Authored by BEAUTYON via BictoinMagazine.com,

The nomenclature used to help the layman understand Bitcoin makes lawmakers confuse it as money instead of entries in a database. We must change the terms.

1/Deal! After months of negotiations with the Council, we agreed the most ambitious travel rule for transfers of crypto-assets in the world. We are putting an end to the wild west of unregulated crypto, closing major loopholes in the European anti-money laundering rules. Thread👇 pic.twitter.com/Jr9IAspsb8

— Ernest Urtasun (@ernesturtasun) June 29, 2022

A group of bitter, twisted computer illiterates in the beleaguered European Union have managed to convince the European Council that bitcoin is money, that Bitcoin wallets are actual wallets that hold actual balances of money and that they should be regulated. This is of course totally insane and an idea borne out of profound ignorance.

Since it is not possible to have a rational argument with people like this, another, better strategy of dealing with these violent types must be formulated and implemented. They’re fixated on the idea that bitcoin is money and, from the seed of this mistaken idea, a monstrous Pandora’s Box of evil has been opened.

“Bitcoin is not money. If you seek “compliance” you are asking for trouble. People who want to see the widespread and rapid adoption of Bitcoin should not seek tight regulation and the blessing.” \

- Beautyon

In order to avoid the unethical attacks of the dribbling geriatrics in the United States and the delusional EU socialists, Bitcoin wallet software developers must devise a strategy to stay out of the crosshairs of the very misguided apparatchiks hell-bent on damaging Bitcoin businesses.

Every law that touches Bitcoin uses deceptive language as definition and pretext. These definitions come from ambulance chasers and not computer scientists or software developers. By re-contextualizing Bitcoin wallets, it will be possible to totally escape the onslaught of destruction being planned by the EU and U.S. legislators.

This is how you do it.

Bitcoin wallet developers, quite naturally, have centered on using the conventions of money to translate what is happening under the hood into something ordinary people can understand. There is no “coin management” or UTXO information displayed to users in the consumer grade Bitcoin wallets: BlueWallet, Wallet of Satoshi, Samourai, Pine, Phoenix, Muun; all of that is hidden away because it is of no use to consumers.

No normal person can deal with coin control, UTXOs or anything like that.

Instead, a set of familiar, easy to understand and simple conventions has been borrowed from the world of banking to make everything in Bitcoin understandable to normal people.

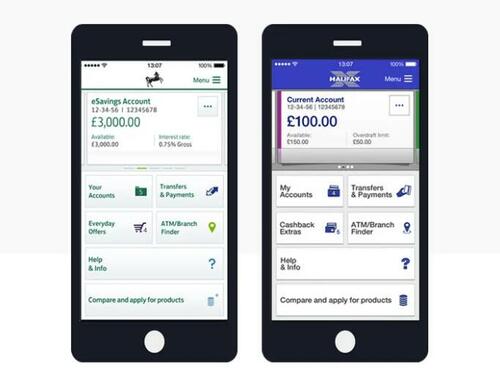

This is why Bitcoin wallets have taken on the appearance, nomenclature and styling of banking apps, which normally look something like these apps from Halifax and Lloyds respectively.

Bank apps from Lloyds and Halifax. Obviously bought off the shelf from the same developer.

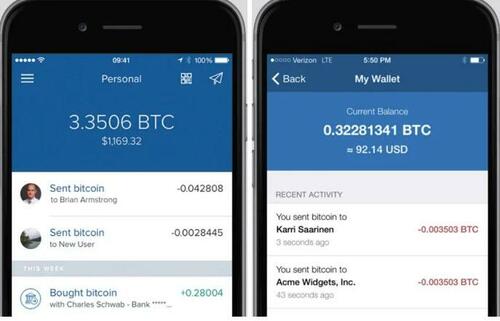

Below is a picture of Coinbase’s phone app, which looks exactly like a bank app.

