Authored by Gail Tverberg via Our Finite World blog,

Ramping up wind turbines, solar panels and electric vehicles can’t solve our energy problem

-

Renewables are hailed as a potential solution to the world’s energy problem, but it might not be as easy as simply installing more turbines or solar panels.

-

Renewable tech is incredibly complex and requires a lot of support in order to function.

-

Increasingly complex energy solutions are undoubtedly powerful and promising, but in practice, they often result in more fuel use rather than less.

Many people believe that installing more wind turbines and solar panels and manufacturing more electric vehicles can solve our energy problem, but I don’t agree with them. These devices, plus the batteries, charging stations, transmission lines and many other structures necessary to make them work represent a high level of complexity.

A relatively low level of complexity, such as the complexity embodied in a new hydroelectric dam, can sometimes be used to solve energy problems, but we cannot expect ever-higher levels of complexity to always be achievable.

According to the anthropologist Joseph Tainter, in his well-known book, The Collapse of Complex Societies, there are diminishing returns to added complexity. In other words, the most beneficial innovations tend to be found first. Later innovations tend to be less helpful. Eventually the energy cost of added complexity becomes too high, relative to the benefit provided.

In this post, I will discuss complexity further. I will also present evidence that the world economy may already have hit complexity limits. Furthermore, the popular measure, “Energy Return on Energy Investment” (EROEI) pertains to direct use of energy, rather than energy embodied in added complexity. As a result, EROEI indications tend to suggest that innovations such as wind turbines, solar panels and EVs are more helpful than they really are. Other measures similar to EROEI make a similar mistake.

[1] In this video with Nate Hagens, Joseph Tainter explains how energy and complexity tend to grow simultaneously, in what Tainter calls the Energy-Complexity Spiral.

Figure 1. The Energy-Complexity Spiral from 2010 presentation called The Energy-Complexity Spiral by Joseph Tainter.

According to Tainter, energy and complexity build on each other. At first, growing complexity can be helpful to a growing economy by encouraging the uptake of available energy products. Unfortunately, this growing complexity reaches diminishing returns because the easiest, most beneficial solutions are found first. When the benefit of added complexity becomes too small relative to the additional energy required, the overall economy tends to collapse–something he says is equivalent to “rapidly losing complexity.”

Growing complexity can make goods and services less expensive in several ways:

-

Economies of scale arise due to larger businesses.

-

Globalization allows use of alternative raw materials, cheaper labor and energy products.

-

Higher education and more specialization allow more innovation.

-

Improved technology allows goods to be less expensive to manufacture.

-

Improved technology may allow fuel savings for vehicles, allowing ongoing fuel savings.

Strangely enough, in practice, growing complexity tends to lead to more fuel use, rather than less. This is known as Jevons’ Paradox. If products are less expensive, more people can afford to buy and operate them, so that total energy consumption tends to be greater.

[2] In the above linked video, one way Professor Tainter describes complexity is that it is something that adds structure and organization to a system.

The reason I consider electricity from wind turbines and solar panels to be much more complex than, say, electricity from hydroelectric plants, or from fossil fuel plants, is because the output from the devices is further from what is needed to fill the demands of the electricity system we currently have operating. Wind and solar generation need complexity to fix their intermittency problems.

With hydroelectric generation, water is easily captured behind a dam. Often, some of the water can be stored for later use when demand is high. The water captured behind the dam can be run through a turbine, so that the electrical output matches the pattern of alternating current used in the local area. The electricity from a hydroelectric dam can be quickly added to other available electricity generation to match the pattern of electricity consumption users would prefer.

On the other hand, the output of wind turbines and solar panels requires a great deal more assistance (“complexity”) to match the electricity consumption pattern of consumers. Electricity from wind turbines tends to be very disorganized. It comes and goes according to its own schedule. Electricity from solar panels is organized, but the organization is not well aligned with the pattern of consumers prefer.

A major issue is that electricity for heating is required in winter, but solar electricity is disproportionately available in the summer; wind availability is irregular. Batteries can be added, but these mostly mitigate wrong “time-of-day” problems. Wrong “time-of-year” problems need to be mitigated with a lightly used parallel system. The most popular backup system seems to be natural gas, but backup systems with oil or coal can also be used.

This double system has a higher cost than either system would have if operated alone, on a full-time basis. For example, a natural gas system with pipelines and storage needs to be put in place, even if electricity from natural gas is only used for part of the year. The combined system needs experts in all areas, including electricity transmission, natural gas generation, repair of wind turbines and solar panels, and battery manufacture and maintenance. All of this requires educational systems and international trade, sometimes with unfriendly countries.

I also consider electric vehicles to be complex. One major problem is that the economy will require a double system, (for internal combustion engines and electric vehicles) for many, many years. Electric vehicles require batteries made using elements from around the world. They also need a whole system of charging stations to fill their need for frequent recharging.

[3] Professor Tainter makes the point that complexity has an energy cost, but this cost is virtually impossible to measure.

Energy needs are hidden in many areas. For example, to have a complex system, we need a financial system. The cost of this system cannot be added back in. We need modern roads and a system of laws. The cost of a government providing these services cannot be easily discerned. An increasingly complex system needs education to support it, but this cost is also hard to measure. Also, as we note elsewhere, having double systems adds other costs that are hard to measure or predict.

[3] The energy-complexity spiral cannot continue forever in an economy.

