Shares of Salesforce Inc. are trading marginally higher in premarket on a Wall Street Journal report that a fifth activist investor, Dan Loeb's Third Point Hedge fund, has taken a stake in the software company.

Third Point's stake was reported Wednesday evening, which builds on the increasing number of activist investors taking positions in Salesforce. So far, Elliott Investment Management LP, Starboard Value LP, ValueAct Capital Partners LP, and Jeff Ubben's Inclusive Capital have taken stakes.

WSJ couldn't confirm Third Point's size of the position or future plans to overhaul the software company. They noted, "it's possible the firm will stay quiet and not launch a campaign."

Third Point has been known for pushing significant corporate change at the blue-chip level. They've done this with Campbell Soup Co., Shell PLC, and Walt Disney Co.

The swarm of activists encircling Salesforce comes as the company has lost $134 billion in market cap, down from $303 billion in November of 2021.

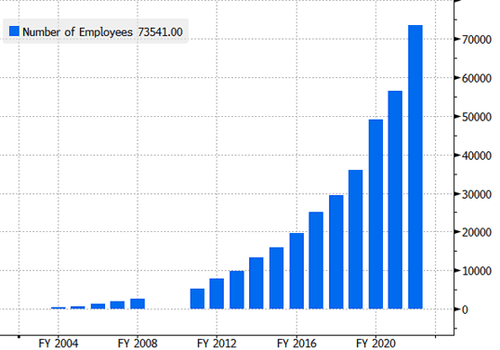

Last month, Salesforce announced a broad restructuring plan "intended to reduce operating costs, improve operating margins, and continue advancing the Company's ongoing commitment to profitable growth." Included in that plan was a reduction of 10% of its workforce. The latest SEC filings show the company has 73,541 employees.

The chart below shows Salesforce's hiring binge has peaked.

"Activism is clearly now circling the Salesforce name in droves as the massive cloud installed base, free-cash flow potential, under performing margin story, headache Slack deal, and rotating C-level suite has created the perfect storm for Benioff," said Wedbush analyst Dan Ives, who has a 'outperform' rating with a $200 price target on the stock.

"Ultimately we view this all as a much needed positive for the story to put pressure on under performing assets and strategically look at possible spin-offs over the next 6-12 months depending on outside strategic interests as well as further cost cuts," Ives added.

Salesforce shares in the premarket were about 2% higher.

How many more activist will join the party?

Shares of Salesforce Inc. are trading marginally higher in premarket on a Wall Street Journal report that a fifth activist investor, Dan Loeb’s Third Point Hedge fund, has taken a stake in the software company.

Third Point’s stake was reported Wednesday evening, which builds on the increasing number of activist investors taking positions in Salesforce. So far, Elliott Investment Management LP, Starboard Value LP, ValueAct Capital Partners LP, and Jeff Ubben’s Inclusive Capital have taken stakes.

WSJ couldn’t confirm Third Point’s size of the position or future plans to overhaul the software company. They noted, “it’s possible the firm will stay quiet and not launch a campaign.”

Third Point has been known for pushing significant corporate change at the blue-chip level. They’ve done this with Campbell Soup Co., Shell PLC, and Walt Disney Co.

The swarm of activists encircling Salesforce comes as the company has lost $134 billion in market cap, down from $303 billion in November of 2021.

Last month, Salesforce announced a broad restructuring plan “intended to reduce operating costs, improve operating margins, and continue advancing the Company’s ongoing commitment to profitable growth.” Included in that plan was a reduction of 10% of its workforce. The latest SEC filings show the company has 73,541 employees.

The chart below shows Salesforce’s hiring binge has peaked.

“Activism is clearly now circling the Salesforce name in droves as the massive cloud installed base, free-cash flow potential, under performing margin story, headache Slack deal, and rotating C-level suite has created the perfect storm for Benioff,” said Wedbush analyst Dan Ives, who has a ‘outperform’ rating with a $200 price target on the stock.

“Ultimately we view this all as a much needed positive for the story to put pressure on under performing assets and strategically look at possible spin-offs over the next 6-12 months depending on outside strategic interests as well as further cost cuts,” Ives added.

Salesforce shares in the premarket were about 2% higher.

How many more activist will join the party?

Loading…