Coinbase phone app

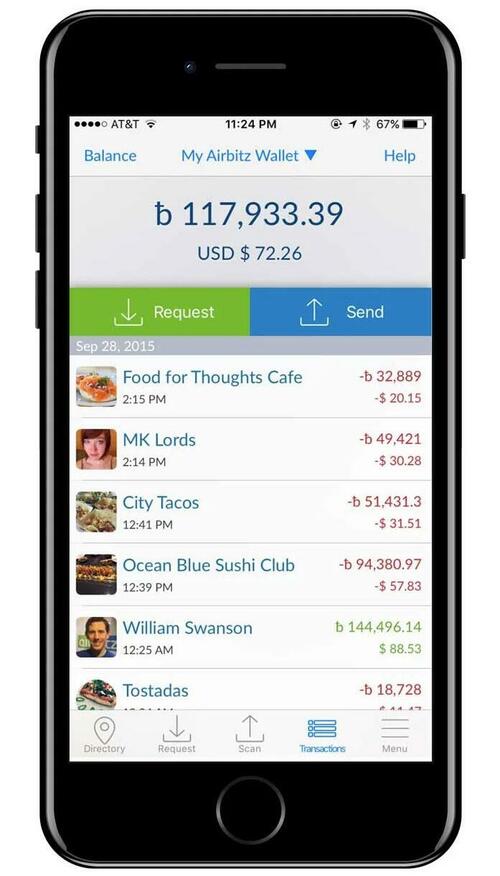

Now Airbitz:

Airbitz dashboard

When a normal, ignorant, computer-illiterate person from the EU government looks at any Bitcoin app, they recognize it as a financial tool because it looks exactly like the financial apps they’re familiar with. As for what is going on under the hoods of these very different classes of tools, they have absolutely no clue.

They only see the surface and make all their judgements based on that alone.

This is why they reflexively conflate Bitcoin with money and think that the balance in a Bitcoin wallet is analogous to the fiat balance in a banking app.

“There is a lot of talk about using “Blockchains” to improve data integrity, but what all these solutions fail to address is what I call “The Flat Screen Dilemma”. Just because something is displayed on a screen, it does not follow that it is true.”

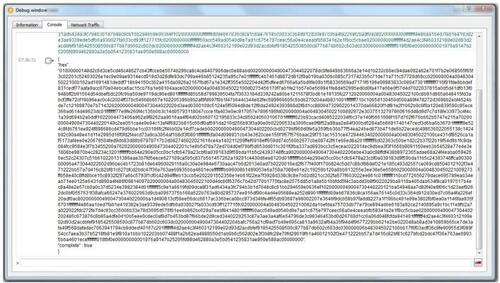

The fact of the matter is very different, however. Bitcoin apps show you the total of the UTXOs that you have control over by virtue of you being in possession of the private key. That is a sum of UTXOs; it is not a single balance. Furthermore, that “money” is not on the device. What is on the user’s device is an app that stores a cryptographic key (a string of text) that allows you to sign messages for broadcast to the Bitcoin network. Bitcoin wallets do not contain or receive bitcoin. They simply tell you what your private key can sign for on the block chain.

By saying this, I am obviously simplifying the process. But the simplification I am presenting here is more accurate than saying a Bitcoin wallet “receives and stores bitcoin,” which never, ever happens and never has happened. It is also wrong to characterize a Bitcoin wallet as “unhosted” if it can sign a message on command of a user without reference to anyone else. There are no “wallets” in Bitcoin at all. It’s just another analogy.

Bitcoin is a database. It is not a “payment network” nor is value “sent” over it at all. There are no “wallets” either. Signed messages are what are sent to the network for inclusion in the public database. It is a database used to keep a record of who controls which outputs. It is not — and never has been — money in the conventional sense. Just because people use this database as money doesn’t mean that bitcoin is money. Just because people use the word “wallet” does not mean that there are actual “Bitcoin wallets” that hold bitcoin the way a leather wallet holds cash.

