Via AdventuresInCapitalism.com,

Investors like to focus on QE and QT, because the quantity of money has an immediate effect on risk assets. In the same way, we like to focus on the Fed Funds Rate as the price of money also has a dramatic effect on risk assets. Oddly, we rarely focus on the actual banking function of the Fed.

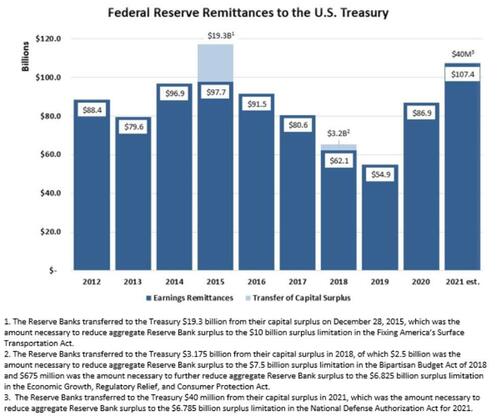

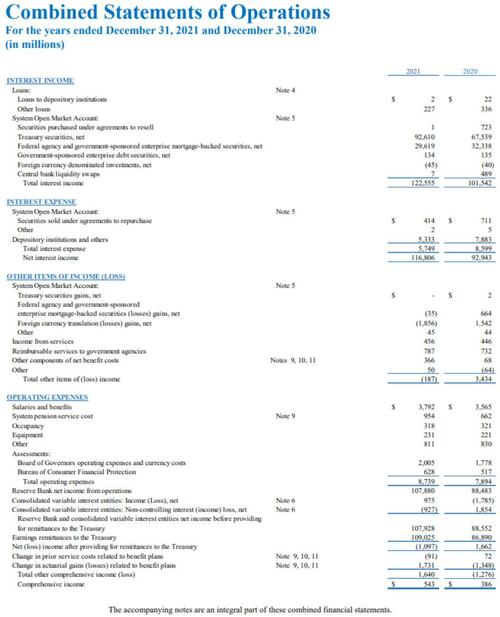

The Fed acts like a bank by effectively earning a net interest spread on the difference in yield on the securities it owns when compared to the funding cost of deposits from depository institutions. During 2021, the Fed took in $122.5 billion in interest income, paid out $5.7 billion in interest expense, incurred $8.7 billion in expenses (mostly worthless economists who staff the Fed) and then sent most of the remaining profits to the US Treasury. As you can imagine, the Treasury appreciates the proceeds, which amounted to $107.4 billion in 2021, helping to make the budget deficit slightly less egregious. 2021 Federal Reserve Financials

The Fed is also an odd bank in that it cannot go broke. Think of it as being very much akin to Credit Suisse—no matter how much it screws up, it continues to stumble forward. I bring all of this up, because something peculiar is about to happen. Look at the consistent earnings over the past decade. What if those earnings became a sea of red ink?

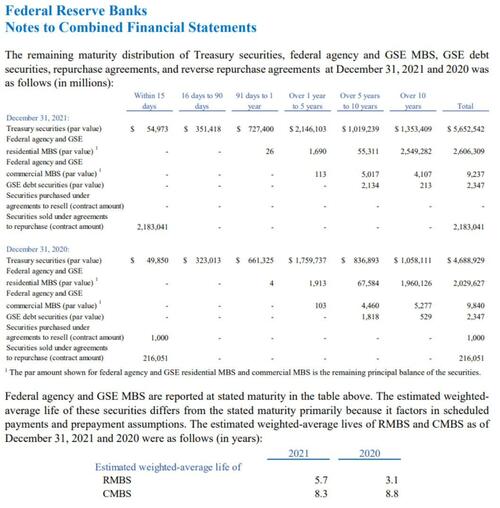

Why would the earnings revert to red? Let’s use some very rough numbers. For those of you who follow the Fed more closely, just bear with me—I’m focused on concepts, not precision. At year-end, the Fed had $8.7 trillion in liabilities. As a result, every 100-basis point move higher in the Fed Funds rate, increases the interest cost by $87 billion. As mentioned previously, in 2021, the Fed paid $5.7 billion in interest expense—so we’re talking about big changes in funding costs. Let’s say that JPOW is serious about a terminal rate of 4%, that’s $348 billion in increased funding costs. Meanwhile, the Fed’s securities portfolio is mostly fixed rate. Some will roll off and get replaced, but a good chunk of the balance sheet has a duration in excess of 1 year, with $2.5 trillion of the MBS having a duration in excess of 10 years.