The energy-complexity spiral can reach limits in at least three ways:

[a] Extraction of minerals of all kinds is placed in the best locations first. Oil wells are first placed in areas where oil is easy to extract and close to population areas. Coal mines are first placed in locations where coal is easy to extract and transportation costs to users will be low. Mines for lithium, nickel, copper, and other minerals are put in the best-yielding locations first.

Eventually, the cost of energy production rises, rather than falls, due to diminishing returns. Oil, coal, and energy products become more expensive. Wind turbines, solar panels, and batteries for electric vehicles also tend to become more expensive because the cost of the minerals to manufacture them rises. All kinds of energy goods, including “renewables,” tend to become less affordable. In fact, there are many reports that the cost of producing wind turbines and solar panels rose in 2022, making the manufacture of these devices unprofitable. Either higher prices of finished devices or lower profitability for those producing the devices could stop the rise in usage.

[b] Human population tends to keep rising if food and other supplies are adequate, but the supply of arable land stays close to constant. This combination puts pressure on society to produce a continuous stream of innovations that will allow greater food supply per acre. These innovations eventually reach diminishing returns, making it more difficult for food production to keep up with population growth. Sometimes adverse fluctuations in weather patterns make it clear that food supplies have been too close to the minimum level for many years. The growth spiral is pushed down by spiking food prices and the poor health of workers who can only afford an inadequate diet.

[c] Growth in complexity reaches limits. The earliest innovations tend to be most productive. For example, electricity can be invented only once, as can the light bulb. Globalization can only go so far before a maximum level is reached. I think of debt as part of complexity. At some point, debt cannot be repaid with interest. Higher education (needed for specialization) reaches limits when workers cannot find jobs with sufficiently high wages to repay educational loans, besides covering living costs.

[4] One point Professor Tainter makes is that if the available energy supply is reduced, the system will need to simplify.

Typically, an economy grows for well over one hundred years, reaches energy-complexity limits, and then collapses over a period of years. This collapse can occur in different ways. A layer of government can collapse. I think of the collapse of the central government of the Soviet Union in 1991 as a form of collapse to a lower level of simplicity. Or one country conquers another country (with energy-complexity problems), taking over the government and resources of the other country. Or a financial collapse occurs.

Tainter says that simplification usually doesn’t happen voluntarily. One example he gives of voluntary simplification involves the Byzantine Empire in the 7th century. With less funding available for the military, it abandoned some of its distant posts, and it used a less costly approach to operating its remaining posts.

[5] In my opinion, it is easy for EROEI calculations (and similar calculations) to overstate the benefit of complex types of energy supply.

A major point that Professor Tainter makes in the talk linked above is that complexity has an energy cost, but the energy cost of this complexity is virtually impossible to measure. He also makes the point that growing complexity is seductive; the overall cost of complexity tends to grow over time. Models tend to miss necessary parts of the overall system needed to support a highly complex new source of energy supply.

Because the energy required for complexity is hard to measure, EROEI calculations with respect to complex systems will tend to make complex forms of electricity generation, such as wind and solar, look like they use less energy (have a higher EROEI) than they actually do. The problem is that EROEI calculations consider only direct “energy investment” costs. For example, the calculations are not designed to collect information regarding the higher energy cost of a dual system, with parts of the system under-utilized for portions of the year. Annual costs will not necessarily be reduced proportionately.

In the linked video, Professor Tainter talks about the EROEI of oil over the years. I don’t have a problem with this type of comparison, especially if it stops before the recent change to greater use of fracking, since the level of complexity is similar. In fact, such a comparison omitting fracking seems to be the one that Tainter makes. Comparison among different energy types, with different complexity levels, is what is easily distorted.

[6] The current world economy already seems to be trending in the direction of simplification, suggesting that the tendency toward greater complexity is already past its maximum level, given the lack of availability of inexpensive energy products.

I wonder if we are already starting to see simplification in trade, especially international trade, because shipping (generally using oil products) is becoming high-priced. This might be considered a type of simplification, in response to a lack of sufficient inexpensive energy supply.

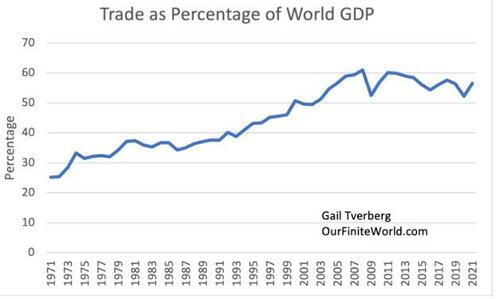

Figure 2. Trade as a percentage of world GDP, based on data of the World Bank.

Based on Figure 2, trade as a percentage of GDP hit a peak in 2008. There has been a generally downward trend in trade since then, giving an indication that the world economy has tended to shrink back, at least in some ways, as it has hit high-price limits.

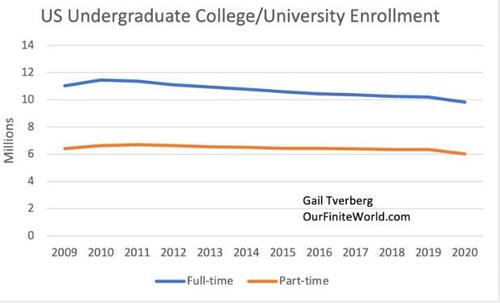

Another example of a trend toward lower complexity is the drop in US undergraduate college and university enrollment since 2010. Other data shows that undergraduate enrollment nearly tripled between 1950 and 2010, so the shift to a downtrend after 2010 presents a major turning point.

