Elevators. They get us from here to there in buildings across cities all around the country. But other than that, they are little considered or thought about. Perhaps until now.

That's because Bisnow is reporting that many of New York City's over 70,000 elevators in subway stations, offices, stores, and residential towers are set to be replaced or modernized. And replacing each can cost up to $500,000 and take a year—a hefty expense landlords may soon face.

Elevators typically last 20 to 25 years, and many are nearing their end. Of 23 million units globally, over 7 million are already 20+ years old, with more replacements looming. In New York, new policies, health standards, and aging systems are driving the urgent need for elevator upgrades.

Joe Bera, vice president of modernization sales and fulfillment of Schindler Elevator Corp., said: “I've been in modernization for most of my career, 30 years, and I've never seen the market like it is today. This market has been growing about 5% a year for the last five years.”

The rising demand for elevator upgrades stems largely from the 1990 Americans with Disabilities Act (ADA), which set stricter requirements for elevator design and placement, according to the Bisnow report.

This led many landlords to update their systems for compliance.

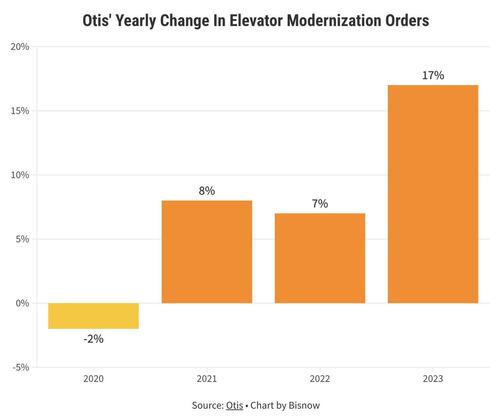

The 2000s construction boom, adding new skyscrapers in Manhattan, further increased demand. Otis, the world’s largest elevator manufacturer, has seen modernization orders surge, up 17% last year after growth in the previous two years.

Crawford Green, Otis vice president of modernization acceleration in the Americas, said: “The big push is, ‘How do we get that growing backlog into process? So we don't have a clog in the funnel.”

The report says that the aging of elevators can be planned for, but unexpected office renovations and new policies can catch landlords off guard.

The pandemic-driven shift to remote work has sparked a move toward high-quality office spaces. In New York, availability in top-tier buildings dropped slightly this year, while over 1M SF of Class-B space opened up as tenants sought better spaces, per JLL data.

To attract tenants, landlords are investing heavily in renovations, including elevator upgrades. Modern systems feature touch screens, faster cars, and advanced tech like AI and facial recognition. Multifamily buildings have also upgraded to meet growing resident demands for better amenities.

Elevators. They get us from here to there in buildings across cities all around the country. But other than that, they are little considered or thought about. Perhaps until now.

That’s because Bisnow is reporting that many of New York City’s over 70,000 elevators in subway stations, offices, stores, and residential towers are set to be replaced or modernized. And replacing each can cost up to $500,000 and take a year—a hefty expense landlords may soon face.

Elevators typically last 20 to 25 years, and many are nearing their end. Of 23 million units globally, over 7 million are already 20+ years old, with more replacements looming. In New York, new policies, health standards, and aging systems are driving the urgent need for elevator upgrades.

Joe Bera, vice president of modernization sales and fulfillment of Schindler Elevator Corp., said: “I’ve been in modernization for most of my career, 30 years, and I’ve never seen the market like it is today. This market has been growing about 5% a year for the last five years.”

The rising demand for elevator upgrades stems largely from the 1990 Americans with Disabilities Act (ADA), which set stricter requirements for elevator design and placement, according to the Bisnow report.

This led many landlords to update their systems for compliance.

The 2000s construction boom, adding new skyscrapers in Manhattan, further increased demand. Otis, the world’s largest elevator manufacturer, has seen modernization orders surge, up 17% last year after growth in the previous two years.

Crawford Green, Otis vice president of modernization acceleration in the Americas, said: “The big push is, ‘How do we get that growing backlog into process? So we don’t have a clog in the funnel.”

The report says that the aging of elevators can be planned for, but unexpected office renovations and new policies can catch landlords off guard.

The pandemic-driven shift to remote work has sparked a move toward high-quality office spaces. In New York, availability in top-tier buildings dropped slightly this year, while over 1M SF of Class-B space opened up as tenants sought better spaces, per JLL data.

To attract tenants, landlords are investing heavily in renovations, including elevator upgrades. Modern systems feature touch screens, faster cars, and advanced tech like AI and facial recognition. Multifamily buildings have also upgraded to meet growing resident demands for better amenities.

Loading…