By Michael Every of Rabobank

Three Years And Five-To-Ten Years On

Three years ago today, Russia invaded Ukraine. As we now stagger towards a possible negotiated end to the conflict --or at least a pause to rearm-- the world around us is vastly changed even if some politicians and many in markets still don’t fully grasp just how much.

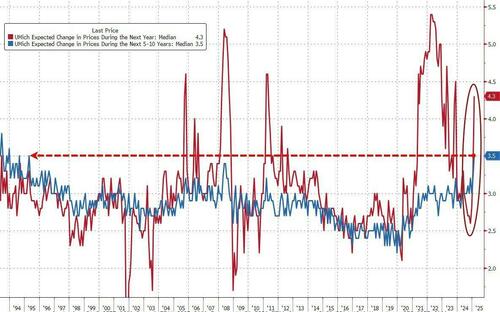

Inflation was supposed to be over after the initial Ukraine energy shock, or so we keep being told by central banks. However, Friday’s US Michigan consumer survey’s 5- to 10-year inflation expectations rose to 3.5%, the highest in 30 years. For younger/“I don’t do geopolitics” readers, that was the early post-Cold War era of US hyperpower globalization now ending; and it shows Main Street gets something Wall Street is struggling to accept.

Meanwhile, another flurry of Friday White House economic statecraft executive orders threatened to further upend the global trading and financial system and take us back not to the 1990s, nor the 1980s, but perhaps the 1880s.

‘America First Investment Policy’ argues: “Economic security is national security,” and “Investment at all costs is not always in the national interest.” The US FDI screening agency will now block Chinese investments in US tech, food supplies, farmland, minerals, natural resources, ports, and shipping terminals. The US will “fast-track” friendly tech FDI, provided it can prove it has distanced itself from China. It will also use all necessary legal instruments to deter investment into China’s military-industrial sector, which given the latter’s civil-military fusion policy covers a lot - and this is just as Wall Street started to get bullish on Chinese tech stocks.

The US Trade Representative proposed charging Chinese ocean carriers, and those who use Chinese-built ships, for entering US ports. $1,000 per net tonne, up to $1m max ($1.5m for Chinese built and operated ships) is the fee, on a sliding scale even if fleet reshuffling meant they did not come to the US. That could force fleet bifurcation, as with the global ‘shadow fleet’ carrying Russian oil. So will quotas for US cargo exports to be carried on American ships. At first, 1% of all US container, dry bulk, and tanker exports on US-flagged and operated vessels; after two years, 3%; after three years, 5%, with 3% on US-built vessels; and after year seven years, 15%, with 5% US-built. This means a lot of ships must be reflagged; a lot of crews trained (“Learn to sail”); and a lot of shipyards and shipbuilding required. The economic impact is enormous: industry experts suggest it would push up freight rates 15-20%. This all echoes US mercantilist merchant marine history I flagged as something we could logically see reoccur in 2021’s ‘In Deep Ship’.

(On which, Australia and New Zealand were both just shocked by a Chinese warship popping up in the Tasman Sea test-firing its guns and disrupting flights into Sydney airport: and those in the Antipodes who thought geopolitics only happens far from their shores, and they don’t really need defence spending.)

That Trump ‘Grand Macro Strategy’ looks like “US + allies vs. China” than “US alone” but would force hard choices on those trying to play both sides. Indeed, the official list of US “foreign adversaries” in the executive order now includes Hong Kong. What does that say about the outlook for markets there?!

The same is evident in the US asking Mexico to raise its external tariffs on China (and enforce them) as a quid pro quo for the US not imposing tariffs on it. Canada next? If so, is it join a North American bloc (with reshuffled key industries) and a common external tariff against China and third parties who could transship Chinese goods, or do without the US market? This was argued as the likely economic statecraft angle when tariffs on Mexico and Canada were first announced, and while less disruptive than a global all vs. all, it would still be a huge blow.

As that Great Game is played, we also see:

- Ukraine’s President Zelenskyy has offered to step down if it brings peace and allows Ukraine NATO entry, though it remains to be seen if those are compatible goals, or if NATO still means anything.

