Authored by Bruce WIlds via Advancing Time blog,

Mortgage rates have doubled over the past year and this has hit housing affordability hard. How much housing prices will retrench is still up in the air. Consider the whole premise housing prices in America are about to fall like a stone may be overdone. Hard economic times could very well take a greater toll on the price of intangible assets and paper promises than on things like housing.

Whether a person is better off renting or buying is often directly linked to rental rates that are related to cost. Feeding into what a landlord charges are things such as taxes, insurance, maintenance, utilities, and a slew of fees. If landlords cannot make money, they exit the business and the number of housing rental units is reduced. This puts a bottom under the market and/or drives rents higher. Yes, a lot of new rental units are coming online but how easy will it be to rapidly fill them with good tenants? Simply filling a unit at a huge discount or with tenants that want a new unit but fail to pay or tear the hell out of it does not work.

What many renters fail to consider is that landlords have far more to risk than tenants. It is the kiss of death to lower your standards just to fill units up. Doing so simply destroys a property's reputation while creating a slew of evictions, costly turnover, and an explosion in maintenance costs. Adding to this ugly path forward is the fact our costly legal system has lost its teeth when it comes to collecting on small claim judgments.

Much of the problems we see in housing stem from a lack of starter homes and new small houses at a reasonable cost. Several reasons exist for this situation. First and foremost is that builders and realtors like bigger more exotic homes because that is where the money is. Another factor is zoning, this includes tightening rules and restrictions in plotted additions. These are often intended to keep standards and values high. People are seldom excited to see less expensive homes being built in their area.

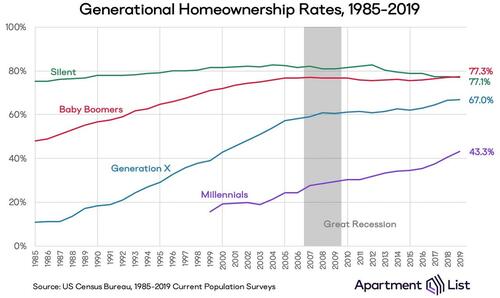

Millennials Have Been Locked Out Of Buying Because Of Affordability

The cost of shelter has skyrocketed and the face of housing ownership is changing.

Over the last several decades starter homes have become a thing of the past. This has created a shortage of low-cost housing that will put a floor under housing prices. The areas where housing will drop the most are areas where prices have increased the most with the bigger most expensive houses taking the brunt of the hit. This is partly because they cost more to maintain and are more heavily taxed.

Low-Interest Rates Have Pushed Prices Higher

The decision of the Fed to buy mortgage-backed securities years ago added to soaring prices and the mess we face today. Buyers are out there, many are speculators and inflation believers, these buyers are circling each new listing like hungry sharks. They are driven by the idea interest rates will soon fall and they will be able to refinance. If rates drop prices are likely to soar again. This could put a strong floor under most of the housing market.

One problem causing an issue for those looking at the low end of this market is that lenders have little interest in making small dollar loans because they are less profitable. This means these properties are often picked up by cash buyers. Many of these now go to big players that at times may buy without looking at the property but simply have it inspected by a company that sends them a report. Others are sold on contracts that often give the buyer little protection.

As stated many times in previous articles here at AdvancingTime, it could be argued the government holds huge responsible for many of America's housing problems. Our government makes the rules by which builders and landlords must play. This includes some of the factors I have moaned about in the past, a big one is that roughly 80% of new apartment construction has been for the high-end luxury market.

The government has its finger prints all over the housing sector and also causes problems for renters. This is because its policies avoid dealing with the growing number of tenants that are irresponsible. In short, Government housing cherry-picks the best of the low-income renters providing them with very low rents and nice apartments while dumping the worst of these renters on the private sector. This makes housing more expensive for the rest of the population.

The number of units being built during inflationary times with higher interest rates also plays into this market. Who buys homes greatly depends on who can afford them and how these buyers envision the future unfolding. In short, if buyers think prices will continue to rise this is very supportive of higher prices.

And then, there is the decision of the Fed to buy mortgage-backed securities years ago, this has added to soaring prices and the mess we face today. Following 2008, big money from Wall Street got behind a move to have Fanny Mae and other big lenders bundle foreclosed properties. Selling them in packages eliminated and locked out small concerns and individuals from participating in buying. In recent years, a small but mighty group of corporations have purchased hundreds of thousands of homes.

These Wall Street funded corporations are just one of the forces shutting people out of the home-buying market and locking them into being perpetual renters. When it comes to financing, short of some government giveaways to certain segments of the population, Wall Street has a huge advantage over individuals. This is why even though managing the renting of individual houses is challenging, Wall Street may not retreat from the task. It is important to remember this is about the real rate of inflation.

Not only have institutional buyers with deep pockets hijacked some markets by buying whole neighborhoods but the market is changing in other ways. The U.S. housing market has become a speculative investment and now homebuyers are competing with I-Buyers that have lots of low-cost capital. An I Buyer is an "Instant Buyer" in the real estate industry who uses data-driven online home value assessment tools to determine what your house is worth and then makes you an offer.

Returning to the subject of inflation and the benefits of buying tangible assets as a way to protect ones buying power, as it becomes more obvious inflation is only going to get worse, those that can afford to buy houses will continue to do so even at higher prices. The point is, we should not be surprised if housing prices prove far more resilient in a slowing economy than many experts think. In an inflationary environment, these houses fall into the category of a tangible asset capable of earning a positive return. Few investments meet this criteria and those that do will be in strong demand.

