Authored by Bruce Wilds via Advancing Time blog,

It is time to revisit six of the most common financial myths we have come to believe. Accepting any of these as a reflection of reality could lead us down the path to ruin. Unfortunately, belief in them is so widespread most people no longer even question them and are putting their economic future in peril. A myth is often defined as any invented story, idea, concept, or false collective belief that is used to justify a social institution. With this in mind, it is understandable those in the government and financial systems would crank out such yarns to keep us docile.

The six favorite financial myths are easier to believe when financial fears are low and times are good.

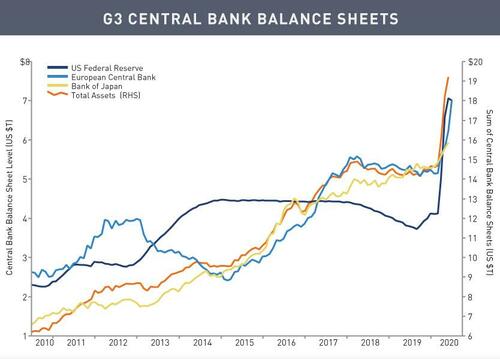

Over the last few years, a slug of freshly printed liquidity being pumped into the global financial system and stock markets has caused many asset bubbles to expand sending the wealth effect into overdrive. An increase in liquidity results in people feeling comfortable to take on more risk and this tends to cause people to "leverage up." During such a time true price discovery has a way of being greatly diminished.

Changes made to the rules and financial engineering have made many comparisons to the past obsolete. Sometimes, it is a question of people just being too lazy to question what they see, at other times, it is because they simply can't face the truth. It should be noted that the entertainment industry has flourished as society seeks any diversion to pull our attention away from the sharp edges of reality and into the soft comfort of escape. In some ways, it could be said that our culture has become obsessed with avoiding what is real. Regardless of the reason why people fail to view the myths below as lies the point is they will result in the financial ruin of those counting on them in time of need.

Over the years, extraordinary efforts have been made to keep the economy afloat. The most noticeable is the massive amount of new money and credit released into the financial system by central banks. This has been interpreted by many people as confirmation the current trend of never-ending growth will continue. Rather than considering it is time for a reality check it is both easier and more comforting to adopt an "all is well" attitude and ignore the signs of danger lurking around the corner.

The crux of this article is about some of society's favorite myths. These feed directly into the economy and our feelings about our financial security. While it could be argued the myths below have more to do with how we feel about life than about money, it cannot be denied that most people make many of their financial decisions based on the assumption the below statements are true. As a society, we rapidly choose to embrace and often choose not to question them because of the discomfort it would undoubtedly create. The six below permeate society and should be enough to remind you and even shed a bit of light upon the fact we as individuals are vulnerable at any time if reality raises its' ugly head.

Believing Myths Is A Head In Sand Approach

#1 Government is for the people and by the people - Seriously? After the dog and pony show, we experienced during the last presidential primary all illusions of that should have been erased. After often being forced to choose between the least of two evils it is difficult to praise our political system. After all the talk about "we the people," the fact is the average "person" is far removed from the power to decide important issues.

#2 Financial planning means you only have to start saving a little money each year to guarantee an easy retirement. - The fact is life is a casino where our future is tenuous at best. Much of our circumstances and lives revolve around money and the number of options it gives us when we possess it. I intentionally used the term "casino" to conjure up the image of financial fortune. Which you can lose in a blink of an eye if things go against you. This myth extends deeply into the promises made by the government and others such as pension plans and financial institutions. Many of these promises will not be honored.

#3 You have rights and that we are not slaves - I defer to a few lines from a blog by Gerry Spence who has spent his lifetime representing and protecting victims of the legal system from what he calls The New Slave Master: big corporations and big government. In his blog, Spence wrote; The Moneyed Master has closed its doors against the people and sits on its money like an old hen on rotten eggs. The people will not prevail. With its endless propaganda, the Moneyed Master has caused its slaves to believe they are free.

#4 Your life will progress and move along pretty much as you have planned - When you think back over the years of your life if you are like most people things have not unfolded as you had planned. You may not be in the occupation you trained for or with your true love. Throughout our life watershed events occur that we have little control over, this holds true when it comes to your finances as well. Having an investment or pension plan go south can completely alter your life.

#5 Those in charge or above you care about you and will make an effort to protect you - Sadly, more than one person has been sliced and diced by the people and institutions he or she trusted most. History shows when push comes to shove it is not uncommon for a person to look out for the person they treasure the most and that is often him or herself. Politicians and those in power have a long history of throwing the populace under the bus rather than taking responsibility for the problems they create.

#6 It could be argued the biggest myth of all is the idea that inflation is reflected in the Consumer Price Index. Those making financial decisions have masked their failings. This is done by heavily skewing the CPI to give the impression there is little inflation. This dovetails with a theory I continue to expound on, that inflation would be much higher if people were not willing to invest in intangible assets such as stocks and Bitcoin. This removes a lot of demand for tangible items people use in their everyday life.

The fact is inflation is soaring and acts as a wealth transfer mechanism that hurts far more people than it helps. My apologies if this post has been a downer or seems overly negative, however, it is what it is and it was written for a reason. Best stated by a comment I read on another site; These myths add up to where "This is not a can of worms but a warehouse stacked with pallets of cans of worms."