Clearly, there’s a mismatch. The Fed earned $122.5 billion in interest income in 2021. Assuming this figure stays constant (it won’t, but bear with me) we’re talking about almost a quarter trillion in losses for the Fed at a 4% interest rate.

-

Interest Income $122.5 billion

-

Prior Interest Expense $5.7

-

Increased Interest Expense $348 billion

-

Worthless Economists $8.7 billion

-

Total Loss $239.9 billion

But it gets worse. Remember when the Treasury earned $107.4 billion? Now that’s reversed, and someone needs to plug the $239.9 billion loss. Call it a swing of $347.3 billion.

Remember how the Fed is sort of like Credit Suisse?? It can keep losing money and there are no ramifications. At my hedge fund, we need to mark everything to market. Banks get a pass on that. They assume that securities mature. There’s no sense in getting into the details, but they do not need to mark their book—which is a good thing because a good chunk of the long-duration portfolio was purchased at peak prices during the COVID panic when QE was running in insanity mode.

I shudder to think what the marks would be, but the $40.7 billion in balance sheet capital is nowhere near sufficient as a buffer. In fact, the negative equity is already likely hundreds of billions and accelerating.

Now, here’s the oddity of Central Bank accounting. You get a free pass on mark-to-market losses if you hold onto the security, but when you sell a security at a loss, you must recognize that loss. Well, the Fed is now liquidating securities as part of its QT program. It’s inevitable that it will be recognizing substantial losses as prices have moved dramatically since they were purchased.

Remember, Central Banks don’t go broke. Instead, they can either ignore the losses indefinitely or get bailed out by the government—usually by printing money to buy treasuries directly from the Treasury. As the 40-year interest rates cycle continues to turn, the Fed will increasingly be forced to the printing press in order to offset losses from its own negative interest rate spread, its own balance sheet and to plug the hole in the Treasury’s balance sheet that is caused by $107.4 billion in income reversing and becoming a sea of red.

Eventually, the Fed will succeed in breaking something—quite possibly themselves—then pivot. You cannot have massive fiscal deficits while simultaneously having the Fed tighten, as someone has to buy the rapidly increasing pool of debt—especially as the government’s own funding costs are about to explode due to much higher interest rates as short-term paper rolls over at much higher rates. For that matter, the government had over a decade to term out the nation’s debt, yet multiple Treasury Secretaries failed to accomplish this. Now a rather increased percentage of total fiscal revenue will go simply towards paying interest expense.

Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” As the Fed tries to fight inflation, it’s inevitably going to smash into the wall that I have described above. As a result, I doubt they get too far on the rates side, as past a certain threshold, increasing rates only forces them to print money. Thus, higher rates only accelerate the inflation crisis—especially as higher funding costs disincentivize investment in new capacity across the economy.

In summary, higher interest rates will only increase the cash burn everywhere within the Fed and the Treasury. They’ll rapidly realize that they’re completely trapped. They cannot tame inflation without effectively bankrupting themselves. Except, Central Banks don’t go bankrupt—neither do countries that borrow in their own currencies. Instead, they’ll go bankrupt in a whirlwind of money printing and inflation.

Simply put, they’ll try this experiment, realize it won’t work and get back to monetizing debt. Despite nearly $9 billion spent annually on economists and operations, I doubt any of them have even considered this. As the Fed effectively goes broke, so does the currency. We’re rapidly approaching the moment when “Project Zimbabwe” moves from conceptual to reality.

* * *

If you enjoyed this post, subscribe for more at http://www.adventuresincapitalism.com

Via AdventuresInCapitalism.com,

Investors like to focus on QE and QT, because the quantity of money has an immediate effect on risk assets. In the same way, we like to focus on the Fed Funds Rate as the price of money also has a dramatic effect on risk assets. Oddly, we rarely focus on the actual banking function of the Fed.

The Fed acts like a bank by effectively earning a net interest spread on the difference in yield on the securities it owns when compared to the funding cost of deposits from depository institutions. During 2021, the Fed took in $122.5 billion in interest income, paid out $5.7 billion in interest expense, incurred $8.7 billion in expenses (mostly worthless economists who staff the Fed) and then sent most of the remaining profits to the US Treasury. As you can imagine, the Treasury appreciates the proceeds, which amounted to $107.4 billion in 2021, helping to make the budget deficit slightly less egregious. 2021 Federal Reserve Financials

The Fed is also an odd bank in that it cannot go broke. Think of it as being very much akin to Credit Suisse—no matter how much it screws up, it continues to stumble forward. I bring all of this up, because something peculiar is about to happen. Look at the consistent earnings over the past decade. What if those earnings became a sea of red ink?

