Authored by Simon White, Bloomberg macro strategist,

Wednesday sees the Federal Reserve meeting and the Treasury’s quarterly refunding announcement (QRA). It’s the latter, however, that has the most potential to upset markets through possible disruptions to liquidity and funding.

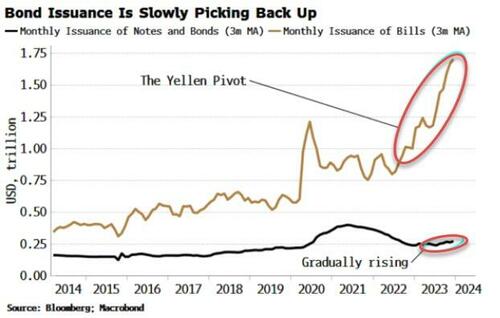

The overlapping of fiscal and monetary policy will be center stage this week as the Treasury today announces its total borrowing estimates, and on Wednesday how it expects to fund this deficit over the next three months. The Yellen pivot, at the beginning of 2023, allowed the government to fund its large borrowing needs without cratering the market. Skewing issuance towards bills let money market funds (MMFs) lend to the government using trillions of dollars of idle liquidity parked at the Fed’s reverse repo facility (RRP).

But bills are now well over 20% of government debt, a level the Treasury has generally preferred to keep the ratio under. The Treasury may therefore continue to increase auction sizes of notes and bonds, as has gradually started to happen. It was larger-than-expected bond auction sizes at the October QRA that was the initial impetus for the bond sell-off into the end of last year.

Expectations are for bond and note auction-sizes to climb again. It is hard to know exactly what is priced in, but there is a risk of a repeat of October if the increase in auction sizes is large.

Not only could that trigger another bond sell-off, but it could also jeopardize hitherto market-friendly liquidity conditions. MMFs cannot directly buy longer-term debt. Moreover, banks have been reducing their UST holdings, and the Fed is not a buyer while QT is ongoing, thus it will fall mainly on the private non-bank sector to buy the bonds using bank deposits, which will eat up reserves and thus worsen liquidity.

But even if the Treasury keeps bill issuance high (and the yields bills offer stay above the RRP’s rate), that could soon lead to funding issues, also problematic for markets if they move in an uncontrolled fashion.

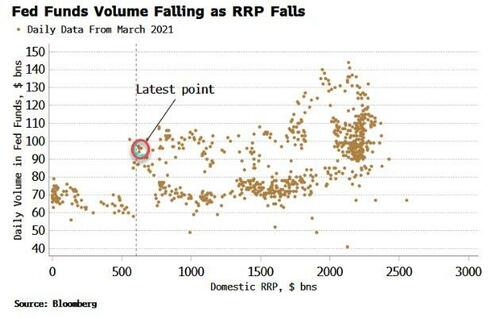

The domestic RRP has fallen sharply from its peak, and now sits at $570 billion. The closer it gets to zero, the closer we are likely approaching the point where reserves can go from abundant to scarce in a flicker. The chart below shows that historically trading in fed funds (i.e. reserves) has dropped notably when the domestic repo has gone below ~$500 billion.

That’s potentially a sign banks are hoarding reserves, and likely the precursor to funding issues, one of the inputs to my Funding Stress Trigger.

So whatever the Treasury decides to do this week, the structure of the monetary system is such that the days where it could innocuously announce its funding intentions, without fear of upsetting markets, are gone for now.

Authored by Simon White, Bloomberg macro strategist,

Wednesday sees the Federal Reserve meeting and the Treasury’s quarterly refunding announcement (QRA). It’s the latter, however, that has the most potential to upset markets through possible disruptions to liquidity and funding.

The overlapping of fiscal and monetary policy will be center stage this week as the Treasury today announces its total borrowing estimates, and on Wednesday how it expects to fund this deficit over the next three months. The Yellen pivot, at the beginning of 2023, allowed the government to fund its large borrowing needs without cratering the market. Skewing issuance towards bills let money market funds (MMFs) lend to the government using trillions of dollars of idle liquidity parked at the Fed’s reverse repo facility (RRP).

But bills are now well over 20% of government debt, a level the Treasury has generally preferred to keep the ratio under. The Treasury may therefore continue to increase auction sizes of notes and bonds, as has gradually started to happen. It was larger-than-expected bond auction sizes at the October QRA that was the initial impetus for the bond sell-off into the end of last year.

Expectations are for bond and note auction-sizes to climb again. It is hard to know exactly what is priced in, but there is a risk of a repeat of October if the increase in auction sizes is large.

Not only could that trigger another bond sell-off, but it could also jeopardize hitherto market-friendly liquidity conditions. MMFs cannot directly buy longer-term debt. Moreover, banks have been reducing their UST holdings, and the Fed is not a buyer while QT is ongoing, thus it will fall mainly on the private non-bank sector to buy the bonds using bank deposits, which will eat up reserves and thus worsen liquidity.

But even if the Treasury keeps bill issuance high (and the yields bills offer stay above the RRP’s rate), that could soon lead to funding issues, also problematic for markets if they move in an uncontrolled fashion.

The domestic RRP has fallen sharply from its peak, and now sits at $570 billion. The closer it gets to zero, the closer we are likely approaching the point where reserves can go from abundant to scarce in a flicker. The chart below shows that historically trading in fed funds (i.e. reserves) has dropped notably when the domestic repo has gone below ~$500 billion.

That’s potentially a sign banks are hoarding reserves, and likely the precursor to funding issues, one of the inputs to my Funding Stress Trigger.

So whatever the Treasury decides to do this week, the structure of the monetary system is such that the days where it could innocuously announce its funding intentions, without fear of upsetting markets, are gone for now.

Loading…