A brand new study from McKinsey has revealed that nearly half of Americans who own EVs want to go back to traditional gas powered vehicles.

Apparently trillions of dollars in 'green' taxpayer-backed global subsidies over the last decade are no match for good ole' fashioned common sense and free markets. Go figure.

Speaking to Automotive News, Philipp Kampshoff, leader of the consulting firm's Center for Future Mobility said: "I didn't expect that. I thought, 'Once an EV buyer, always an EV buyer.' "

The study found that over 40% of U.S. electric vehicle owners are likely to buy a combustion engine car next.

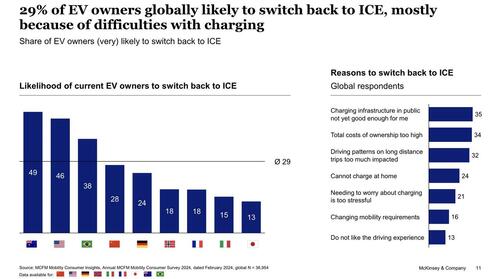

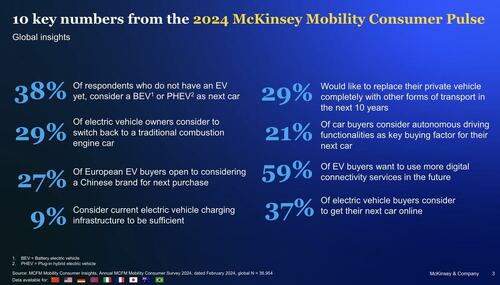

Charging concerns are a major hindrance to EV adoption, with 29% of global EV owners considering a switch, rising to 46% in the U.S. Consumers cite inadequate public charging infrastructure, high ownership costs, and impacts on long-distance travel as key issues.

These concerns align with the slow rollout of the U.S. National Electric Vehicle Infrastructure program. Only eight stations are operational, and 23 states have started using funds from the $5 billion federal program as of May, according to EVAdoption.

The U.S. isn't alone in facing EV charging challenges. Only 9% of global respondents find the public-charging infrastructure adequate. This issue is set to grow, as future EV buyers will depend more on public charging, according to Kampshoff.

McKinsey's survey highlights include:

- 21% of global respondents never want to switch to an EV, with 33% citing charging concerns.

- Range expectations have increased from 270 miles in 2022 to 291.4 miles today, outpacing current EV offerings.

McKinsey's biennial survey, released on June 12, included around 200 questions to over 30,000 consumers in 15 countries, covering over 80% of global sales. The survey shows a slight increase in willingness to consider EVs, with 38% of non-EV owners eyeing a plug-in hybrid or full electric for their next vehicle, up from 37% in 2022.

Consumer preferences for EVs, plug-ins, and combustion powertrains, coupled with evolving global regulations, complicate planning for the auto industry and its supply chain.

Kevin Laczkowski, global co-lead of McKinsey's automotive and assembly practice, concluded: "OEMs and suppliers now have to invest in multiple technologies. This is the ultimate uncertainty right now, like almost never before."

A brand new study from McKinsey has revealed that nearly half of Americans who own EVs want to go back to traditional gas powered vehicles.

Apparently trillions of dollars in ‘green’ taxpayer-backed global subsidies over the last decade are no match for good ole’ fashioned common sense and free markets. Go figure.

Speaking to Automotive News, Philipp Kampshoff, leader of the consulting firm’s Center for Future Mobility said: “I didn’t expect that. I thought, ‘Once an EV buyer, always an EV buyer.’ ”

The study found that over 40% of U.S. electric vehicle owners are likely to buy a combustion engine car next.

Charging concerns are a major hindrance to EV adoption, with 29% of global EV owners considering a switch, rising to 46% in the U.S. Consumers cite inadequate public charging infrastructure, high ownership costs, and impacts on long-distance travel as key issues.

These concerns align with the slow rollout of the U.S. National Electric Vehicle Infrastructure program. Only eight stations are operational, and 23 states have started using funds from the $5 billion federal program as of May, according to EVAdoption.

The U.S. isn’t alone in facing EV charging challenges. Only 9% of global respondents find the public-charging infrastructure adequate. This issue is set to grow, as future EV buyers will depend more on public charging, according to Kampshoff.

McKinsey’s survey highlights include:

- 21% of global respondents never want to switch to an EV, with 33% citing charging concerns.

- Range expectations have increased from 270 miles in 2022 to 291.4 miles today, outpacing current EV offerings.

McKinsey’s biennial survey, released on June 12, included around 200 questions to over 30,000 consumers in 15 countries, covering over 80% of global sales. The survey shows a slight increase in willingness to consider EVs, with 38% of non-EV owners eyeing a plug-in hybrid or full electric for their next vehicle, up from 37% in 2022.

Consumer preferences for EVs, plug-ins, and combustion powertrains, coupled with evolving global regulations, complicate planning for the auto industry and its supply chain.

Kevin Laczkowski, global co-lead of McKinsey’s automotive and assembly practice, concluded: “OEMs and suppliers now have to invest in multiple technologies. This is the ultimate uncertainty right now, like almost never before.”

Loading…