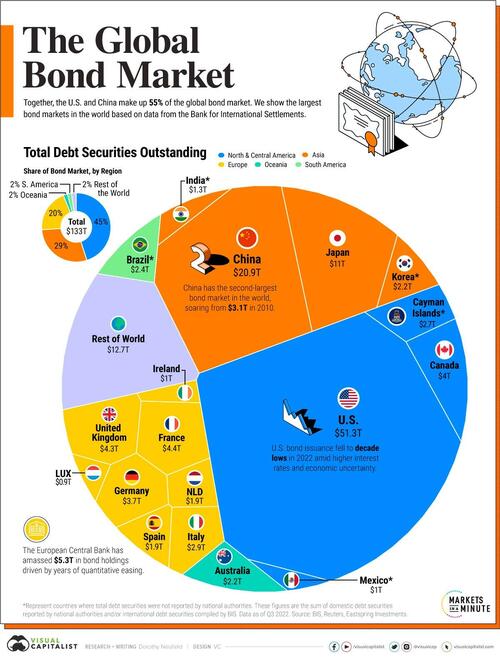

In 2022, the global bond market totaled $133 trillion.

As one of the world’s largest capital markets, debt securities have grown sevenfold over the last 40 years. As Visual Capitalists Dorothy Neufeld details below, government and corporate debt sales across major economies and emerging markets have fueled this dramatic growth. Over the last three years, China’s bond market has grown 13% annually.

Based on estimates from the Bank for International Statements, this graphic shows the largest bond markets in the world.

Total debt numbers here include both domestic and international debt securities in each particular country or region. BIS notes that international debt securities are issued outside the local market of the country where the borrower resides and cover eurobonds as well as foreign bonds, but exclude negotiable loans.

Ranked: The World’s Top Bond Markets

Valued at over $51 trillion, the U.S. has the largest bond market globally.

Government bonds made up the majority of its debt market, with over $26 trillion in securities outstanding. In 2022, the Federal government paid $534 billion in interest on this debt.

China is second, at 16% of the global total. Local commercial banks hold the greatest share of its outstanding bonds, while foreign ownership remains fairly low. Foreign interest in China’s bonds slowed in 2022 amid geopolitical tensions in Ukraine and lower yields.\

*Represent countries where total debt securities were not reported by national authorities. These figures are the sum of domestic debt securities reported by national authorities and/or international debt securities compiled by BIS.

Data as of Q3 2022.

As the above table shows, Japan has the third biggest debt market. Japan’s central bank owns a massive share of its government bonds. Central bank ownership hit a record 50% as it tweaked its yield curve control policy that was introduced in 2016. The policy was designed to help boost inflation and prevent interest rates from falling. As inflation began to rise in 2022 and bond investors began selling, it had to increase its yield to spur demand and liquidity. The adjustment sent shockwaves through financial markets.

In Europe, France is home to the largest bond market at $4.4 trillion in total debt, surpassing the United Kingdom by roughly $150 billion.

Banks: A Major Buyer in Bond Markets

Like central banks around the world, commercial banks are key players in bond markets.

In fact, commercial banks are among the top three buyers of U.S. government debt. This is because commercial banks will reinvest client deposits into interest-bearing securities. These often include U.S. Treasuries, which are highly liquid and one of the safest assets globally.

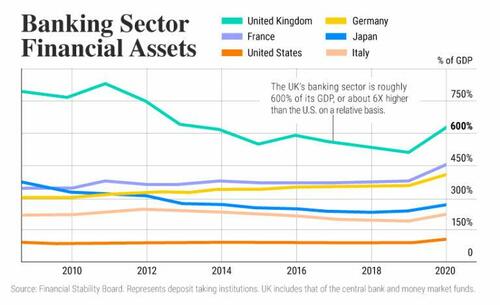

As we can see in the chart below, the banking sector often surpasses an economy’s total GDP.

As interest rates have risen sharply since 2022, the price of bonds has been pushed down, given their inverse relationship. This has raised questions about what type of bonds banks hold.

In the U.S., commercial banks hold $4.2 trillion in Treasury bonds and other government securities. For large U.S. banks, these holdings account for almost 24% of assets on average. They make up an average 15% of assets for small banks in 2023. Since mid-2022, small banks have reduced their bond holdings due to interest rate increases.

As higher rates reverberate across the banking system and wider economy, it may expose further strains on global bond markets which have expanded rapidly in an era of dovish monetary policy and ultra-low interest rates.

In 2022, the global bond market totaled $133 trillion.

As one of the world’s largest capital markets, debt securities have grown sevenfold over the last 40 years. As Visual Capitalists Dorothy Neufeld details below, government and corporate debt sales across major economies and emerging markets have fueled this dramatic growth. Over the last three years, China’s bond market has grown 13% annually.

Based on estimates from the Bank for International Statements, this graphic shows the largest bond markets in the world.

Total debt numbers here include both domestic and international debt securities in each particular country or region. BIS notes that international debt securities are issued outside the local market of the country where the borrower resides and cover eurobonds as well as foreign bonds, but exclude negotiable loans.

Ranked: The World’s Top Bond Markets

Valued at over $51 trillion, the U.S. has the largest bond market globally.

Government bonds made up the majority of its debt market, with over $26 trillion in securities outstanding. In 2022, the Federal government paid $534 billion in interest on this debt.

China is second, at 16% of the global total. Local commercial banks hold the greatest share of its outstanding bonds, while foreign ownership remains fairly low. Foreign interest in China’s bonds slowed in 2022 amid geopolitical tensions in Ukraine and lower yields.\

*Represent countries where total debt securities were not reported by national authorities. These figures are the sum of domestic debt securities reported by national authorities and/or international debt securities compiled by BIS.

Data as of Q3 2022.

As the above table shows, Japan has the third biggest debt market. Japan’s central bank owns a massive share of its government bonds. Central bank ownership hit a record 50% as it tweaked its yield curve control policy that was introduced in 2016. The policy was designed to help boost inflation and prevent interest rates from falling. As inflation began to rise in 2022 and bond investors began selling, it had to increase its yield to spur demand and liquidity. The adjustment sent shockwaves through financial markets.

In Europe, France is home to the largest bond market at $4.4 trillion in total debt, surpassing the United Kingdom by roughly $150 billion.

Banks: A Major Buyer in Bond Markets

Like central banks around the world, commercial banks are key players in bond markets.

In fact, commercial banks are among the top three buyers of U.S. government debt. This is because commercial banks will reinvest client deposits into interest-bearing securities. These often include U.S. Treasuries, which are highly liquid and one of the safest assets globally.

As we can see in the chart below, the banking sector often surpasses an economy’s total GDP.

As interest rates have risen sharply since 2022, the price of bonds has been pushed down, given their inverse relationship. This has raised questions about what type of bonds banks hold.

In the U.S., commercial banks hold $4.2 trillion in Treasury bonds and other government securities. For large U.S. banks, these holdings account for almost 24% of assets on average. They make up an average 15% of assets for small banks in 2023. Since mid-2022, small banks have reduced their bond holdings due to interest rate increases.

As higher rates reverberate across the banking system and wider economy, it may expose further strains on global bond markets which have expanded rapidly in an era of dovish monetary policy and ultra-low interest rates.

Loading…