Figure 3. Total number of US full-time and part-time undergraduate college and university students, according to the National Center for Education Statistics.

The reason why the shift in enrollment is a problem is because colleges and universities have a huge amount of fixed expenses. These include buildings and grounds that must be maintained. Often debt needs to be repaid, as well. Educational systems also have tenured faculty members that they are obligated to keep on their staff, under most circumstances. They may have pension obligations that are not fully funded, adding another cost pressure.

According to the college faculty members whom I have talked to, in recent years there has been pressure to improve the retention rate of students who have been admitted. In other words, they feel that they are being encouraged to keep current students from dropping out, even if it means lowering their standards a little. At the same time, faculty wages are not keeping pace with inflation.

Other information suggests that colleges and universities have recently put a great deal of emphasis on achieving a more diverse student body. Students who might not have been admitted in the past because of low high school grades are increasingly being admitted in order to keep the enrollment from dropping further.

From the students’ point of view, the problem is that jobs that pay a sufficiently high wage to justify the high cost of a college education are increasingly unavailable. This seems to be the reason for both the US student debt crisis and the drop in undergraduate enrollment.

Of course, if colleges are at least somewhat lowering their admission standards and perhaps lowering standards for graduation, as well, there is a need to “sell” these increasingly diverse graduates with somewhat lower undergraduate achievement records to governments and businesses who might hire them. It seems to me that this is a further sign of the loss of complexity.

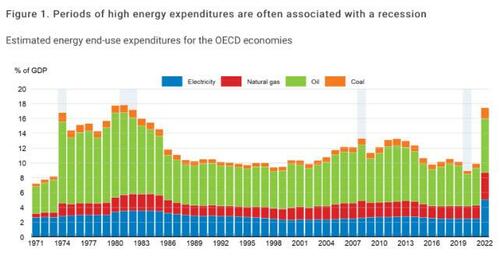

[7] In 2022, the total energy costs for most OECD countries started spiking to high levels, relative to GDP. When we analyze the situation, electricity prices are spiking, as are the prices of coal and natural gas–the two types of fuel used most frequently to produce electricity.

Figure 4. Chart from article called, Energy expenditures have surged, posing challenges for policymakers, by two OECD economists.

The OECD is an intergovernmental organization of mostly rich countries that was formed to stimulate economic progress and foster world growth. It includes the US, most European countries, Japan, Australia, and Canada, among other countries. Figure 4, with the caption “Periods of high energy expenditures are often associated with recession” is has been prepared by two economists working for OECD. The gray bars indicate recession.

Figure 4 shows that in 2021, prices for practically every cost segment associated with energy consumption tended to spike. Electricity, coal, and natural gas prices were all very high relative to prior years. The only segment of energy costs that was not very out of line relative to costs in prior years was oil. Coal and natural gas are both used to make electricity, so high electricity costs should not be surprising.

In Figure 4, the caption by the economists from OECD is pointing out what should be obvious to economists everywhere: High energy prices often push an economy into recession. Citizens are forced to cut back on non-essentials, reducing demand and pushing their economies into recession.

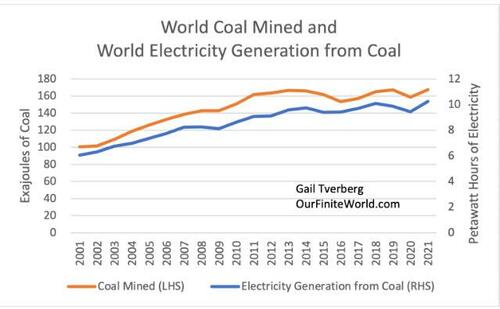

[8] The world seems to be up against extraction limits for coal. This, together with the high cost of shipping coal over long distances, is leading to very high prices for coal.

World coal production has been close to flat since 2011. Growth in electricity generation from coal has been almost as flat as world coal production. Indirectly, this lack of growth in coal production is forcing utilities around the world to move to other types of electricity generation.

Figure 5. World coal mined and world electricity generation from coal, based on data from BP’s 2022 Statistical Review of World Energy.

[9] Natural gas is now also in short supply when growing demand of many types is considered.

While natural gas production has been growing, in recent years it hasn’t been growing quickly enough to keep up with the world’s rising demand for natural gas imports. World natural gas production in 2021 was only 1.7% higher than production in 2019.

Growth in the demand for natural gas imports comes from several directions, simultaneously:

-

With coal supply flat and imports not sufficiently available, countries are seeking to substitute natural gas generation for coal generation of electricity. China is the world’s largest importer of natural gas partly for this reason.

-

Countries with electricity from wind or solar find that electricity from natural gas can ramp up quickly and fill in when wind and solar aren’t available.

-

There are several countries, including Indonesia, India and Pakistan, whose natural gas production is declining.

-

Europe chose to end its pipeline imports of natural gas from Russia and now needs more LNG instead.

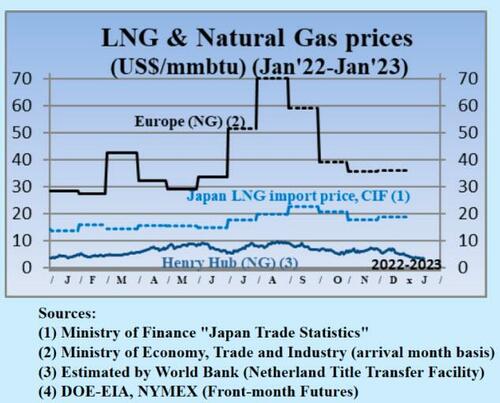

[10] Prices for natural gas are extremely variable, depending on whether the natural gas is locally produced, and depending on how it is shipped and the type of contract it is under. Generally, locally produced natural gas is the least expensive. Coal has somewhat similar issues, with locally produced coal being the least expensive.