Why would the earnings revert to red? Let’s use some very rough numbers. For those of you who follow the Fed more closely, just bear with me—I’m focused on concepts, not precision. At year-end, the Fed had $8.7 trillion in liabilities. As a result, every 100-basis point move higher in the Fed Funds rate, increases the interest cost by $87 billion. As mentioned previously, in 2021, the Fed paid $5.7 billion in interest expense—so we’re talking about big changes in funding costs. Let’s say that JPOW is serious about a terminal rate of 4%, that’s $348 billion in increased funding costs. Meanwhile, the Fed’s securities portfolio is mostly fixed rate. Some will roll off and get replaced, but a good chunk of the balance sheet has a duration in excess of 1 year, with $2.5 trillion of the MBS having a duration in excess of 10 years.

Clearly, there’s a mismatch. The Fed earned $122.5 billion in interest income in 2021. Assuming this figure stays constant (it won’t, but bear with me) we’re talking about almost a quarter trillion in losses for the Fed at a 4% interest rate.

-

Interest Income $122.5 billion

-

Prior Interest Expense $5.7

-

Increased Interest Expense $348 billion

-

Worthless Economists $8.7 billion

-

Total Loss $239.9 billion

But it gets worse. Remember when the Treasury earned $107.4 billion? Now that’s reversed, and someone needs to plug the $239.9 billion loss. Call it a swing of $347.3 billion.

Remember how the Fed is sort of like Credit Suisse?? It can keep losing money and there are no ramifications. At my hedge fund, we need to mark everything to market. Banks get a pass on that. They assume that securities mature. There’s no sense in getting into the details, but they do not need to mark their book—which is a good thing because a good chunk of the long-duration portfolio was purchased at peak prices during the COVID panic when QE was running in insanity mode.

I shudder to think what the marks would be, but the $40.7 billion in balance sheet capital is nowhere near sufficient as a buffer. In fact, the negative equity is already likely hundreds of billions and accelerating.

Now, here’s the oddity of Central Bank accounting. You get a free pass on mark-to-market losses if you hold onto the security, but when you sell a security at a loss, you must recognize that loss. Well, the Fed is now liquidating securities as part of its QT program. It’s inevitable that it will be recognizing substantial losses as prices have moved dramatically since they were purchased.

Remember, Central Banks don’t go broke. Instead, they can either ignore the losses indefinitely or get bailed out by the government—usually by printing money to buy treasuries directly from the Treasury. As the 40-year interest rates cycle continues to turn, the Fed will increasingly be forced to the printing press in order to offset losses from its own negative interest rate spread, its own balance sheet and to plug the hole in the Treasury’s balance sheet that is caused by $107.4 billion in income reversing and becoming a sea of red.

Eventually, the Fed will succeed in breaking something—quite possibly themselves—then pivot. You cannot have massive fiscal deficits while simultaneously having the Fed tighten, as someone has to buy the rapidly increasing pool of debt—especially as the government’s own funding costs are about to explode due to much higher interest rates as short-term paper rolls over at much higher rates. For that matter, the government had over a decade to term out the nation’s debt, yet multiple Treasury Secretaries failed to accomplish this. Now a rather increased percentage of total fiscal revenue will go simply towards paying interest expense.

Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” As the Fed tries to fight inflation, it’s inevitably going to smash into the wall that I have described above. As a result, I doubt they get too far on the rates side, as past a certain threshold, increasing rates only forces them to print money. Thus, higher rates only accelerate the inflation crisis—especially as higher funding costs disincentivize investment in new capacity across the economy.

In summary, higher interest rates will only increase the cash burn everywhere within the Fed and the Treasury. They’ll rapidly realize that they’re completely trapped. They cannot tame inflation without effectively bankrupting themselves. Except, Central Banks don’t go bankrupt—neither do countries that borrow in their own currencies. Instead, they’ll go bankrupt in a whirlwind of money printing and inflation.

Simply put, they’ll try this experiment, realize it won’t work and get back to monetizing debt. Despite nearly $9 billion spent annually on economists and operations, I doubt any of them have even considered this. As the Fed effectively goes broke, so does the currency. We’re rapidly approaching the moment when “Project Zimbabwe” moves from conceptual to reality.

* * *

If you enjoyed this post, subscribe for more at http://www.adventuresincapitalism.com