By Jan-Patrick Barnert and Allegra Catelli, Bloomberg Markets Live reporters and strategists

This recent stock rally now needs another push to keep going, break some pivotal technical levels and get closer to overbought territory. A cool US inflation print Tuesday, garnished with some friendly words out of the US-China meeting later, would be just the right dish to serve to the bulls.

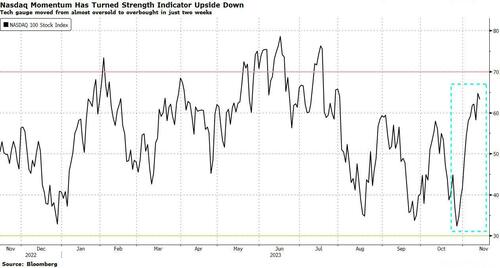

For the moment, US stocks look a touch hotter than Europe’s, with the Nasdaq 100 leading the charge, once again thanks to the relentless performance contribution from the “Magnificent 7.” The tech gauge has moved from close to oversold to near overbought in just two weeks, and is the first developed-market benchmark to flash the 60-day high-range indicator in our momentum tracker.

What looked like a fading trade as stocks arrived at or approached their downtrend levels last Thursday could now potentially morph into a breakout play. The week isn’t short of potential triggers, with today’s US inflation reading the first, followed by retail data, PPI and jobs later this week. European GDP and French CPI add to the macro mix. And then there are more signs of thawing US-China ties emerging ahead of the meeting between Joe Biden and Xi Jinping later this week.

“It’s hard to look much beyond Tuesday’s US CPI as the key highlight of the week but US retail sales will be a big driver of GDP forecasts,” notes Deutsche Bank’s Macro Strategist Jim Reid. “Something that will sneak up on markets will be the potential US government shutdown on Friday.”

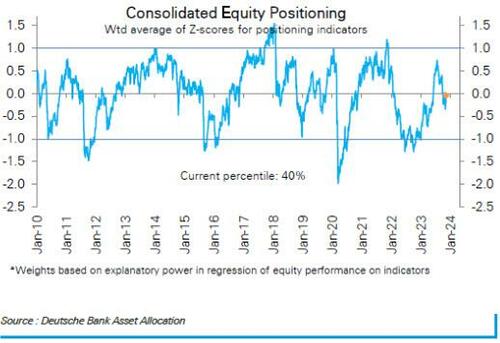

Sector rotation in Europe suggests a pro-cyclical approach is prevailing, with real estate, industrials, autos and construction stocks all outperforming the wider Stoxx 600 benchmark. Factors look a touch more defensive as styles like value, dividends, size and quality lead on performance since the end of October. Meanwhile, general positioning still doesn’t suggest that buyers are running scarce, with data compiled by Deutsche Bank showing a neutral stance with more upside in store should investors actually start chasing.

And while a decline in US inflation is widely expected and market reaction today might be limited, it would still add to the Goldilocks narrative supporting risk assets, with the economy remaining resilient and disinflation allowing the Fed to cut in 2024, says Skylar Montgomery Koning, a senior global macro strategist at TS Lombard.

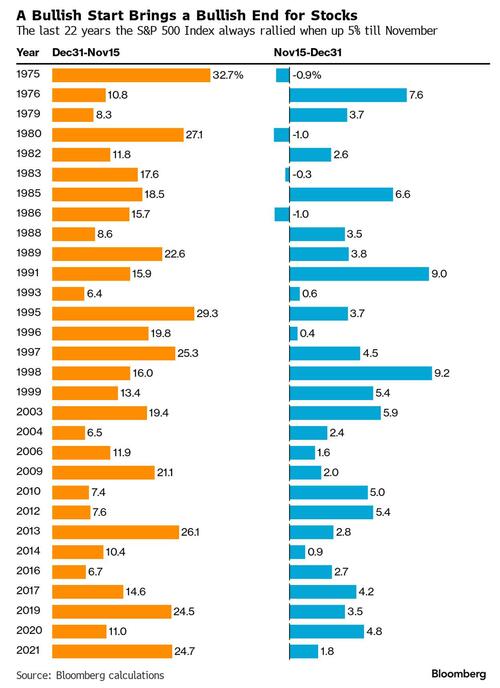

The much-cited seasonal pattern for a year-end rally is still intact, but here is another statistic supporting an even more bullish view on the final weeks of trading. In the past 22 years, when the S&P 500 was up 5% or more by mid-November, the remainder of that year was positive every single time. Go back 50 years, and that setup was positive 26 out of 30 times, with the decline in the four exceptions being 1% or less.

Peter Chatwell, head of global macro strategies trading at Mizuho International, notes that “event risk is low at this point in the year, and some key technical levels have been broken in e-mini futures; we probably need a large upside surprise in CPI to generate a selloff.”

