–>

October 17, 2022

America is facing formidable challenges, both domestically and abroad, as the midterm elections approach. This is when voters can exercise their choice to make a course correction in current leadership and the direction of the country. It’s also a good time to ask, “Are you better off today than you were a year ago?” and take note of who was in charge then versus now.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); }

Rasmussen Reports offers a current snapshot of public opinion regarding this question. In a survey from several weeks ago, they found that only 29% of likely US voters think the country is heading in the right direction, barely a quarter of voters. In contrast, 64% say we are headed in the wrong direction.

President Bill Clinton’s consigliere James Carville quipped during one of Clinton’s presidential campaigns, “It’s the economy stupid”. 30 years later the economy is still an important issue as Rasmussen Reports found in a recent survey, that 57% of American adults believe it’s likely that, in the next few years, the US will enter a 1930s like depression.

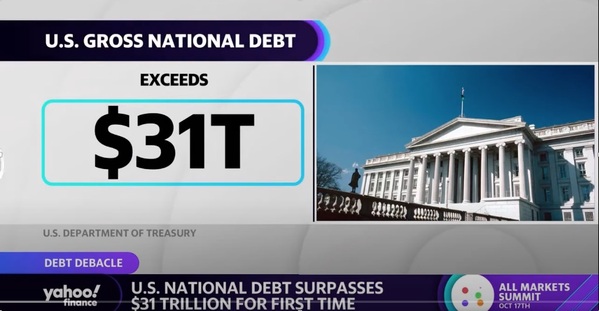

One big reason for such pessimism is the looming time bomb of the national debt, not at some nebulous point in the distant future, but now. The US national debt is now over $31 trillion, and rapidly rising as the federal government spends more than it takes in, borrowing money to pay the growing shortfall, taking out more loans to pay the previous loans.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); }

The unsustainable national debt in the elephant in the room that the ruling class and the media refuse to talk about. This is a Ponzi scheme being perpetrated on US taxpayers.

YouTube screen grab

A rising national debt is not unique to the current administration. Spending more than we take in seems to be one of few bipartisan issues that leaders of both political parties agree upon. And they seem to be just fine with it, as long as they can spend taxpayer money on their pet projects and reelection efforts. Let’s look back at the past twenty years.

Under President George W Bush, the national debt doubled, from $5 to $10 trillion. President Barack Obama said, “hold my beer” doubling it again under his 8-year term from $10 to $20 trillion. Under President Donald Trump, the debt still crept upwards, but COVID pushed it into the stratosphere, with relief funds and paying Americans to not work. President Joe Biden has kept his foot on the accelerator and now the debt stands at $31 trillion with no sign of slowing, much less stopping.

Today we have double digit inflation, depending on how it is calculated, forcing the US Federal Reserve to raise interest rates to slow the inflation inferno. As Investopedia indicated, to curb inflation,

With inflation at its highest rate in decades, the U.S. Federal Reserve has repeatedly increased benchmark interest rates in recent months. As of October 2022, the federal funds rate ranged from 3% to 3.25%, compared with close to 0% early in the COVID-19 pandemic. While the rate is already the highest since 2008, analysts expect the Fed to keep pushing it up this year.

Time for some basic arithmetic. With the national debt exceeding $31 trillion, each percent increase of the federal funds rate translates into over $300 billion in annual interest payments on the national debt.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); } if (publir_show_ads) { document.write(“

Suppose the Fed raises interest rates to 4% to slow or stop inflation. That is a low estimate since the, “Well-respected Taylor rule recommends that interest rates rise one-and-a-half times as much as inflation.” Accepting the government inflation rate as 8.2%, this rule suggests interest rates need to exceed 12% to stop inflation. What if the true inflation rate is higher? Then even these horrific figures underestimate the necessary solution.

12% interest on a $31 trillion debt is $3.7 trillion per year. The federal government is expected to spend $5.9 trillion in 2022, according to the Congressional Budget office, meaning the interest on the debt would be 63% of total government expenditures. That’s to stop inflation. What about just using the current Fed rate hikes?

If the Fed only increases rates to 4%, interest on the national debt would be over $1.2 trillion per year. This is compared to only $300 billion on debt service in 2021. But that is still 20% of the federal budget and climbing as there is no political appetite for cutting entitlements or other promised spending. Raising income tax rates won’t be enough to raise this kind of revenue, and hiking taxes during a recession will only make this entire fiasco far worse.

There is no easy way out of this self-inflicted disaster. The government could certainly print more money to cover the debt service, but that would worsen the inflation they are trying to fight. Creating more inflation to fight inflation may make sense to our brilliant president but not to anyone else.

This would be like consumers maxing out their credit cards, unable to make more than the minimum monthly payment, and asking for a credit increase so they can keep spending, going further into debt. That is exactly where America is headed.

As a real economist Herb Stein once observed, “If something cannot go on forever, it will stop.” This applies not only to the American economy, but also the entire American experiment and society, unless there is a serious course correction. What a choice – runaway inflation or a depression, or both.

There are no good solutions here other than the tough and painful high interest rates and recession that we went through in the early Reagan years to end the Carter era stagflation. Only now the debt is now far larger. It was less than a trillion when Reagan was elected in 1980. Now it is 30 times higher, meaning much greater debt service.

15% interest on a $1 trillion debt was $150 billion in the early 1980s, close to what we have spent today financing our proxy war against Russia. Debt service will soon be greater than the entire federal budget during Reagan’s years.

The Fed has been printing money through “quantitative easing” for over a decade and the chickens are coming home to roost for this massive and reckless printing of easy money. Was this incompetence on the part of the Fed, made up of “supposedly smart” economists? Or was this a deliberate scheme to eventually crash the economy and destroy the middle class?

This would be a good question for Cloward and Piven. Their “strategy” was to implement political crisis to achieve a guaranteed annual income. Watch the news today and see that their strategy, first published in 1966, is playing out in 2022. Crash the economy, wipe out the middle class’s savings and wealth, and “rescue” everyone with a “guaranteed annual income” barely sufficient to cover Nancy Pelosi’s gourmet ice cream consumption.

Ideas like cutting government spending and lowering tax rates to grow the economy are lost on the Biden administration, which is hell bent on doing the exact opposite, continuing to spend money it doesn’t have on Ukraine, renewable energy, student loan forgiveness, and other wasteful endeavors. The Fed’s only option now is to fight inflation by creating more inflation, inflating away our unsustainable national debt, destroying the middle class and the American dream. Only in Washington, DC does this pass for logic.

The current trajectory is to double down on fiscal insanity. As the saying goes, “when in a hole, stop digging”. The current administration is not only continuing to dig but is also bringing in the big earth movers to dig a much deeper hole. This will not end well for America or the world as the mother of all debt bombs is soon due to explode.

Brian C Joondeph, MD, is a physician and writer.

Follow me on Twitter @retinaldoctor

Truth Social @BrianJoondeph

LinkedIn @Brian Joondeph

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>