By Peter Tchir of Academy Securities

This week we will all focus on CPI on Tuesday and the Fed on Wednesday. What Chair Powell says and does on Wednesday will reverberate through the markets. For the record, I expect 50 bps and he will keep a rate hike on the table for the February 1 st announcement.

Rather than attempting to estimate this week’s CPI data (which will be important), today’s report will focus on what will drive inflation (and the economy/markets) after the Fed decision.

We have seven weeks between this FOMC decision and the next one. Seven weeks feels like a lifetime in a market that is prone to large daily and weekly swings. Even the views on the economy are shifting rapidly as more economists seem to be heading in our direction, which is that the recession will start sooner (Q1) and be deeper than most people previously thought.

If anything, the market is pricing in a Squishy Landing. That report tried to define a “squishy” landing and also tried to figure out why markets may misinterpret data as indicating a “soft” landing when the worst is yet to come. Finally, we re-iterated our more pessimistic outlook in that report.

Inflation Factors versus Inflation

Rather than just trying to “estimate” inflation, we examine the factors that “drive” inflation. While we could just estimate various inflation components such as rent, in this report, we will try something different. We will lay out the factors that drive inflation. We believe that these factors do a good job of predicting where inflation and the economy are headed

In theory this is what many do, but we hope that today’s analysis makes it clear how these factors have been behaving (and how they will behave). That will go a long way in explaining why our current outlook is more pessimistic and is strongly in the camp that “the Fed has gone too far already.”

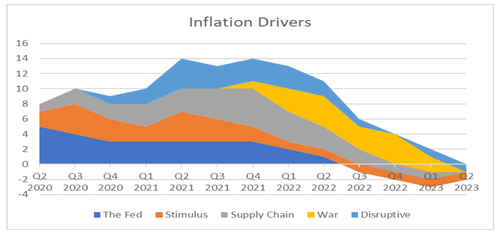

We will address the individual components that go into this model. This model shows the highest inflationary pressures were from Q2 2021 to Q4 2021. It remained elevated for that extended period of time due to a variety of factors (the importance of which changed within that period). The factors have been pointing to steadily declining inflation and growth pressures ever since.

If anything, the factors point to deflationary pressures in Q1 and Q2 next year – which is another way of reaching our conclusion that the economy and markets are in jeopardy of a large “risk-off” trade that will break 2022’s lows on stocks (while yields plummet).

The Inflation Factors

We will use 5 factors. The factors are somewhat broad and the influence that they have on inflation is just an estimate. Yes, inflation and the economy are closely linked. No, our model is not tested and is both arbitrary and subjective. Nonetheless, it seems logical and almost elegant. The explanation fits the narrative of what has been going on, and some version of this “model” has been influencing my thoughts on inflation, the economy, and markets. It is a good starting point for this overall discussion and what to expect in terms of economic data and corporate reporting over the next seven weeks.

The factors that we use are:

- The Fed. This is primarily focused on rates and the balance sheet. Lower rates are stimulative and higher rates act as a headwind. Balance sheet expansion (QE) is stimulative while balance sheet reduction (QT) is contractionary. Other “extraordinary” measures are included as well.

- Stimulus. This includes a range of items such as checks sent to individuals, moratoriums on rent/student loans, PPP, and government spending programs like the “Inflation Reduction” Act.

- Supply Chains. This attempts to broadly incorporate supply chain issues from the actual inability to produce goods to the costs of shipping and transporting. It is difficult to get an exact definition, but we all know it when we see it.

- War. Russia’s invasion of Ukraine and the sanctions are also factors.

- Disruptive. Another broad topic and not only is it extremely important, but it has been overlooked by many. It does not just include the wealth gained and lost by investors or the impact on the economy. The spending generated by “disruptive” companies (and even units of larger/more “traditional” organizations) was quite simply massive. This segment can easily include crypto as well as disruptive companies (some of which were already public or recently went public, and others largely benefitted from PE/VC investments). This may be the most contentious factor, which likely makes it the most important in terms of explaining why our outlook remains so pessimistic.

We did not treat wage inflation as an inflation factor. This is a tricky and almost circular issue. Is wage inflation a factor? Certainly, the Fed focuses on wage inflation because it could potentially create “sticky” (or rather “non-transitory”) inflation. From that perspective, it is a factor rather than an output. However, we will treat wage inflation as another output (wage inflation will respond to the other factors, making it okay to ignore in the factor model). It is somewhat circular, which is why we highlight it.

