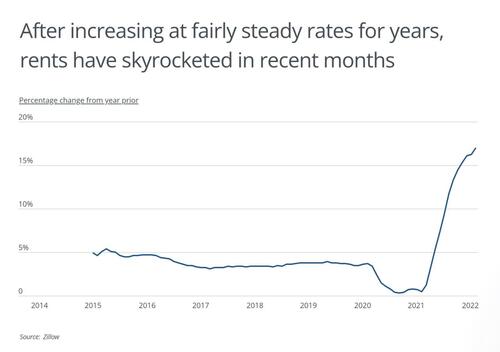

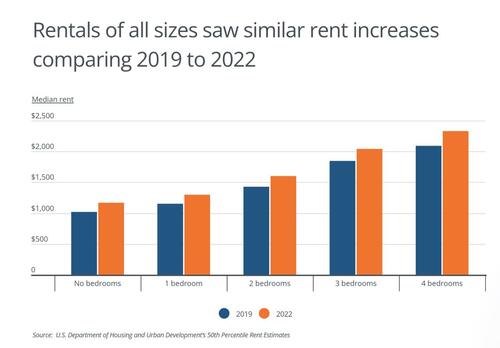

Amid a historic stretch of inflation over the last year, the cost of housing (especially rent) has been one of the most significant pressures on household finances.

Renters in many markets are seeing increases of 20% or more as they sign new leases, and, with the nationwide rental vacancy rate at just 5.6%, renters have few alternatives to find more affordable housing.

The current state of the rental market is a product of both supply and demand, with issues compiling over time and being exacerbated since the pandemic began.

Source: Stessa

On the supply side, the US has an estimated shortage of nearly 4 million housing units. Zoning and density restrictions have made it more difficult to add housing stock in many locations, both for rentals and owner-occupied units.

With rising real estate prices, 70% of the growth of the rental market since 2009 has come from higher-income earners who might otherwise have bought a home.

Source: Stessa

And as more high earners enter or stay in the rental market, builders and developers are incentivized to provide more luxury units, which means less new stock to meet the needs of low- and middle-income earners.

Source: Stessa

The pandemic-era economy has made all of these issues worse.

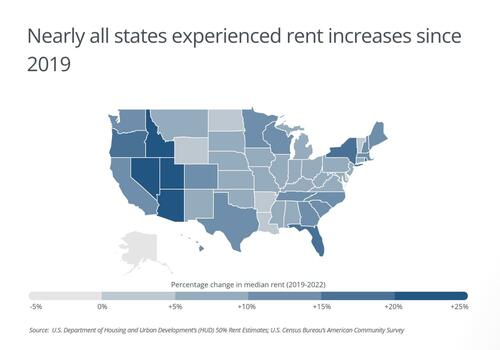

Meanwhile, these are the small and midsize cities where rents have risen the most (and the least).

The spike in home values and rising interest rates are putting homeownership further out of reach for many would-be buyers, keeping more people in the rental market.

Builders and developers are also struggling to keep up with heightened demand while managing costs. Ongoing supply chain challenges have made it more time-consuming and expensive to obtain building materials, while the tight labor market has left hundreds of thousands of construction positions unfilled.

Amid a historic stretch of inflation over the last year, the cost of housing (especially rent) has been one of the most significant pressures on household finances.

Renters in many markets are seeing increases of 20% or more as they sign new leases, and, with the nationwide rental vacancy rate at just 5.6%, renters have few alternatives to find more affordable housing.

The current state of the rental market is a product of both supply and demand, with issues compiling over time and being exacerbated since the pandemic began.

Source: Stessa

On the supply side, the US has an estimated shortage of nearly 4 million housing units. Zoning and density restrictions have made it more difficult to add housing stock in many locations, both for rentals and owner-occupied units.

With rising real estate prices, 70% of the growth of the rental market since 2009 has come from higher-income earners who might otherwise have bought a home.

Source: Stessa

And as more high earners enter or stay in the rental market, builders and developers are incentivized to provide more luxury units, which means less new stock to meet the needs of low- and middle-income earners.

Source: Stessa

The pandemic-era economy has made all of these issues worse.

Meanwhile, these are the small and midsize cities where rents have risen the most (and the least).

The spike in home values and rising interest rates are putting homeownership further out of reach for many would-be buyers, keeping more people in the rental market.

Builders and developers are also struggling to keep up with heightened demand while managing costs. Ongoing supply chain challenges have made it more time-consuming and expensive to obtain building materials, while the tight labor market has left hundreds of thousands of construction positions unfilled.