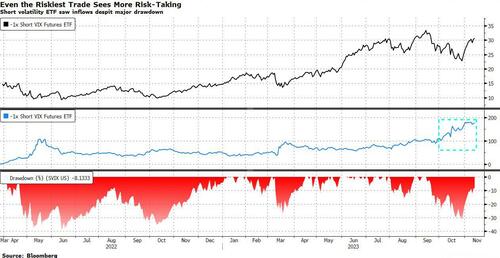

More signs of prevailing bullishness in the market, even in some of the positions that were challenged recently, can be found in short-volatility trades. Selling options and being short volatility was among the best-performing trades of 2023, with the SVIX ETF gaining as much as 127% before taking its biggest hit in a year. Yet instead of fleeing a trade that is often considered “picking up pennies in front of a bulldozer,” investors increased assets in the fund by almost 70%. Some might even call this a sign of market exuberance, considering it’s a position that can go from 100 to zero in a matter of days.

To complete this roundup of bullish indicators, let’s turn to the sell-side strategists who are playing along with the positive sentiment. Investors are overly concerned about the weakening outlook for US corporate earnings, according to Goldman Sachs strategists; RBC flagged a bullish signal, and Morgan Stanley started the 2024 prediction game with upbeat comments on buying opportunities in US assets next year.

By Jan-Patrick Barnert and Allegra Catelli, Bloomberg Markets Live reporters and strategists

This recent stock rally now needs another push to keep going, break some pivotal technical levels and get closer to overbought territory. A cool US inflation print Tuesday, garnished with some friendly words out of the US-China meeting later, would be just the right dish to serve to the bulls.

For the moment, US stocks look a touch hotter than Europe’s, with the Nasdaq 100 leading the charge, once again thanks to the relentless performance contribution from the “Magnificent 7.” The tech gauge has moved from close to oversold to near overbought in just two weeks, and is the first developed-market benchmark to flash the 60-day high-range indicator in our momentum tracker.

What looked like a fading trade as stocks arrived at or approached their downtrend levels last Thursday could now potentially morph into a breakout play. The week isn’t short of potential triggers, with today’s US inflation reading the first, followed by retail data, PPI and jobs later this week. European GDP and French CPI add to the macro mix. And then there are more signs of thawing US-China ties emerging ahead of the meeting between Joe Biden and Xi Jinping later this week.

“It’s hard to look much beyond Tuesday’s US CPI as the key highlight of the week but US retail sales will be a big driver of GDP forecasts,” notes Deutsche Bank’s Macro Strategist Jim Reid. “Something that will sneak up on markets will be the potential US government shutdown on Friday.”

Sector rotation in Europe suggests a pro-cyclical approach is prevailing, with real estate, industrials, autos and construction stocks all outperforming the wider Stoxx 600 benchmark. Factors look a touch more defensive as styles like value, dividends, size and quality lead on performance since the end of October. Meanwhile, general positioning still doesn’t suggest that buyers are running scarce, with data compiled by Deutsche Bank showing a neutral stance with more upside in store should investors actually start chasing.

And while a decline in US inflation is widely expected and market reaction today might be limited, it would still add to the Goldilocks narrative supporting risk assets, with the economy remaining resilient and disinflation allowing the Fed to cut in 2024, says Skylar Montgomery Koning, a senior global macro strategist at TS Lombard.

The much-cited seasonal pattern for a year-end rally is still intact, but here is another statistic supporting an even more bullish view on the final weeks of trading. In the past 22 years, when the S&P 500 was up 5% or more by mid-November, the remainder of that year was positive every single time. Go back 50 years, and that setup was positive 26 out of 30 times, with the decline in the four exceptions being 1% or less.

Peter Chatwell, head of global macro strategies trading at Mizuho International, notes that “event risk is low at this point in the year, and some key technical levels have been broken in e-mini futures; we probably need a large upside surprise in CPI to generate a selloff.”

More signs of prevailing bullishness in the market, even in some of the positions that were challenged recently, can be found in short-volatility trades. Selling options and being short volatility was among the best-performing trades of 2023, with the SVIX ETF gaining as much as 127% before taking its biggest hit in a year. Yet instead of fleeing a trade that is often considered “picking up pennies in front of a bulldozer,” investors increased assets in the fund by almost 70%. Some might even call this a sign of market exuberance, considering it’s a position that can go from 100 to zero in a matter of days.

To complete this roundup of bullish indicators, let’s turn to the sell-side strategists who are playing along with the positive sentiment. Investors are overly concerned about the weakening outlook for US corporate earnings, according to Goldman Sachs strategists; RBC flagged a bullish signal, and Morgan Stanley started the 2024 prediction game with upbeat comments on buying opportunities in US assets next year.

Loading…