It's "Murky".

That's how Peter Schiff describes what is going on with regard Ukraine's gold reserves currently, and as you'll see below, he is somewhat understating the uncertainty.

But first, some history...

In March 2014, we wrote about a mysterious operation that took place under the cover of night that sources claimed at the time saw Ukraine's gold reserves loaded on an unmarked plane, which reportedly took the gold to the US (for safekeeping?).

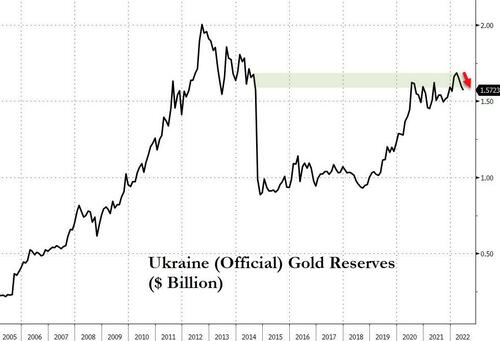

In the following few months - after we reported this outbound flow - Ukraine's official (IMF-sourced) holdings of gold collapsed...

There has been no denials of this report since.

With that in mind, Reuters reported that, on Sunday, Ukraine National Bank (UNB) Deputy Governor Kateryna Rozhkova said on national television that the UNB had sold $12.4 billion of gold reserves since the beginning of Russia's invasion on Feb. 24.

"We are selling (this gold) so that our importers are able to buy necessary goods for the country," Rozhkova said.

She said the gold was not being sold to shore up Ukraine's hryvnia currency.

There's just one problem:

Ukraine doesn't have $12 billion in gold reserves (according to official IMF data at the end of June).

As Peter Schiff explains, it remains unclear how Ukraine sold so much gold.

When the Russians invaded, UNB held about 27 tons of gold in its reserves valued at about $1.6 billion, according to the WGC.

In other words, according to Rozhkova, the central bank has sold more than 7 times its total gold holdings.

That’s not to say Rozhkova’s statement was misleading.

The country could be tapping into domestic gold supplies held by commercial banks or other institutions. PrivatBank ranks as the largest commercial bank in Ukraine. It was nationalized in 2016.

It’s also possible that other countries or private entities gave Ukraine gold to sell. Countries around the world have sent billions in aid to the Ukrainian government. For example. earlier this month, Sweeden sent 577.7 million SEK to Ukraine. That’s over $55.5 million USD and 1.5 billion UAH.

Less likely is a quick ramp-up in mine production. According to a Mining World report, Ukraine sits on nearly 3,000 tons of gold but the country had few operating mines before the invasion.

Regardless of the mechanism involved, it’s clear that Ukraine is relying on gold sales as an important source of currency as the war drags on.

The thot plickens though (or was Rozhkova caught in a lie?)...

This morning, Bloomberg reports that Rozhkova denied saying that last week and in fact the money came from FX reserves, not gold...

“We were selling foreign currency from our reserves to carry out transactions on our overseas trade contracts and with payment systems.”

Rozhkova explained in a text message that the UNB spent $12b from international reserves to fulfill foreign contracts since Russia’s invasion but also saw $10b inflow during the period (likely mainly from US taxpayers).

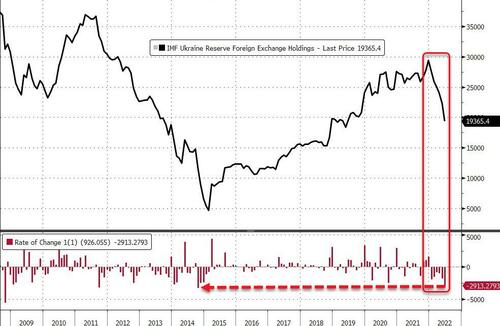

Overall, Ukraine's FX reserves are down considerably this year as exports sink and military spending surges...

“Nowadays a significant pressure on reserves is being caused by the National Bank’s financing of the budget," central bank Deputy Governor Serhiy Nikolaychuk said by email to Bloomberg News Thursday.

“If there were political will, this financing could be minimized and even stopped via redistribution of the country’s financial flows, and we believe it needs to be done.”

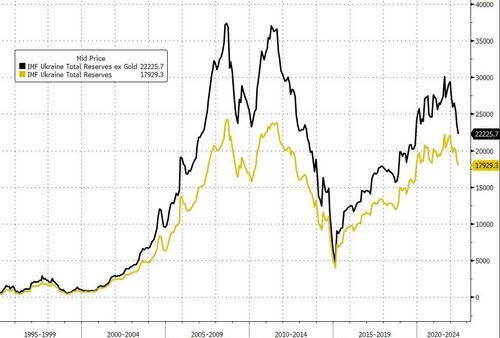

What is rather odd though - and we truly have no explanation for this - is that, according to official IMF data via Bloomberg, Ukraine's total reserves ex-gold are higher than Ukraine's total reserves...?