- Polish President Duda, set to spend 6% of GDP on defense, flew to the US for a meeting with President Trump and was snubbed: he was kept waiting 90 minutes, then only got a 10-minute slot not the promised hour, with zero US commitments. If this is what Poland gets, what about everyone else in Europe? It’s UK PM Starmer’s turn to go to the US this week, and he seems to think that a promise to boost defence spending from 2.3% to 2.5% of GDP going forwards is going to win him US praise.

- The German election results mean a likely CDU-SDP coalition government after the far-left BSW party, like the liberal FDP, seemingly just fell under the 5% threshold to enter the Bundestag. It’s far from clear if this will be a government capable of acting rapidly and radically enough to address the vast challenges it faces. If not, some commentators are warning that the AfD is waiting in the wings.

Next Chancellor Merz, despite being congratulated by President Trump, has already stated:

- NATO “may soon be dead”;

- Europe needs “strategic autonomy”; and

- Germany needs “independence from the US”

Does that include removing the 50,000 US troops stationed in Germany? It apparently means Berlin requesting France and the UK extend their nuclear umbrellas to it. Yet Germany is going to have to give to get, and giving is expensive.

We are talking about a *vast* German, and European spending bill ahead – or Draghi’s “slow agony” greatly speeded up. We had already estimated that pursuing ‘strategic autonomy’ would cost up 4-5% of EU GDP annually, which the Draghi report assumed would come from the private sector, and we didn’t. That was before President Trump shook everything up. Indeed, it would take 3% of GDP extra on defence alone for Europe to get serious, and that doesn’t include any of the costs of dealing with supply chains, energy, commodity stockpiles, subsidies, industrial policy, tech investment, and social cohesion. It was also before Friday’s latest White House executive orders made a “with us or against us” global trade, technology, capital flows, and maritime supply chain bifurcation even more likely.

The market is so far reacting to the German election with a stronger Euro. When one thinks about the clashing grand macro strategies here, and who can press their claims hardest, that reaction does not appear logical: then again, markets are still full of people who think we are still in the now-defunct world of macrostrategy.

Underlining that we aren’t, Hungary has announced a lifetime income tax exemption for mothers who have two or three children, as part of its ‘Year of the Breakthrough’ to address demographic decline.

So, in three years we have moved to a US consumer 5- to 10-year inflation expectation of 3.5% and worries over the future of Ukraine; and the EU; and NATO; and liberal democracy; and the re-emergence of not just 1990’s but 1980’s and 1880’s economic statecraft and mercantilism, and neo-imperialism and ‘spheres of influence’. Where do you think all the above will be in another three years, or in five to ten? So, where do you think markets should be trading?

By Michael Every of Rabobank

Three Years And Five-To-Ten Years On

Three years ago today, Russia invaded Ukraine. As we now stagger towards a possible negotiated end to the conflict –or at least a pause to rearm– the world around us is vastly changed even if some politicians and many in markets still don’t fully grasp just how much.

Inflation was supposed to be over after the initial Ukraine energy shock, or so we keep being told by central banks. However, Friday’s US Michigan consumer survey’s 5- to 10-year inflation expectations rose to 3.5%, the highest in 30 years. For younger/“I don’t do geopolitics” readers, that was the early post-Cold War era of US hyperpower globalization now ending; and it shows Main Street gets something Wall Street is struggling to accept.

Meanwhile, another flurry of Friday White House economic statecraft executive orders threatened to further upend the global trading and financial system and take us back not to the 1990s, nor the 1980s, but perhaps the 1880s.

‘America First Investment Policy’ argues: “Economic security is national security,” and “Investment at all costs is not always in the national interest.” The US FDI screening agency will now block Chinese investments in US tech, food supplies, farmland, minerals, natural resources, ports, and shipping terminals. The US will “fast-track” friendly tech FDI, provided it can prove it has distanced itself from China. It will also use all necessary legal instruments to deter investment into China’s military-industrial sector, which given the latter’s civil-military fusion policy covers a lot – and this is just as Wall Street started to get bullish on Chinese tech stocks.

