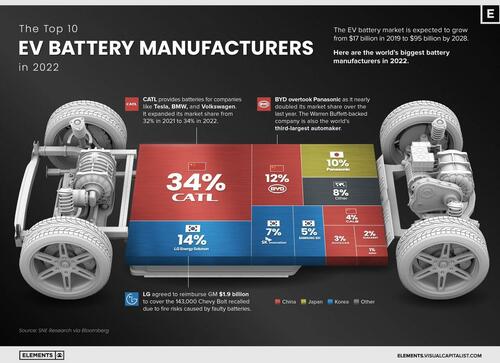

The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028.

With increasing demand to decarbonize the transportation sector, companies producing the batteries that power EVs have seen substantial momentum.

Visual Capitalist's Bruno Venditti and Sabrina Lam have updated their previous infographic to show the world’s biggest battery manufacturers in 2022.

Chinese Dominance

Despite efforts from the United States and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

The top 10 producers are all Asian companies.

Currently, Chinese companies make up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%).

The leading battery supplier, CATL, expanded its market share from 32% in 2021 to 34% in 2022. One-third of the world’s EV batteries come from the Chinese company. CATL provides lithium-ion batteries to Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo.

Despite facing strict scrutiny after EV battery-fire recalls in the United States, LG Energy Solution remains the second-biggest battery manufacturer. In 2021, the South Korean supplier agreed to reimburse General Motors $1.9 billion to cover the 143,000 Chevy Bolt EVs recalled due to fire risks from faulty batteries.

BYD took the third spot from Panasonic as it nearly doubled its market share over the last year. The Warren Buffett-backed company is the world’s third-largest automaker by market cap, but it also produces batteries sold in markets around the world. Recent sales figures point to BYD overtaking LG Energy Solution in market share the coming months or years.

The Age of Battery Power

Electric vehicles are here to stay, while internal combustion engine (ICE) vehicles are set to fade away in the coming decades. Recently, General Motors announced that it aims to stop selling ICE vehicles by 2035, while Audi plans to stop producing such models by 2033.

Besides EVs, battery technology is essential for the energy transition, providing storage capacity for intermittent solar and wind generation.

As battery makers work to supply the EV transition’s increasing demand and improve energy density in their products, we can expect more interesting developments within this industry.

The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028.

With increasing demand to decarbonize the transportation sector, companies producing the batteries that power EVs have seen substantial momentum.

Visual Capitalist’s Bruno Venditti and Sabrina Lam have updated their previous infographic to show the world’s biggest battery manufacturers in 2022.

Chinese Dominance

Despite efforts from the United States and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

The top 10 producers are all Asian companies.

Currently, Chinese companies make up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%).

The leading battery supplier, CATL, expanded its market share from 32% in 2021 to 34% in 2022. One-third of the world’s EV batteries come from the Chinese company. CATL provides lithium-ion batteries to Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo.

Despite facing strict scrutiny after EV battery-fire recalls in the United States, LG Energy Solution remains the second-biggest battery manufacturer. In 2021, the South Korean supplier agreed to reimburse General Motors $1.9 billion to cover the 143,000 Chevy Bolt EVs recalled due to fire risks from faulty batteries.

BYD took the third spot from Panasonic as it nearly doubled its market share over the last year. The Warren Buffett-backed company is the world’s third-largest automaker by market cap, but it also produces batteries sold in markets around the world. Recent sales figures point to BYD overtaking LG Energy Solution in market share the coming months or years.

The Age of Battery Power

Electric vehicles are here to stay, while internal combustion engine (ICE) vehicles are set to fade away in the coming decades. Recently, General Motors announced that it aims to stop selling ICE vehicles by 2035, while Audi plans to stop producing such models by 2033.

Besides EVs, battery technology is essential for the energy transition, providing storage capacity for intermittent solar and wind generation.

As battery makers work to supply the EV transition’s increasing demand and improve energy density in their products, we can expect more interesting developments within this industry.