This is a chart from a recent Japanese publication (IEEJ).

Figure 6. Comparison of natural gas prices in three parts of the world from the Japanese publication IEEJ, dated January 23, 2023.

The low Henry Hub price at the bottom is the US price, available only locally. If supplies are high within the US, its price tends to be low. The next higher price is Japan’s price for imported liquefied natural gas (LNG), arranged under long-term contracts, over a period of years. The top price is the price that Europe is paying for LNG based on “spot market” prices. Spot market LNG is the only type of LNG available to those who did not plan ahead.

In recent years, Europe has been taking its chances on getting low spot market prices, but this approach can backfire badly when there is not enough to go around. Note that the high price of European imported LNG was already evident in January 2013, before the Ukraine invasion began.

A major issue is that shipping natural gas is extremely expensive, tending to at least double or triple the price to the user. Producers need to be guaranteed a high price for LNG over the long term to make all of the infrastructure needed to produce and ship natural gas as LNG profitable. The extremely variable prices for LNG have been a problem for natural gas producers.

The very high recent prices for LNG in Europe have made the price of natural gas too high for industrial users who need natural gas for processes other than making electricity, such as making nitrogen fertilizer. These high prices cause distress from the lack of inexpensive natural gas to spill over into the farming sector.

Most people are “energy blind,” especially when it comes to coal and natural gas. They assume that there is plenty of both fuels to be cheaply extracted, essentially forever. Unfortunately, for both coal and natural gas, the cost of shipping tends to be very high. This is something that modelers miss. It is the high delivered cost of natural gas and coal that makes it impossible for companies to actually extract the amounts of coal and natural gas that seem to be available based on reserve estimates.

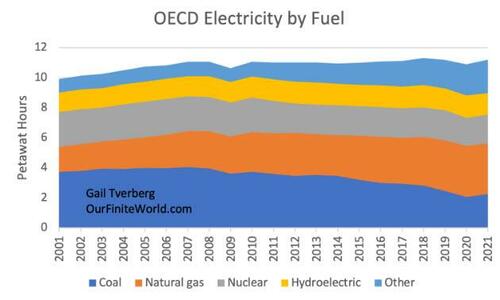

[10] When we analyze electricity consumption in recent years, we discover that OECD and non-OECD countries have had amazingly different patterns of electricity consumption growth since 2001.

OECD electricity consumption has been close to flat, especially since 2008. Even before 2008, its electricity consumption was not growing rapidly.

The proposal now is to increase the use of electricity in OECD countries. Electricity will be used to a greater extent for fueling vehicles and heating homes. It will also to be used more for local manufacturing, especially for batteries and semiconductor chips. I wonder how OECD countries will be able to ramp up electricity production sufficiently to cover both current uses of electricity and planned new uses, if past electricity production has been essentially flat.

Figure 7. Electricity production by type of fuel for OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

Figure 7 shows that coal’s share of electricity production has been falling for OECD countries, especially since 2008. “Other” has been rising, but only enough to keep overall production flat. Other is comprised of renewables, including wind and solar, plus electricity from oil and from burning of trash. The latter categories are small.

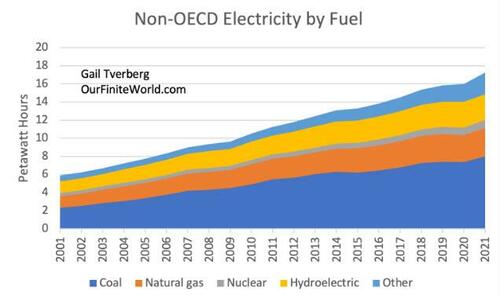

The pattern of recent energy production for non-OECD countries is very different:

Figure 8. Electricity production by type of fuel for non-OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

Figure 8 shows that non-OECD countries have been rapidly ramping up electricity production from coal. Other major sources of fuel are natural gas and electricity produced by hydroelectric dams. All these energy sources are relatively non-complex. Electricity from locally produced coal, locally produced natural gas, and hydroelectric generation all tend to be quite inexpensive. With these inexpensive sources of electricity, non-OECD countries have been able to dominate the world’s heavy industry and much of its manufacturing.

In fact, if we look at the local production of fuels generally used to produce electricity (that is, all fuels except oil), we can see a pattern emerge.

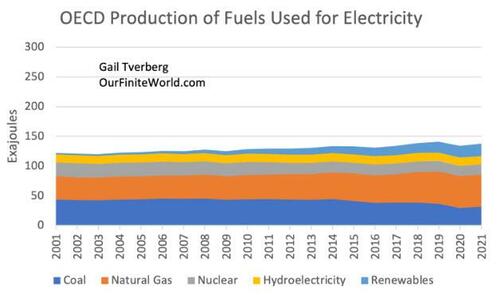

Figure 9. Energy production of fuels often used for electricity production for OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

With respect to extraction of fuels often associated with electricity, production has been closed to flat, even with “renewables” (wind, solar, geothermal, and wood chips) included. Coal production is down. The decline in coal production is likely a big part of the lack of growth in OECD’s electricity supply. Electricity from locally produced coal has historically been very inexpensive, bringing the average price of electricity down.

