By Stefan Koopman, Senior macro strategist at Rabobank

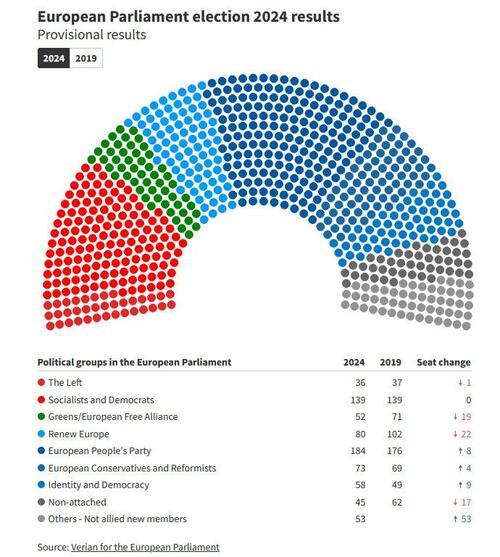

The European elections saw the centre hold its ground, albeit narrowly. The European People’s Party is poised to secure 184 seats in the new 720-seat Parliament, with the Socialists and the centrist Renew obtaining 139 and 80 seats respectively. This totals 403 seats for the grand coalition, a decrease from their current 417 seats in the old 705-seat Parliament. The hard-right ECR alliance of Giorga Meloni’s Fratelli d’Italia and the Polish nationalists are projected to rank fourth, with 73 seats, while the far-right Identity & Democracy group is expected to gain 58 seats. The Greens suffered a significant loss, dropping to sixth place with 52 seats, with the Left following at 36 seats, a slight decrease. There are also 45 seats for non-attached members, and 53 newly elected members that are not allied to any of the political groups yet. The overall left-right balance aligns with projections that indicated a lean but not a lurch to the right.

The coming weeks will see national parties formally choosing their European groups and this may alter the seat numbers. The battle for top positions commences at this week’s G7. The most coveted roles are the presidencies of the European Commission, European Council, European Parliament, and the EU Foreign Affairs Chief. The first EU summit of government leaders will be on June 27 and 28, where they will seek to nominate the new president of the European Commission. Nominations for the new European Commissioners will follow after the summer, with all nominees appearing at hearings in the European Parliament in the autumn. The new European Commission then begins on December 1, if everything goes according to plan.

So there’s still a long road ahead, but the implications are clear. Despite the center maintaining the majority, this is the most right-wing European Parliament ever elected. The results signal a European shift towards conservative and radical-right policies and away from progressive and green politics. The center will have to accommodate this shift over the coming years and will sometimes have to lean right to maintain a majority. It means that internal EPP politics will be a major factor in the direction of European policy, being both the median and the largest party in this parliament. We discussed our take on this here.

The Sunday Surprise was in Paris, not Brussels. Following a drubbing in the European election, French President Macron decided it was time to play some 3D Chess and to call a snap parliamentary election for June 30 and July 7, just a fortnight before the start of the Olympics. With this bold move he is putting Le Pen’s Rassemblement National, which dominated yesterday’s election by securing 31.5% of the votes, to the test. The two-round system often presents difficulties for populist parties, making it possible that the far-right may not achieve an outright majority. However, even if they triumph and RN’s Bardella does assume the role of Prime Minister, Macron’s calculation appears to be based on the assumption that if they underperform, they’ll be in a much weaker position for the 2027 presidential election. He also seems intent on compelling the Socialists and the Republicans to join the majority, which would likewise put them at a disadvantage in the 2027 election. This particularly places Melenchon, who aims to consolidate the entire left ahead of that election, in a difficult position. His courage is undeniable, we’d give him that, but it seems like doubling down on a bet after a poor performance.

Adresse aux Français. https://t.co/sqVqfH3gXy

— Emmanuel Macron (@EmmanuelMacron) June 9, 2024

Investors don’t share Macron’s risk appetite. The euro is the worst performing G10 currency this morning, trading at 1.075 at the time of writing. The CAC 40 is down 1.5%, dragging the Euro Stoxx 50 lower towards a -1.2% loss. Yields on EGBs are rising, with spreads widening, including France’s. The 10-year note now yields 3.17%, up 8 basis points on Friday’s close.

This follows the losses suffered by the EUR on Friday afternoon, after a ‘hot’ NFP report indicated that the US economy added 272,000 jobs in May, surpassing the consensus forecast once again. The unemployment rate slightly increased to 4.0%, and average hourly earnings rose by 0.4% monthly, to an annual rate of 4.1%.

