We live in an information-abundant digital world, where data is the new currency, and data centers are the vaults that protect and power it.

The amount of data created each year has skyrocketed from 2 zettabytes in 2010 to 44 zettabytes (44 trillion gigabytes) in 2020. This has surged demand for data storage and processing, leading to the construction of massive data centers around the world.

So, where are the biggest data centers?

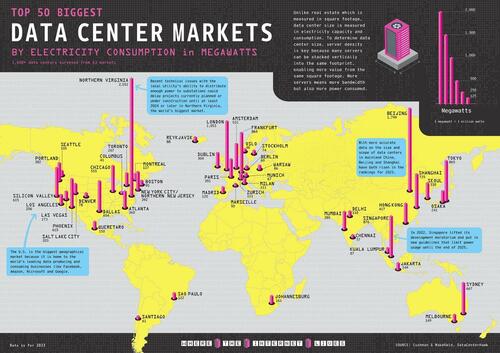

In this graphic,Visual Capitalist's Julie Peasley uses 2023 data from Cushman & Wakefield to shed light on the biggest data center markets.

The Biggest Data Center Markets

Today, it is estimated that there are over 8,000 data centers in the world.

Many of these centers end up clustered together due to beneficial infrastructure and provisions from local governments and utilities. They also need lots of power, often at least 100 MW for each center, making power consumption one of the best ways to measure total market size.

While a majority of these data center markets are in the United States, some of them are scattered across Asia and Europe.

