While prevailing consensus was that the Fed didn't really say anything unexpected, or anything that wasn't already telegraphed both in the Nov 2 statement and subsequent Fed speak, Wall Street commentators agreed that "the statement overall comes across as dovish" as BBG Economics chief Anna Wong put it, With Integrity Asset Management's Joe Gilbert adding that "it is constructive that Fed participants were becoming increasingly aware of the lagged impact of all the rate hikes this year. Generally, this is bullish for equities and fixed income because there is now a slight change in consensus at the Fed which means that significantly more rate hikes are now less likely."

Wong added that "there’s widespread agreement within the committee to slow the pace of rate hikes soon, with only ‘a few’ preferring to wait until the policy stance is more clearly in restrictive territory. We think Powell belongs to this latter group."

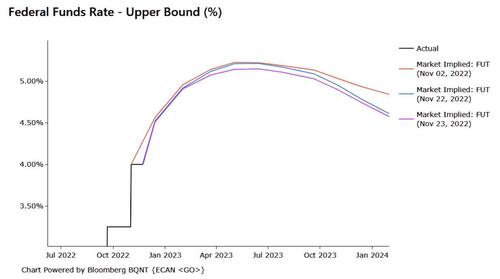

The market agrees with the dovish take and stocks have jumped to session highs while the market implied Fed Funds curve has dipped on the outer end,

Here are some of the initial reactions to the FOMC Minutes:

Chris Low, FHN Financial

“The two big headlines are most Fed officials favor slower tightening pace soon and various Fed officials see higher peak rates. Both of these confirm post-meeting press conference guidance from Powell.”

Interactive Brokers’ Chief Strategist Steve Sosnick:

“With pivot off the table, and with no pause coming yet, slower pacing seems to be enough for stock traders now.”

Lara Rhame of FS Investments:

"This rate-hike cycle has been “fast and furious” and the Fed has to slow down eventually. But the central bank can’t afford to let markets just rip higher."

Doug Fincher, hedge fund manager of Ionic Capital Management:

“Amazed at the magnitude of tightening in credit spreads over the weeks since the CPI print. Curve is inverted, all kinds of risks (including recession) yet credit spreads tightened by 30% and signal all clear.... A slowdown is not a cut and many hurdles remain -- like strong employment. It’s good, but a lot already priced in, I think, and many risks need to be solved for soft landing to play out.”

Childe-Freeman of Bloomberg Intelligence:

"The reference to slowing rate hikes will grab headlines. This will add to the bearish-dollar view for now, with $1.04 euro-dollar in sight again.”

Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors LLC.

"There isn’t much to glean from the minutes. From what I’ve seen, it’s exactly the same message we heard at the press conference: slower and possibly higher peak Fed funds rate. Any major reaction off of the minutes is probably an overreaction.”

Joe Gilbert, portfolio manager at Integrity Asset Management

“Keeping in mind that these minutes are before the October CPI print, it is constructive that Fed participants were becoming increasingly aware of the lagged impact of all the rate hikes this year. Generally, this is bullish for equities and fixed income because there is now a slight change in consensus at the Fed which means that significantly more rate hikes are now less likely.”

Anna Wong, head of Bloomberg Economics

“We think the statement overall comes across as dovish. There’s widespread agreement within the committee to slow the pace of rate hikes soon, with only ‘a few’ preferring to wait until the policy stance is more clearly in restrictive territory. We think Powell belongs to this latter group.”

While prevailing consensus was that the Fed didn’t really say anything unexpected, or anything that wasn’t already telegraphed both in the Nov 2 statement and subsequent Fed speak, Wall Street commentators agreed that “the statement overall comes across as dovish” as BBG Economics chief Anna Wong put it, With Integrity Asset Management’s Joe Gilbert adding that “it is constructive that Fed participants were becoming increasingly aware of the lagged impact of all the rate hikes this year. Generally, this is bullish for equities and fixed income because there is now a slight change in consensus at the Fed which means that significantly more rate hikes are now less likely.”

Wong added that “there’s widespread agreement within the committee to slow the pace of rate hikes soon, with only ‘a few’ preferring to wait until the policy stance is more clearly in restrictive territory. We think Powell belongs to this latter group.“

The market agrees with the dovish take and stocks have jumped to session highs while the market implied Fed Funds curve has dipped on the outer end,

Here are some of the initial reactions to the FOMC Minutes:

Chris Low, FHN Financial

“The two big headlines are most Fed officials favor slower tightening pace soon and various Fed officials see higher peak rates. Both of these confirm post-meeting press conference guidance from Powell.”

Interactive Brokers’ Chief Strategist Steve Sosnick:

“With pivot off the table, and with no pause coming yet, slower pacing seems to be enough for stock traders now.”

Lara Rhame of FS Investments:

“This rate-hike cycle has been “fast and furious” and the Fed has to slow down eventually. But the central bank can’t afford to let markets just rip higher.”

Doug Fincher, hedge fund manager of Ionic Capital Management:

“Amazed at the magnitude of tightening in credit spreads over the weeks since the CPI print. Curve is inverted, all kinds of risks (including recession) yet credit spreads tightened by 30% and signal all clear…. A slowdown is not a cut and many hurdles remain — like strong employment. It’s good, but a lot already priced in, I think, and many risks need to be solved for soft landing to play out.”

Childe-Freeman of Bloomberg Intelligence:

“The reference to slowing rate hikes will grab headlines. This will add to the bearish-dollar view for now, with $1.04 euro-dollar in sight again.”

Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors LLC.

“There isn’t much to glean from the minutes. From what I’ve seen, it’s exactly the same message we heard at the press conference: slower and possibly higher peak Fed funds rate. Any major reaction off of the minutes is probably an overreaction.”

Joe Gilbert, portfolio manager at Integrity Asset Management

“Keeping in mind that these minutes are before the October CPI print, it is constructive that Fed participants were becoming increasingly aware of the lagged impact of all the rate hikes this year. Generally, this is bullish for equities and fixed income because there is now a slight change in consensus at the Fed which means that significantly more rate hikes are now less likely.”

Anna Wong, head of Bloomberg Economics

“We think the statement overall comes across as dovish. There’s widespread agreement within the committee to slow the pace of rate hikes soon, with only ‘a few’ preferring to wait until the policy stance is more clearly in restrictive territory. We think Powell belongs to this latter group.”