Believing the above myths will impact your life, that is why it is important to recognize them for what they are, lies. This is not to say that by making good and reasonable choices we cannot eliminate some of the risks we encounter when we get out of bed each morning. Developing the habit of being skeptical while pressing on to reach solid and reasonable goals is the best medicine to combat a deck that is often stacked against us. Be careful out there!

* * *

Authored by Bruce Wilds via Advancing Time blog,

It is time to revisit six of the most common financial myths we have come to believe. Accepting any of these as a reflection of reality could lead us down the path to ruin. Unfortunately, belief in them is so widespread most people no longer even question them and are putting their economic future in peril. A myth is often defined as any invented story, idea, concept, or false collective belief that is used to justify a social institution. With this in mind, it is understandable those in the government and financial systems would crank out such yarns to keep us docile.

The six favorite financial myths are easier to believe when financial fears are low and times are good.

Over the last few years, a slug of freshly printed liquidity being pumped into the global financial system and stock markets has caused many asset bubbles to expand sending the wealth effect into overdrive. An increase in liquidity results in people feeling comfortable to take on more risk and this tends to cause people to “leverage up.” During such a time true price discovery has a way of being greatly diminished.

Changes made to the rules and financial engineering have made many comparisons to the past obsolete. Sometimes, it is a question of people just being too lazy to question what they see, at other times, it is because they simply can’t face the truth. It should be noted that the entertainment industry has flourished as society seeks any diversion to pull our attention away from the sharp edges of reality and into the soft comfort of escape. In some ways, it could be said that our culture has become obsessed with avoiding what is real. Regardless of the reason why people fail to view the myths below as lies the point is they will result in the financial ruin of those counting on them in time of need.

Over the years, extraordinary efforts have been made to keep the economy afloat. The most noticeable is the massive amount of new money and credit released into the financial system by central banks. This has been interpreted by many people as confirmation the current trend of never-ending growth will continue. Rather than considering it is time for a reality check it is both easier and more comforting to adopt an “all is well” attitude and ignore the signs of danger lurking around the corner.

The crux of this article is about some of society’s favorite myths. These feed directly into the economy and our feelings about our financial security. While it could be argued the myths below have more to do with how we feel about life than about money, it cannot be denied that most people make many of their financial decisions based on the assumption the below statements are true. As a society, we rapidly choose to embrace and often choose not to question them because of the discomfort it would undoubtedly create. The six below permeate society and should be enough to remind you and even shed a bit of light upon the fact we as individuals are vulnerable at any time if reality raises its’ ugly head.

Believing Myths Is A Head In Sand Approach

#1 Government is for the people and by the people – Seriously? After the dog and pony show, we experienced during the last presidential primary all illusions of that should have been erased. After often being forced to choose between the least of two evils it is difficult to praise our political system. After all the talk about “we the people,” the fact is the average “person” is far removed from the power to decide important issues.

#2 Financial planning means you only have to start saving a little money each year to guarantee an easy retirement. – The fact is life is a casino where our future is tenuous at best. Much of our circumstances and lives revolve around money and the number of options it gives us when we possess it. I intentionally used the term “casino” to conjure up the image of financial fortune. Which you can lose in a blink of an eye if things go against you. This myth extends deeply into the promises made by the government and others such as pension plans and financial institutions. Many of these promises will not be honored.

#3 You have rights and that we are not slaves – I defer to a few lines from a blog by Gerry Spence who has spent his lifetime representing and protecting victims of the legal system from what he calls The New Slave Master: big corporations and big government. In his blog, Spence wrote; The Moneyed Master has closed its doors against the people and sits on its money like an old hen on rotten eggs. The people will not prevail. With its endless propaganda, the Moneyed Master has caused its slaves to believe they are free.

#4 Your life will progress and move along pretty much as you have planned – When you think back over the years of your life if you are like most people things have not unfolded as you had planned. You may not be in the occupation you trained for or with your true love. Throughout our life watershed events occur that we have little control over, this holds true when it comes to your finances as well. Having an investment or pension plan go south can completely alter your life.

#5 Those in charge or above you care about you and will make an effort to protect you – Sadly, more than one person has been sliced and diced by the people and institutions he or she trusted most. History shows when push comes to shove it is not uncommon for a person to look out for the person they treasure the most and that is often him or herself. Politicians and those in power have a long history of throwing the populace under the bus rather than taking responsibility for the problems they create.

#6 It could be argued the biggest myth of all is the idea that inflation is reflected in the Consumer Price Index. Those making financial decisions have masked their failings. This is done by heavily skewing the CPI to give the impression there is little inflation. This dovetails with a theory I continue to expound on, that inflation would be much higher if people were not willing to invest in intangible assets such as stocks and Bitcoin. This removes a lot of demand for tangible items people use in their everyday life.

The fact is inflation is soaring and acts as a wealth transfer mechanism that hurts far more people than it helps. My apologies if this post has been a downer or seems overly negative, however, it is what it is and it was written for a reason. Best stated by a comment I read on another site; These myths add up to where “This is not a can of worms but a warehouse stacked with pallets of cans of worms.”

Believing the above myths will impact your life, that is why it is important to recognize them for what they are, lies. This is not to say that by making good and reasonable choices we cannot eliminate some of the risks we encounter when we get out of bed each morning. Developing the habit of being skeptical while pressing on to reach solid and reasonable goals is the best medicine to combat a deck that is often stacked against us. Be careful out there!

* * *