The US Trade Representative proposed charging Chinese ocean carriers, and those who use Chinese-built ships, for entering US ports. $1,000 per net tonne, up to $1m max ($1.5m for Chinese built and operated ships) is the fee, on a sliding scale even if fleet reshuffling meant they did not come to the US. That could force fleet bifurcation, as with the global ‘shadow fleet’ carrying Russian oil. So will quotas for US cargo exports to be carried on American ships. At first, 1% of all US container, dry bulk, and tanker exports on US-flagged and operated vessels; after two years, 3%; after three years, 5%, with 3% on US-built vessels; and after year seven years, 15%, with 5% US-built. This means a lot of ships must be reflagged; a lot of crews trained (“Learn to sail”); and a lot of shipyards and shipbuilding required. The economic impact is enormous: industry experts suggest it would push up freight rates 15-20%. This all echoes US mercantilist merchant marine history I flagged as something we could logically see reoccur in 2021’s ‘In Deep Ship’.

(On which, Australia and New Zealand were both just shocked by a Chinese warship popping up in the Tasman Sea test-firing its guns and disrupting flights into Sydney airport: and those in the Antipodes who thought geopolitics only happens far from their shores, and they don’t really need defence spending.)

That Trump ‘Grand Macro Strategy’ looks like “US + allies vs. China” than “US alone” but would force hard choices on those trying to play both sides. Indeed, the official list of US “foreign adversaries” in the executive order now includes Hong Kong. What does that say about the outlook for markets there?!

The same is evident in the US asking Mexico to raise its external tariffs on China (and enforce them) as a quid pro quo for the US not imposing tariffs on it. Canada next? If so, is it join a North American bloc (with reshuffled key industries) and a common external tariff against China and third parties who could transship Chinese goods, or do without the US market? This was argued as the likely economic statecraft angle when tariffs on Mexico and Canada were first announced, and while less disruptive than a global all vs. all, it would still be a huge blow.

As that Great Game is played, we also see:

- Ukraine’s President Zelenskyy has offered to step down if it brings peace and allows Ukraine NATO entry, though it remains to be seen if those are compatible goals, or if NATO still means anything.

- Polish President Duda, set to spend 6% of GDP on defense, flew to the US for a meeting with President Trump and was snubbed: he was kept waiting 90 minutes, then only got a 10-minute slot not the promised hour, with zero US commitments. If this is what Poland gets, what about everyone else in Europe? It’s UK PM Starmer’s turn to go to the US this week, and he seems to think that a promise to boost defence spending from 2.3% to 2.5% of GDP going forwards is going to win him US praise.

- The German election results mean a likely CDU-SDP coalition government after the far-left BSW party, like the liberal FDP, seemingly just fell under the 5% threshold to enter the Bundestag. It’s far from clear if this will be a government capable of acting rapidly and radically enough to address the vast challenges it faces. If not, some commentators are warning that the AfD is waiting in the wings.

Next Chancellor Merz, despite being congratulated by President Trump, has already stated:

- NATO “may soon be dead”;

- Europe needs “strategic autonomy”; and

- Germany needs “independence from the US”

Does that include removing the 50,000 US troops stationed in Germany? It apparently means Berlin requesting France and the UK extend their nuclear umbrellas to it. Yet Germany is going to have to give to get, and giving is expensive.

We are talking about a *vast* German, and European spending bill ahead – or Draghi’s “slow agony” greatly speeded up. We had already estimated that pursuing ‘strategic autonomy’ would cost up 4-5% of EU GDP annually, which the Draghi report assumed would come from the private sector, and we didn’t. That was before President Trump shook everything up. Indeed, it would take 3% of GDP extra on defence alone for Europe to get serious, and that doesn’t include any of the costs of dealing with supply chains, energy, commodity stockpiles, subsidies, industrial policy, tech investment, and social cohesion. It was also before Friday’s latest White House executive orders made a “with us or against us” global trade, technology, capital flows, and maritime supply chain bifurcation even more likely.

The market is so far reacting to the German election with a stronger Euro. When one thinks about the clashing grand macro strategies here, and who can press their claims hardest, that reaction does not appear logical: then again, markets are still full of people who think we are still in the now-defunct world of macrostrategy.

Underlining that we aren’t, Hungary has announced a lifetime income tax exemption for mothers who have two or three children, as part of its ‘Year of the Breakthrough’ to address demographic decline.

So, in three years we have moved to a US consumer 5- to 10-year inflation expectation of 3.5% and worries over the future of Ukraine; and the EU; and NATO; and liberal democracy; and the re-emergence of not just 1990’s but 1980’s and 1880’s economic statecraft and mercantilism, and neo-imperialism and ‘spheres of influence’. Where do you think all the above will be in another three years, or in five to ten? So, where do you think markets should be trading?

Loading…