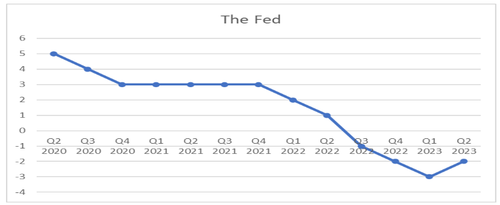

The Fed

The Fed did everything it could in the immediate aftermath of COVID and the COVID lockdowns. They bought corporate bonds/ETFs, backstopped money markets and corporate new issuance, expanded their balance sheet, and cut rates to zero.

Over time they pulled back on that support. By Q3 of 2022 we saw them acting as a moderate headwind. We should not just expect higher rates for now because the Fed is telegraphing higher rates into the future (while ramping up QT) as well.

By early 2023 the Fed will be a deflationary pressure.

That will start to reverse course as the Fed backpedals (likely smaller QT before rate cuts). In any case, on a standalone basis this might be the right policy, but given how the other factors are behaving, it may be a mistake.

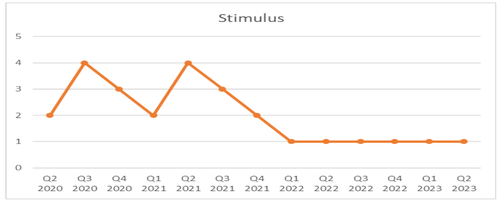

Stimulus

Stimulus started slowly, ramped up, tailed off, ramped back up again, and is now in the process of declining. We’ve left it as a small positive factor for much of this year and next year.

The bump in Q2 2021 may have been the most awkward of the inflation drivers as yet another stimulus package was passed long after there was an obvious need for it (the very nature of inflationary).

We didn’t get a “bounce” in the factor when the so-called “Inflation Reduction Act” was passed, because it wasn’t heavily front loaded, but it is why we leave stimulus as a positive factor going forward.

Supply Chain

The supply chain issues didn’t manifest themselves right away. In Q2 2020 oil (WTI) futures briefly traded negative. Yes, there were all sorts of weird shortages and mismatches during that time. You could get rolls and rolls of industrial grade toilet paper if you could figure out where to go, but it was virtually impossible to get high quality toilet paper (I’m sure there were other initial issues, but that one sticks out).

It was only over time as we re-opened and inventories got whittled down that supply chain issues started to mount. Add to that the fact that there weren’t enough workers at the docks to unload (let alone ship) things. Supply chain constraints were off the charts (as was the cost of shipping). However, those costs have since come down.

There are still some supply chain issues. Shipping isn’t great, but other issues are much smaller now. Offsetting that pressure further are the inventory builds that we’ve seen across so many industries. It is still a moderately inflationary factor, but should go away by Q2

War

Russia invaded Ukraine in Q1 2022, but as troops were building up before that, we started to see some pressure on commodity prices that could be attributed to the war risk. That escalated post invasion as sanctions took hold. It abated a little in the summer on the energy front (seasonal) and as some deals were attempted on the commodity front. It has ramped back up and that will continue into Q1 of next year and then it should subside into the summer again.

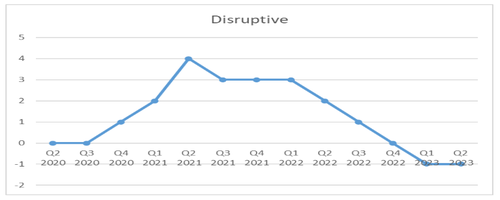

Disruptive

This doesn’t exactly follow the chart of bitcoin, ARKK, or SPAC issuance, but it is probably somewhat linked. Were those just a factor of the other factors, or a factor in their own right?

The wealth created and spent in this subset of the universe (which was unique to this period) is its own driver. It ties into my argument that jobs lost will NOT be the metric of this recession, rather it will be jobs lost multiplied by average pay that will define this recession.

I’m hearing this from programmers, software and hardware sellers, and event planners. The wealth created and spent was enormous, concentrated, and inflationary.

The Whole Picture

This chart might be a little bit messy, but it is a useful illustration of how these various factors have worked to drive inflation.

Thinking about these factors and when they started to turn down (and how inflation/the economy have followed) sends a somewhat chilling message if they are correct.

