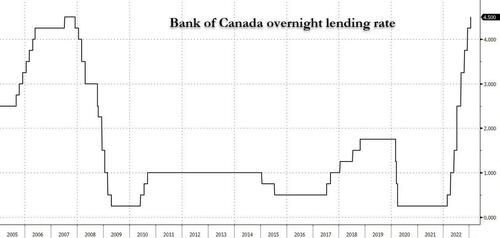

The Bank of Canada joined the "one and done" bandwagon moments ago when the central bank hiked rates by 25bps - as expected by most strategists - for an eight consecutive, but also perhaps final time, because the central bank says it "expects to hold" rates "while it assesses the impact of the cumulative interest rate increases." The hike brought the benchmark overnight rate to 4.5%, the highest level in 15 years... and where it was back in 2007 when it rapidly plunged to a record low one year later.

Previously, the BOC's guidance said that "the Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target."

And while this is likely the BOC's final hike for a long time, now that central banks around the world are rapidly pausing their tightening cycle at a time when a global recession is the modal outcome, most analysts didn’t see the central bank explicitly declaring a potential end point.

In the quarterly monetary policy report published alongside the decision, officials said the economy is still overheating but growth is expected to decelerate rapidly as rate hikes weigh on household spending and help to bring inflation back within the bank’s control range by the middle of this year.

Looking ahead, the Bank said its "ongoing program of quantitative tightening is complementing the restrictive stance of the policy rate." It added that "if economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level."

At the same time, the BOC cautioned that more hikes may be needed if economic data surprise to the upside. The bank “is prepared to increase the policy rate further if needed to return inflation to the 2% target.”

In their report, officials raised their estimate of economic growth in 2022 to 3.6% and forecast a 1% expansion this year, up from 3.3% and 0.9% in their October projections. The chances of two consecutive quarters of negative growth, a so-called technical recession, are nonetheless seen as “roughly the same” as a small expansion in 2023.

Policymakers also flagged slowing 3-month measures of core inflation as evidence underlying price pressures have peaked. Global supply chain conditions and lower energy prices are also reasons the central bank sees inflation coming down “significantly” this year. Officials flagged sticker services price inflation as the biggest upside risk to their outlook which is why it will be up to the data to justify the expectations that inflation will "come down significantly this year."

The BOC's conditional pause - the first among Group of Seven central banks according to Bloomberg - suggests "policymakers are convinced the current rate is restrictive enough to restore price stability."

As Bloomberg adds, the Bank of Canada, which led its global peers in raising rates rapidly last year, could now be laying out a blueprint for how they pivot to pausing. This comes at a confusing time: globally, the economic outlook is improving amid Europe’s resilience during an energy crisis, China’s reopening, and subsiding inflationary pressures from declining commodity prices and easing supply challenges.

Despite the so-called economic rebound, Canadian households, which are among the most indebted among advanced countries, are feeling the crushing pain of higher rates and rising prices for shelter and food. The nation’s housing activity has slowed considerably, and consumption spending is expected to decline further.

“There is growing evidence that restrictive monetary policy is slowing activity, especially household spending,” the bank said in its statement.

Wednesday decision marks the first time in the Bank of Canada’s history that the public will get a glimpse of its interest-rate setting process, joining central banks such as the US Federal Reserve and Bank of England in sharing records of their policy meetings. A minutes-like summary of the bank’s deliberations will be published on Feb. 8.

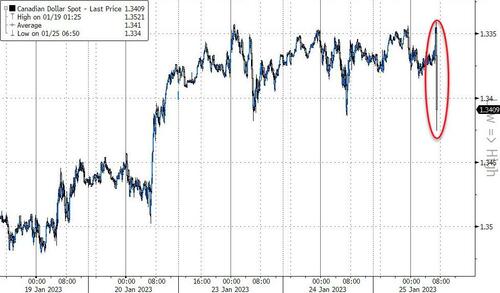

In kneejerk response, and even though the BOC move was widely expected and telegraphed, the Loonie dropped to 1.34 vs the USD.

d

The Bank of Canada joined the “one and done” bandwagon moments ago when the central bank hiked rates by 25bps – as expected by most strategists – for an eight consecutive, but also perhaps final time, because the central bank says it “expects to hold” rates “while it assesses the impact of the cumulative interest rate increases.” The hike brought the benchmark overnight rate to 4.5%, the highest level in 15 years… and where it was back in 2007 when it rapidly plunged to a record low one year later.

Previously, the BOC’s guidance said that “the Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

And while this is likely the BOC’s final hike for a long time, now that central banks around the world are rapidly pausing their tightening cycle at a time when a global recession is the modal outcome, most analysts didn’t see the central bank explicitly declaring a potential end point.

In the quarterly monetary policy report published alongside the decision, officials said the economy is still overheating but growth is expected to decelerate rapidly as rate hikes weigh on household spending and help to bring inflation back within the bank’s control range by the middle of this year.

Looking ahead, the Bank said its “ongoing program of quantitative tightening is complementing the restrictive stance of the policy rate.” It added that “if economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level.”

At the same time, the BOC cautioned that more hikes may be needed if economic data surprise to the upside. The bank “is prepared to increase the policy rate further if needed to return inflation to the 2% target.”

In their report, officials raised their estimate of economic growth in 2022 to 3.6% and forecast a 1% expansion this year, up from 3.3% and 0.9% in their October projections. The chances of two consecutive quarters of negative growth, a so-called technical recession, are nonetheless seen as “roughly the same” as a small expansion in 2023.

Policymakers also flagged slowing 3-month measures of core inflation as evidence underlying price pressures have peaked. Global supply chain conditions and lower energy prices are also reasons the central bank sees inflation coming down “significantly” this year. Officials flagged sticker services price inflation as the biggest upside risk to their outlook which is why it will be up to the data to justify the expectations that inflation will “come down significantly this year.”

The BOC’s conditional pause – the first among Group of Seven central banks according to Bloomberg – suggests “policymakers are convinced the current rate is restrictive enough to restore price stability.“

As Bloomberg adds, the Bank of Canada, which led its global peers in raising rates rapidly last year, could now be laying out a blueprint for how they pivot to pausing. This comes at a confusing time: globally, the economic outlook is improving amid Europe’s resilience during an energy crisis, China’s reopening, and subsiding inflationary pressures from declining commodity prices and easing supply challenges.

Despite the so-called economic rebound, Canadian households, which are among the most indebted among advanced countries, are feeling the crushing pain of higher rates and rising prices for shelter and food. The nation’s housing activity has slowed considerably, and consumption spending is expected to decline further.

“There is growing evidence that restrictive monetary policy is slowing activity, especially household spending,” the bank said in its statement.

Wednesday decision marks the first time in the Bank of Canada’s history that the public will get a glimpse of its interest-rate setting process, joining central banks such as the US Federal Reserve and Bank of England in sharing records of their policy meetings. A minutes-like summary of the bank’s deliberations will be published on Feb. 8.

In kneejerk response, and even though the BOC move was widely expected and telegraphed, the Loonie dropped to 1.34 vs the USD.

d

Loading…