Authored by Jeffrey Tucker via The Epoch Times,

The Bureau of Labor Statistics (BLS) tomorrow morning will report its Consumer Price data from October. The Producer Price Index (PPI) appears the following day.

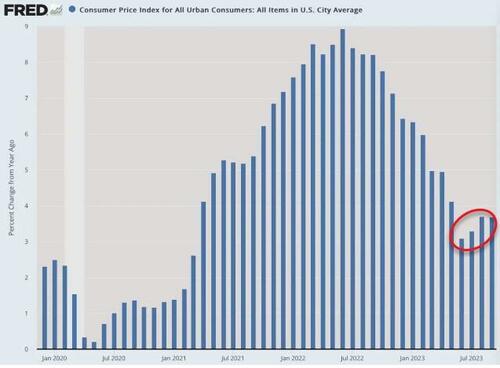

There will likely be no real surprise here: inflation will still be running hot around 3.7 percent, confirming what I and many have suspected. Inflation is overall accelerating over the declines earlier this year. That’s bad economic news because it further confirms lower living standards and continues to vex average people juggling multiple jobs, high interest payments on debt, and increased unaffordability of just about everything.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

“Inflation has given us a few head fakes,” Fed chair Jerome Powell said at an International Monetary Conference over the weekend.

He further swore that he would continue to use the power of the Fed to beat back this monster. But notice that he took no responsibility for inflation at all, despite the factual record showing that he enabled some $5 trillion in debt purchases from a spending-mad Congress, and soared the money stock in ways we’ve never seen.

This is the first time that I can recall the Fed chair having anthropomorphized inflation, as if it has a will of its own, has a head on its body, while using clever tricks to get around the defense front line, which of course is the Fed.

The line about “head fakes” pertains not to inanimate inflation but to the very human and oddly devious Fed itself. To understand Powell’s remark here fully requires a refresher lesson from Freud in what it means to project one’s failings on something else. It’s really childish—the young child blaming the monsters under the bed for the mess in his room—but it works due to the economic ignorance of the public.

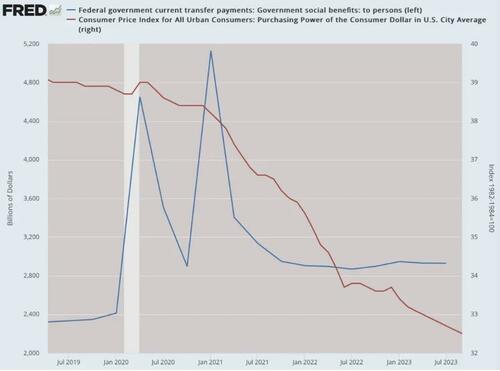

So let’s talk about real head fakes. They are done by people, not statistics. The people in charge are the ones who shut down economic life, dumped multiple rounds of trillions of individuals and businesses, created an absurdly fraudulent appearance of prosperity, and then allowed the bill to become due in the form of mass and extended depreciation of the currency. It was riches to rags in less than a year. By earlier this year, the entire value of the stimulus was inflated away.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

We watched in real time, in disbelief, as this was happening. Did people really believe that manna was falling from heaven and that there would be no price to pay? Did people actually believe that the key to getting rich was to wake up late, laze around in PJs all day, start cocktail hour at 2pm, and stay up late catching movie after movie on streaming services, and continuing this absurd pattern for the better part of a year or more?

Surely no one believed that. But maybe I’m wrong. The financial world has been built on so much fakery for so long, it sometimes becomes unclear what is real and what is not. I recall having a conversation with someone at the wait staff of a high-end restaurant in those days. She had recently come back to work, and was thrilled with her riches, which she had considered spending on paying off her college loans but thought better of it when it seemed like all would be forgiven.

“It’s all fake anyway,” she said.

“What’s fake?” I asked.

“Money. Wealth. Finance. All of it. They make it all up anyway. None of it is real. It’s all fake. Everyone in Washington, D.C. knows it. The rest of us are just now catching on.”

I thanked her for the economic lesson but knew for sure that she would rue the day she said that. All these people are now being punished very heavily for this belief. Yes, there is a lot of fakery out there but reality bites back eventually. It’s simply impossible to expand the money stock by 40 percent and not have that bleed over to prices and distort economic structures in other ways.

