For many across the U.S., hour-long transit rides and traffic jams to work have been replaced by roll-out-of-bed commutes and stand-up desks at home, leaving vacant offices behind.

Long story short, more and more offices in major U.S. cities are empty.

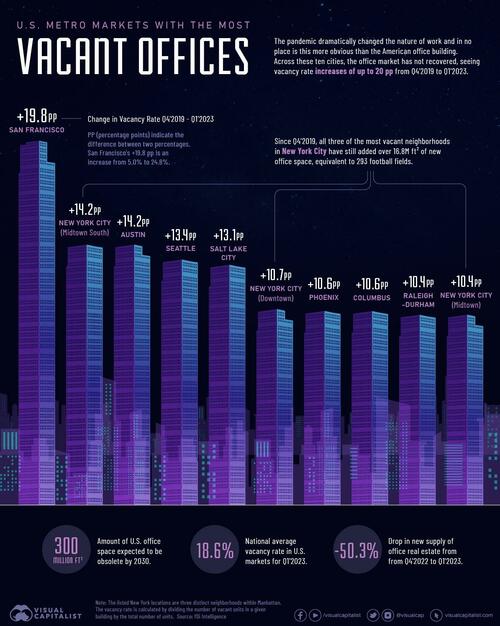

As Visual Capitalist's Avery Koop details below, at the end of March 2023, the national average vacancy rate of U.S. offices had climbed as high as 18.6%.

So how have different cities in the U.S. been impacted? This ranking uses data out of fDi Intelligence to rank the top 10 cities that have seen the biggest increases in office vacancy rates from Q4’2019 to Q1’2023.

No Vacancy

It is anticipated that by 2030, over 300 million square feet of U.S. office spaces will be obsolete.

According to Pew Research Center, around 35% of U.S. workers who can work from home in 2023 are already doing so all the time. In short, unless trends begin to reverse, offices in many cities will stay empty or continue getting emptier.

Here’s a closer look at the cities with the fastest growing vacancy rates in percentage points (p.p.) terms since just before the COVID-19 pandemic:

San Francisco has been hardest hit, with vacancy rates climbing by 19.8 p.p. in just over three years. Meanwhile, New York City has added over 16.8 million square feet, equivalent to 293 football fields, of new office space since Q4’2019 between its three most vacant neighborhoods.

However, not all of the cities with the most vacant offices are huge metropolises. Urban areas like Austin, Columbus, and Raleigh-Durham have also seen massive increases in their office vacancies, but their increasing rates may be blamed more on new construction and oversupply than to falling demand.

The Office Real Estate Market

At the national level, the supply of new office real estate has been dropping steadily since Q1’2022, down by a whopping 67% year-over-year.

Overall, it looks like U.S. office buildings are not as bustling as they once were, but there still may be opportunities for the office real estate market in growing cities.

For many across the U.S., hour-long transit rides and traffic jams to work have been replaced by roll-out-of-bed commutes and stand-up desks at home, leaving vacant offices behind.

Long story short, more and more offices in major U.S. cities are empty.

As Visual Capitalist’s Avery Koop details below, at the end of March 2023, the national average vacancy rate of U.S. offices had climbed as high as 18.6%.

So how have different cities in the U.S. been impacted? This ranking uses data out of fDi Intelligence to rank the top 10 cities that have seen the biggest increases in office vacancy rates from Q4’2019 to Q1’2023.

No Vacancy

It is anticipated that by 2030, over 300 million square feet of U.S. office spaces will be obsolete.

According to Pew Research Center, around 35% of U.S. workers who can work from home in 2023 are already doing so all the time. In short, unless trends begin to reverse, offices in many cities will stay empty or continue getting emptier.

Here’s a closer look at the cities with the fastest growing vacancy rates in percentage points (p.p.) terms since just before the COVID-19 pandemic:

San Francisco has been hardest hit, with vacancy rates climbing by 19.8 p.p. in just over three years. Meanwhile, New York City has added over 16.8 million square feet, equivalent to 293 football fields, of new office space since Q4’2019 between its three most vacant neighborhoods.

However, not all of the cities with the most vacant offices are huge metropolises. Urban areas like Austin, Columbus, and Raleigh-Durham have also seen massive increases in their office vacancies, but their increasing rates may be blamed more on new construction and oversupply than to falling demand.

The Office Real Estate Market

At the national level, the supply of new office real estate has been dropping steadily since Q1’2022, down by a whopping 67% year-over-year.

Overall, it looks like U.S. office buildings are not as bustling as they once were, but there still may be opportunities for the office real estate market in growing cities.

Loading…