| Rank | Data Center Market | Country | Capacity (MW) |

|---|---|---|---|

| 1 | Northern Virginia | 🇺🇸 United States | 2,552 |

| 2 | Beijing | 🇨🇳 China | 1,799 |

| 3 | London | 🇬🇧 United Kingdom | 1,053 |

| 4 | Singapore | 🇸🇬 Singapore | 876 |

| 5 | Tokyo | 🇯🇵 Japan | 865 |

| 6 | Frankfurt | 🇩🇪 Germany | 864 |

| 7 | Shanghai | 🇨🇳 China | 725 |

| 8 | Sydney | 🇦🇺 Australia | 667 |

| 9 | Dallas | 🇺🇸 United States | 654 |

| 10 | Silicon Valley | 🇺🇸 United States | 615 |

| 11 | Phoenix | 🇺🇸 United States | 615 |

| 12 | Chicago | 🇺🇸 United States | 555 |

| 13 | Amsterdam | 🇳🇱 Netherlands | 531 |

| 14 | Hong Kong | 🇭🇰 Hong Kong | 417 |

| 15 | New York City - Northern New Jersey | 🇺🇸 United States | 392 |

| 16 | Paris | 🇫🇷 France | 391 |

| 17 | Portland | 🇺🇸 United States | 382 |

| 18 | Mumbai | 🇮🇳 India | 380 |

| 19 | Atlanta | 🇺🇸 United States | 360 |

| 20 | Seoul | 🇰🇷 South Korea | 330 |

| 21 | Dublin | 🇮🇪 Ireland | 304 |

| 22 | Toronto | 🇨🇦 Canada | 267 |

| 23 | Osaka | 🇯🇵 Japan | 241 |

| 24 | Los Angeles | 🇺🇸 United States | 206 |

| 25 | Salt Lake City | 🇺🇸 United States | 203 |

| 26 | Las Vegas | 🇺🇸 United States | 173 |

| 27 | Johannesburg | 🇿🇦 South Africa | 161 |

| 28 | Querétaro | 🇲🇽 Mexico | 150 |

| 29 | Melbourne | 🇦🇺 Australia | 149 |

| 30 | Jakarta | 🇮🇩 Indonesia | 144 |

| 31 | Montreal | 🇨🇦 Canada | 127 |

| 32 | São Paulo | 🇧🇷 Brazil | 122 |

| 33 | Madrid | 🇪🇸 Spain | 120 |

| 34 | Milan | 🇮🇹 Italy | 111 |

| 35 | Zurich | 🇨🇭 Switzerland | 111 |

| 36 | Delhi | 🇮🇳 India | 110 |

| 37 | Seattle | 🇺🇸 United States | 105 |

| 38 | Boston | 🇺🇸 United States | 95 |

| 39 | Reykjavík | 🇮🇸 Iceland | 88 |

| 40 | Kuala Lumpur | 🇲🇾 Malaysia | 87 |

| 41 | Warsaw | 🇵🇱 Poland | 86 |

| 42 | Denver | 🇺🇸 United States | 78 |

| 43 | Stockholm | 🇸🇪 Sweden | 74 |

| 44 | Munich | 🇩🇪 Germany | 67 |

| 45 | Santiago | 🇨🇱 Chile | 61 |

| 46 | Berlin | 🇩🇪 Germany | 60 |

| 47 | Chennai | 🇮🇳 India | 57 |

| 48 | Marseille | 🇫🇷 France | 50 |

| 49 | Oslo | 🇳🇴 Norway | 48 |

| 50 | Columbus | 🇺🇸 United States | 41 |

With nearly 300 data centers, including many AWS servers, the Northern Virginia data center market is the largest in the world. Data centers in the region are estimated to handle more than one-third of global online traffic.

In 2023, Northern Virginia data centers had a combined power consumption capacity of 2,552 MW. That’s four times the capacity of the next closest American markets, Dallas (654 MW) and Silicon Valley (615 MW).

The second-biggest market, Beijing, has a measured capacity of 1,799 MW. Though it is currently the only market with an operational capacity of over 1,000 MW in the Asia Pacific Region, Tokyo (865 MW) appears to be catching up fast.

Europe’s biggest data center clusters are in London (1,053 MW) and Frankfurt (864 MW), largely due to demand from large local enterprises and organizations. It’s no coincidence that they are major hubs for government and commerce—the world’s largest data center markets are near capital cities, as historically, governments (and their militaries) were the first to invest in internet infrastructure.

Future of Data

Data centers will continue growing in scale and expanding into new markets to meet the demands of digitalization.

Already the wider adoption of artificial intelligence has changed where internet data is flowing. And with increasing digital demands, the amount of energy needed to power these centers also increases.

That has increasingly put the spotlight not just on companies and data center markets, but on the energy they’re using. With massive power consumption requirements, efficiency and sustainability become increasingly important, and not every market is prioritizing efficient sources of electricity.

We live in an information-abundant digital world, where data is the new currency, and data centers are the vaults that protect and power it.

The amount of data created each year has skyrocketed from 2 zettabytes in 2010 to 44 zettabytes (44 trillion gigabytes) in 2020. This has surged demand for data storage and processing, leading to the construction of massive data centers around the world.

So, where are the biggest data centers?

In this graphic,Visual Capitalist’s Julie Peasley uses 2023 data from Cushman & Wakefield to shed light on the biggest data center markets.

The Biggest Data Center Markets

Today, it is estimated that there are over 8,000 data centers in the world.

Many of these centers end up clustered together due to beneficial infrastructure and provisions from local governments and utilities. They also need lots of power, often at least 100 MW for each center, making power consumption one of the best ways to measure total market size.

While a majority of these data center markets are in the United States, some of them are scattered across Asia and Europe.