Using the word “wallet” for the sake of user experience is a convention to help make the primary function of tools understandable for users. Those conventions are a choice, not a rule and they are not a universal truth, either. That means that anyone can choose any convention or any analogy they want to compare what happens in their Bitcoin app. It is entirely possible that oil traders could use the block chain to denominate barrels of oil using barrels as measurement. Today, one barrel of oil is 0.0048 bitcoin/barrel. In an oil trader’s wallet this would be represented as “100” if the trader had one hundred barrels showing on his device as allocated to his private key in a UTXO.

In this scenario, which is totally plausible, no one would claim that “bitcoin is oil” — but maybe they would? Apparatchiks are completely insane and insane thinking is what you’d expect from them.

BlueWallet does nothing more than present the user with conventions users can understand. It is not an “unhosted wallet;” it is a block chain viewer and signing device. In no way, shape or form is a Bitcoin wallet on a mobile phone a “financial tool” of any kind. If very stupid people were to classify a signing device as a financial tool, then many other software tools would be captured by that insanity immediately. BlueWallet could pivot to the oil industry tomorrow and start calling itself “OilWallet.” The fact that people use bitcoin as money is irrelevant to bitcoin’s nature. They exchange it for goods and services and money while “OilWallet” is used to manage the exchange of barrels of oil. Common to all of this is Bitcoin is only a database; what you impute to it is up to you and has nothing to do with its fundamental nature.

WhatsApp uses exactly the same encryption techniques as Bitcoin does to authenticate users to each other. You have a pair of cryptographic keys that you use to encrypt, decrypt and sign messages so that the other person receiving your call or texts or pictures knows it came from you and could have only come from you. Users of WhatsApp are not exposed to how all of this works, in the same way that users of Bitcoin wallets are not shown the text of their private keys. The software takes care of all of that for the user and simply gives them information that is useful to them. In the case of WhatsApp, that useful information is text messages. In Bitcoin it is the sum of UTXOs that are associated with your private key that are written into the public database of the chain of blocks.

“So what is the answer?” I hear you bleating.

The answer is to call Bitcoin wallets “viewers” and “signers.”

If wallets were to rebrand as “bitcoin viewers,” to better reflect their function and distance themselves from the language of the financial industry, no one could argue that they are “financial tools” or “unhosted wallets.”

That is literally what all Bitcoin wallets do: they act as viewers or, to analogize, “Windows on the block chain,” showing you which outputs are controllable by you.

When you “send” bitcoin to someone (note how I put “send” in quotes, because bitcoin is never sent anywhere; it is not like money) you take their public key (what is called a “Bitcoin address”) and use your private key to sign a message granting control of those bitcoin to the recipient’s address. Had the money convention been taken to the logical conclusion, Bitcoin addresses might have been called “Bitcoin account numbers.” This signing of a message has more in common with contracts than it does with money handling. This further breaks the absurd “Swiss bank account in your pocket” imagery. Sent, received, deposit, payment, account — all of these words must be abolished from Bitcoin wallet interfaces, the Bitcoin Lexicon and the overall nomenclature or the reckless, dangerous and very harmful conflation of bitcoin with money will continue.

When these messages are broadcast to be added to the public chain of blocks, either from your own full node, which is a copy of all the messages ever incorporated into the block chain, they are incorporated once the network of database administrators decide the addition should be made. “Database administrators” not “miners.” Are you starting to understand? Mining is what companies do to extract precious metals from the earth. Precious metals like gold, which actually is money, unlike bitcoin. All of these analogies and the language from the financial world must be abolished from the lexicon of Bitcoin companies.

Once the message is accepted as legitimate by the network, your block chain viewer will be able to see that the signature you made has been added to the public record and the sum of your UTXOs will be smaller than they were before the message was sent. In the current wallet convention, this is expressed as a single number, sometimes juxtaposed with a conversion into fiat with the “approximately equal to” sign (≈). All of this is to help you understand but is not a reflection of what is really happening, or an absolute prerequisite or necessity.

Is “Liquid bitcoin” money?

