era as some value returns to global fixed income.

Loading…