We are seeing little to no inflationary (growth) pressures in the economy in Q1, yet we are behaving as though fighting inflation is still job number 1.

Bottom Line

Look for growth and inflation to slow, regardless of what the Fed does going forward. Inflation was driven by many factors, most of which are receding on their own.

We have seven weeks of data after this Fed meeting and will be entering into Q4 earnings. I have little reason to be optimistic unless something about these risk factors change. It would be great to have discussions on the appropriateness of these factors and their relative importance.

This model may have many errors, but I welcome the opportunity to discuss/refine it and hopefully it gives you some food for thought on why our inflation and growth projections are on the pessimistic side of consensus.

Good luck on Wednesday and get ready for the next 7 weeks!

By Peter Tchir of Academy Securities

This week we will all focus on CPI on Tuesday and the Fed on Wednesday. What Chair Powell says and does on Wednesday will reverberate through the markets. For the record, I expect 50 bps and he will keep a rate hike on the table for the February 1 st announcement.

Rather than attempting to estimate this week’s CPI data (which will be important), today’s report will focus on what will drive inflation (and the economy/markets) after the Fed decision.

We have seven weeks between this FOMC decision and the next one. Seven weeks feels like a lifetime in a market that is prone to large daily and weekly swings. Even the views on the economy are shifting rapidly as more economists seem to be heading in our direction, which is that the recession will start sooner (Q1) and be deeper than most people previously thought.

If anything, the market is pricing in a Squishy Landing. That report tried to define a “squishy” landing and also tried to figure out why markets may misinterpret data as indicating a “soft” landing when the worst is yet to come. Finally, we re-iterated our more pessimistic outlook in that report.

Inflation Factors versus Inflation

Rather than just trying to “estimate” inflation, we examine the factors that “drive” inflation. While we could just estimate various inflation components such as rent, in this report, we will try something different. We will lay out the factors that drive inflation. We believe that these factors do a good job of predicting where inflation and the economy are headed

In theory this is what many do, but we hope that today’s analysis makes it clear how these factors have been behaving (and how they will behave). That will go a long way in explaining why our current outlook is more pessimistic and is strongly in the camp that “the Fed has gone too far already.”

We will address the individual components that go into this model. This model shows the highest inflationary pressures were from Q2 2021 to Q4 2021. It remained elevated for that extended period of time due to a variety of factors (the importance of which changed within that period). The factors have been pointing to steadily declining inflation and growth pressures ever since.

If anything, the factors point to deflationary pressures in Q1 and Q2 next year – which is another way of reaching our conclusion that the economy and markets are in jeopardy of a large “risk-off” trade that will break 2022’s lows on stocks (while yields plummet).

The Inflation Factors

We will use 5 factors. The factors are somewhat broad and the influence that they have on inflation is just an estimate. Yes, inflation and the economy are closely linked. No, our model is not tested and is both arbitrary and subjective. Nonetheless, it seems logical and almost elegant. The explanation fits the narrative of what has been going on, and some version of this “model” has been influencing my thoughts on inflation, the economy, and markets. It is a good starting point for this overall discussion and what to expect in terms of economic data and corporate reporting over the next seven weeks.

The factors that we use are:

- The Fed. This is primarily focused on rates and the balance sheet. Lower rates are stimulative and higher rates act as a headwind. Balance sheet expansion (QE) is stimulative while balance sheet reduction (QT) is contractionary. Other “extraordinary” measures are included as well.

- Stimulus. This includes a range of items such as checks sent to individuals, moratoriums on rent/student loans, PPP, and government spending programs like the “Inflation Reduction” Act.

- Supply Chains. This attempts to broadly incorporate supply chain issues from the actual inability to produce goods to the costs of shipping and transporting. It is difficult to get an exact definition, but we all know it when we see it.

- War. Russia’s invasion of Ukraine and the sanctions are also factors.

- Disruptive. Another broad topic and not only is it extremely important, but it has been overlooked by many. It does not just include the wealth gained and lost by investors or the impact on the economy. The spending generated by “disruptive” companies (and even units of larger/more “traditional” organizations) was quite simply massive. This segment can easily include crypto as well as disruptive companies (some of which were already public or recently went public, and others largely benefitted from PE/VC investments). This may be the most contentious factor, which likely makes it the most important in terms of explaining why our outlook remains so pessimistic.