Is Ukraine 'over-lending' gold it doesn't have?

Finally, some reports suggested that Ukraine's gold has been 'relocated' to Poland.

Deputy Head of the National Bank of Ukraine Sergey Nikolaychuk said in an interview with Rabbit Hole magazine that Kyiv sends Ukraine’s gold and foreign exchange reserves to Poland, where they will be stored until the situation normalizes.

At the same time, he did not disclose either the volumes of these same reserves, or what they are. Apparently, this is not about physical gold, but about security.

This action suggests that the leadership of Ukraine is far less optimistic about its own and the country's prospects in the war with Russia than Zelensky proclaims to the world.

So there we have it - UNB officials said they sold 7 times the amount of gold they have in reserves... then denied it.

Is this 'relocation' the cost of the new 'liberation'? "Murky" indeed...

It’s “Murky”.

That’s how Peter Schiff describes what is going on with regard Ukraine’s gold reserves currently, and as you’ll see below, he is somewhat understating the uncertainty.

But first, some history…

In March 2014, we wrote about a mysterious operation that took place under the cover of night that sources claimed at the time saw Ukraine’s gold reserves loaded on an unmarked plane, which reportedly took the gold to the US (for safekeeping?).

In the following few months – after we reported this outbound flow – Ukraine’s official (IMF-sourced) holdings of gold collapsed…

There has been no denials of this report since.

With that in mind, Reuters reported that, on Sunday, Ukraine National Bank (UNB) Deputy Governor Kateryna Rozhkova said on national television that the UNB had sold $12.4 billion of gold reserves since the beginning of Russia’s invasion on Feb. 24.

“We are selling (this gold) so that our importers are able to buy necessary goods for the country,” Rozhkova said.

She said the gold was not being sold to shore up Ukraine’s hryvnia currency.

There’s just one problem:

Ukraine doesn’t have $12 billion in gold reserves (according to official IMF data at the end of June).

As Peter Schiff explains, it remains unclear how Ukraine sold so much gold.

When the Russians invaded, UNB held about 27 tons of gold in its reserves valued at about $1.6 billion, according to the WGC.

In other words, according to Rozhkova, the central bank has sold more than 7 times its total gold holdings.

That’s not to say Rozhkova’s statement was misleading.

The country could be tapping into domestic gold supplies held by commercial banks or other institutions. PrivatBank ranks as the largest commercial bank in Ukraine. It was nationalized in 2016.

It’s also possible that other countries or private entities gave Ukraine gold to sell. Countries around the world have sent billions in aid to the Ukrainian government. For example. earlier this month, Sweeden sent 577.7 million SEK to Ukraine. That’s over $55.5 million USD and 1.5 billion UAH.

Less likely is a quick ramp-up in mine production. According to a Mining World report, Ukraine sits on nearly 3,000 tons of gold but the country had few operating mines before the invasion.

Regardless of the mechanism involved, it’s clear that Ukraine is relying on gold sales as an important source of currency as the war drags on.

The thot plickens though (or was Rozhkova caught in a lie?)…

This morning, Bloomberg reports that Rozhkova denied saying that last week and in fact the money came from FX reserves, not gold…

“We were selling foreign currency from our reserves to carry out transactions on our overseas trade contracts and with payment systems.”

Rozhkova explained in a text message that the UNB spent $12b from international reserves to fulfill foreign contracts since Russia’s invasion but also saw $10b inflow during the period (likely mainly from US taxpayers).

Overall, Ukraine’s FX reserves are down considerably this year as exports sink and military spending surges…

“Nowadays a significant pressure on reserves is being caused by the National Bank’s financing of the budget,” central bank Deputy Governor Serhiy Nikolaychuk said by email to Bloomberg News Thursday.

“If there were political will, this financing could be minimized and even stopped via redistribution of the country’s financial flows, and we believe it needs to be done.”

What is rather odd though – and we truly have no explanation for this – is that, according to official IMF data via Bloomberg, Ukraine’s total reserves ex-gold are higher than Ukraine’s total reserves…?

Is Ukraine ‘over-lending’ gold it doesn’t have?

Finally, some reports suggested that Ukraine’s gold has been ‘relocated’ to Poland.

Deputy Head of the National Bank of Ukraine Sergey Nikolaychuk said in an interview with Rabbit Hole magazine that Kyiv sends Ukraine’s gold and foreign exchange reserves to Poland, where they will be stored until the situation normalizes.

At the same time, he did not disclose either the volumes of these same reserves, or what they are. Apparently, this is not about physical gold, but about security.

This action suggests that the leadership of Ukraine is far less optimistic about its own and the country’s prospects in the war with Russia than Zelensky proclaims to the world.

So there we have it – UNB officials said they sold 7 times the amount of gold they have in reserves… then denied it.

Is this ‘relocation’ the cost of the new ‘liberation’? “Murky” indeed…