Note, housing prices are much higher in many parts of the world. One thing for certain, it will be interesting to see what happens next. Before you just assume housing prices are going far lower consider who will be buying those units that come available. All of what you have read above feeds into why those homeowners that have a low-interest rate mortgage may not be in a hurry to sell their home if they are not in distress. Expect how people handle their investments in the future to play a huge factor in future housing values.

Authored by Bruce WIlds via Advancing Time blog,

Mortgage rates have doubled over the past year and this has hit housing affordability hard. How much housing prices will retrench is still up in the air. Consider the whole premise housing prices in America are about to fall like a stone may be overdone. Hard economic times could very well take a greater toll on the price of intangible assets and paper promises than on things like housing.

Whether a person is better off renting or buying is often directly linked to rental rates that are related to cost. Feeding into what a landlord charges are things such as taxes, insurance, maintenance, utilities, and a slew of fees. If landlords cannot make money, they exit the business and the number of housing rental units is reduced. This puts a bottom under the market and/or drives rents higher. Yes, a lot of new rental units are coming online but how easy will it be to rapidly fill them with good tenants? Simply filling a unit at a huge discount or with tenants that want a new unit but fail to pay or tear the hell out of it does not work.

What many renters fail to consider is that landlords have far more to risk than tenants. It is the kiss of death to lower your standards just to fill units up. Doing so simply destroys a property’s reputation while creating a slew of evictions, costly turnover, and an explosion in maintenance costs. Adding to this ugly path forward is the fact our costly legal system has lost its teeth when it comes to collecting on small claim judgments.

Much of the problems we see in housing stem from a lack of starter homes and new small houses at a reasonable cost. Several reasons exist for this situation. First and foremost is that builders and realtors like bigger more exotic homes because that is where the money is. Another factor is zoning, this includes tightening rules and restrictions in plotted additions. These are often intended to keep standards and values high. People are seldom excited to see less expensive homes being built in their area.

Millennials Have Been Locked Out Of Buying Because Of Affordability

The cost of shelter has skyrocketed and the face of housing ownership is changing.

Over the last several decades starter homes have become a thing of the past. This has created a shortage of low-cost housing that will put a floor under housing prices. The areas where housing will drop the most are areas where prices have increased the most with the bigger most expensive houses taking the brunt of the hit. This is partly because they cost more to maintain and are more heavily taxed.

Low-Interest Rates Have Pushed Prices Higher

The decision of the Fed to buy mortgage-backed securities years ago added to soaring prices and the mess we face today. Buyers are out there, many are speculators and inflation believers, these buyers are circling each new listing like hungry sharks. They are driven by the idea interest rates will soon fall and they will be able to refinance. If rates drop prices are likely to soar again. This could put a strong floor under most of the housing market.

One problem causing an issue for those looking at the low end of this market is that lenders have little interest in making small dollar loans because they are less profitable. This means these properties are often picked up by cash buyers. Many of these now go to big players that at times may buy without looking at the property but simply have it inspected by a company that sends them a report. Others are sold on contracts that often give the buyer little protection.

As stated many times in previous articles here at AdvancingTime, it could be argued the government holds huge responsible for many of America’s housing problems. Our government makes the rules by which builders and landlords must play. This includes some of the factors I have moaned about in the past, a big one is that roughly 80% of new apartment construction has been for the high-end luxury market.

The government has its finger prints all over the housing sector and also causes problems for renters. This is because its policies avoid dealing with the growing number of tenants that are irresponsible. In short, Government housing cherry-picks the best of the low-income renters providing them with very low rents and nice apartments while dumping the worst of these renters on the private sector. This makes housing more expensive for the rest of the population.

The number of units being built during inflationary times with higher interest rates also plays into this market. Who buys homes greatly depends on who can afford them and how these buyers envision the future unfolding. In short, if buyers think prices will continue to rise this is very supportive of higher prices.

And then, there is the decision of the Fed to buy mortgage-backed securities years ago, this has added to soaring prices and the mess we face today. Following 2008, big money from Wall Street got behind a move to have Fanny Mae and other big lenders bundle foreclosed properties. Selling them in packages eliminated and locked out small concerns and individuals from participating in buying. In recent years, a small but mighty group of corporations have purchased hundreds of thousands of homes.

These Wall Street funded corporations are just one of the forces shutting people out of the home-buying market and locking them into being perpetual renters. When it comes to financing, short of some government giveaways to certain segments of the population, Wall Street has a huge advantage over individuals. This is why even though managing the renting of individual houses is challenging, Wall Street may not retreat from the task. It is important to remember this is about the real rate of inflation.

Not only have institutional buyers with deep pockets hijacked some markets by buying whole neighborhoods but the market is changing in other ways. The U.S. housing market has become a speculative investment and now homebuyers are competing with I-Buyers that have lots of low-cost capital. An I Buyer is an “Instant Buyer” in the real estate industry who uses data-driven online home value assessment tools to determine what your house is worth and then makes you an offer.

Returning to the subject of inflation and the benefits of buying tangible assets as a way to protect ones buying power, as it becomes more obvious inflation is only going to get worse, those that can afford to buy houses will continue to do so even at higher prices. The point is, we should not be surprised if housing prices prove far more resilient in a slowing economy than many experts think. In an inflationary environment, these houses fall into the category of a tangible asset capable of earning a positive return. Few investments meet this criteria and those that do will be in strong demand.

Note, housing prices are much higher in many parts of the world. One thing for certain, it will be interesting to see what happens next. Before you just assume housing prices are going far lower consider who will be buying those units that come available. All of what you have read above feeds into why those homeowners that have a low-interest rate mortgage may not be in a hurry to sell their home if they are not in distress. Expect how people handle their investments in the future to play a huge factor in future housing values.

Loading…