Tomorrow’s report will certainly confirm the persistence if not the reacceleration of inflation long after it was supposed to be conquered by the mighty Fed that caused this disaster in the first place.

Alongside that, we have several other major storms happening beneath the surface. Despite the ridiculous propaganda coming from the Biden administration, the job market is a mess, with huge losses in full-time employment, even as those jobs are being replaced with part-time jobs. Hiring for the holiday season has become a breeze for many businesses, which is a contrast from the last several years.

And as predicted, the crisis in the commercial real estate market is intensifying. A Wall Street Journal analysis of so-called mezzanine loans—an off-the-books second mortgage for commercial loans with high risk and high reward for banks—shows a sudden record number of defaults. This is the proverbial cloud no bigger than a man’s hand, as renewals come up over the next 12 to 24 months. Our cities are replete with huge office structures that are terrible candidates for conversion to apartments. What’s going to happen to them?

There is a deeper worry to the persistence of inflation. No one likes spending more for less, of course. But the financial squeeze on household finance has a psychological cost too. No matter how much we work, how much we save, how much we reduce our consumption, we just cannot get ahead. This produces a cloud of despair over the human mind.

The American Psychological Association (APA) has taken a survey on the state of American mental health. The conclusions are simply incredible.

“The survey revealed that those ages 35 to 44 reported the most significant increase in chronic health conditions since the pandemic — 58 percent in 2023 compared with 48 percent in 2019. Adults ages 35 to 44 also experienced the highest increase in mental health diagnoses — 45 percent reported a mental illness in 2023 compared with 31 percent in 2019 — though adults ages 18 to 34 still reported the highest rate of mental illnesses at 50 percent in 2023. Adults ages 35 to 44 were more likely to report that money (77 percent vs. 65 percent) and the economy (74 percent vs. 51 percent) were the factors that cause them significant stress today compared with 2019.”

Notice that this most profoundly impacted population segment is that which is trying to raise families and build a future. They are finding that they simply cannot. The stress is leading to chronic mental illness, also called depression. Depression, one wag said, is simply anger without enthusiasm. The anger in this case is all about what the ruling class has done.

And contrary to what the APA claimed, this is not merely sadness about the loss of life from the pandemic. It’s sadness over the policy response to the pandemic, which wrecked lives everywhere in the world. The injury only intensified with the vaccine mandates that have harmed and killed so many. The reality is showing up in the data: lower lifespans, higher excess deaths, infertility, and generalized population despair that compares to PTSD following wartime. It was indeed like a war.

And that war continues. It’s a war on your standard of living, your household finance, your hopes and dreams, and your own mental health. Sadly the ruling class is winning this one.

Authored by Jeffrey Tucker via The Epoch Times,

The Bureau of Labor Statistics (BLS) tomorrow morning will report its Consumer Price data from October. The Producer Price Index (PPI) appears the following day.

There will likely be no real surprise here: inflation will still be running hot around 3.7 percent, confirming what I and many have suspected. Inflation is overall accelerating over the declines earlier this year. That’s bad economic news because it further confirms lower living standards and continues to vex average people juggling multiple jobs, high interest payments on debt, and increased unaffordability of just about everything.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

“Inflation has given us a few head fakes,” Fed chair Jerome Powell said at an International Monetary Conference over the weekend.

He further swore that he would continue to use the power of the Fed to beat back this monster. But notice that he took no responsibility for inflation at all, despite the factual record showing that he enabled some $5 trillion in debt purchases from a spending-mad Congress, and soared the money stock in ways we’ve never seen.

This is the first time that I can recall the Fed chair having anthropomorphized inflation, as if it has a will of its own, has a head on its body, while using clever tricks to get around the defense front line, which of course is the Fed.

The line about “head fakes” pertains not to inanimate inflation but to the very human and oddly devious Fed itself. To understand Powell’s remark here fully requires a refresher lesson from Freud in what it means to project one’s failings on something else. It’s really childish—the young child blaming the monsters under the bed for the mess in his room—but it works due to the economic ignorance of the public.