| Rank | Data Center Market | Country | Capacity (MW) |

|---|---|---|---|

| 1 | Northern Virginia | 🇺🇸 United States | 2,552 |

| 2 | Beijing | 🇨🇳 China | 1,799 |

| 3 | London | 🇬🇧 United Kingdom | 1,053 |

| 4 | Singapore | 🇸🇬 Singapore | 876 |

| 5 | Tokyo | 🇯🇵 Japan | 865 |

| 6 | Frankfurt | 🇩🇪 Germany | 864 |

| 7 | Shanghai | 🇨🇳 China | 725 |

| 8 | Sydney | 🇦🇺 Australia | 667 |

| 9 | Dallas | 🇺🇸 United States | 654 |

| 10 | Silicon Valley | 🇺🇸 United States | 615 |

| 11 | Phoenix | 🇺🇸 United States | 615 |

| 12 | Chicago | 🇺🇸 United States | 555 |

| 13 | Amsterdam | 🇳🇱 Netherlands | 531 |

| 14 | Hong Kong | 🇭🇰 Hong Kong | 417 |

| 15 | New York City – Northern New Jersey | 🇺🇸 United States | 392 |

| 16 | Paris | 🇫🇷 France | 391 |

| 17 | Portland | 🇺🇸 United States | 382 |

| 18 | Mumbai | 🇮🇳 India | 380 |

| 19 | Atlanta | 🇺🇸 United States | 360 |

| 20 | Seoul | 🇰🇷 South Korea | 330 |

| 21 | Dublin | 🇮🇪 Ireland | 304 |

| 22 | Toronto | 🇨🇦 Canada | 267 |

| 23 | Osaka | 🇯🇵 Japan | 241 |

| 24 | Los Angeles | 🇺🇸 United States | 206 |

| 25 | Salt Lake City | 🇺🇸 United States | 203 |

| 26 | Las Vegas | 🇺🇸 United States | 173 |

| 27 | Johannesburg | 🇿🇦 South Africa | 161 |

| 28 | Querétaro | 🇲🇽 Mexico | 150 |

| 29 | Melbourne | 🇦🇺 Australia | 149 |

| 30 | Jakarta | 🇮🇩 Indonesia | 144 |

| 31 | Montreal | 🇨🇦 Canada | 127 |

| 32 | São Paulo | 🇧🇷 Brazil | 122 |

| 33 | Madrid | 🇪🇸 Spain | 120 |

| 34 | Milan | 🇮🇹 Italy | 111 |

| 35 | Zurich | 🇨🇭 Switzerland | 111 |

| 36 | Delhi | 🇮🇳 India | 110 |

| 37 | Seattle | 🇺🇸 United States | 105 |

| 38 | Boston | 🇺🇸 United States | 95 |

| 39 | Reykjavík | 🇮🇸 Iceland | 88 |

| 40 | Kuala Lumpur | 🇲🇾 Malaysia | 87 |

| 41 | Warsaw | 🇵🇱 Poland | 86 |

| 42 | Denver | 🇺🇸 United States | 78 |

| 43 | Stockholm | 🇸🇪 Sweden | 74 |

| 44 | Munich | 🇩🇪 Germany | 67 |

| 45 | Santiago | 🇨🇱 Chile | 61 |

| 46 | Berlin | 🇩🇪 Germany | 60 |

| 47 | Chennai | 🇮🇳 India | 57 |

| 48 | Marseille | 🇫🇷 France | 50 |

| 49 | Oslo | 🇳🇴 Norway | 48 |

| 50 | Columbus | 🇺🇸 United States | 41 |

With nearly 300 data centers, including many AWS servers, the Northern Virginia data center market is the largest in the world. Data centers in the region are estimated to handle more than one-third of global online traffic.

In 2023, Northern Virginia data centers had a combined power consumption capacity of 2,552 MW. That’s four times the capacity of the next closest American markets, Dallas (654 MW) and Silicon Valley (615 MW).

The second-biggest market, Beijing, has a measured capacity of 1,799 MW. Though it is currently the only market with an operational capacity of over 1,000 MW in the Asia Pacific Region, Tokyo (865 MW) appears to be catching up fast.

Europe’s biggest data center clusters are in London (1,053 MW) and Frankfurt (864 MW), largely due to demand from large local enterprises and organizations. It’s no coincidence that they are major hubs for government and commerce—the world’s largest data center markets are near capital cities, as historically, governments (and their militaries) were the first to invest in internet infrastructure.

Future of Data

Data centers will continue growing in scale and expanding into new markets to meet the demands of digitalization.

Already the wider adoption of artificial intelligence has changed where internet data is flowing. And with increasing digital demands, the amount of energy needed to power these centers also increases.

That has increasingly put the spotlight not just on companies and data center markets, but on the energy they’re using. With massive power consumption requirements, efficiency and sustainability become increasingly important, and not every market is prioritizing efficient sources of electricity.

Loading…