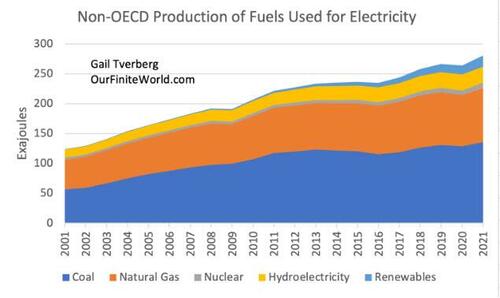

A very different pattern emerges when the production of fuels used to generate electricity for non-OECD countries is viewed. Note that the same scale has been used on both Figures 9 and 10. Thus, in 2001, the production of these fuels was about equal for OECD and non-OECD countries. Production of these fuels has about doubled since 2001 for non-OECD countries, while OECD production has remained close to flat.

Figure 10. Energy production of fuels often used for electricity production for non-OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

One item of interest on Figure 10 is coal production for non-OECD countries, shown in blue at the bottom. It has been barely increasing since 2011. This is part of what is now tightening world coal supplies. I am doubtful that spiking coal prices will add very much to long-term coal production because truly local supplies are becoming depleted, even in non-OECD countries. The spiking prices are much more likely to lead to recession, debt defaults, lower commodity prices, and lower coal supply.

[11] I am afraid that the world economy has hit complexity limits as well as energy production limits.

The world economy seems likely to collapse over a period of years. In the near term, the result may look like a bad recession, or it may look like war, or possibly both. So far, the economies using fuels that are not very complex for electricity (locally produced coal and natural gas, plus hydroelectric generation) seem to be doing better than others. But the overall world economy is stressed by inadequate cheap-to-produce local energy supplies.

In physics terms, the world economy, as well as all of the individual economies within it, are dissipative structures. As such, growth followed by collapse is a usual pattern. At the same time, new versions of dissipative structures can be expected to form, some of which may be better adapted to changing conditions. Thus, approaches for economic growth that seem impossible today may be possible over a longer timeframe.

For example, if climate change opens up access to more coal supplies in very cold areas, the Maximum Power Principle would suggest that some economy will eventually access such deposits. Thus, while we seem to be reaching an end now, over the long-term, self-organizing systems can be expected to find ways to utilize (“dissipate”) any energy supply that can be inexpensively accessed, considering both complexity and direct fuel use.

Authored by Gail Tverberg via Our Finite World blog,

Ramping up wind turbines, solar panels and electric vehicles can’t solve our energy problem

-

Renewables are hailed as a potential solution to the world’s energy problem, but it might not be as easy as simply installing more turbines or solar panels.

-

Renewable tech is incredibly complex and requires a lot of support in order to function.

-

Increasingly complex energy solutions are undoubtedly powerful and promising, but in practice, they often result in more fuel use rather than less.

Many people believe that installing more wind turbines and solar panels and manufacturing more electric vehicles can solve our energy problem, but I don’t agree with them. These devices, plus the batteries, charging stations, transmission lines and many other structures necessary to make them work represent a high level of complexity.

A relatively low level of complexity, such as the complexity embodied in a new hydroelectric dam, can sometimes be used to solve energy problems, but we cannot expect ever-higher levels of complexity to always be achievable.

According to the anthropologist Joseph Tainter, in his well-known book, The Collapse of Complex Societies, there are diminishing returns to added complexity. In other words, the most beneficial innovations tend to be found first. Later innovations tend to be less helpful. Eventually the energy cost of added complexity becomes too high, relative to the benefit provided.

In this post, I will discuss complexity further. I will also present evidence that the world economy may already have hit complexity limits. Furthermore, the popular measure, “Energy Return on Energy Investment” (EROEI) pertains to direct use of energy, rather than energy embodied in added complexity. As a result, EROEI indications tend to suggest that innovations such as wind turbines, solar panels and EVs are more helpful than they really are. Other measures similar to EROEI make a similar mistake.

[1] In this video with Nate Hagens, Joseph Tainter explains how energy and complexity tend to grow simultaneously, in what Tainter calls the Energy-Complexity Spiral.

Figure 1. The Energy-Complexity Spiral from 2010 presentation called The Energy-Complexity Spiral by Joseph Tainter.

According to Tainter, energy and complexity build on each other. At first, growing complexity can be helpful to a growing economy by encouraging the uptake of available energy products. Unfortunately, this growing complexity reaches diminishing returns because the easiest, most beneficial solutions are found first. When the benefit of added complexity becomes too small relative to the additional energy required, the overall economy tends to collapse–something he says is equivalent to “rapidly losing complexity.”

[embedded content]

Growing complexity can make goods and services less expensive in several ways:

-

Economies of scale arise due to larger businesses.

-

Globalization allows use of alternative raw materials, cheaper labor and energy products.

-

Higher education and more specialization allow more innovation.

-

Improved technology allows goods to be less expensive to manufacture.

-

Improved technology may allow fuel savings for vehicles, allowing ongoing fuel savings.

Strangely enough, in practice, growing complexity tends to lead to more fuel use, rather than less. This is known as Jevons’ Paradox. If products are less expensive, more people can afford to buy and operate them, so that total energy consumption tends to be greater.

[2] In the above linked video, one way Professor Tainter describes complexity is that it is something that adds structure and organization to a system.

The reason I consider electricity from wind turbines and solar panels to be much more complex than, say, electricity from hydroelectric plants, or from fossil fuel plants, is because the output from the devices is further from what is needed to fill the demands of the electricity system we currently have operating. Wind and solar generation need complexity to fix their intermittency problems.

