By Vincent Cignarella, Bloomberg Markets Live reporter and strategist

Markets on Friday latched onto positive news from the University of Michigan sentiment survey. US consumers tempered inflation expectations in the second half of May, compared with earlier in the month, though high prices continue to weigh on sentiment. The news brought hope to market bulls that next weeks PCE readings would offer further signs inflation may be easing and so the countdown to the first Fed rate cut can commence.

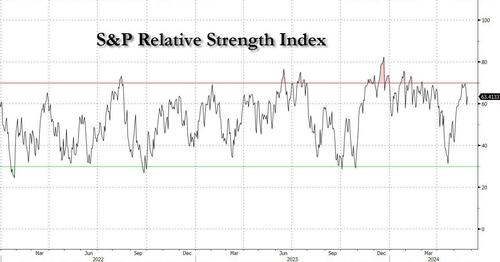

Still, the bullish momentum that has carried the load for the month of May does show indications of running out of steam. One would have hoped that Thursday’s big selloff would have primed markets to cheer the opportunity to buy the dip, but investors stepped cautiously instead.

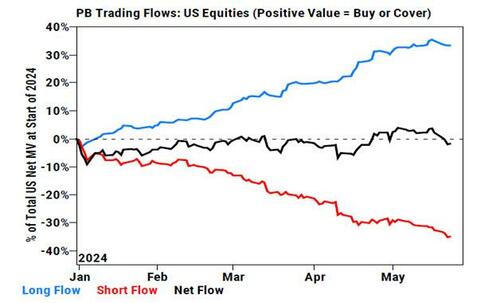

Maybe that was linked to the long US weekend, but the tape looks tired. As we head into the end of the month and into the summer, it remains to be seen if investors will continue to shrug off bad news and embrace the rally or take the bad news and run to the nearest exits (according to Goldman's prime brokerage, it's not looking good: see "Hedge Funds Sold Stocks At The Fastest Pace Since January").

Trading ahead of the US open on Tuesday after the long weekend will be telling as regards market appetite for risk. While most pundits remain confident, my feel is the traders are taking on a more cautious tone.

The mantra of sell in May and go away may still hold true, it’s just the bears may have had to wait for near the end of the month for it to come true.

By Vincent Cignarella, Bloomberg Markets Live reporter and strategist

Markets on Friday latched onto positive news from the University of Michigan sentiment survey. US consumers tempered inflation expectations in the second half of May, compared with earlier in the month, though high prices continue to weigh on sentiment. The news brought hope to market bulls that next weeks PCE readings would offer further signs inflation may be easing and so the countdown to the first Fed rate cut can commence.

Still, the bullish momentum that has carried the load for the month of May does show indications of running out of steam. One would have hoped that Thursday’s big selloff would have primed markets to cheer the opportunity to buy the dip, but investors stepped cautiously instead.

Maybe that was linked to the long US weekend, but the tape looks tired. As we head into the end of the month and into the summer, it remains to be seen if investors will continue to shrug off bad news and embrace the rally or take the bad news and run to the nearest exits (according to Goldman’s prime brokerage, it’s not looking good: see “Hedge Funds Sold Stocks At The Fastest Pace Since January“).

Trading ahead of the US open on Tuesday after the long weekend will be telling as regards market appetite for risk. While most pundits remain confident, my feel is the traders are taking on a more cautious tone.

The mantra of sell in May and go away may still hold true, it’s just the bears may have had to wait for near the end of the month for it to come true.

Loading…