The commodity supercycle intermission is ongoing, but the structural thesis remains in tact (see our original thesis from Oct 2020 here). We have been helping clients manage their commodities exposure this year, balancing structural tailwinds, cyclical headwinds and tactical signals. The below is an excerpt from our July 26th report.

In our May Leading Indicator Watch, we wrote:

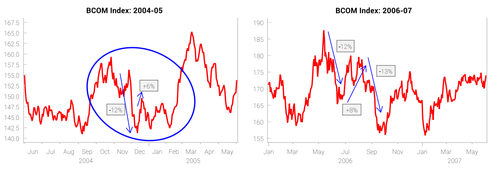

“Our commodity supercycle thesis could be due for an intermission similar to 4Q04, or 2H06 when commodities traded sideways with a lot of volatility.”

We expect large swings and little directional bias to define the trading environment for the rest of 2022. 4Q04 and 2H06 are close analogs for today’s price action. Both had violent swings within the 2000s supercycle.

Since our May report, the “demand-destruction” narrative has driven a sharp commodity price correction. The BCOM index (based on futures prices) is down ~16% since June highs with many individual commodities falling 30-40%. The CRB industrial index (based on spot prices) is down ~13%. Our supply-demand model for commodities turned down sharply in May and is still weighed down by negative liquidity LEIs.

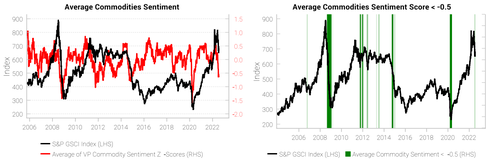

The speed of the collapse in commodity prices has triggered tactical contrarian buy signals across many commodities. Our contrarian sentiment scores for commodities have collapsed.

The poor depth of trading liquidity in commodity futures will also amplify the potential for short-squeeze rallies. Commodity trading houses have expressed concerns about extreme price-volatility and poor liquidity:

“…the lack of depth available in the commodities futures markets looks set to continue to be a challenge for the industry, as reduced access to derivatives for all participants in turn puts pressure on the ability to move physical commodities.” – Trafigura CEO, Jeremy Weir.

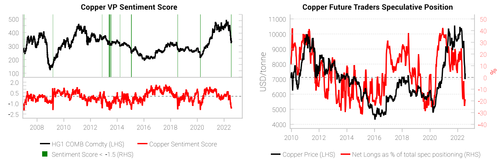

Copper looks most vulnerable to a short-squeeze rally. Copper has moved ~6% off its lows and there is more upside risk based on an extremely low sentiment score (left chart). The near straight-line collapse in copper has coincided with a positioning flush out (right chart). A positive narrative shift towards China reflation would likely see spec flows return and amplify the rebound (China accounts for >50% of global copper demand).

The commodity supercycle intermission is ongoing, but the structural thesis remains in tact (see our original thesis from Oct 2020 here). We have been helping clients manage their commodities exposure this year, balancing structural tailwinds, cyclical headwinds and tactical signals. The below is an excerpt from our July 26th report.

In our May Leading Indicator Watch, we wrote:

“Our commodity supercycle thesis could be due for an intermission similar to 4Q04, or 2H06 when commodities traded sideways with a lot of volatility.”

We expect large swings and little directional bias to define the trading environment for the rest of 2022. 4Q04 and 2H06 are close analogs for today’s price action. Both had violent swings within the 2000s supercycle.

Since our May report, the “demand-destruction” narrative has driven a sharp commodity price correction. The BCOM index (based on futures prices) is down ~16% since June highs with many individual commodities falling 30-40%. The CRB industrial index (based on spot prices) is down ~13%. Our supply-demand model for commodities turned down sharply in May and is still weighed down by negative liquidity LEIs.

The speed of the collapse in commodity prices has triggered tactical contrarian buy signals across many commodities. Our contrarian sentiment scores for commodities have collapsed.

The poor depth of trading liquidity in commodity futures will also amplify the potential for short-squeeze rallies. Commodity trading houses have expressed concerns about extreme price-volatility and poor liquidity:

“…the lack of depth available in the commodities futures markets looks set to continue to be a challenge for the industry, as reduced access to derivatives for all participants in turn puts pressure on the ability to move physical commodities.” – Trafigura CEO, Jeremy Weir.

Copper looks most vulnerable to a short-squeeze rally. Copper has moved ~6% off its lows and there is more upside risk based on an extremely low sentiment score (left chart). The near straight-line collapse in copper has coincided with a positioning flush out (right chart). A positive narrative shift towards China reflation would likely see spec flows return and amplify the rebound (China accounts for >50% of global copper demand).