With hydroelectric generation, water is easily captured behind a dam. Often, some of the water can be stored for later use when demand is high. The water captured behind the dam can be run through a turbine, so that the electrical output matches the pattern of alternating current used in the local area. The electricity from a hydroelectric dam can be quickly added to other available electricity generation to match the pattern of electricity consumption users would prefer.

On the other hand, the output of wind turbines and solar panels requires a great deal more assistance (“complexity”) to match the electricity consumption pattern of consumers. Electricity from wind turbines tends to be very disorganized. It comes and goes according to its own schedule. Electricity from solar panels is organized, but the organization is not well aligned with the pattern of consumers prefer.

A major issue is that electricity for heating is required in winter, but solar electricity is disproportionately available in the summer; wind availability is irregular. Batteries can be added, but these mostly mitigate wrong “time-of-day” problems. Wrong “time-of-year” problems need to be mitigated with a lightly used parallel system. The most popular backup system seems to be natural gas, but backup systems with oil or coal can also be used.

This double system has a higher cost than either system would have if operated alone, on a full-time basis. For example, a natural gas system with pipelines and storage needs to be put in place, even if electricity from natural gas is only used for part of the year. The combined system needs experts in all areas, including electricity transmission, natural gas generation, repair of wind turbines and solar panels, and battery manufacture and maintenance. All of this requires educational systems and international trade, sometimes with unfriendly countries.

I also consider electric vehicles to be complex. One major problem is that the economy will require a double system, (for internal combustion engines and electric vehicles) for many, many years. Electric vehicles require batteries made using elements from around the world. They also need a whole system of charging stations to fill their need for frequent recharging.

[3] Professor Tainter makes the point that complexity has an energy cost, but this cost is virtually impossible to measure.

Energy needs are hidden in many areas. For example, to have a complex system, we need a financial system. The cost of this system cannot be added back in. We need modern roads and a system of laws. The cost of a government providing these services cannot be easily discerned. An increasingly complex system needs education to support it, but this cost is also hard to measure. Also, as we note elsewhere, having double systems adds other costs that are hard to measure or predict.

[3] The energy-complexity spiral cannot continue forever in an economy.

The energy-complexity spiral can reach limits in at least three ways:

[a] Extraction of minerals of all kinds is placed in the best locations first. Oil wells are first placed in areas where oil is easy to extract and close to population areas. Coal mines are first placed in locations where coal is easy to extract and transportation costs to users will be low. Mines for lithium, nickel, copper, and other minerals are put in the best-yielding locations first.

Eventually, the cost of energy production rises, rather than falls, due to diminishing returns. Oil, coal, and energy products become more expensive. Wind turbines, solar panels, and batteries for electric vehicles also tend to become more expensive because the cost of the minerals to manufacture them rises. All kinds of energy goods, including “renewables,” tend to become less affordable. In fact, there are many reports that the cost of producing wind turbines and solar panels rose in 2022, making the manufacture of these devices unprofitable. Either higher prices of finished devices or lower profitability for those producing the devices could stop the rise in usage.

[b] Human population tends to keep rising if food and other supplies are adequate, but the supply of arable land stays close to constant. This combination puts pressure on society to produce a continuous stream of innovations that will allow greater food supply per acre. These innovations eventually reach diminishing returns, making it more difficult for food production to keep up with population growth. Sometimes adverse fluctuations in weather patterns make it clear that food supplies have been too close to the minimum level for many years. The growth spiral is pushed down by spiking food prices and the poor health of workers who can only afford an inadequate diet.

[c] Growth in complexity reaches limits. The earliest innovations tend to be most productive. For example, electricity can be invented only once, as can the light bulb. Globalization can only go so far before a maximum level is reached. I think of debt as part of complexity. At some point, debt cannot be repaid with interest. Higher education (needed for specialization) reaches limits when workers cannot find jobs with sufficiently high wages to repay educational loans, besides covering living costs.

[4] One point Professor Tainter makes is that if the available energy supply is reduced, the system will need to simplify.

Typically, an economy grows for well over one hundred years, reaches energy-complexity limits, and then collapses over a period of years. This collapse can occur in different ways. A layer of government can collapse. I think of the collapse of the central government of the Soviet Union in 1991 as a form of collapse to a lower level of simplicity. Or one country conquers another country (with energy-complexity problems), taking over the government and resources of the other country. Or a financial collapse occurs.

Tainter says that simplification usually doesn’t happen voluntarily. One example he gives of voluntary simplification involves the Byzantine Empire in the 7th century. With less funding available for the military, it abandoned some of its distant posts, and it used a less costly approach to operating its remaining posts.

[5] In my opinion, it is easy for EROEI calculations (and similar calculations) to overstate the benefit of complex types of energy supply.

A major point that Professor Tainter makes in the talk linked above is that complexity has an energy cost, but the energy cost of this complexity is virtually impossible to measure. He also makes the point that growing complexity is seductive; the overall cost of complexity tends to grow over time. Models tend to miss necessary parts of the overall system needed to support a highly complex new source of energy supply.

Because the energy required for complexity is hard to measure, EROEI calculations with respect to complex systems will tend to make complex forms of electricity generation, such as wind and solar, look like they use less energy (have a higher EROEI) than they actually do. The problem is that EROEI calculations consider only direct “energy investment” costs. For example, the calculations are not designed to collect information regarding the higher energy cost of a dual system, with parts of the system under-utilized for portions of the year. Annual costs will not necessarily be reduced proportionately.