It was one of those reports that serves as a reminder that the Employment Report is based on two separate surveys, with a lot of noise in the establishment survey and even more noise in the household survey. They now present two different perspectives on the labor market: one suggests steady, broad-based, and solid hiring, while the other indicates a sharp slowdown in hiring over the past year, with unemployment and underemployment ticking higher. Throwing last week’s JOLTS report in the mix too, the overall picture is of a solid labor market that is showing signs of loosening, appearing increasingly more ‘pre-pandemic’ than ‘post-pandemic’. It also implies that the US needs a higher rate of job growth to maintain the unemployment rate, possibly due to the surge in immigration. The ‘breakeven pace’ of monthly job growth may be significantly higher than the generally assumed 100-150k. The upshot is that the labor market may not be as hot as the headline NFP’s suggest.

By Stefan Koopman, Senior macro strategist at Rabobank

The European elections saw the centre hold its ground, albeit narrowly. The European People’s Party is poised to secure 184 seats in the new 720-seat Parliament, with the Socialists and the centrist Renew obtaining 139 and 80 seats respectively. This totals 403 seats for the grand coalition, a decrease from their current 417 seats in the old 705-seat Parliament. The hard-right ECR alliance of Giorga Meloni’s Fratelli d’Italia and the Polish nationalists are projected to rank fourth, with 73 seats, while the far-right Identity & Democracy group is expected to gain 58 seats. The Greens suffered a significant loss, dropping to sixth place with 52 seats, with the Left following at 36 seats, a slight decrease. There are also 45 seats for non-attached members, and 53 newly elected members that are not allied to any of the political groups yet. The overall left-right balance aligns with projections that indicated a lean but not a lurch to the right.

The coming weeks will see national parties formally choosing their European groups and this may alter the seat numbers. The battle for top positions commences at this week’s G7. The most coveted roles are the presidencies of the European Commission, European Council, European Parliament, and the EU Foreign Affairs Chief. The first EU summit of government leaders will be on June 27 and 28, where they will seek to nominate the new president of the European Commission. Nominations for the new European Commissioners will follow after the summer, with all nominees appearing at hearings in the European Parliament in the autumn. The new European Commission then begins on December 1, if everything goes according to plan.

So there’s still a long road ahead, but the implications are clear. Despite the center maintaining the majority, this is the most right-wing European Parliament ever elected. The results signal a European shift towards conservative and radical-right policies and away from progressive and green politics. The center will have to accommodate this shift over the coming years and will sometimes have to lean right to maintain a majority. It means that internal EPP politics will be a major factor in the direction of European policy, being both the median and the largest party in this parliament. We discussed our take on this here.

The Sunday Surprise was in Paris, not Brussels. Following a drubbing in the European election, French President Macron decided it was time to play some 3D Chess and to call a snap parliamentary election for June 30 and July 7, just a fortnight before the start of the Olympics. With this bold move he is putting Le Pen’s Rassemblement National, which dominated yesterday’s election by securing 31.5% of the votes, to the test. The two-round system often presents difficulties for populist parties, making it possible that the far-right may not achieve an outright majority. However, even if they triumph and RN’s Bardella does assume the role of Prime Minister, Macron’s calculation appears to be based on the assumption that if they underperform, they’ll be in a much weaker position for the 2027 presidential election. He also seems intent on compelling the Socialists and the Republicans to join the majority, which would likewise put them at a disadvantage in the 2027 election. This particularly places Melenchon, who aims to consolidate the entire left ahead of that election, in a difficult position. His courage is undeniable, we’d give him that, but it seems like doubling down on a bet after a poor performance.

Adresse aux Français. https://t.co/sqVqfH3gXy

— Emmanuel Macron (@EmmanuelMacron) June 9, 2024

Investors don’t share Macron’s risk appetite. The euro is the worst performing G10 currency this morning, trading at 1.075 at the time of writing. The CAC 40 is down 1.5%, dragging the Euro Stoxx 50 lower towards a -1.2% loss. Yields on EGBs are rising, with spreads widening, including France’s. The 10-year note now yields 3.17%, up 8 basis points on Friday’s close.

This follows the losses suffered by the EUR on Friday afternoon, after a ‘hot’ NFP report indicated that the US economy added 272,000 jobs in May, surpassing the consensus forecast once again. The unemployment rate slightly increased to 4.0%, and average hourly earnings rose by 0.4% monthly, to an annual rate of 4.1%.

It was one of those reports that serves as a reminder that the Employment Report is based on two separate surveys, with a lot of noise in the establishment survey and even more noise in the household survey. They now present two different perspectives on the labor market: one suggests steady, broad-based, and solid hiring, while the other indicates a sharp slowdown in hiring over the past year, with unemployment and underemployment ticking higher. Throwing last week’s JOLTS report in the mix too, the overall picture is of a solid labor market that is showing signs of loosening, appearing increasingly more ‘pre-pandemic’ than ‘post-pandemic’. It also implies that the US needs a higher rate of job growth to maintain the unemployment rate, possibly due to the surge in immigration. The ‘breakeven pace’ of monthly job growth may be significantly higher than the generally assumed 100-150k. The upshot is that the labor market may not be as hot as the headline NFP’s suggest.

Loading…