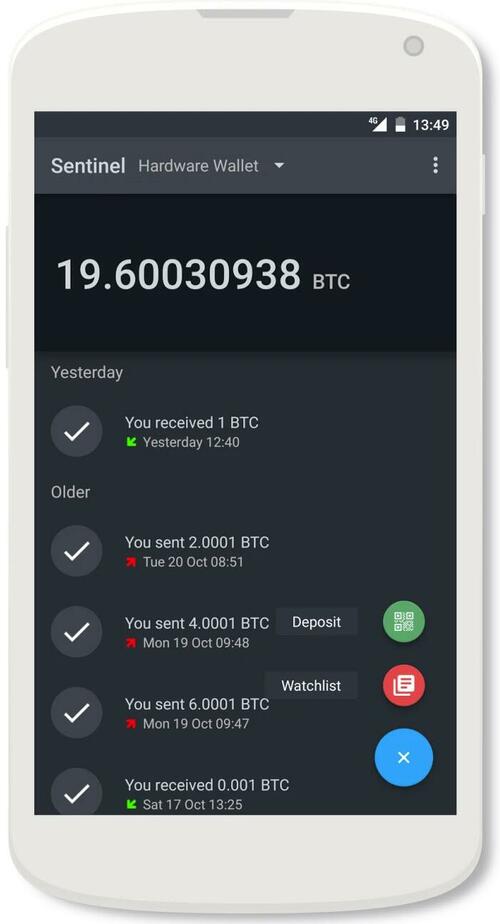

There are already “watch-only” tools from Bitcoin companies like the great Samourai Wallet. Sentinel allows you to scan your keys and then whenever the chain of blocks is updated, it will show you the status of the UTXOs you control on the block chain.

By the bizarre, irrational and stupid thinking of the EU, Sentinel is an “unhosted financial services application” because it shows you a balance in bitcoin as a single number. If it is not a financial services application, why not? Are they going to claim that a tool that watches a database is a “wallet?” No one is asking these questions because they don’t understand how Bitcoin works at any level other than analogies.

Samourai Wallet Sentinel app

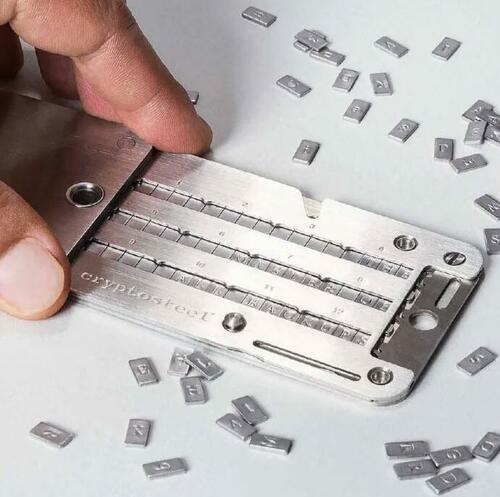

And don’t get me started on metal storage devices.

Is this an “unhosted Bitcoin wallet?” (Photo/Cryptosteel)

In the end, there is going to have to be a U.S. Supreme Court case to force the venal and stupid legislators to obey their oaths and stop interfering with the free speech of American software developers. Bitcoin is not money — it is speech — and no lawmaker can interfere with the speech of U.S. citizens. I explain more about this in “Why America Can’t Regulate Bitcoin”

Once this is settled by case law, the benefits for the U.S. will be enormous. All software developers working in Bitcoin will run to incorporate in the country and base their operations in Florida. No one anywhere in the EU will dare to start a Bitcoin wallet company because the ignorant apparatchiks there can’t tell the difference between a chat app and a Bitcoin app (pro tip: there is no difference).

When this happens, hundreds of billions of dollars from all over the world will flow through Bitcoin wallet companies being run from America, and those companies will be paying taxes in the U.S. The entire world’s financial infrastructure and tooling will come from America and flow through America for Uncle Sam to get his slice. America wins again.