In the linked video, Professor Tainter talks about the EROEI of oil over the years. I don’t have a problem with this type of comparison, especially if it stops before the recent change to greater use of fracking, since the level of complexity is similar. In fact, such a comparison omitting fracking seems to be the one that Tainter makes. Comparison among different energy types, with different complexity levels, is what is easily distorted.

[6] The current world economy already seems to be trending in the direction of simplification, suggesting that the tendency toward greater complexity is already past its maximum level, given the lack of availability of inexpensive energy products.

I wonder if we are already starting to see simplification in trade, especially international trade, because shipping (generally using oil products) is becoming high-priced. This might be considered a type of simplification, in response to a lack of sufficient inexpensive energy supply.

Figure 2. Trade as a percentage of world GDP, based on data of the World Bank.

Based on Figure 2, trade as a percentage of GDP hit a peak in 2008. There has been a generally downward trend in trade since then, giving an indication that the world economy has tended to shrink back, at least in some ways, as it has hit high-price limits.

Another example of a trend toward lower complexity is the drop in US undergraduate college and university enrollment since 2010. Other data shows that undergraduate enrollment nearly tripled between 1950 and 2010, so the shift to a downtrend after 2010 presents a major turning point.

Figure 3. Total number of US full-time and part-time undergraduate college and university students, according to the National Center for Education Statistics.

The reason why the shift in enrollment is a problem is because colleges and universities have a huge amount of fixed expenses. These include buildings and grounds that must be maintained. Often debt needs to be repaid, as well. Educational systems also have tenured faculty members that they are obligated to keep on their staff, under most circumstances. They may have pension obligations that are not fully funded, adding another cost pressure.

According to the college faculty members whom I have talked to, in recent years there has been pressure to improve the retention rate of students who have been admitted. In other words, they feel that they are being encouraged to keep current students from dropping out, even if it means lowering their standards a little. At the same time, faculty wages are not keeping pace with inflation.

Other information suggests that colleges and universities have recently put a great deal of emphasis on achieving a more diverse student body. Students who might not have been admitted in the past because of low high school grades are increasingly being admitted in order to keep the enrollment from dropping further.

From the students’ point of view, the problem is that jobs that pay a sufficiently high wage to justify the high cost of a college education are increasingly unavailable. This seems to be the reason for both the US student debt crisis and the drop in undergraduate enrollment.

Of course, if colleges are at least somewhat lowering their admission standards and perhaps lowering standards for graduation, as well, there is a need to “sell” these increasingly diverse graduates with somewhat lower undergraduate achievement records to governments and businesses who might hire them. It seems to me that this is a further sign of the loss of complexity.

[7] In 2022, the total energy costs for most OECD countries started spiking to high levels, relative to GDP. When we analyze the situation, electricity prices are spiking, as are the prices of coal and natural gas–the two types of fuel used most frequently to produce electricity.

Figure 4. Chart from article called, Energy expenditures have surged, posing challenges for policymakers, by two OECD economists.

The OECD is an intergovernmental organization of mostly rich countries that was formed to stimulate economic progress and foster world growth. It includes the US, most European countries, Japan, Australia, and Canada, among other countries. Figure 4, with the caption “Periods of high energy expenditures are often associated with recession” is has been prepared by two economists working for OECD. The gray bars indicate recession.

Figure 4 shows that in 2021, prices for practically every cost segment associated with energy consumption tended to spike. Electricity, coal, and natural gas prices were all very high relative to prior years. The only segment of energy costs that was not very out of line relative to costs in prior years was oil. Coal and natural gas are both used to make electricity, so high electricity costs should not be surprising.

In Figure 4, the caption by the economists from OECD is pointing out what should be obvious to economists everywhere: High energy prices often push an economy into recession. Citizens are forced to cut back on non-essentials, reducing demand and pushing their economies into recession.

[8] The world seems to be up against extraction limits for coal. This, together with the high cost of shipping coal over long distances, is leading to very high prices for coal.

World coal production has been close to flat since 2011. Growth in electricity generation from coal has been almost as flat as world coal production. Indirectly, this lack of growth in coal production is forcing utilities around the world to move to other types of electricity generation.

Figure 5. World coal mined and world electricity generation from coal, based on data from BP’s 2022 Statistical Review of World Energy.

[9] Natural gas is now also in short supply when growing demand of many types is considered.

While natural gas production has been growing, in recent years it hasn’t been growing quickly enough to keep up with the world’s rising demand for natural gas imports. World natural gas production in 2021 was only 1.7% higher than production in 2019.

Growth in the demand for natural gas imports comes from several directions, simultaneously:

-

With coal supply flat and imports not sufficiently available, countries are seeking to substitute natural gas generation for coal generation of electricity. China is the world’s largest importer of natural gas partly for this reason.

-

Countries with electricity from wind or solar find that electricity from natural gas can ramp up quickly and fill in when wind and solar aren’t available.

-

There are several countries, including Indonesia, India and Pakistan, whose natural gas production is declining.

-

Europe chose to end its pipeline imports of natural gas from Russia and now needs more LNG instead.

[10] Prices for natural gas are extremely variable, depending on whether the natural gas is locally produced, and depending on how it is shipped and the type of contract it is under. Generally, locally produced natural gas is the least expensive. Coal has somewhat similar issues, with locally produced coal being the least expensive.

This is a chart from a recent Japanese publication (IEEJ).