So let’s talk about real head fakes. They are done by people, not statistics. The people in charge are the ones who shut down economic life, dumped multiple rounds of trillions of individuals and businesses, created an absurdly fraudulent appearance of prosperity, and then allowed the bill to become due in the form of mass and extended depreciation of the currency. It was riches to rags in less than a year. By earlier this year, the entire value of the stimulus was inflated away.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

We watched in real time, in disbelief, as this was happening. Did people really believe that manna was falling from heaven and that there would be no price to pay? Did people actually believe that the key to getting rich was to wake up late, laze around in PJs all day, start cocktail hour at 2pm, and stay up late catching movie after movie on streaming services, and continuing this absurd pattern for the better part of a year or more?

Surely no one believed that. But maybe I’m wrong. The financial world has been built on so much fakery for so long, it sometimes becomes unclear what is real and what is not. I recall having a conversation with someone at the wait staff of a high-end restaurant in those days. She had recently come back to work, and was thrilled with her riches, which she had considered spending on paying off her college loans but thought better of it when it seemed like all would be forgiven.

“It’s all fake anyway,” she said.

“What’s fake?” I asked.

“Money. Wealth. Finance. All of it. They make it all up anyway. None of it is real. It’s all fake. Everyone in Washington, D.C. knows it. The rest of us are just now catching on.”

I thanked her for the economic lesson but knew for sure that she would rue the day she said that. All these people are now being punished very heavily for this belief. Yes, there is a lot of fakery out there but reality bites back eventually. It’s simply impossible to expand the money stock by 40 percent and not have that bleed over to prices and distort economic structures in other ways.

Tomorrow’s report will certainly confirm the persistence if not the reacceleration of inflation long after it was supposed to be conquered by the mighty Fed that caused this disaster in the first place.

Alongside that, we have several other major storms happening beneath the surface. Despite the ridiculous propaganda coming from the Biden administration, the job market is a mess, with huge losses in full-time employment, even as those jobs are being replaced with part-time jobs. Hiring for the holiday season has become a breeze for many businesses, which is a contrast from the last several years.

And as predicted, the crisis in the commercial real estate market is intensifying. A Wall Street Journal analysis of so-called mezzanine loans—an off-the-books second mortgage for commercial loans with high risk and high reward for banks—shows a sudden record number of defaults. This is the proverbial cloud no bigger than a man’s hand, as renewals come up over the next 12 to 24 months. Our cities are replete with huge office structures that are terrible candidates for conversion to apartments. What’s going to happen to them?

There is a deeper worry to the persistence of inflation. No one likes spending more for less, of course. But the financial squeeze on household finance has a psychological cost too. No matter how much we work, how much we save, how much we reduce our consumption, we just cannot get ahead. This produces a cloud of despair over the human mind.

The American Psychological Association (APA) has taken a survey on the state of American mental health. The conclusions are simply incredible.

“The survey revealed that those ages 35 to 44 reported the most significant increase in chronic health conditions since the pandemic — 58 percent in 2023 compared with 48 percent in 2019. Adults ages 35 to 44 also experienced the highest increase in mental health diagnoses — 45 percent reported a mental illness in 2023 compared with 31 percent in 2019 — though adults ages 18 to 34 still reported the highest rate of mental illnesses at 50 percent in 2023. Adults ages 35 to 44 were more likely to report that money (77 percent vs. 65 percent) and the economy (74 percent vs. 51 percent) were the factors that cause them significant stress today compared with 2019.”

Notice that this most profoundly impacted population segment is that which is trying to raise families and build a future. They are finding that they simply cannot. The stress is leading to chronic mental illness, also called depression. Depression, one wag said, is simply anger without enthusiasm. The anger in this case is all about what the ruling class has done.

And contrary to what the APA claimed, this is not merely sadness about the loss of life from the pandemic. It’s sadness over the policy response to the pandemic, which wrecked lives everywhere in the world. The injury only intensified with the vaccine mandates that have harmed and killed so many. The reality is showing up in the data: lower lifespans, higher excess deaths, infertility, and generalized population despair that compares to PTSD following wartime. It was indeed like a war.

And that war continues. It’s a war on your standard of living, your household finance, your hopes and dreams, and your own mental health. Sadly the ruling class is winning this one.

Loading…