By Greg Miller of FreightWaves

Shipping lines finally seem to be making some headway in managing vessel capacity in the Asia-U.S. trades.

Spot rates have been on the rise for three straight weeks, rebounding to levels last seen in early 2023 and late 2022, according to several index providers. U.S. import bookings remain above pre-COVID levels, and multiple analysts are now highlighting positive rate effects from reduced vessel capacity.

Liners managing down trans-Pacific capacity

“Typically, higher demand leads to higher capacity availability, but over the past month, liners have focused on tightening service offerings as demand has improved,” Omar Nokta, shipping analyst at investment bank Jefferies, said on Monday.

Platts, an analytics and price-reporting agency, quoted multiple market participants who see effects from capacity constraints, including more limited space availability forcing shippers to book earlier and expectations for continued spot rate gains in August.

One logistics source told Platts that Asia-West Coast capacity is down 15% this month versus June, with Asia-East Coast capacity down 8% to 10%, including the effect of Panama Canal restrictions.

Consultancy Drewry attributed rising trans-Pacific spot rates to “capacity reductions due to an increase in blank [canceled] sailings,” fallout from labor disruptions in British Columbia and “a more optimistic outlook on cargo demand in North America.”

Another analytics company, Linerlytica, highlighted divergent trends in the trans-Pacific and Asia-Europe as a result of capacity issues, with trans-Pacific rates rising and Asia-Europe rates still falling.

Many of the newbuildings being delivered this year are ships with capacity of 24,000 twenty-foot equivalent units designed for Asia-Europe service, creating supply side pressure in that trade. (Deliveries in 2024 and 2025 will be weighted more toward ship sizes that serve the trans-Pacific.)

Linerlytica said trans-Pacific deployments are down 12.1% to date, while Asia-Europe capacity is up 7.6%, “with further divergence expected in the coming months as even more capacity is added to Europe while capacity is withdrawn from the trans-Pacific market.”

“There is growing optimism for the Aug. 1 rate hike, especially on the trans-Pacific, where utilization has been very strong.” Linerlytica said on Monday.

Drewry: Shanghai-LA rates up 29% since late June

Spot rates are still believed to be at loss-making levels in the trans-Pacific and recent double-digit gains are off a low base. Yet rates are moving closer to breakeven and they’re already above or in the vicinity of pre-COVID levels, according to most spot indexes.

Different indexes use different data sources and different methodologies, so they come up with different rate numbers. However, they’ve all trended in the same upward direction in the past three weeks.

Platts assessed North Asia-West Coast North America spot rates at $1,700 per forty-foot equivalent unit on Monday, up 31% week on week to the highest level since October. Platts put North Asia-East Coast North America rates at $2,600 per FEU, up 13% week on week to the highest level since early February.

Xeneta, a company that tracks both short- and long-term freight rates, put average Far East-West Coast short-term rates at $1,715 per FEU on Monday, the highest level since late November and up 33% from June 29.

Xeneta assessed average Far East-East Coast short-term rates at $2,339 per FEU, the highest since February and up 6% from late June.

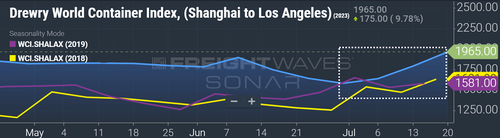

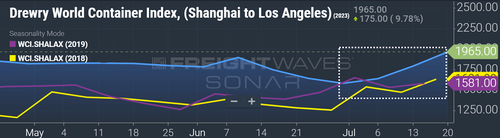

According to the Drewry World Container Index (WCI), spot rates on the Shanghai-Los Angeles route averaged $1,965 per FEU during the week ending Thursday, up 29% from the last week of June. Compared to pre-COVID, WCI rates for this route are 20% higher than at this time in 2018 and 24% higher than in 2019.

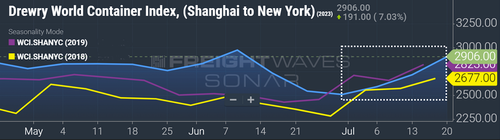

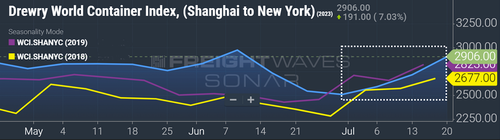

The WCI Shanghai-New York assessment rose to $2,906 per FEU for the week ending Thursday, up 16% since the last week of June, 9% from the same week in 2018 and 3% from 2019.

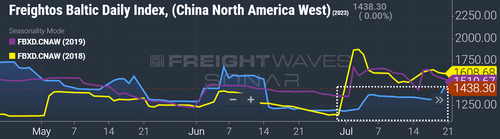

The Freightos Baltic Daily Index (FBX) paints a somewhat different picture, underscoring how different providers generate different numbers.

The FBX China-West Coast index is rising like the others — up 20% since June 30 — but was at $1,438 per FEU on Friday, well below other assessments.

Friday’s FBX China-West Coast rate assessment was 11% below levels at the same time in 2018 and 5% below 2019.

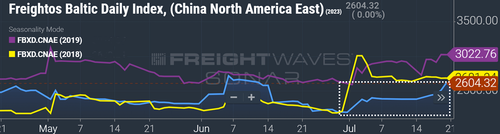

The FBX China-East Coast assessment was at $2,604 per FEU on Friday, up 19% from late June, albeit down 14% from 2019 levels and 3% versus 2018.