Upon reading this, there will be many stupid people out there who will cry, “This is just semantics!” Those people don’t use Bitcoin wallets, don’t have any bitcoin, don’t run Bitcoin businesses of any kind and are as ignorant as the EU idiots and U.S. geriatrics who want to cripple Bitcoin.

When this goes to the U.S. Supreme Court, it will not be them paying the legal bill, though they will reap the world-changing benefits of software developers working with the Bitcoin database free of arbitrary, unethical and unconstitutional restrictions hampering their ability to display the UTXOs you can assign with your block chain viewer and signer.

Authored by BEAUTYON via BictoinMagazine.com,

The nomenclature used to help the layman understand Bitcoin makes lawmakers confuse it as money instead of entries in a database. We must change the terms.

1/Deal! After months of negotiations with the Council, we agreed the most ambitious travel rule for transfers of crypto-assets in the world. We are putting an end to the wild west of unregulated crypto, closing major loopholes in the European anti-money laundering rules. Thread👇 pic.twitter.com/Jr9IAspsb8

— Ernest Urtasun (@ernesturtasun) June 29, 2022

A group of bitter, twisted computer illiterates in the beleaguered European Union have managed to convince the European Council that bitcoin is money, that Bitcoin wallets are actual wallets that hold actual balances of money and that they should be regulated. This is of course totally insane and an idea borne out of profound ignorance.

Since it is not possible to have a rational argument with people like this, another, better strategy of dealing with these violent types must be formulated and implemented. They’re fixated on the idea that bitcoin is money and, from the seed of this mistaken idea, a monstrous Pandora’s Box of evil has been opened.

“Bitcoin is not money. If you seek “compliance” you are asking for trouble. People who want to see the widespread and rapid adoption of Bitcoin should not seek tight regulation and the blessing.” \

– Beautyon

In order to avoid the unethical attacks of the dribbling geriatrics in the United States and the delusional EU socialists, Bitcoin wallet software developers must devise a strategy to stay out of the crosshairs of the very misguided apparatchiks hell-bent on damaging Bitcoin businesses.

Every law that touches Bitcoin uses deceptive language as definition and pretext. These definitions come from ambulance chasers and not computer scientists or software developers. By re-contextualizing Bitcoin wallets, it will be possible to totally escape the onslaught of destruction being planned by the EU and U.S. legislators.

This is how you do it.

Bitcoin wallet developers, quite naturally, have centered on using the conventions of money to translate what is happening under the hood into something ordinary people can understand. There is no “coin management” or UTXO information displayed to users in the consumer grade Bitcoin wallets: BlueWallet, Wallet of Satoshi, Samourai, Pine, Phoenix, Muun; all of that is hidden away because it is of no use to consumers.

No normal person can deal with coin control, UTXOs or anything like that.

Instead, a set of familiar, easy to understand and simple conventions has been borrowed from the world of banking to make everything in Bitcoin understandable to normal people.

This is why Bitcoin wallets have taken on the appearance, nomenclature and styling of banking apps, which normally look something like these apps from Halifax and Lloyds respectively.

Bank apps from Lloyds and Halifax. Obviously bought off the shelf from the same developer.

Below is a picture of Coinbase’s phone app, which looks exactly like a bank app.

Coinbase phone app

Now Airbitz:

Airbitz dashboard

When a normal, ignorant, computer-illiterate person from the EU government looks at any Bitcoin app, they recognize it as a financial tool because it looks exactly like the financial apps they’re familiar with. As for what is going on under the hoods of these very different classes of tools, they have absolutely no clue.

They only see the surface and make all their judgements based on that alone.

This is why they reflexively conflate Bitcoin with money and think that the balance in a Bitcoin wallet is analogous to the fiat balance in a banking app.

“There is a lot of talk about using “Blockchains” to improve data integrity, but what all these solutions fail to address is what I call “The Flat Screen Dilemma”. Just because something is displayed on a screen, it does not follow that it is true.”