We did not treat wage inflation as an inflation factor. This is a tricky and almost circular issue. Is wage inflation a factor? Certainly, the Fed focuses on wage inflation because it could potentially create “sticky” (or rather “non-transitory”) inflation. From that perspective, it is a factor rather than an output. However, we will treat wage inflation as another output (wage inflation will respond to the other factors, making it okay to ignore in the factor model). It is somewhat circular, which is why we highlight it.

The Fed

The Fed did everything it could in the immediate aftermath of COVID and the COVID lockdowns. They bought corporate bonds/ETFs, backstopped money markets and corporate new issuance, expanded their balance sheet, and cut rates to zero.

Over time they pulled back on that support. By Q3 of 2022 we saw them acting as a moderate headwind. We should not just expect higher rates for now because the Fed is telegraphing higher rates into the future (while ramping up QT) as well.

By early 2023 the Fed will be a deflationary pressure.

That will start to reverse course as the Fed backpedals (likely smaller QT before rate cuts). In any case, on a standalone basis this might be the right policy, but given how the other factors are behaving, it may be a mistake.

Stimulus

Stimulus started slowly, ramped up, tailed off, ramped back up again, and is now in the process of declining. We’ve left it as a small positive factor for much of this year and next year.

The bump in Q2 2021 may have been the most awkward of the inflation drivers as yet another stimulus package was passed long after there was an obvious need for it (the very nature of inflationary).

We didn’t get a “bounce” in the factor when the so-called “Inflation Reduction Act” was passed, because it wasn’t heavily front loaded, but it is why we leave stimulus as a positive factor going forward.

Supply Chain

The supply chain issues didn’t manifest themselves right away. In Q2 2020 oil (WTI) futures briefly traded negative. Yes, there were all sorts of weird shortages and mismatches during that time. You could get rolls and rolls of industrial grade toilet paper if you could figure out where to go, but it was virtually impossible to get high quality toilet paper (I’m sure there were other initial issues, but that one sticks out).

It was only over time as we re-opened and inventories got whittled down that supply chain issues started to mount. Add to that the fact that there weren’t enough workers at the docks to unload (let alone ship) things. Supply chain constraints were off the charts (as was the cost of shipping). However, those costs have since come down.

There are still some supply chain issues. Shipping isn’t great, but other issues are much smaller now. Offsetting that pressure further are the inventory builds that we’ve seen across so many industries. It is still a moderately inflationary factor, but should go away by Q2

War

Russia invaded Ukraine in Q1 2022, but as troops were building up before that, we started to see some pressure on commodity prices that could be attributed to the war risk. That escalated post invasion as sanctions took hold. It abated a little in the summer on the energy front (seasonal) and as some deals were attempted on the commodity front. It has ramped back up and that will continue into Q1 of next year and then it should subside into the summer again.

Disruptive

This doesn’t exactly follow the chart of bitcoin, ARKK, or SPAC issuance, but it is probably somewhat linked. Were those just a factor of the other factors, or a factor in their own right?

The wealth created and spent in this subset of the universe (which was unique to this period) is its own driver. It ties into my argument that jobs lost will NOT be the metric of this recession, rather it will be jobs lost multiplied by average pay that will define this recession.

I’m hearing this from programmers, software and hardware sellers, and event planners. The wealth created and spent was enormous, concentrated, and inflationary.

The Whole Picture

This chart might be a little bit messy, but it is a useful illustration of how these various factors have worked to drive inflation.

Thinking about these factors and when they started to turn down (and how inflation/the economy have followed) sends a somewhat chilling message if they are correct.

We are seeing little to no inflationary (growth) pressures in the economy in Q1, yet we are behaving as though fighting inflation is still job number 1.

Bottom Line

Look for growth and inflation to slow, regardless of what the Fed does going forward. Inflation was driven by many factors, most of which are receding on their own.

We have seven weeks of data after this Fed meeting and will be entering into Q4 earnings. I have little reason to be optimistic unless something about these risk factors change. It would be great to have discussions on the appropriateness of these factors and their relative importance.

This model may have many errors, but I welcome the opportunity to discuss/refine it and hopefully it gives you some food for thought on why our inflation and growth projections are on the pessimistic side of consensus.

Good luck on Wednesday and get ready for the next 7 weeks!

Loading…