US import bookings remain healthy

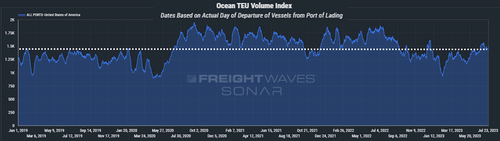

U.S. imports were up by single digits versus prepandemic levels during the first half of 2023. The latest bookings data from FreightWaves SONAR’s Container Atlas implies U.S. imports should remain at healthy levels through August and into the first half of September.

The data covers a portion of overall bookings (not loadings) and is based on the date of scheduled departure. The volume of bookings scheduled to depart Monday from all overseas ports was up 25% from the recent low hit on May 8 and up 8% from volumes on the same date in 2019, pre-COVID.

If U.S. import volumes hold steady or increase in August and carriers reduce trans-Pacific via blank sailings, spot rates could continue to trend toward profitability.

According to Nokta, “The latest rise in spot rates likely means guidance revisions this earnings season may be more modest than previously feared or nonexistent.”

By Greg Miller of FreightWaves

Shipping lines finally seem to be making some headway in managing vessel capacity in the Asia-U.S. trades.

Spot rates have been on the rise for three straight weeks, rebounding to levels last seen in early 2023 and late 2022, according to several index providers. U.S. import bookings remain above pre-COVID levels, and multiple analysts are now highlighting positive rate effects from reduced vessel capacity.

Liners managing down trans-Pacific capacity

“Typically, higher demand leads to higher capacity availability, but over the past month, liners have focused on tightening service offerings as demand has improved,” Omar Nokta, shipping analyst at investment bank Jefferies, said on Monday.

Platts, an analytics and price-reporting agency, quoted multiple market participants who see effects from capacity constraints, including more limited space availability forcing shippers to book earlier and expectations for continued spot rate gains in August.

One logistics source told Platts that Asia-West Coast capacity is down 15% this month versus June, with Asia-East Coast capacity down 8% to 10%, including the effect of Panama Canal restrictions.

Consultancy Drewry attributed rising trans-Pacific spot rates to “capacity reductions due to an increase in blank [canceled] sailings,” fallout from labor disruptions in British Columbia and “a more optimistic outlook on cargo demand in North America.”

Another analytics company, Linerlytica, highlighted divergent trends in the trans-Pacific and Asia-Europe as a result of capacity issues, with trans-Pacific rates rising and Asia-Europe rates still falling.

Many of the newbuildings being delivered this year are ships with capacity of 24,000 twenty-foot equivalent units designed for Asia-Europe service, creating supply side pressure in that trade. (Deliveries in 2024 and 2025 will be weighted more toward ship sizes that serve the trans-Pacific.)

Linerlytica said trans-Pacific deployments are down 12.1% to date, while Asia-Europe capacity is up 7.6%, “with further divergence expected in the coming months as even more capacity is added to Europe while capacity is withdrawn from the trans-Pacific market.”

“There is growing optimism for the Aug. 1 rate hike, especially on the trans-Pacific, where utilization has been very strong.” Linerlytica said on Monday.

Drewry: Shanghai-LA rates up 29% since late June

Spot rates are still believed to be at loss-making levels in the trans-Pacific and recent double-digit gains are off a low base. Yet rates are moving closer to breakeven and they’re already above or in the vicinity of pre-COVID levels, according to most spot indexes.

Different indexes use different data sources and different methodologies, so they come up with different rate numbers. However, they’ve all trended in the same upward direction in the past three weeks.

Platts assessed North Asia-West Coast North America spot rates at $1,700 per forty-foot equivalent unit on Monday, up 31% week on week to the highest level since October. Platts put North Asia-East Coast North America rates at $2,600 per FEU, up 13% week on week to the highest level since early February.

Xeneta, a company that tracks both short- and long-term freight rates, put average Far East-West Coast short-term rates at $1,715 per FEU on Monday, the highest level since late November and up 33% from June 29.

Xeneta assessed average Far East-East Coast short-term rates at $2,339 per FEU, the highest since February and up 6% from late June.

According to the Drewry World Container Index (WCI), spot rates on the Shanghai-Los Angeles route averaged $1,965 per FEU during the week ending Thursday, up 29% from the last week of June. Compared to pre-COVID, WCI rates for this route are 20% higher than at this time in 2018 and 24% higher than in 2019.

The WCI Shanghai-New York assessment rose to $2,906 per FEU for the week ending Thursday, up 16% since the last week of June, 9% from the same week in 2018 and 3% from 2019.

The Freightos Baltic Daily Index (FBX) paints a somewhat different picture, underscoring how different providers generate different numbers.

The FBX China-West Coast index is rising like the others — up 20% since June 30 — but was at $1,438 per FEU on Friday, well below other assessments.

Friday’s FBX China-West Coast rate assessment was 11% below levels at the same time in 2018 and 5% below 2019.

The FBX China-East Coast assessment was at $2,604 per FEU on Friday, up 19% from late June, albeit down 14% from 2019 levels and 3% versus 2018.

US import bookings remain healthy

U.S. imports were up by single digits versus prepandemic levels during the first half of 2023. The latest bookings data from FreightWaves SONAR’s Container Atlas implies U.S. imports should remain at healthy levels through August and into the first half of September.

The data covers a portion of overall bookings (not loadings) and is based on the date of scheduled departure. The volume of bookings scheduled to depart Monday from all overseas ports was up 25% from the recent low hit on May 8 and up 8% from volumes on the same date in 2019, pre-COVID.

If U.S. import volumes hold steady or increase in August and carriers reduce trans-Pacific via blank sailings, spot rates could continue to trend toward profitability.

According to Nokta, “The latest rise in spot rates likely means guidance revisions this earnings season may be more modest than previously feared or nonexistent.”

Loading…