Figure 6. Comparison of natural gas prices in three parts of the world from the Japanese publication IEEJ, dated January 23, 2023.

The low Henry Hub price at the bottom is the US price, available only locally. If supplies are high within the US, its price tends to be low. The next higher price is Japan’s price for imported liquefied natural gas (LNG), arranged under long-term contracts, over a period of years. The top price is the price that Europe is paying for LNG based on “spot market” prices. Spot market LNG is the only type of LNG available to those who did not plan ahead.

In recent years, Europe has been taking its chances on getting low spot market prices, but this approach can backfire badly when there is not enough to go around. Note that the high price of European imported LNG was already evident in January 2013, before the Ukraine invasion began.

A major issue is that shipping natural gas is extremely expensive, tending to at least double or triple the price to the user. Producers need to be guaranteed a high price for LNG over the long term to make all of the infrastructure needed to produce and ship natural gas as LNG profitable. The extremely variable prices for LNG have been a problem for natural gas producers.

The very high recent prices for LNG in Europe have made the price of natural gas too high for industrial users who need natural gas for processes other than making electricity, such as making nitrogen fertilizer. These high prices cause distress from the lack of inexpensive natural gas to spill over into the farming sector.

Most people are “energy blind,” especially when it comes to coal and natural gas. They assume that there is plenty of both fuels to be cheaply extracted, essentially forever. Unfortunately, for both coal and natural gas, the cost of shipping tends to be very high. This is something that modelers miss. It is the high delivered cost of natural gas and coal that makes it impossible for companies to actually extract the amounts of coal and natural gas that seem to be available based on reserve estimates.

[10] When we analyze electricity consumption in recent years, we discover that OECD and non-OECD countries have had amazingly different patterns of electricity consumption growth since 2001.

OECD electricity consumption has been close to flat, especially since 2008. Even before 2008, its electricity consumption was not growing rapidly.

The proposal now is to increase the use of electricity in OECD countries. Electricity will be used to a greater extent for fueling vehicles and heating homes. It will also to be used more for local manufacturing, especially for batteries and semiconductor chips. I wonder how OECD countries will be able to ramp up electricity production sufficiently to cover both current uses of electricity and planned new uses, if past electricity production has been essentially flat.

Figure 7. Electricity production by type of fuel for OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

Figure 7 shows that coal’s share of electricity production has been falling for OECD countries, especially since 2008. “Other” has been rising, but only enough to keep overall production flat. Other is comprised of renewables, including wind and solar, plus electricity from oil and from burning of trash. The latter categories are small.

The pattern of recent energy production for non-OECD countries is very different:

Figure 8. Electricity production by type of fuel for non-OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

Figure 8 shows that non-OECD countries have been rapidly ramping up electricity production from coal. Other major sources of fuel are natural gas and electricity produced by hydroelectric dams. All these energy sources are relatively non-complex. Electricity from locally produced coal, locally produced natural gas, and hydroelectric generation all tend to be quite inexpensive. With these inexpensive sources of electricity, non-OECD countries have been able to dominate the world’s heavy industry and much of its manufacturing.

In fact, if we look at the local production of fuels generally used to produce electricity (that is, all fuels except oil), we can see a pattern emerge.

Figure 9. Energy production of fuels often used for electricity production for OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

With respect to extraction of fuels often associated with electricity, production has been closed to flat, even with “renewables” (wind, solar, geothermal, and wood chips) included. Coal production is down. The decline in coal production is likely a big part of the lack of growth in OECD’s electricity supply. Electricity from locally produced coal has historically been very inexpensive, bringing the average price of electricity down.

A very different pattern emerges when the production of fuels used to generate electricity for non-OECD countries is viewed. Note that the same scale has been used on both Figures 9 and 10. Thus, in 2001, the production of these fuels was about equal for OECD and non-OECD countries. Production of these fuels has about doubled since 2001 for non-OECD countries, while OECD production has remained close to flat.

Figure 10. Energy production of fuels often used for electricity production for non-OECD countries, based on data from BP’s 2022 Statistical Review of World Energy.

One item of interest on Figure 10 is coal production for non-OECD countries, shown in blue at the bottom. It has been barely increasing since 2011. This is part of what is now tightening world coal supplies. I am doubtful that spiking coal prices will add very much to long-term coal production because truly local supplies are becoming depleted, even in non-OECD countries. The spiking prices are much more likely to lead to recession, debt defaults, lower commodity prices, and lower coal supply.

[11] I am afraid that the world economy has hit complexity limits as well as energy production limits.

The world economy seems likely to collapse over a period of years. In the near term, the result may look like a bad recession, or it may look like war, or possibly both. So far, the economies using fuels that are not very complex for electricity (locally produced coal and natural gas, plus hydroelectric generation) seem to be doing better than others. But the overall world economy is stressed by inadequate cheap-to-produce local energy supplies.

In physics terms, the world economy, as well as all of the individual economies within it, are dissipative structures. As such, growth followed by collapse is a usual pattern. At the same time, new versions of dissipative structures can be expected to form, some of which may be better adapted to changing conditions. Thus, approaches for economic growth that seem impossible today may be possible over a longer timeframe.

For example, if climate change opens up access to more coal supplies in very cold areas, the Maximum Power Principle would suggest that some economy will eventually access such deposits. Thus, while we seem to be reaching an end now, over the long-term, self-organizing systems can be expected to find ways to utilize (“dissipate”) any energy supply that can be inexpensively accessed, considering both complexity and direct fuel use.

Loading…