The fact of the matter is very different, however. Bitcoin apps show you the total of the UTXOs that you have control over by virtue of you being in possession of the private key. That is a sum of UTXOs; it is not a single balance. Furthermore, that “money” is not on the device. What is on the user’s device is an app that stores a cryptographic key (a string of text) that allows you to sign messages for broadcast to the Bitcoin network. Bitcoin wallets do not contain or receive bitcoin. They simply tell you what your private key can sign for on the block chain.

By saying this, I am obviously simplifying the process. But the simplification I am presenting here is more accurate than saying a Bitcoin wallet “receives and stores bitcoin,” which never, ever happens and never has happened. It is also wrong to characterize a Bitcoin wallet as “unhosted” if it can sign a message on command of a user without reference to anyone else. There are no “wallets” in Bitcoin at all. It’s just another analogy.

Bitcoin is a database. It is not a “payment network” nor is value “sent” over it at all. There are no “wallets” either. Signed messages are what are sent to the network for inclusion in the public database. It is a database used to keep a record of who controls which outputs. It is not — and never has been — money in the conventional sense. Just because people use this database as money doesn’t mean that bitcoin is money. Just because people use the word “wallet” does not mean that there are actual “Bitcoin wallets” that hold bitcoin the way a leather wallet holds cash.

Using the word “wallet” for the sake of user experience is a convention to help make the primary function of tools understandable for users. Those conventions are a choice, not a rule and they are not a universal truth, either. That means that anyone can choose any convention or any analogy they want to compare what happens in their Bitcoin app. It is entirely possible that oil traders could use the block chain to denominate barrels of oil using barrels as measurement. Today, one barrel of oil is 0.0048 bitcoin/barrel. In an oil trader’s wallet this would be represented as “100” if the trader had one hundred barrels showing on his device as allocated to his private key in a UTXO.

In this scenario, which is totally plausible, no one would claim that “bitcoin is oil” — but maybe they would? Apparatchiks are completely insane and insane thinking is what you’d expect from them.

BlueWallet does nothing more than present the user with conventions users can understand. It is not an “unhosted wallet;” it is a block chain viewer and signing device. In no way, shape or form is a Bitcoin wallet on a mobile phone a “financial tool” of any kind. If very stupid people were to classify a signing device as a financial tool, then many other software tools would be captured by that insanity immediately. BlueWallet could pivot to the oil industry tomorrow and start calling itself “OilWallet.” The fact that people use bitcoin as money is irrelevant to bitcoin’s nature. They exchange it for goods and services and money while “OilWallet” is used to manage the exchange of barrels of oil. Common to all of this is Bitcoin is only a database; what you impute to it is up to you and has nothing to do with its fundamental nature.

WhatsApp uses exactly the same encryption techniques as Bitcoin does to authenticate users to each other. You have a pair of cryptographic keys that you use to encrypt, decrypt and sign messages so that the other person receiving your call or texts or pictures knows it came from you and could have only come from you. Users of WhatsApp are not exposed to how all of this works, in the same way that users of Bitcoin wallets are not shown the text of their private keys. The software takes care of all of that for the user and simply gives them information that is useful to them. In the case of WhatsApp, that useful information is text messages. In Bitcoin it is the sum of UTXOs that are associated with your private key that are written into the public database of the chain of blocks.

“So what is the answer?” I hear you bleating.

The answer is to call Bitcoin wallets “viewers” and “signers.”

If wallets were to rebrand as “bitcoin viewers,” to better reflect their function and distance themselves from the language of the financial industry, no one could argue that they are “financial tools” or “unhosted wallets.”

That is literally what all Bitcoin wallets do: they act as viewers or, to analogize, “Windows on the block chain,” showing you which outputs are controllable by you.

