Things are starting to move fast.

Overnight, AMD stunned investors when it preannounced shockingly bad revenue and margin numbers, making a mockery of its own guidance from August, and signaling that between then and now - i.e., September - the global economy fell off a cliff.

In August, AMD saw Q3 margin of 54%; today it cut it to 50%

— zerohedge (@zerohedge) October 6, 2022

In August, AMD saw $6.7BN revenue, today it cut it to $5.6BN

In September the global economy imploded

The result pummeled AMD stock, hammered its chip sector peers and has nuked the broader Nasdaq which was down 3.5% at last check.

But AMD wasn't the only one to indicate that the bottom fell off the global economy in September: moments ago Fedex stock also plunged after Reuters reported that the division of the global logistics and freight giant that handles most of the company's e-commerce deliveries plans to lower volume forecasts because its customers plan to ship fewer holiday packages, according to an internal memo obtained by Reuters.

"We expect there to be downward adjustments to volume forecasts," Paul Melander, a FedEx Ground senior vice president said in a message to the unit's delivery contractors earlier this week. The new forecasts will be available on or about Oct. 21.

"These changes will reflect the latest information from customers about how they anticipate current conditions are likely to decrease their volumes this holiday season," Melander said, confirming what we all know: in September, the global economy has hit a brick wall, and the fall out is just starting to be felt.

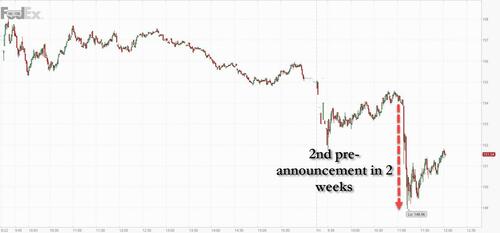

FedEx leaked a preannouncement in the form of an internal memo, which it knew would be immediately leaked to the media, to warn the market of what is coming. There was another reason: the last thing FedEx wanted was to humiliate itself with a second public preannouncement in just two weeks, following the company's shocking preannouncement from Sept 15 when new CEO Raj Subramaniam basically warned that a global recession has arrived.

“I think so. But you know, these numbers, they don’t portend very well,” Subramaniam said in response to Cramer’s question about whether the economy is “going into a worldwide recession.”

“We are a reflection of everybody else’s business, especially the high-value economy in the world,” he concluded.

Following the company's de facto second preannouncement in two weeks, FDX shares tumbled as much as 4% while peers such as UPS dropped over 3%...

... while the broader market was trading at session lows because between tech and logistics both in free fall, the only thing that can save the global economy - if only for a few months, of course - at this point is a powerful blast of either fiscal or monetary stimulus. While the former is not coming after November when Congress will be divided until at least 2024, that least only the Fed stepping in and preventing what will surely be a global depression if the Fed continues to ignore the coming bloodbath.

Things are starting to move fast.

Overnight, AMD stunned investors when it preannounced shockingly bad revenue and margin numbers, making a mockery of its own guidance from August, and signaling that between then and now – i.e., September – the global economy fell off a cliff.

In August, AMD saw Q3 margin of 54%; today it cut it to 50%

In August, AMD saw $6.7BN revenue, today it cut it to $5.6BN

In September the global economy imploded

— zerohedge (@zerohedge) October 6, 2022

The result pummeled AMD stock, hammered its chip sector peers and has nuked the broader Nasdaq which was down 3.5% at last check.

But AMD wasn’t the only one to indicate that the bottom fell off the global economy in September: moments ago Fedex stock also plunged after Reuters reported that the division of the global logistics and freight giant that handles most of the company’s e-commerce deliveries plans to lower volume forecasts because its customers plan to ship fewer holiday packages, according to an internal memo obtained by Reuters.

“We expect there to be downward adjustments to volume forecasts,” Paul Melander, a FedEx Ground senior vice president said in a message to the unit’s delivery contractors earlier this week. The new forecasts will be available on or about Oct. 21.

“These changes will reflect the latest information from customers about how they anticipate current conditions are likely to decrease their volumes this holiday season,” Melander said, confirming what we all know: in September, the global economy has hit a brick wall, and the fall out is just starting to be felt.

FedEx leaked a preannouncement in the form of an internal memo, which it knew would be immediately leaked to the media, to warn the market of what is coming. There was another reason: the last thing FedEx wanted was to humiliate itself with a second public preannouncement in just two weeks, following the company’s shocking preannouncement from Sept 15 when new CEO Raj Subramaniam basically warned that a global recession has arrived.

“I think so. But you know, these numbers, they don’t portend very well,” Subramaniam said in response to Cramer’s question about whether the economy is “going into a worldwide recession.”

“We are a reflection of everybody else’s business, especially the high-value economy in the world,” he concluded.

Following the company’s de facto second preannouncement in two weeks, FDX shares tumbled as much as 4% while peers such as UPS dropped over 3%…

… while the broader market was trading at session lows because between tech and logistics both in free fall, the only thing that can save the global economy – if only for a few months, of course – at this point is a powerful blast of either fiscal or monetary stimulus. While the former is not coming after November when Congress will be divided until at least 2024, that least only the Fed stepping in and preventing what will surely be a global depression if the Fed continues to ignore the coming bloodbath.