When you “send” bitcoin to someone (note how I put “send” in quotes, because bitcoin is never sent anywhere; it is not like money) you take their public key (what is called a “Bitcoin address”) and use your private key to sign a message granting control of those bitcoin to the recipient’s address. Had the money convention been taken to the logical conclusion, Bitcoin addresses might have been called “Bitcoin account numbers.” This signing of a message has more in common with contracts than it does with money handling. This further breaks the absurd “Swiss bank account in your pocket” imagery. Sent, received, deposit, payment, account — all of these words must be abolished from Bitcoin wallet interfaces, the Bitcoin Lexicon and the overall nomenclature or the reckless, dangerous and very harmful conflation of bitcoin with money will continue.

When these messages are broadcast to be added to the public chain of blocks, either from your own full node, which is a copy of all the messages ever incorporated into the block chain, they are incorporated once the network of database administrators decide the addition should be made. “Database administrators” not “miners.” Are you starting to understand? Mining is what companies do to extract precious metals from the earth. Precious metals like gold, which actually is money, unlike bitcoin. All of these analogies and the language from the financial world must be abolished from the lexicon of Bitcoin companies.

Once the message is accepted as legitimate by the network, your block chain viewer will be able to see that the signature you made has been added to the public record and the sum of your UTXOs will be smaller than they were before the message was sent. In the current wallet convention, this is expressed as a single number, sometimes juxtaposed with a conversion into fiat with the “approximately equal to” sign (≈). All of this is to help you understand but is not a reflection of what is really happening, or an absolute prerequisite or necessity.

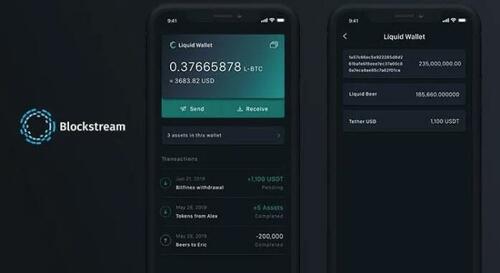

Is “Liquid bitcoin” money?

There are already “watch-only” tools from Bitcoin companies like the great Samourai Wallet. Sentinel allows you to scan your keys and then whenever the chain of blocks is updated, it will show you the status of the UTXOs you control on the block chain.

By the bizarre, irrational and stupid thinking of the EU, Sentinel is an “unhosted financial services application” because it shows you a balance in bitcoin as a single number. If it is not a financial services application, why not? Are they going to claim that a tool that watches a database is a “wallet?” No one is asking these questions because they don’t understand how Bitcoin works at any level other than analogies.

Samourai Wallet Sentinel app

And don’t get me started on metal storage devices.

Is this an “unhosted Bitcoin wallet?” (Photo/Cryptosteel)

In the end, there is going to have to be a U.S. Supreme Court case to force the venal and stupid legislators to obey their oaths and stop interfering with the free speech of American software developers. Bitcoin is not money — it is speech — and no lawmaker can interfere with the speech of U.S. citizens. I explain more about this in “Why America Can’t Regulate Bitcoin”

Once this is settled by case law, the benefits for the U.S. will be enormous. All software developers working in Bitcoin will run to incorporate in the country and base their operations in Florida. No one anywhere in the EU will dare to start a Bitcoin wallet company because the ignorant apparatchiks there can’t tell the difference between a chat app and a Bitcoin app (pro tip: there is no difference).

When this happens, hundreds of billions of dollars from all over the world will flow through Bitcoin wallet companies being run from America, and those companies will be paying taxes in the U.S. The entire world’s financial infrastructure and tooling will come from America and flow through America for Uncle Sam to get his slice. America wins again.

Upon reading this, there will be many stupid people out there who will cry, “This is just semantics!” Those people don’t use Bitcoin wallets, don’t have any bitcoin, don’t run Bitcoin businesses of any kind and are as ignorant as the EU idiots and U.S. geriatrics who want to cripple Bitcoin.

When this goes to the U.S. Supreme Court, it will not be them paying the legal bill, though they will reap the world-changing benefits of software developers working with the Bitcoin database free of arbitrary, unethical and unconstitutional restrictions hampering their ability to display the UTXOs you can assign with your block chain viewer and signer.